1/ Let's take a break from memecoins and check what's new in #DeFi.

I'm tracking the VC money flow to identify new DeFi trends.

Here are 5 innovative DeFi projects that just raised funds: 💸

I'm tracking the VC money flow to identify new DeFi trends.

Here are 5 innovative DeFi projects that just raised funds: 💸

4/ I focus on seed round investments by prominent VCs.

Most of these projects don't have a token yet.

I believe that early-stage projects that secure funding during bear markets have a good chance of thriving in bull runs.

Most of these projects don't have a token yet.

I believe that early-stage projects that secure funding during bear markets have a good chance of thriving in bull runs.

5/ My top 5 projects from last month:

1️⃣ @CatalystAMM is cross-chain liquidity layer, designed for a world where every app will have its own blockchain.

It's built to connect any chain's liquidity to another's, facilitating seamless value transfer from day one.

1️⃣ @CatalystAMM is cross-chain liquidity layer, designed for a world where every app will have its own blockchain.

It's built to connect any chain's liquidity to another's, facilitating seamless value transfer from day one.

6/ Catalyst allows swapping of native assets (no need for wrapped tokens) and offers the first permissionless cross-chain pool creation.

It fits neatly into the modular and multi-chain narrative.

The team raised $4.2M from Robot Ventures, Circle, Hashkey, Spartan, and others.

It fits neatly into the modular and multi-chain narrative.

The team raised $4.2M from Robot Ventures, Circle, Hashkey, Spartan, and others.

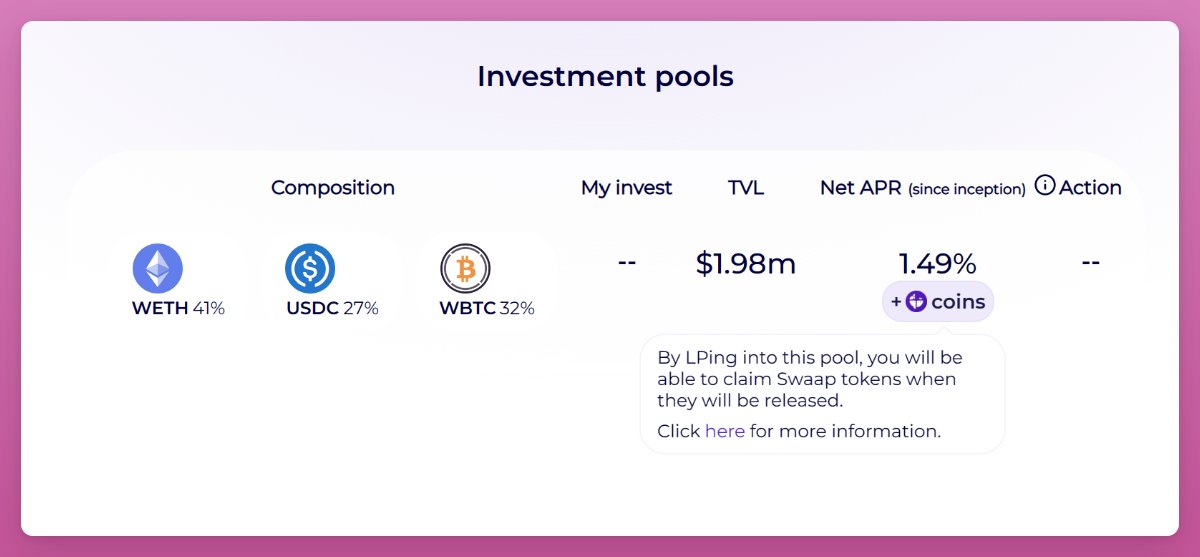

7/ 2️⃣ @SwaapFinance is a next-gen AMM.

It addresses the impermanent loss (IL) issue and reduces trading costs using dynamic spread and price oracles.

The Swaap v1 launched in July, recorded less than <1% IL for WBTC/WETH/USDC pool.

They will also airdrop Swaap tokens to LPs.

It addresses the impermanent loss (IL) issue and reduces trading costs using dynamic spread and price oracles.

The Swaap v1 launched in July, recorded less than <1% IL for WBTC/WETH/USDC pool.

They will also airdrop Swaap tokens to LPs.

8/ The announced v2 introduces more advanced market-making models, greater token variety, and choice between high-yield and low-risk strategies.

There are currently waitlists for both, Catalyst and Swaap.

Swaap team raised $4.5M several VCs and angel investors.

There are currently waitlists for both, Catalyst and Swaap.

Swaap team raised $4.5M several VCs and angel investors.

9/ 3️⃣ @fareprotocol is in stealth mode and doesn't want to be noticed just yet.

Their Twitter account was created 9 months ago, and their Discord is dead silent.

However, they just raised $6.5M USD from top investors like Republic, Arrington Capital, Quantstamp among others.

Their Twitter account was created 9 months ago, and their Discord is dead silent.

However, they just raised $6.5M USD from top investors like Republic, Arrington Capital, Quantstamp among others.

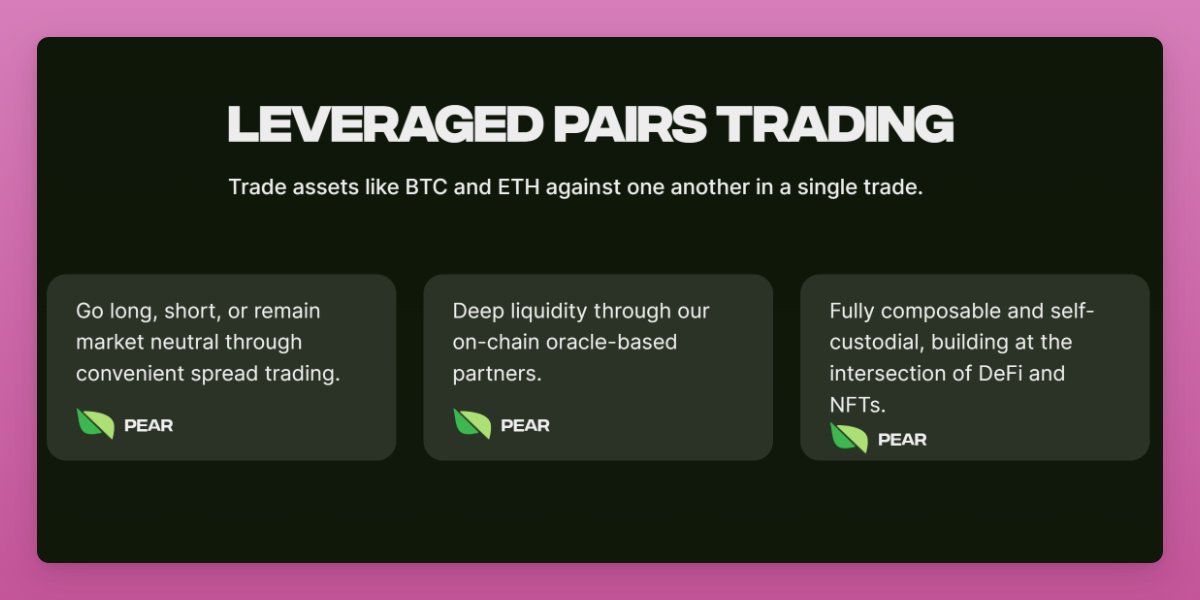

11/ 4️⃣ @pear_protocol is a narrative trading platform simplifying crypto pairs trading.

Long one token, short another with leverage in a single transaction.

App is not live yet.

Long one token, short another with leverage in a single transaction.

App is not live yet.

12/ Traders use $USDC as collateral, choose long/short leveraged pairs, and execute the position in a single transaction, which is represented by an ERC-721 tokenized receipt.

Team raised $1.25M USD from Flow Ventures, Portico, and JY Capital.

Team raised $1.25M USD from Flow Ventures, Portico, and JY Capital.

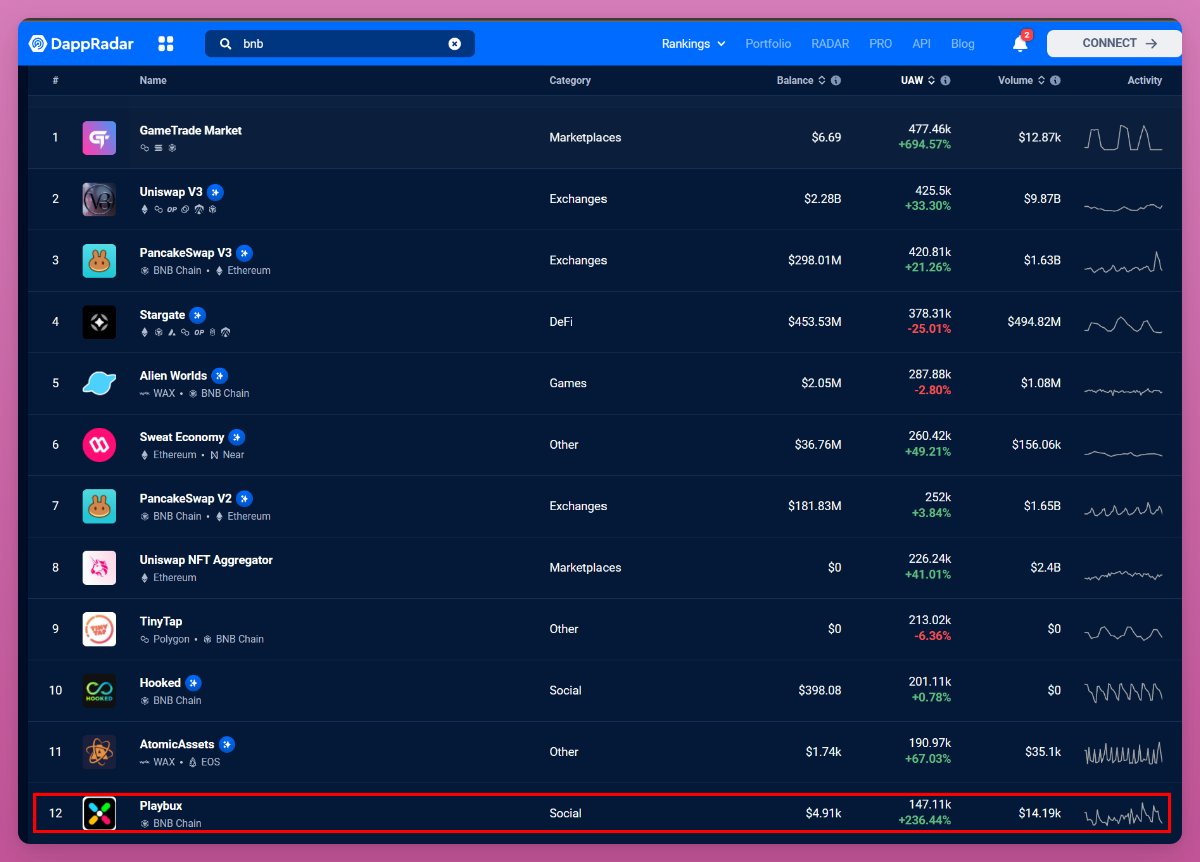

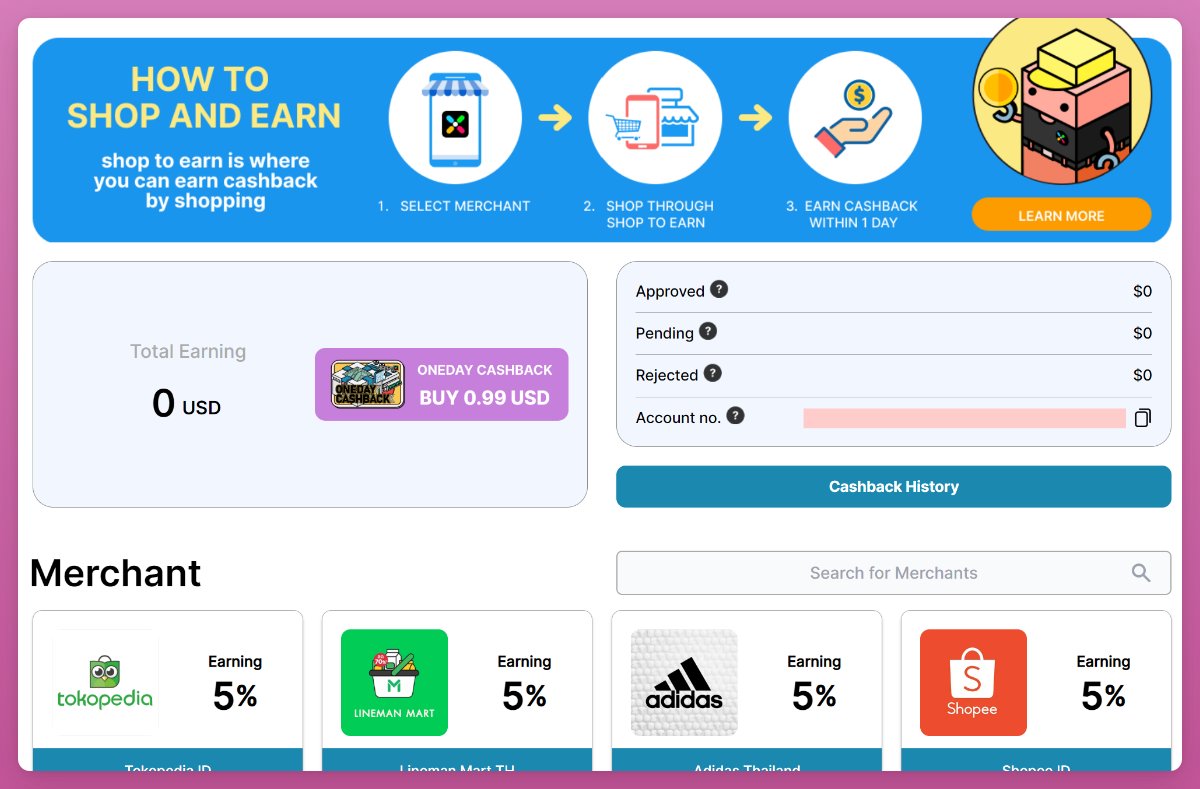

13/ 5️⃣ @playbuxco is totally different from what I've covered so far.

Playbux also explains why BNB Chain has so many users.

It just raised $2M from Binance, Gate, Tron, Certik, and others.

It's already the 12th top crypto dApp by wallet activity.

Playbux also explains why BNB Chain has so many users.

It just raised $2M from Binance, Gate, Tron, Certik, and others.

It's already the 12th top crypto dApp by wallet activity.

16/ There's more to it, but it made me realize that most of DeFi is complicated and targeted towards a small % of crypto users.

dApps like Playbux bring in a new class of users who look for tangible benefits.

They're also gas fee-sensitive and don't care which chain they use.

dApps like Playbux bring in a new class of users who look for tangible benefits.

They're also gas fee-sensitive and don't care which chain they use.

Loading suggestions...