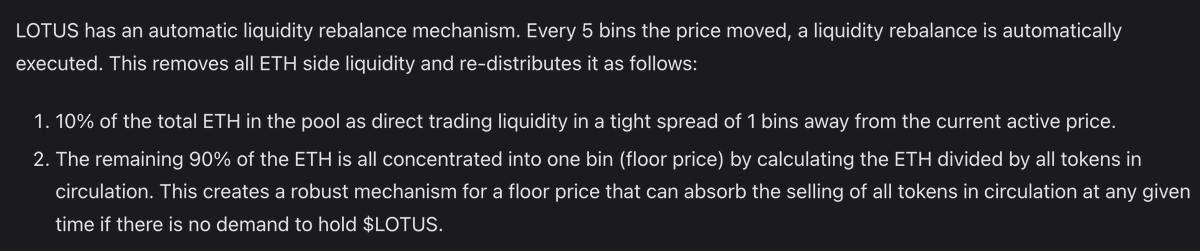

The flywheel occurs when:

• The LOTUS/ETH pool increases its ETH reserves

• Or circulating supply of LOTUS decreases

When either occurs, liquidity is rebalanced up to the "floor price" bin to support the flywheel.

Below we discuss how either occur.

• The LOTUS/ETH pool increases its ETH reserves

• Or circulating supply of LOTUS decreases

When either occurs, liquidity is rebalanced up to the "floor price" bin to support the flywheel.

Below we discuss how either occur.

2) Circulating supply of LOTUS decreases

When selling occurs in the LOTUS/ETH pool, 8% of LOTUS is burned forever.

This decreases circulating supply, which also causes the floor protection bin to go up.

The floor price bin moves every time a rebalance occurs..

When selling occurs in the LOTUS/ETH pool, 8% of LOTUS is burned forever.

This decreases circulating supply, which also causes the floor protection bin to go up.

The floor price bin moves every time a rebalance occurs..

HOWEVER, there are a few issues:

1️⃣ Burning only happens with selling.

What happened was that there was 4000 buys into the pool with no sells in between. Thus, no LOTUS was burned and floor price didn't move up as much as wanted.

1️⃣ Burning only happens with selling.

What happened was that there was 4000 buys into the pool with no sells in between. Thus, no LOTUS was burned and floor price didn't move up as much as wanted.

2️⃣ Burning only occurs if sells are made in the LOTUS/ETH pool

A LOTUS/USDC pool was later created which is where all the sells took place.

As a result, no LOTUS was burned and the floor protection bin wasn't able to move up.

A LOTUS/USDC pool was later created which is where all the sells took place.

As a result, no LOTUS was burned and the floor protection bin wasn't able to move up.

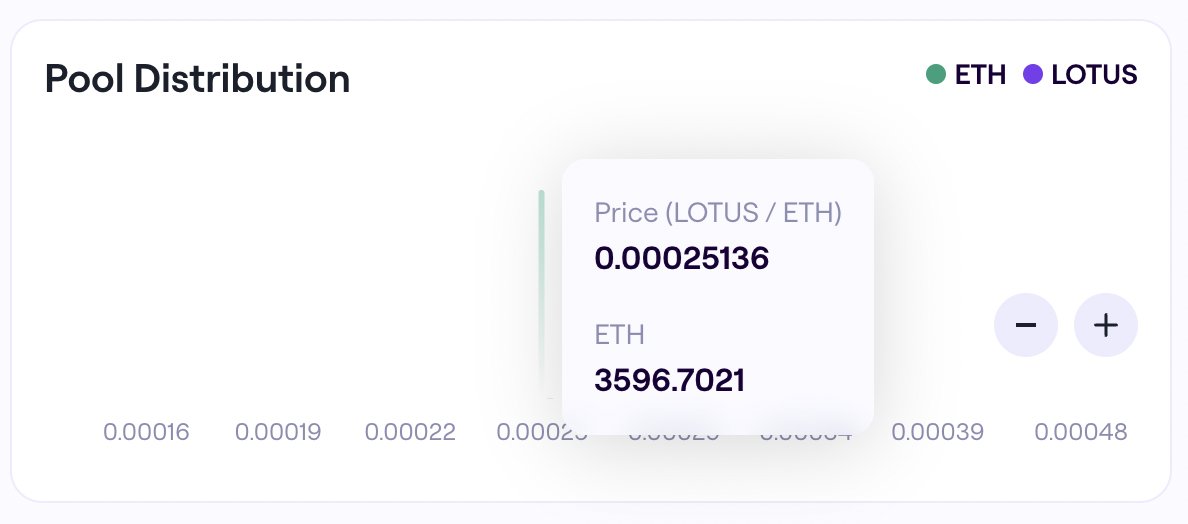

3️⃣ 10% ETH buffer was not enough to absorb the first red candle.

After that 10% of ETH was eaten up, there was a huge gap down until the next bins with ETH were found.

After that 10% of ETH was eaten up, there was a huge gap down until the next bins with ETH were found.

Suggestions:

• Implement burning on buying as well as selling.

• The buffer needs to be greater than 10%. Suggest a sloped distribution down to the floor price bin.

• Find a way to circumvent burning when trades are routed through other pools.

• Implement burning on buying as well as selling.

• The buffer needs to be greater than 10%. Suggest a sloped distribution down to the floor price bin.

• Find a way to circumvent burning when trades are routed through other pools.

As for LOTUS, it's got a solid floor at ~$0.46, but the next bin up is ~$0.90 so this range in between is currently no man's land.

What needs to happen is price to chad to $0.90 or the floor price bin to rebalance up, which can only happen if sells occur through LOTUS/ETH.

What needs to happen is price to chad to $0.90 or the floor price bin to rebalance up, which can only happen if sells occur through LOTUS/ETH.

Loading suggestions...