I've made my living off the markets since 2005.

Here are 12 Lessons for #SwingTrading Stocks, including:

-capital needed

-strategies

-position sizing

-when to avoid trading

-scanning for stocks

-And Much More...

A thread 👇📷 👇

Here are 12 Lessons for #SwingTrading Stocks, including:

-capital needed

-strategies

-position sizing

-when to avoid trading

-scanning for stocks

-And Much More...

A thread 👇📷 👇

1. How Much Capital to Swing Trade #Stocks

If you pay commissions, start with $5,000+. Need bigger profits to compensate for commissions (often a flat fee).

If you don't pay commissions, can start with $1000 or less.

To earn a decent side income, you'll need more.

If you pay commissions, start with $5,000+. Need bigger profits to compensate for commissions (often a flat fee).

If you don't pay commissions, can start with $1000 or less.

To earn a decent side income, you'll need more.

2. Leverage:

Open a "margin" stock trading account to access leverage.

For swing trading, you can often access 2x leverage AKA 50% margin.

This means you can buy positions worth twice your capital. $10K deposit, trade up to $20K.

Bigger potential profits...and losses.

Open a "margin" stock trading account to access leverage.

For swing trading, you can often access 2x leverage AKA 50% margin.

This means you can buy positions worth twice your capital. $10K deposit, trade up to $20K.

Bigger potential profits...and losses.

You don't need to use leverage, it is just an option.

And I recommend NOT using it until you have at least several years of profitable trading under your belt.

I was swing trading stocks almost a decade before using leverage...and I still use it sparingly.

And I recommend NOT using it until you have at least several years of profitable trading under your belt.

I was swing trading stocks almost a decade before using leverage...and I still use it sparingly.

3. Earnings Announcements:

For swing trades lasting days to a few months, don't hold trades through earnings.

It's a gamble whether the market will react favorably.

The price may gap through a stop loss, which means bigger losses than expected.

Exit the day before earnings.

For swing trades lasting days to a few months, don't hold trades through earnings.

It's a gamble whether the market will react favorably.

The price may gap through a stop loss, which means bigger losses than expected.

Exit the day before earnings.

4. Have a #Trading Plan Before trading

At minimum, the plan defines:

-How, why, & when you enter

-How, why, & when you exit

-Position Sizing

-How you determine when to trade and when not to (conditions assessment)

-How you find trades (scanning etc)

(all discussed below)

More:

At minimum, the plan defines:

-How, why, & when you enter

-How, why, & when you exit

-Position Sizing

-How you determine when to trade and when not to (conditions assessment)

-How you find trades (scanning etc)

(all discussed below)

More:

5. Position Sizing

Choose your max number of positions (me: 5-7)

Divide your capital by this.

Put that amount into each stock assuming risk is only about 5% or less.

If risk is more, put less capital.

If risk is less, put a bit more capital.

Example...

Choose your max number of positions (me: 5-7)

Divide your capital by this.

Put that amount into each stock assuming risk is only about 5% or less.

If risk is more, put less capital.

If risk is less, put a bit more capital.

Example...

$100K account, 5 positions.

$20K goes to each stock.

If the difference between the entry and stop loss is 5% (Trade Risk) put $20K to that trade. Because $20K x 5% = $1000 which is only 1% of the account.

Keep risk on the account to about 1% or less per trade.

$20K goes to each stock.

If the difference between the entry and stop loss is 5% (Trade Risk) put $20K to that trade. Because $20K x 5% = $1000 which is only 1% of the account.

Keep risk on the account to about 1% or less per trade.

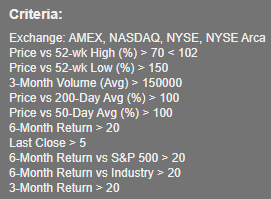

6. Strength

It's easier to swim downstream.

Trade stocks that are stronger than average (indexes are average).

I typically look for stocks with double+ the returns of the S&P 500.

This alone boosts swing trading performance.

They carry you along while they remain strong...

It's easier to swim downstream.

Trade stocks that are stronger than average (indexes are average).

I typically look for stocks with double+ the returns of the S&P 500.

This alone boosts swing trading performance.

They carry you along while they remain strong...

10. Profit Targets

Keep targets grounded in reality, not hope.

For most strong stocks, 20%-30% targets work well. This is usually followed by a sideways period or pullback.

Look at prior price moves in the stock to assess how far it typically moves before pulling back/ranging.

Keep targets grounded in reality, not hope.

For most strong stocks, 20%-30% targets work well. This is usually followed by a sideways period or pullback.

Look at prior price moves in the stock to assess how far it typically moves before pulling back/ranging.

11. Reward: Risk

Based on my assessment of the profit target, I only take a trade if the profit potential is 3x my risk, or more.

For example, if I'm entering at $100 with SL at $95. The price must reasonably be able to move to $115 or higher in order to take the trade.

Based on my assessment of the profit target, I only take a trade if the profit potential is 3x my risk, or more.

For example, if I'm entering at $100 with SL at $95. The price must reasonably be able to move to $115 or higher in order to take the trade.

12. Monitor & Track

Screenshot trades to track slight variations. Details matter. You may notice commonalities between your winners/losers.

Track your win rate & reward:risk on closed trades. Many trading problems can be linked back to these.

Trade log: tradethatswing.com

Screenshot trades to track slight variations. Details matter. You may notice commonalities between your winners/losers.

Track your win rate & reward:risk on closed trades. Many trading problems can be linked back to these.

Trade log: tradethatswing.com

If you enjoyed this thread and want more like this, follow along: @corymitc

Please share or retweet the first tweet in the thread.

This thread is based on my Complete Method Stock Swing Trading Course: tradethatswing.com

Please share or retweet the first tweet in the thread.

This thread is based on my Complete Method Stock Swing Trading Course: tradethatswing.com

Loading suggestions...