2. Capital allocation is key

Allocating capital is the key task of Buffett at Berkshire Hathaway.

Both gentlemen aren’t involved in the daily operations of the companies they own.

Instead, they direct capital at their subsidiaries and select the CEOs who make daily decisions.

Allocating capital is the key task of Buffett at Berkshire Hathaway.

Both gentlemen aren’t involved in the daily operations of the companies they own.

Instead, they direct capital at their subsidiaries and select the CEOs who make daily decisions.

3. Skin in the game matters

More than 99% of Warren Buffett’s net worth is invested in Berkshire Hathaway.

This means that Warren will do everything he possible can to maximize the value for shareholders and himself.

More than 99% of Warren Buffett’s net worth is invested in Berkshire Hathaway.

This means that Warren will do everything he possible can to maximize the value for shareholders and himself.

4. Focus on intrinsic value

While in the short term the market is a voting machine, in the long term it’s a weighting machine.

In the long term, it’s all about the growth of the intrinsic value of the companies you own.

While in the short term the market is a voting machine, in the long term it’s a weighting machine.

In the long term, it’s all about the growth of the intrinsic value of the companies you own.

You can calculate it as follows:

Growth in intrinsic value = free cash flow per share growth + dividend yield

“Our long‐term economic goal is to maximize the average annual rate of gain in intrinsic business value on a per‐share basis.” - Warren Buffett

Growth in intrinsic value = free cash flow per share growth + dividend yield

“Our long‐term economic goal is to maximize the average annual rate of gain in intrinsic business value on a per‐share basis.” - Warren Buffett

5. Return on invested capital matters

A high and consistent Return On Invested Capital (ROIC) is a must for quality investors.

Warren Buffett already stressed this in his annual letters of the 70s.

A high and consistent Return On Invested Capital (ROIC) is a must for quality investors.

Warren Buffett already stressed this in his annual letters of the 70s.

6. Cash is like oxygen

Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

At the end of the year, Berkshire had almost $128 billion in cash.

Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

At the end of the year, Berkshire had almost $128 billion in cash.

7. Good businesses are rare

It’s a misconception that Warren Buffett is a value investor.

Over the years, Warren Buffett has evolved from a pure value investor to a quality investor thanks to the influence of Charlie Munger.

It’s a misconception that Warren Buffett is a value investor.

Over the years, Warren Buffett has evolved from a pure value investor to a quality investor thanks to the influence of Charlie Munger.

8. Never make economic forecasts

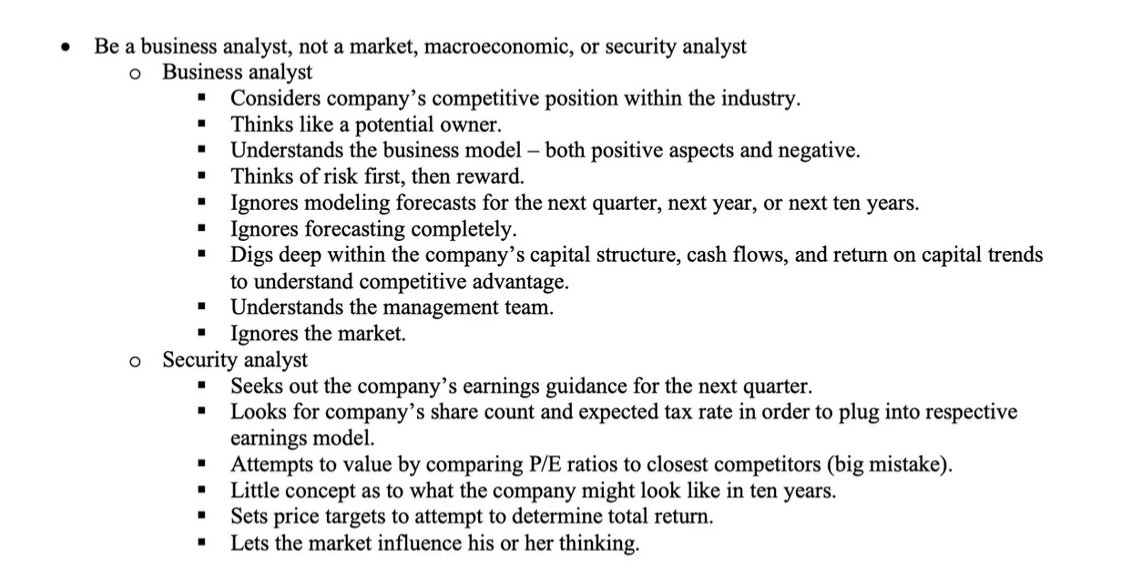

Making economic forecasts and trying to predict the stock market in the short term is a fools game.

In the world, there are only 2 kinds of people: those who don’t know and those who don’t know they don’t know.

Making economic forecasts and trying to predict the stock market in the short term is a fools game.

In the world, there are only 2 kinds of people: those who don’t know and those who don’t know they don’t know.

9. Let your winners run

Peter Lynch once said that selling your winners and holding your losers is like cutting the flowers and watering the weeds.

Peter Lynch once said that selling your winners and holding your losers is like cutting the flowers and watering the weeds.

10. The acquisition criteria of Warren Buffett

Warren Buffett uses a strict approach to acquire entire businesses.

The acquisition criteria can be found in his annual letters.

Warren Buffett uses a strict approach to acquire entire businesses.

The acquisition criteria can be found in his annual letters.

1️⃣ The company must have demonstrated consistent earnings power

2️⃣ The business must earn a high ROE while employing little debt

3️⃣ Management should be in place (Berkshire won’t supply it)

4️⃣ The business should be simple (invest within your circle of competence)

5️⃣ A fair price

2️⃣ The business must earn a high ROE while employing little debt

3️⃣ Management should be in place (Berkshire won’t supply it)

4️⃣ The business should be simple (invest within your circle of competence)

5️⃣ A fair price

That's it for today.

Soon we're sharing a course with everything we learned from the Berkshire Hathaway weekend in Omaha.

Sign up here to receive it: eepurl.com

Soon we're sharing a course with everything we learned from the Berkshire Hathaway weekend in Omaha.

Sign up here to receive it: eepurl.com

Loading suggestions...