4.

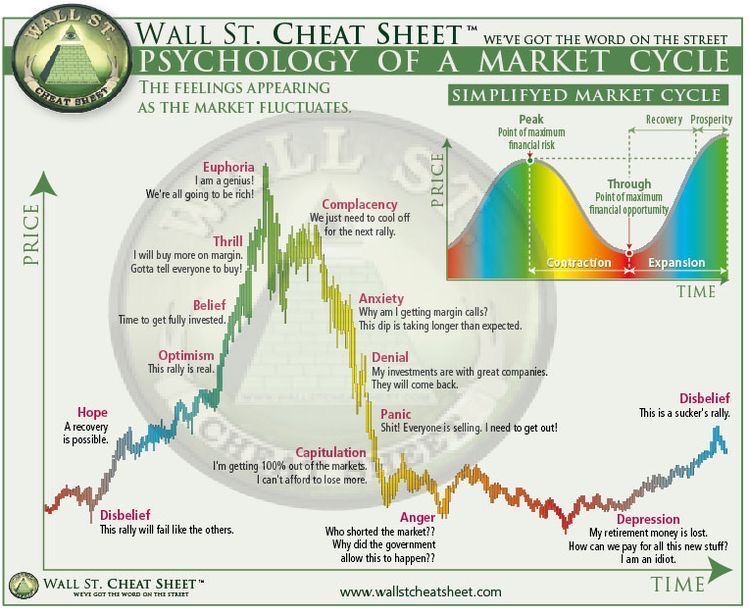

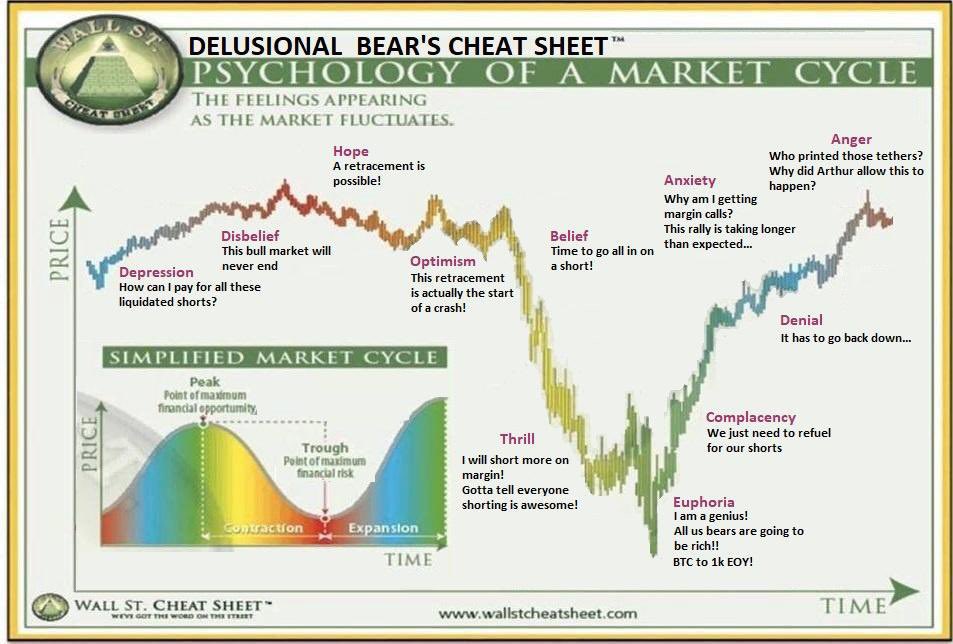

That's why it's important to maintain control over our emotions.

Because everything is part of a cycle.

It doesn't matter the way, bull or bear.

You just need to know that, at some point, the bear will finish and the bull will start again.

And vice-versa.

That's why it's important to maintain control over our emotions.

Because everything is part of a cycle.

It doesn't matter the way, bull or bear.

You just need to know that, at some point, the bear will finish and the bull will start again.

And vice-versa.

5.

~ The Iceberg Illusion ~

The Iceberg Illusion is a deception in which only a small perceptible part of a much larger perspective is visible (the tip of the Iceberg).

The remaining 90% of the iceberg contains hidden underwater parts necessary for the iceberg to emerge.

~ The Iceberg Illusion ~

The Iceberg Illusion is a deception in which only a small perceptible part of a much larger perspective is visible (the tip of the Iceberg).

The remaining 90% of the iceberg contains hidden underwater parts necessary for the iceberg to emerge.

7.

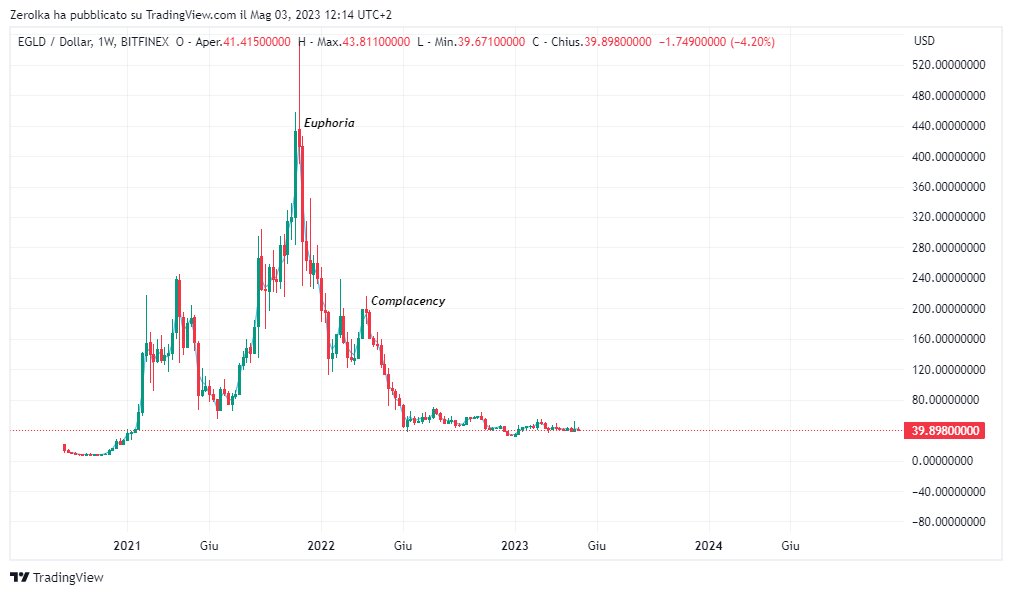

This kind of short-term mental attitude reflects financial markets and common life.

Newcomers buy the riskier periods of a bull market because they don't have to wait.

The candles that everyday flow in are the “motivation” to buy more.

1-month maximum to wait for gains.

This kind of short-term mental attitude reflects financial markets and common life.

Newcomers buy the riskier periods of a bull market because they don't have to wait.

The candles that everyday flow in are the “motivation” to buy more.

1-month maximum to wait for gains.

11.

Inexperienced guys aren’t able to watch at HTFs.

They don’t wait to see if the price can make a strong closure above or below that important 60k mark.

All they want to see are numbers going up, regardless of the sentiment/news/market structure.

Inexperienced guys aren’t able to watch at HTFs.

They don’t wait to see if the price can make a strong closure above or below that important 60k mark.

All they want to see are numbers going up, regardless of the sentiment/news/market structure.

12.

~ Candle effects ~

Green candles make people lose touch of reality.

FOMO, euphoria, gambling attitude..

The candles are intended to do this and disregard everything, especially how high the market has gone in relevance to the lows.

No patience ➩ buy more.

~ Candle effects ~

Green candles make people lose touch of reality.

FOMO, euphoria, gambling attitude..

The candles are intended to do this and disregard everything, especially how high the market has gone in relevance to the lows.

No patience ➩ buy more.

13.

Red candles instead have the ability to make you think that everything is bad, BTC is dying and projects are not delivering.

The prolonged time of a bear market has also the power to strengthen the situation, making you feel annoyed and doubtful of a future recovery.

Red candles instead have the ability to make you think that everything is bad, BTC is dying and projects are not delivering.

The prolonged time of a bear market has also the power to strengthen the situation, making you feel annoyed and doubtful of a future recovery.

14.

~ The hidden hand ~

Financial markets aren't pure.

They're made of sharks and hidden hands that try to manipulate and slaughter as many new participants as possible.

The so-called “exit liquidity”.

You cannot expect to play this game with your rules.

~ The hidden hand ~

Financial markets aren't pure.

They're made of sharks and hidden hands that try to manipulate and slaughter as many new participants as possible.

The so-called “exit liquidity”.

You cannot expect to play this game with your rules.

15.

This involves going against what we believe in.

I'm a strong believer in Bitcoin and the overall crypto sector, but I cannot sew my eyes on the fact that it is highly speculative.

Especially in a strong unregulated market, whales eat small fish.

This involves going against what we believe in.

I'm a strong believer in Bitcoin and the overall crypto sector, but I cannot sew my eyes on the fact that it is highly speculative.

Especially in a strong unregulated market, whales eat small fish.

17.

• Dominating biases

Psychological biases are money killers.

Like many, I was eaten by these mind traps that led

me to horrible financial decisions.

I summarized the 10 most important ones so you can be prepared to face them.

• Dominating biases

Psychological biases are money killers.

Like many, I was eaten by these mind traps that led

me to horrible financial decisions.

I summarized the 10 most important ones so you can be prepared to face them.

18.

• Eco-Chambers resilience

Mass belief is the worst enemy.

Imagine it as the final boss of the game.

If you're able to detach from market sentiment and crowd opinion the prize that awaits you is huge.

• Eco-Chambers resilience

Mass belief is the worst enemy.

Imagine it as the final boss of the game.

If you're able to detach from market sentiment and crowd opinion the prize that awaits you is huge.

19.

• Experience

I can stay here 24H per day to warn you but you will be able to truly understand them only by experiencing them.

Fortunately or unfortunately.

Failures lead to massive growth, so take each mistake you make during your journey as a severe but helpful lesson.

• Experience

I can stay here 24H per day to warn you but you will be able to truly understand them only by experiencing them.

Fortunately or unfortunately.

Failures lead to massive growth, so take each mistake you make during your journey as a severe but helpful lesson.

20.

• Closures

Last but not least, candle closures.

As we saw, being able to recognize if a price closes above/below key support or resistance makes a huge difference.

That daily candle we previously saw, has closed below the 60k mark.

Analyze ➩ execute ➩ achieve.

• Closures

Last but not least, candle closures.

As we saw, being able to recognize if a price closes above/below key support or resistance makes a huge difference.

That daily candle we previously saw, has closed below the 60k mark.

Analyze ➩ execute ➩ achieve.

21.

That's it!

• If you liked this thread, follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

That's it!

• If you liked this thread, follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

Loading suggestions...