💡Ticker Spotlight: $AAPL 💡

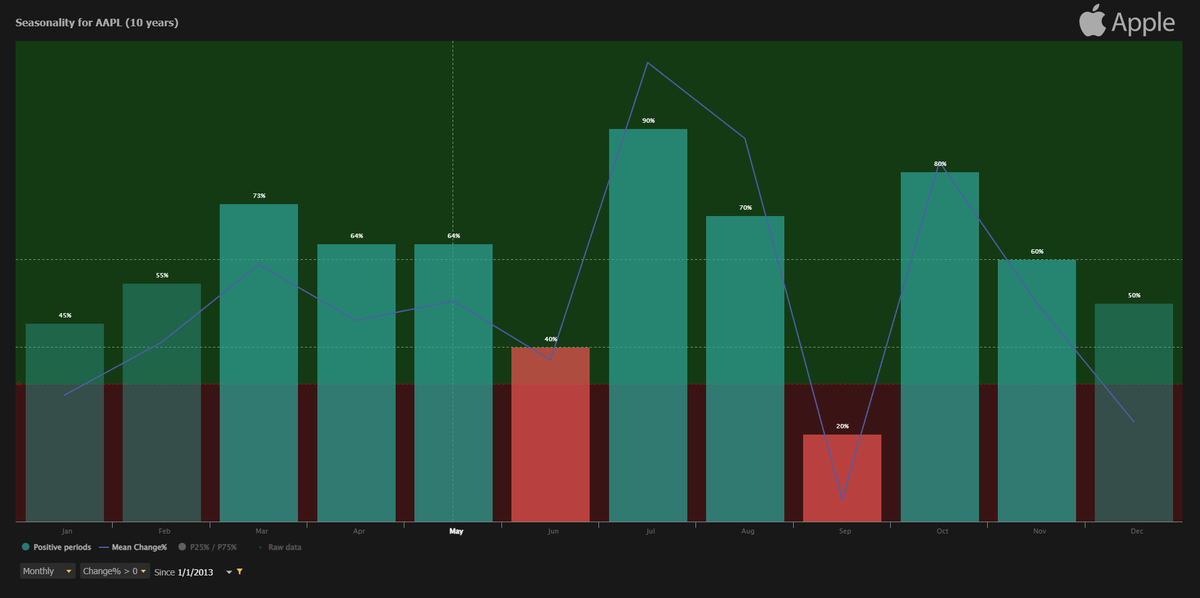

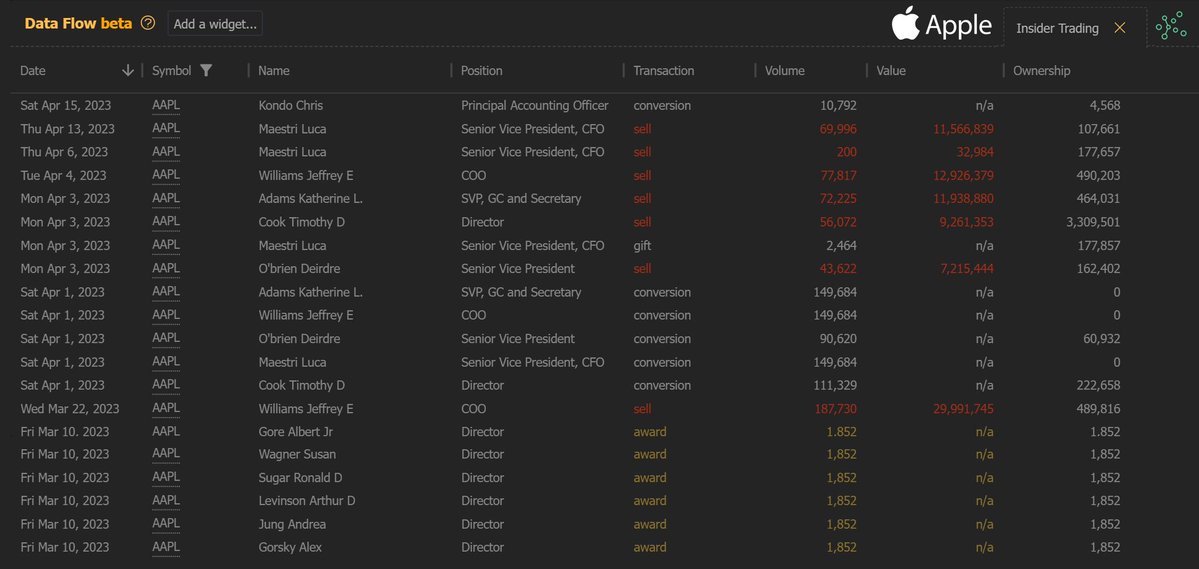

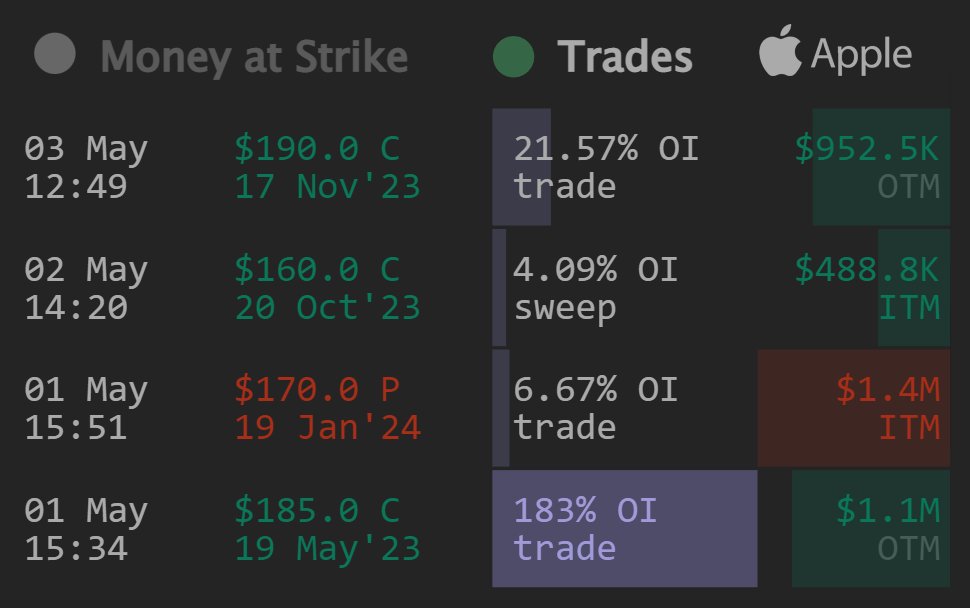

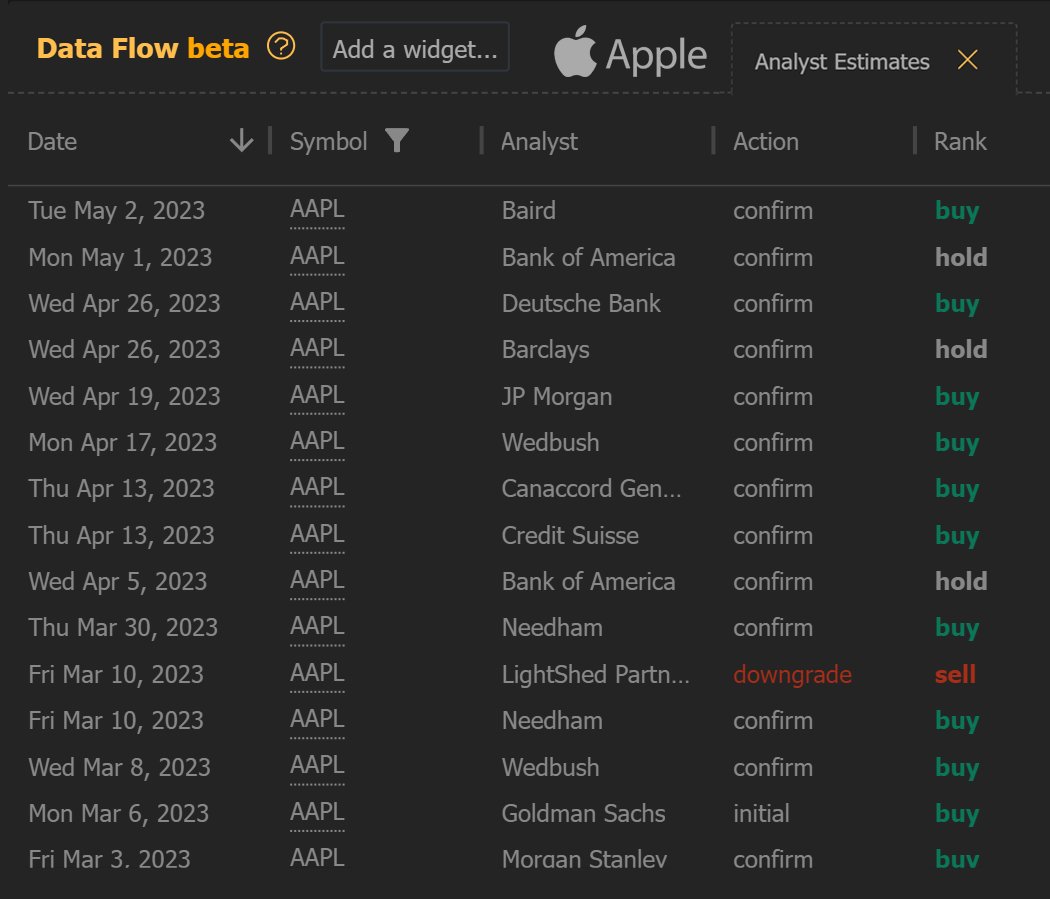

Apple, the largest company in the world by market cap, reports its Q1 2023 earnings tomorrow after the bell.

Let's do some in-depth analysis on Apple using the various features on the @TrendSpider platform!

🧵

Apple, the largest company in the world by market cap, reports its Q1 2023 earnings tomorrow after the bell.

Let's do some in-depth analysis on Apple using the various features on the @TrendSpider platform!

🧵

What are you expecting from $AAPL after tomorrow's earnings report?

Loading suggestions...