Let's learn about MACD today!

The momentum indicator that helps you spot trend changes

A Thread🧵👇

#LearnwithICICIDirect #TechnicalTuesdays

The momentum indicator that helps you spot trend changes

A Thread🧵👇

#LearnwithICICIDirect #TechnicalTuesdays

[A] What is Moving Average Convergence Divergence (MACD)?

🔸Technical analysis indicator used to identify changes in momentum, direction & trend strength of a security or asset

🔸Made up of the conv. & div. of two moving averages

🔸Developed by Gerald Appel in the late 1970s

🔸Technical analysis indicator used to identify changes in momentum, direction & trend strength of a security or asset

🔸Made up of the conv. & div. of two moving averages

🔸Developed by Gerald Appel in the late 1970s

[B] How to calculate MACD?

MACD indicator compares moving avg of a stock's price to identify changes in trend & momentum

It can be calculated using:

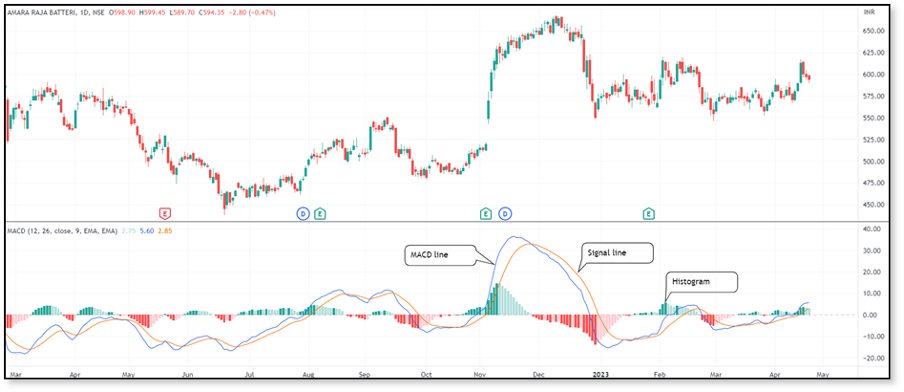

1. MACD Line

🔸Calculate the MACD line by subtracting the long-term moving avg (26-EMA) from the short-term moving avg (12-EMA)

MACD indicator compares moving avg of a stock's price to identify changes in trend & momentum

It can be calculated using:

1. MACD Line

🔸Calculate the MACD line by subtracting the long-term moving avg (26-EMA) from the short-term moving avg (12-EMA)

🔸12-EMA is more reactive to changes in price, while 26-EMA provides a broader view of the asset's trend

🔸By subtracting, MACD can identify changes in trend & momentum

🔸When the MACD line is above 0, it indicates a bullish sign & when it's below 0, it indicates a bearish sign

🔸By subtracting, MACD can identify changes in trend & momentum

🔸When the MACD line is above 0, it indicates a bullish sign & when it's below 0, it indicates a bearish sign

2. Signal Line (SL)

🔸The SL is a moving avg of the MACD line that smooths it out and provides a clearer trend picture

🔸 It's used as a trigger for buy or sell signals when it crosses the MACD line, and a bullish or bearish signal when above or below it, respectively

🔸The SL is a moving avg of the MACD line that smooths it out and provides a clearer trend picture

🔸 It's used as a trigger for buy or sell signals when it crosses the MACD line, and a bullish or bearish signal when above or below it, respectively

3. Histogram

🔸It is the diff. b/w the MACD line & the SL plotted as a bar chart that fluctuates above & below a zero line.

🔸It represents the degree of divergence or convergence & its height reflects the magnitude of the diff. b/w the MACD line and the SL

Contd.👇

🔸It is the diff. b/w the MACD line & the SL plotted as a bar chart that fluctuates above & below a zero line.

🔸It represents the degree of divergence or convergence & its height reflects the magnitude of the diff. b/w the MACD line and the SL

Contd.👇

👉Divergence

🔸Convergence happens when the MACD & prices move in the same direction, indicating a trend's strength &

🔸Divergence occurs when both move in opp. directions, indicating a trend reversal.

Contd.👇

🔸Convergence happens when the MACD & prices move in the same direction, indicating a trend's strength &

🔸Divergence occurs when both move in opp. directions, indicating a trend reversal.

Contd.👇

[D] Drawbacks of using MACD

🔸Lagging Indicator

👉Relies on historical price data & generates delayed signals, leading to untimely alerts.

In fast-moving & unpredictable markets, it may not be effective

🔸Lagging Indicator

👉Relies on historical price data & generates delayed signals, leading to untimely alerts.

In fast-moving & unpredictable markets, it may not be effective

🔸False Signal

👉Produces false signals

👉A crossover b/w the MACD and the SL may suggest a trend reversal, but the price could still move in the same direction

👉Produces false signals

👉A crossover b/w the MACD and the SL may suggest a trend reversal, but the price could still move in the same direction

🔸Overreliance:

👉The default settings may not work for all assets & timeframes, so it's important to experiment with different settings

👉The default settings may not work for all assets & timeframes, so it's important to experiment with different settings

🔸Limited usefulness

👉It may not be effective in range-bound or sideways markets, & other tools such as oscillators may be more appropriate for identifying buy & sell signals

👉It may not be effective in range-bound or sideways markets, & other tools such as oscillators may be more appropriate for identifying buy & sell signals

Want us to keep doing this?

1. Follow us (@ICICI_Direct) and hit the bell icon🔔

2. Retweet this tweet👇

1. Follow us (@ICICI_Direct) and hit the bell icon🔔

2. Retweet this tweet👇

TL;DR

[1] What is MACD?

[2] How to calculate MACD?

[3] Interpretation

[4] Drawbacks of using MACD

[1] What is MACD?

[2] How to calculate MACD?

[3] Interpretation

[4] Drawbacks of using MACD

Disclaimer: Investments in securities markets are subject to market risks. Please read all related documents carefully.

Full disclaimer here: bit.ly

Full disclaimer here: bit.ly

Loading suggestions...

![[C] Interpretation

Guidelines for interpreting the MACD:

👉Crossover

🔸The most basic signal when th...](https://pbs.twimg.com/media/FvHzU30XoAIguia.jpg)