1/ In this thread we will go over:

• What is chainlink

• Market Size

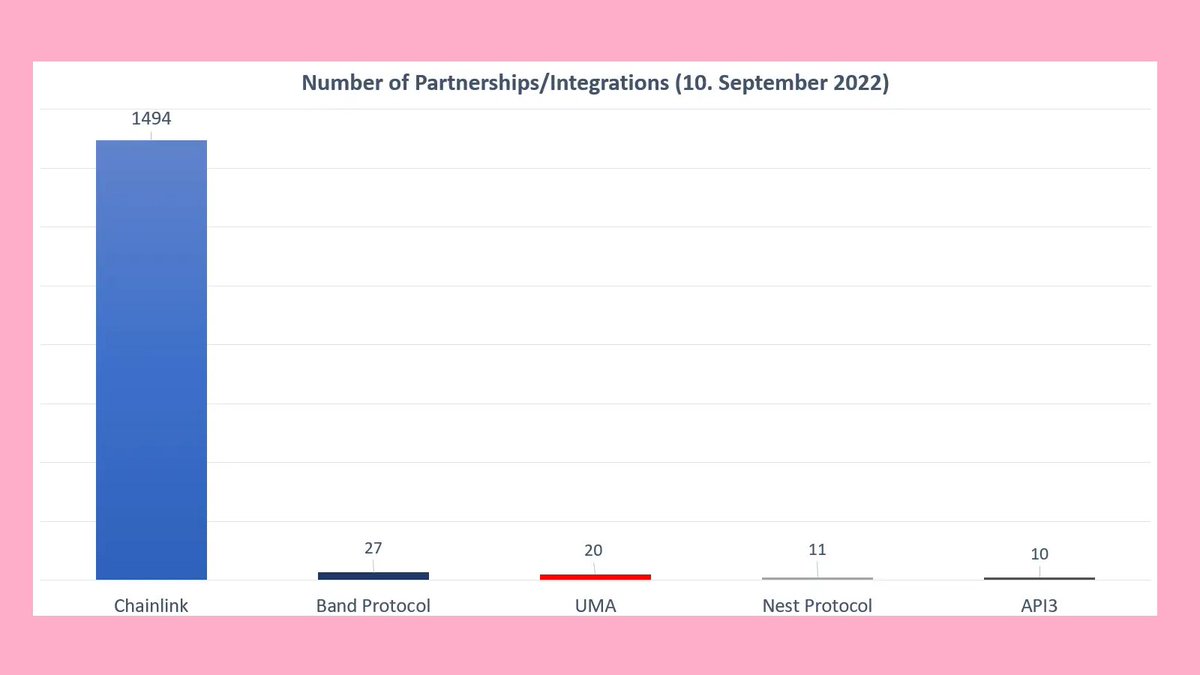

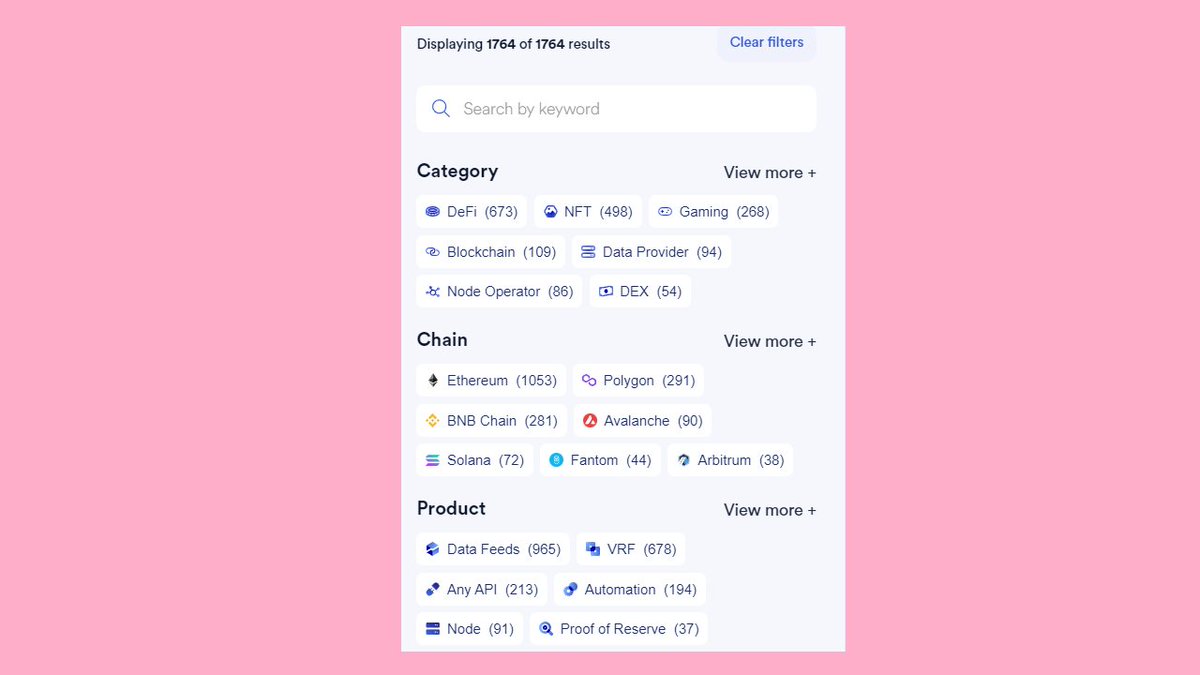

• Chainlink vs. Competitors

• Partnerships

• Product Overview

• Chainlink BUILD

• Token Overview

• Price Action

• Market Opportunity

• Conclusion

• What is chainlink

• Market Size

• Chainlink vs. Competitors

• Partnerships

• Product Overview

• Chainlink BUILD

• Token Overview

• Price Action

• Market Opportunity

• Conclusion

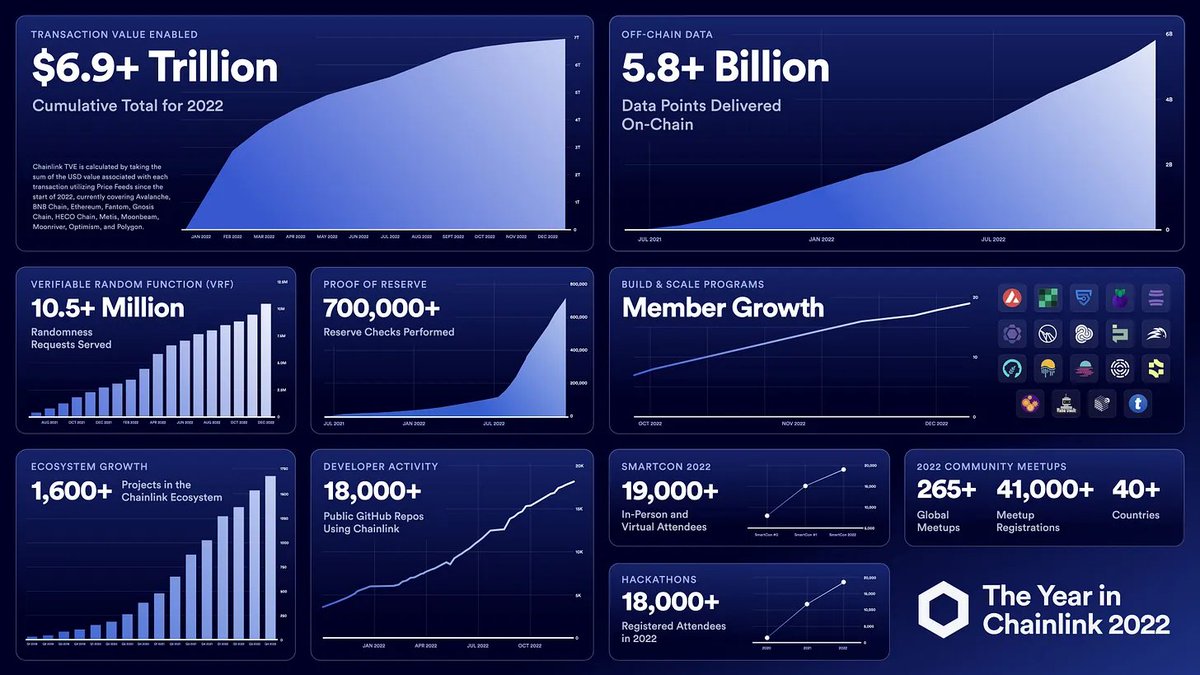

3/

• What is ChainLink?

Chainlink is the most widely used Oracle network for powering hybrid smart contracts, enabling any blockchain to access off-chain data & computations securely.

Simply saying, it connects real-world data to blockchain networks.

• What is ChainLink?

Chainlink is the most widely used Oracle network for powering hybrid smart contracts, enabling any blockchain to access off-chain data & computations securely.

Simply saying, it connects real-world data to blockchain networks.

7/ On top of that @chainlink is building more in-depth partnerships within the DeFi ecosystem, for example with @GMX_IO

@chainlink @GMX_IO 8/

• Product Overview

Chainlink is not just an oracle solution for price feeds as many people would think.

It is the industry-standard Web3 services platform connecting people, businesses, and data with the Web3 world.

• Product Overview

Chainlink is not just an oracle solution for price feeds as many people would think.

It is the industry-standard Web3 services platform connecting people, businesses, and data with the Web3 world.

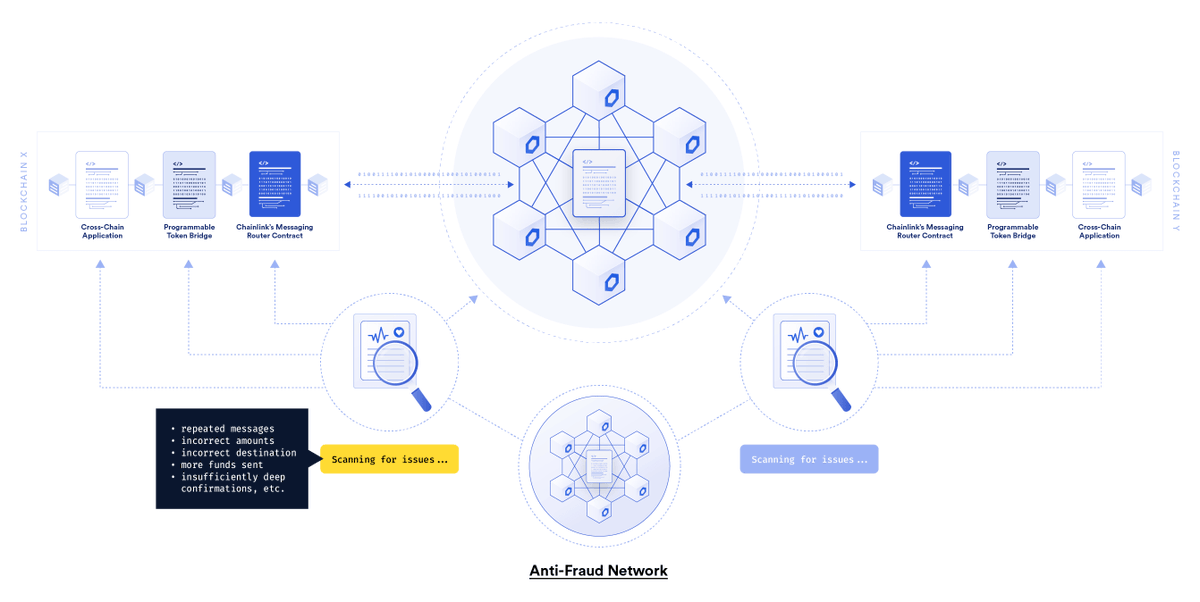

@chainlink @GMX_IO 9/ CCIP

Chainlink CCIP provides a cross-chain messaging framework for developers to build secure services and applications

That can send messages, transfer tokens, and initiate actions across multiple networks, run by independent oracle nodes.

Chainlink CCIP provides a cross-chain messaging framework for developers to build secure services and applications

That can send messages, transfer tokens, and initiate actions across multiple networks, run by independent oracle nodes.

@chainlink @GMX_IO 10/ Applications may communicate and interact with one another across various blockchain networks thanks to Cross-Chain Interoperability.

This enables the exchange of information and value between various systems, increasing connection and facilitating seamless integration.

This enables the exchange of information and value between various systems, increasing connection and facilitating seamless integration.

@chainlink @GMX_IO 11/ CCIP is currently being tested across 3 testnet with 25 users (including @synthetix_io, @AaveAave, @QiDaoProtocol).

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 12/ CCIP is not just a cross-chain bridge for transferring funds but a technology that

Evolves hybrid smart contracts, brings the speed, efficiency, and cost-effectiveness of Web2 to the development of Web3, and opens a door to institutional adoption.

Evolves hybrid smart contracts, brings the speed, efficiency, and cost-effectiveness of Web2 to the development of Web3, and opens a door to institutional adoption.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 13/ For example, SWIFT announced a partnership with Chainlink to use CCIP in a PoC to enable 11000 banks to connect to the multi-chain.

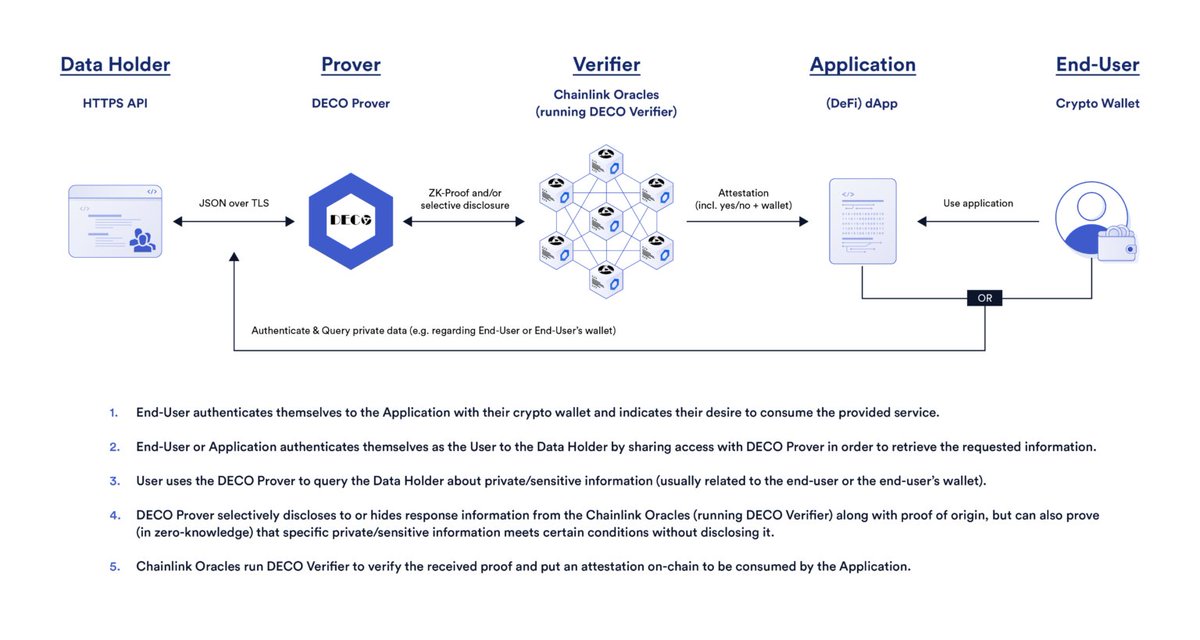

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 14/ DECO

Everyone is talking about privacy and ZK-proofs, but most people do not realize that ChainLink's DECO is a privacy-preserving oracle technology that utilizes ZKPs.

Everyone is talking about privacy and ZK-proofs, but most people do not realize that ChainLink's DECO is a privacy-preserving oracle technology that utilizes ZKPs.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 15/ It allows data transmitted over the Internet to be confidentially attested to by oracles without the data being revealed to the public or to the oracle nodes themselves.

With DECO (ZKPs), sensitive information can be proven without concerns about data privacy.

With DECO (ZKPs), sensitive information can be proven without concerns about data privacy.

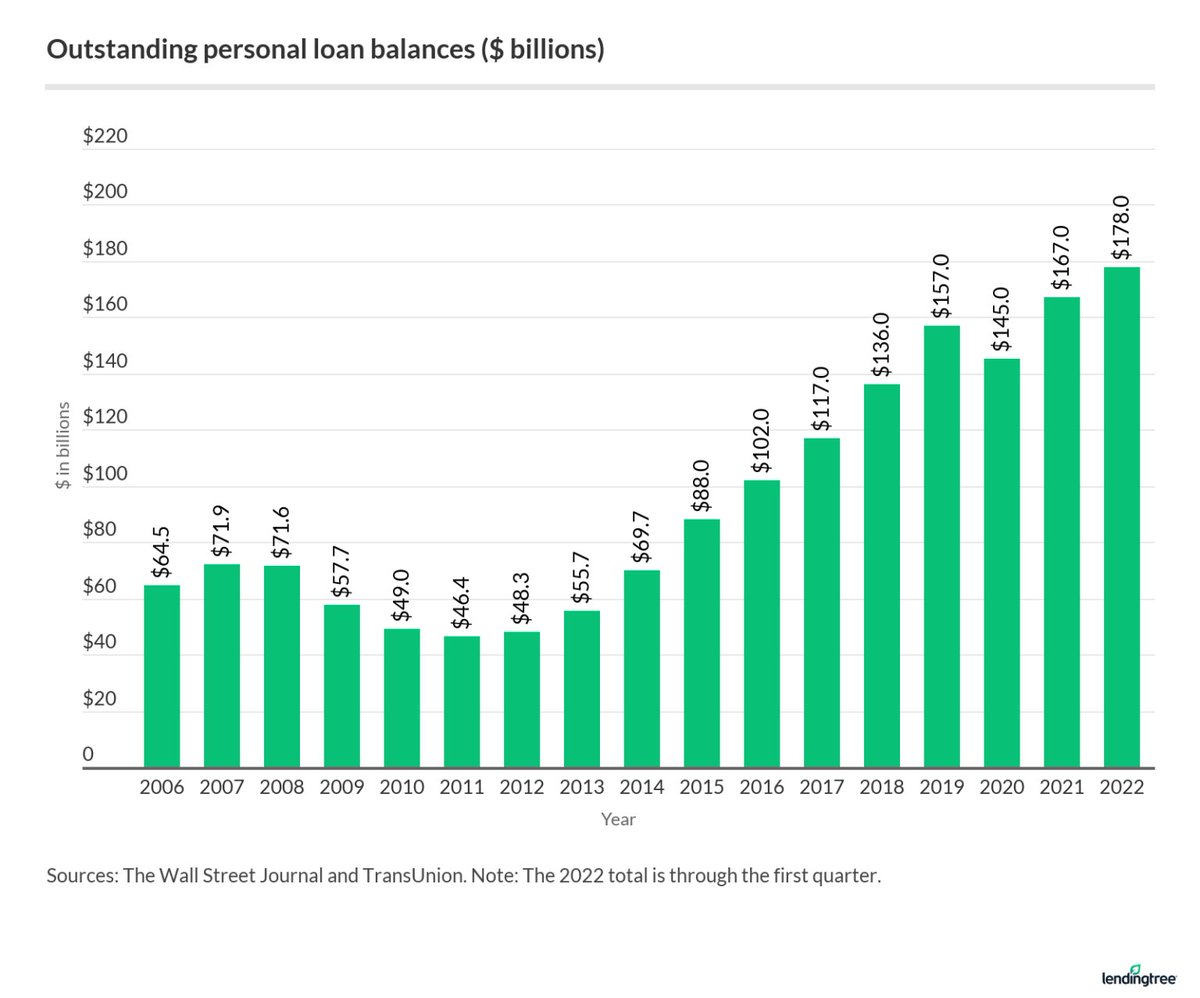

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 16/ DECO (ZKPs) solves a large limitation with existing web communication standards, where users can privately communicate with a web server but cannot prove it to third parties.

For example, this tech can bring a $200b unsecured personal loan market to DeFi.

For example, this tech can bring a $200b unsecured personal loan market to DeFi.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 17/ Proof of Reserve

Chainlink PoR provides autonomous, reliable, and timely verification of on-chain and off-chain reserves.

Supporting both DeFi and institutional interest in tokenized RWAs to bring more value on-chain with enhanced transparency and verifiability.

Chainlink PoR provides autonomous, reliable, and timely verification of on-chain and off-chain reserves.

Supporting both DeFi and institutional interest in tokenized RWAs to bring more value on-chain with enhanced transparency and verifiability.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 18/ For example, as in the case, I explained before:

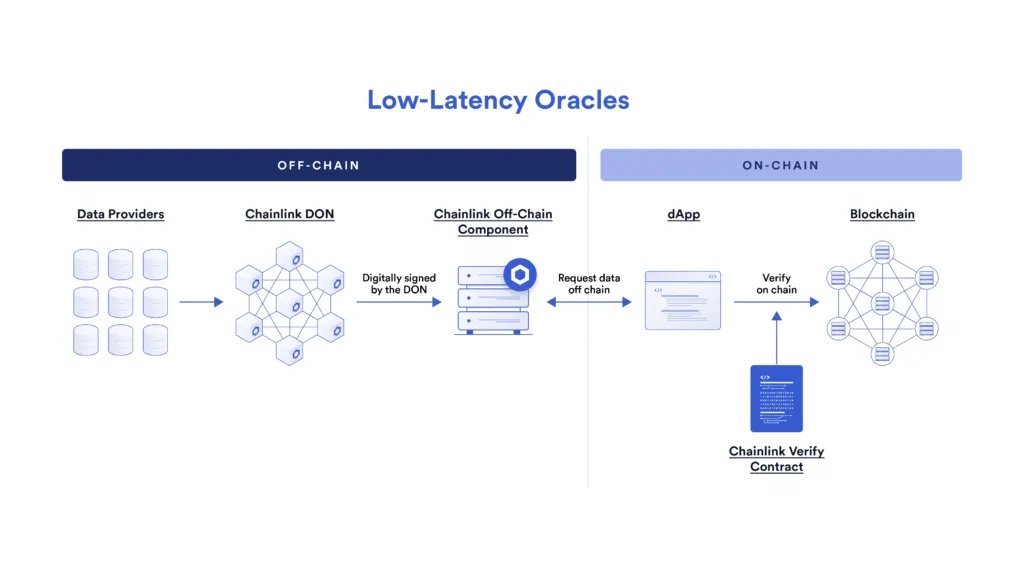

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 19/ Low-Latency Oracles

In capital markets, firms need low-latency algorithmic trading systems to increase profitability and react to market events quicker.

Faster data processing time allows that firms to catch events and profit from them before the market returns to normal.

In capital markets, firms need low-latency algorithmic trading systems to increase profitability and react to market events quicker.

Faster data processing time allows that firms to catch events and profit from them before the market returns to normal.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 20/ As of today platforms like GMX can not offer low-latency trading and to protect LP from draining it has a small delay before the trade is executed.

Low latency oracles would allow to remove this delay and attract more professional traders to the platform.

Low latency oracles would allow to remove this delay and attract more professional traders to the platform.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 21/ Chainlink's low-latency oracle solution leverages high-speed data providers with Chainlink’s DON to deliver high-frequency pricing data off-chain, yet provide on-chain verification.

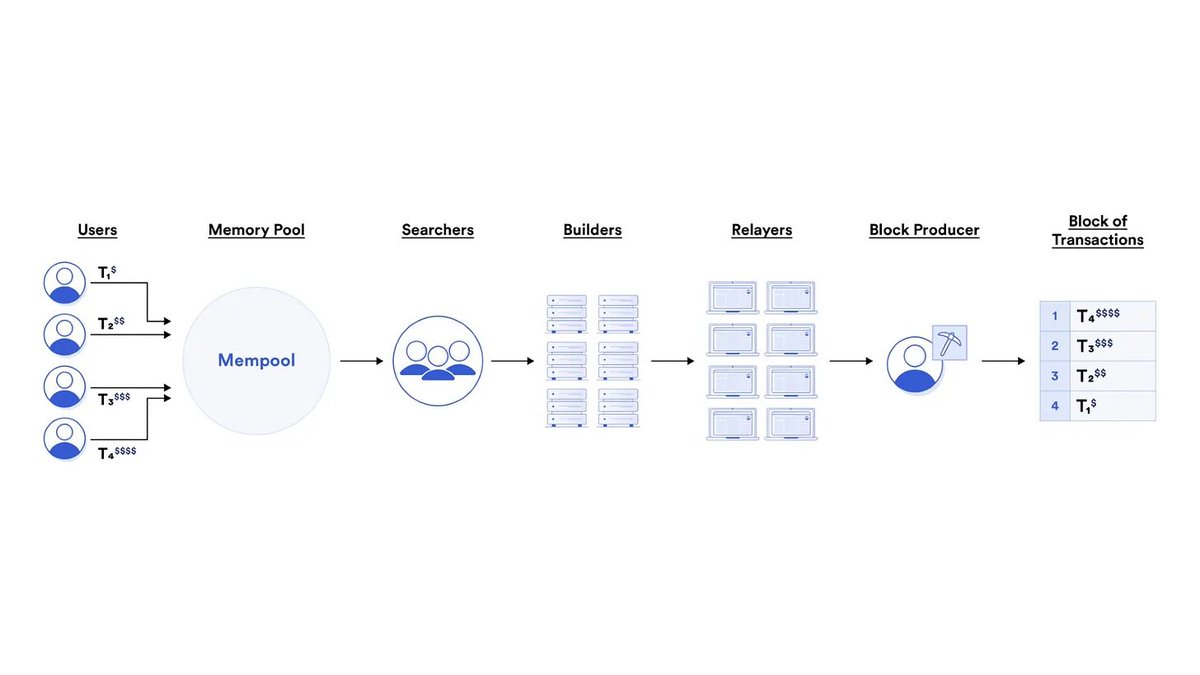

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 22/ Fair Sequencing Services

FSS is a transaction ordering solution that aims to mitigate harmful forms of MEV in order to help decentralized systems become fundamentally fairer.

FSS aims to solve the problems of both high gas costs and unfair transaction ordering.

FSS is a transaction ordering solution that aims to mitigate harmful forms of MEV in order to help decentralized systems become fundamentally fairer.

FSS aims to solve the problems of both high gas costs and unfair transaction ordering.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol 23/ Ordinary users do not always notice these things but harmful MEV often causes unnecessary slippage, creating an invisible tax on users, and degrading the overall user experience.

@arbitrum was one of the first to explore the FSS solution from CL.

@arbitrum was one of the first to explore the FSS solution from CL.

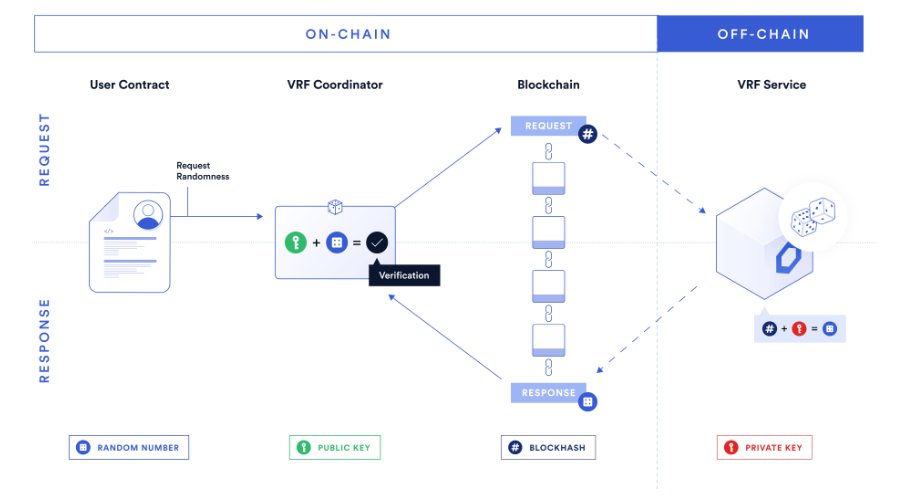

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 24/ Verifiable Randomness Function

Randomness is at the heart of massive markets, like the lottery market ($340B+), the video game industry (~$200B), and blockchain gaming ($5B).

But legacy randomness is not provably fair, which goes against the core promise of Web3.

Randomness is at the heart of massive markets, like the lottery market ($340B+), the video game industry (~$200B), and blockchain gaming ($5B).

But legacy randomness is not provably fair, which goes against the core promise of Web3.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 25/ Chainlink VRF is the industry-standard source of provably fair and tamper-proof on-chain randomness for blockchain-based applications.

For example, most of the web3 gambling protocols are using CL VRF to ensure the fairness of the game.

For example, most of the web3 gambling protocols are using CL VRF to ensure the fairness of the game.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 26/ NFT Floor Prices, Off-Chain Reporting, Automation 2.0, Chainlink Functions, and many other products are in development which will make this thread never-ending.

The point is that Chainlink is not just a price feed provider.

The point is that Chainlink is not just a price feed provider.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 27/

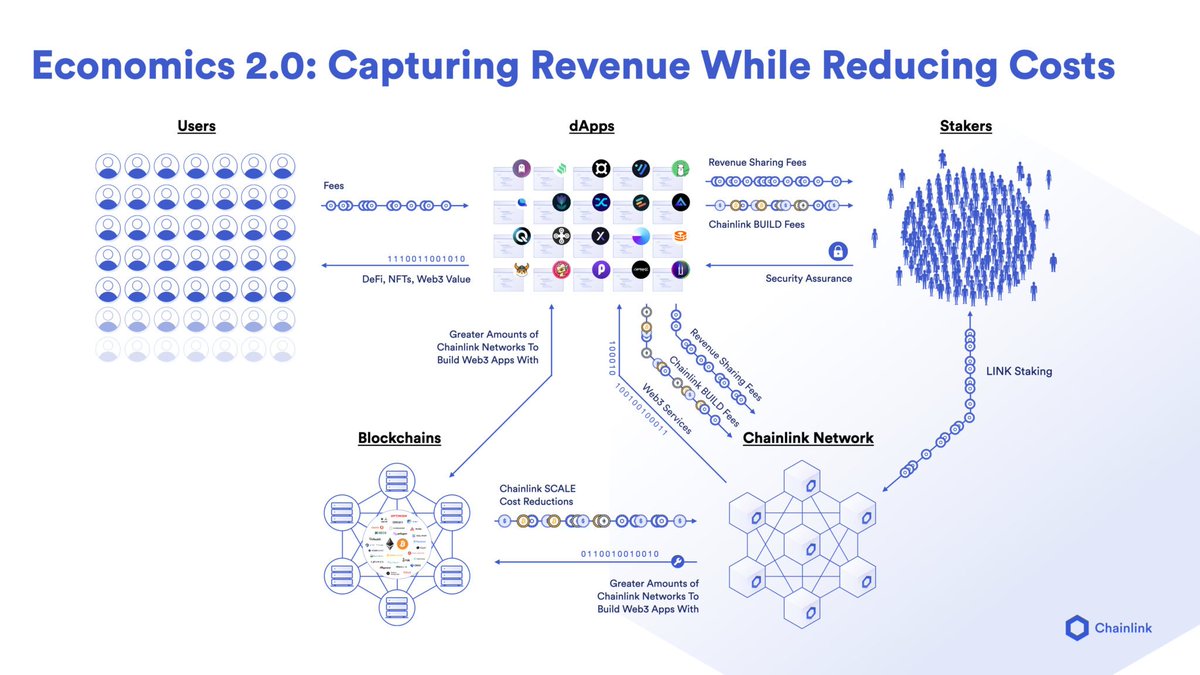

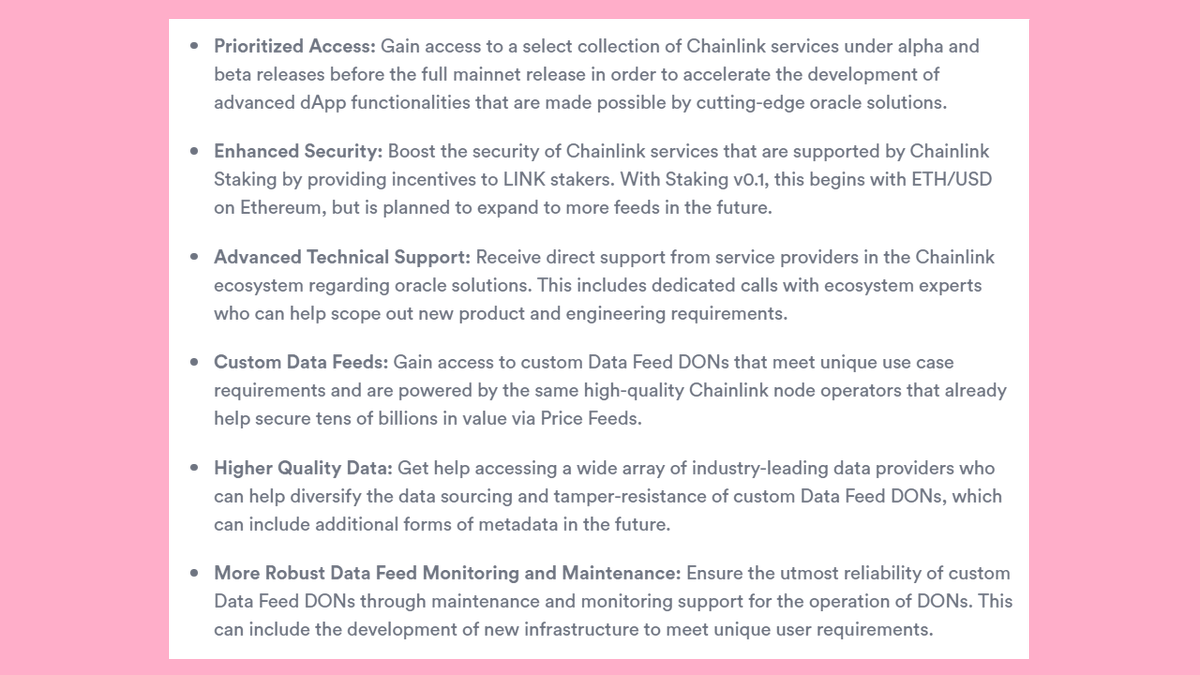

• Chainlink BUILD

Participating projects in BUILD commit to pay network fees and provide incentives (native tokens) to the service providers in the Chainlink community, such as Chainlink stakers.

• Chainlink BUILD

Participating projects in BUILD commit to pay network fees and provide incentives (native tokens) to the service providers in the Chainlink community, such as Chainlink stakers.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 28/ In return, these projects will get access to some of the following benefits:

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 29/

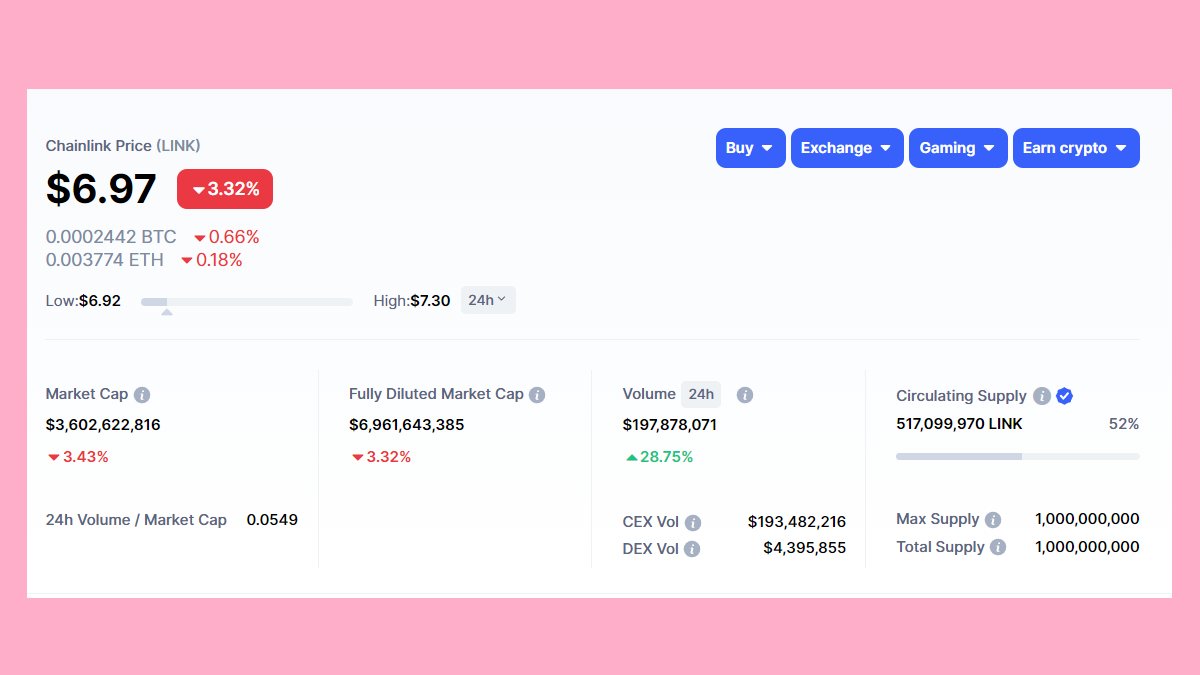

• Token Overview

MC - $3.6B

FDV - $7B

$LINK has 2 main use cases

🔹 Payment to Chainlink node operators for providing oracle services

🔹 Node operators need to stake it as collateral to provide services

• Token Overview

MC - $3.6B

FDV - $7B

$LINK has 2 main use cases

🔹 Payment to Chainlink node operators for providing oracle services

🔹 Node operators need to stake it as collateral to provide services

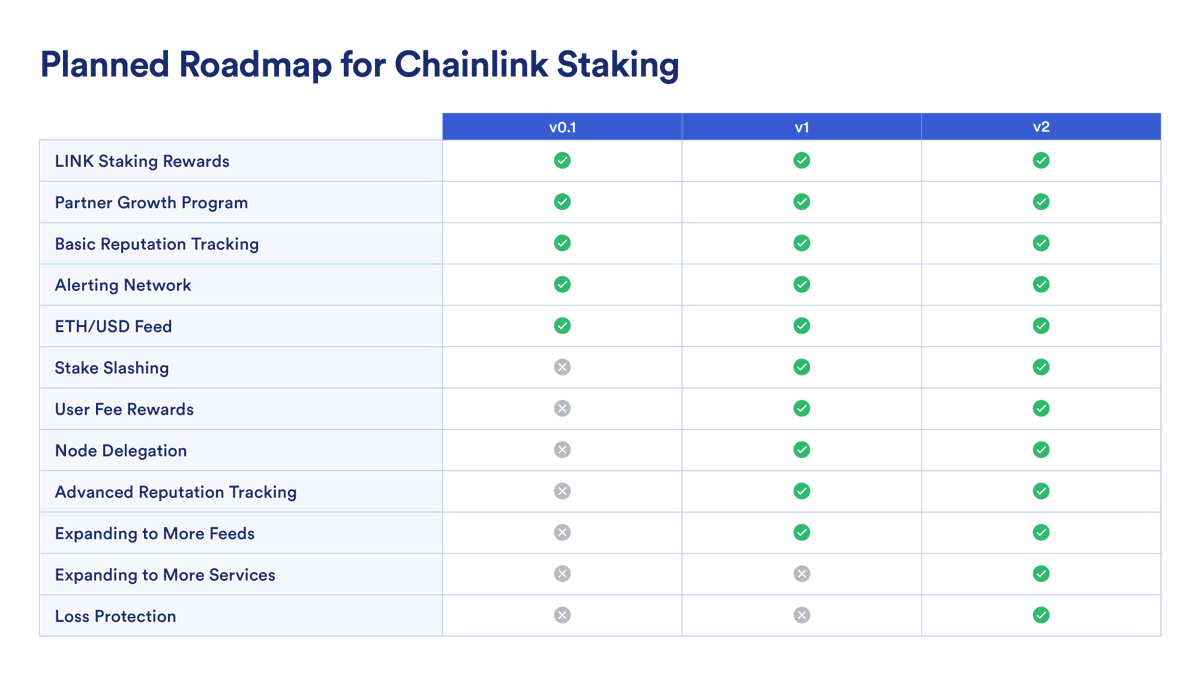

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 30/ Average holders do not have any benefits of holding the $link.

Until the Chainlink Staking was introduced.

Until the Chainlink Staking was introduced.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 31/ Stakers earn rewards for helping to secure the data feed by participating in a decentralized alerting system.

Alerting conditions will be focused on feed uptime but will expand in scope in later versions.

Alerting conditions will be focused on feed uptime but will expand in scope in later versions.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 32/

• Price Action

$link is in the accumulation phase for over a year which signals that there is significant interest from market participants at these prices.

I think that the comfortable entry point would be below $5.3.

• Price Action

$link is in the accumulation phase for over a year which signals that there is significant interest from market participants at these prices.

I think that the comfortable entry point would be below $5.3.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 33/

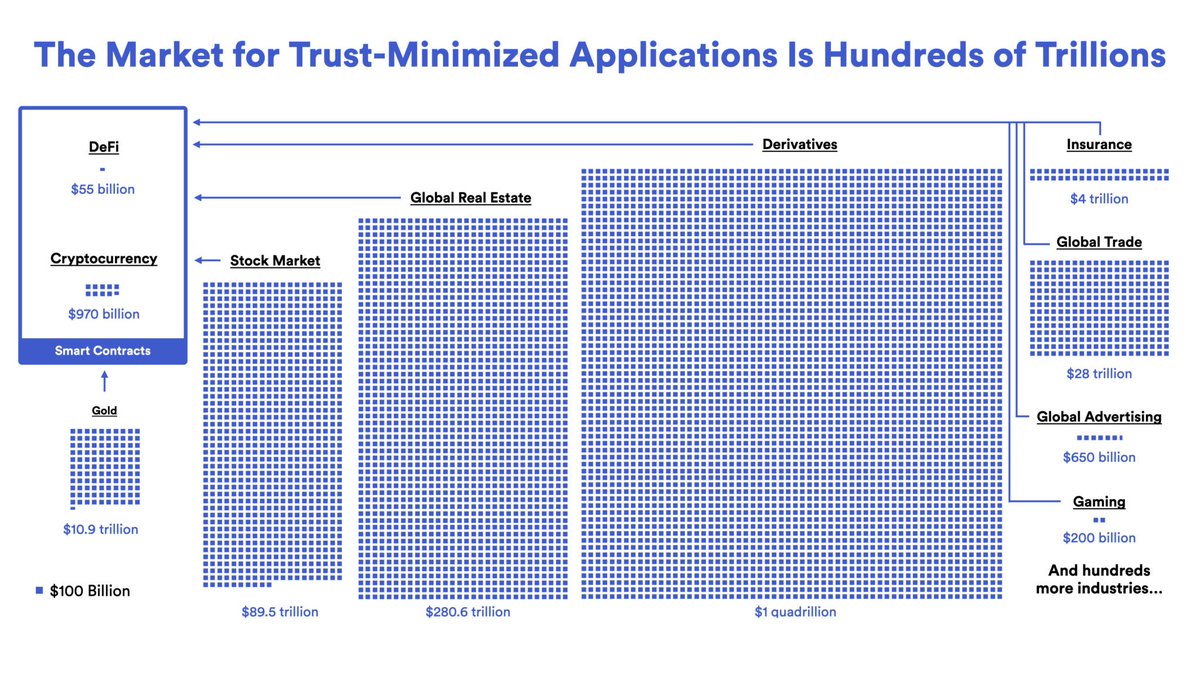

• Market Opportunity

We already understood that Chainlink has captured most of the DeFi market, but the real opportuning comes from RWA adoption.

• Market Opportunity

We already understood that Chainlink has captured most of the DeFi market, but the real opportuning comes from RWA adoption.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 34/ Web3 is a multi-trillion-dollar opportunity for developers, startups, entrepreneurs, and established businesses who want to realize the power of cryptographic truth.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 35/ There are hundreds of trillions in transaction value yet to be transferred into DeFi and

Chainlink positioned itself to capture a significant portion of the future capital migration into web3.

Chainlink positioned itself to capture a significant portion of the future capital migration into web3.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 36/

• Conclusion

The long-term investment thesis for $link comes from the merge of the global economy with web3 world

Where Chainlink will be the main infrastructure for processing transaction value and data from all industries.

• Conclusion

The long-term investment thesis for $link comes from the merge of the global economy with web3 world

Where Chainlink will be the main infrastructure for processing transaction value and data from all industries.

@chainlink @GMX_IO @synthetix_io @AaveAave @QiDaoProtocol @arbitrum 37/ At the same time, the $link will get a value accrual mechanism and will attract more holders and stakers.

38/ That’s a wrap.

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Thank You and stay safe!

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Thank You and stay safe!

Loading suggestions...