Everyone is so focused on LSDfi and they are missing out on what else the big boys are looking at.

@cz_binance and @GoldmanSachs are betting on RWA narrative before anyone else. Follow smart investments to front run whales.

A growth engine powering the next 100x in Defi🧵

@cz_binance and @GoldmanSachs are betting on RWA narrative before anyone else. Follow smart investments to front run whales.

A growth engine powering the next 100x in Defi🧵

1/ Lets get up to speed on this topic. Real world asset in short is RWA.

Some stuff that you would want to know:

1️⃣About RWA

2️⃣How RWA impacts Defi

3️⃣Potential of RWA

4️⃣Mass adoption

5️⃣Projects in the RWA space

Some stuff that you would want to know:

1️⃣About RWA

2️⃣How RWA impacts Defi

3️⃣Potential of RWA

4️⃣Mass adoption

5️⃣Projects in the RWA space

3/ One that I just realized too. Stablecoins are as a result of a successful use case for RWA implementation.

USDT and USDC are pegged to and represents the US dollar on the blockchain.

USDT and USDC are pegged to and represents the US dollar on the blockchain.

5/ RWA bring a slew of benefits to Defi, such as:

🔹Borderless possibility

Real-world assets (RWA) may be tokenized and added to the chain, allowing for cross-border asset exchange and eliminating geographical restrictions.

Anyone can invest in real estate for a fraction.

🔹Borderless possibility

Real-world assets (RWA) may be tokenized and added to the chain, allowing for cross-border asset exchange and eliminating geographical restrictions.

Anyone can invest in real estate for a fraction.

6/ 🔹Diverse income

Additionally, RWA broadens the source of DeFi income, giving if a continuous fee boosts.

MakerDAO has confirmed RWA's capacity to ingest real-world revenue, which is essential for the DeFi protocol to be competitive.

Additionally, RWA broadens the source of DeFi income, giving if a continuous fee boosts.

MakerDAO has confirmed RWA's capacity to ingest real-world revenue, which is essential for the DeFi protocol to be competitive.

7/ 🔹Deepen liquidity

It might be the next big thing for DeFi, offering limitless liquidity and creating new avenues for the development of the capital markets.

On-chain, there are a lot of treasury bonds and real estates, giving DeFi a real return in the real world.

It might be the next big thing for DeFi, offering limitless liquidity and creating new avenues for the development of the capital markets.

On-chain, there are a lot of treasury bonds and real estates, giving DeFi a real return in the real world.

8/ 3️⃣Potential of RWA

RWA is not a new concept. In fact, it is already existing for the longest time, with USDC and USDT being the US dollar representation on-chain.

More popular RWA includes assets like equities, carbon credits, real estate, and US Treasury bonds.

RWA is not a new concept. In fact, it is already existing for the longest time, with USDC and USDT being the US dollar representation on-chain.

More popular RWA includes assets like equities, carbon credits, real estate, and US Treasury bonds.

9/ 🔹MakerDAO

It holds US Treasury bonds accounting for $500 million of the RWA collateral. These are AAA bonds.

It holds US Treasury bonds accounting for $500 million of the RWA collateral. These are AAA bonds.

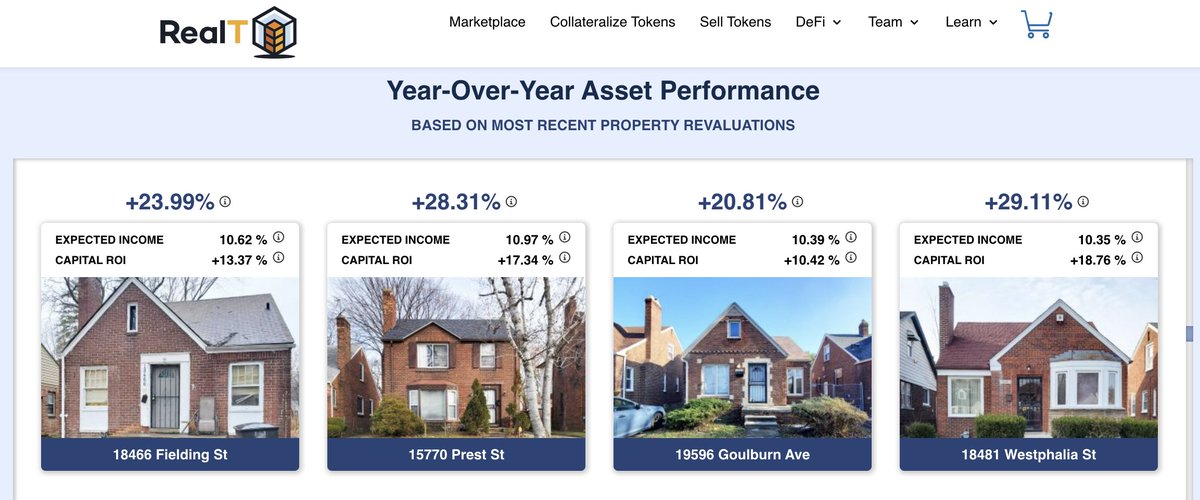

10/ 🔹RealT

(powered by @AaveAave) Tokenizes real estate assets to address their liquidity and transaction cost issues.

Investors can invest in a faction of the asset vs traditional investment of buying the whole house.

(powered by @AaveAave) Tokenizes real estate assets to address their liquidity and transaction cost issues.

Investors can invest in a faction of the asset vs traditional investment of buying the whole house.

11/ RWA is still being used, although its scope is modest when compared to the DeFi as a whole.

More of its use cases are waiting to be uncovered.

More of its use cases are waiting to be uncovered.

12/ 4️⃣Mass adoption

It's always a hurdle for crypto concepts to attain mass adoption because it will usually be challenged with regulation and transparency concerns.

It's always a hurdle for crypto concepts to attain mass adoption because it will usually be challenged with regulation and transparency concerns.

13/ If we think about the stablecoin depeg saga, many times, the uncertainty develop fear in people and they these stablecoins often questioned.

What is backing it, do they have the balance to prove, is it truly decentralized?

These are tough questions to provide answers for.

What is backing it, do they have the balance to prove, is it truly decentralized?

These are tough questions to provide answers for.

14/ With other RWA being brought on-chain, matters complicate. Issues such as value of assets, asset ownership, legal protection of property rights arise.

And to achieve larger scale adoption, compliance have to be introduced.

And to achieve larger scale adoption, compliance have to be introduced.

15/ We also have to be cautious of regulatory bodies challenging RWA. It's a fine balance to juggle decentralisation and centralisation well.

Central bodies could interfere with the Defi and may hinder or push forth the RWA towards maturity, which we are still pretty far from.

Central bodies could interfere with the Defi and may hinder or push forth the RWA towards maturity, which we are still pretty far from.

16/ 5️⃣Projects in the RWA space

Credit: @MakerDAO, @maplefinance, @centrifuge, @Credix_finance, @TrueFiDAO, @ClearpoolFin,

@Polytrade_fin, @credefi_finance

Carbon credits: @ToucanProtocol, @weareflowcarbon, @regen_network

Finance: @ELYSIA_HQ, @realio_network, @Axis_Defi

Credit: @MakerDAO, @maplefinance, @centrifuge, @Credix_finance, @TrueFiDAO, @ClearpoolFin,

@Polytrade_fin, @credefi_finance

Carbon credits: @ToucanProtocol, @weareflowcarbon, @regen_network

Finance: @ELYSIA_HQ, @realio_network, @Axis_Defi

17/ Luxury: @galileoprotocol

Real estate: @TheopetraLabs, @SwarmMarkets, @RealTPlatform,

@labsgroupio, @Oceanpoint_BST, @LiquidProp_xyz, @codedestate

Real estate: @TheopetraLabs, @SwarmMarkets, @RealTPlatform,

@labsgroupio, @Oceanpoint_BST, @LiquidProp_xyz, @codedestate

Loading suggestions...