1.

~ A steady war ~

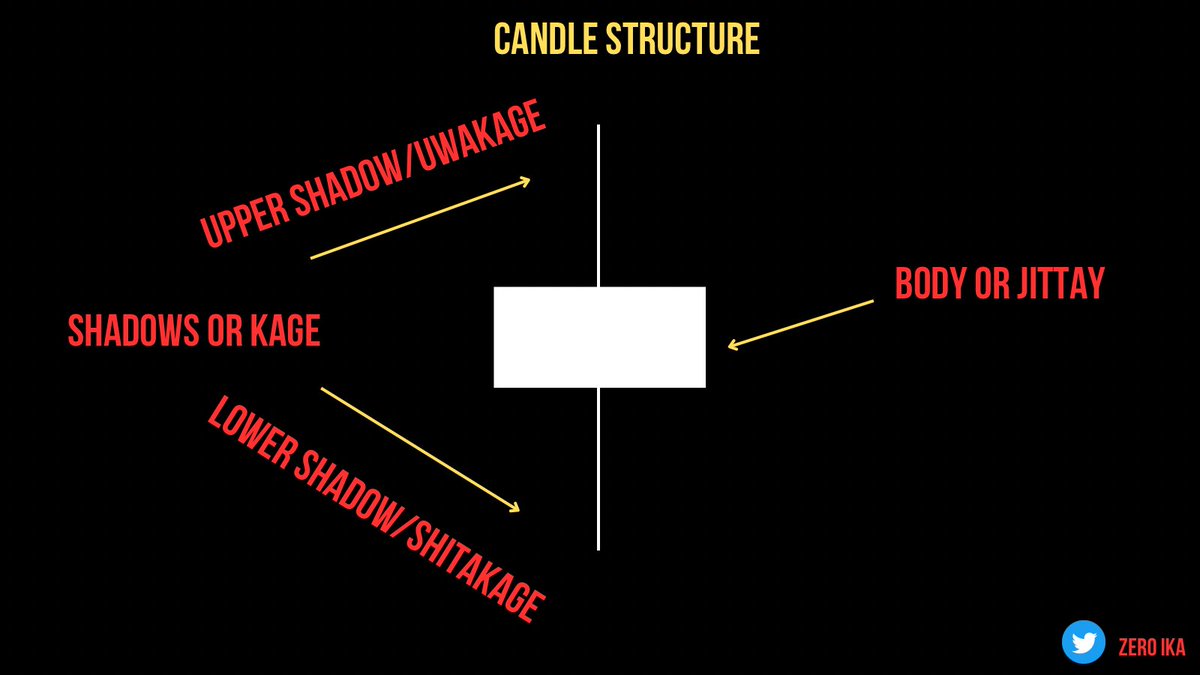

Imagine candlesticks like a battle.

We have buyers (green candles) and sellers (red candles).

When the opposing forces of buyers and sellers are in balance, the battle is reduced to a stalemate, neither side prevails over the other.

~ A steady war ~

Imagine candlesticks like a battle.

We have buyers (green candles) and sellers (red candles).

When the opposing forces of buyers and sellers are in balance, the battle is reduced to a stalemate, neither side prevails over the other.

2.

On the opposite, if one force dominates the other, we can see a direction, supported by volatility and volumes.

We can also have fake movements that give the illusion of predominance, but end up in a fakeout.

That's why closures (1D-1W-1M) are important.

On the opposite, if one force dominates the other, we can see a direction, supported by volatility and volumes.

We can also have fake movements that give the illusion of predominance, but end up in a fakeout.

That's why closures (1D-1W-1M) are important.

4

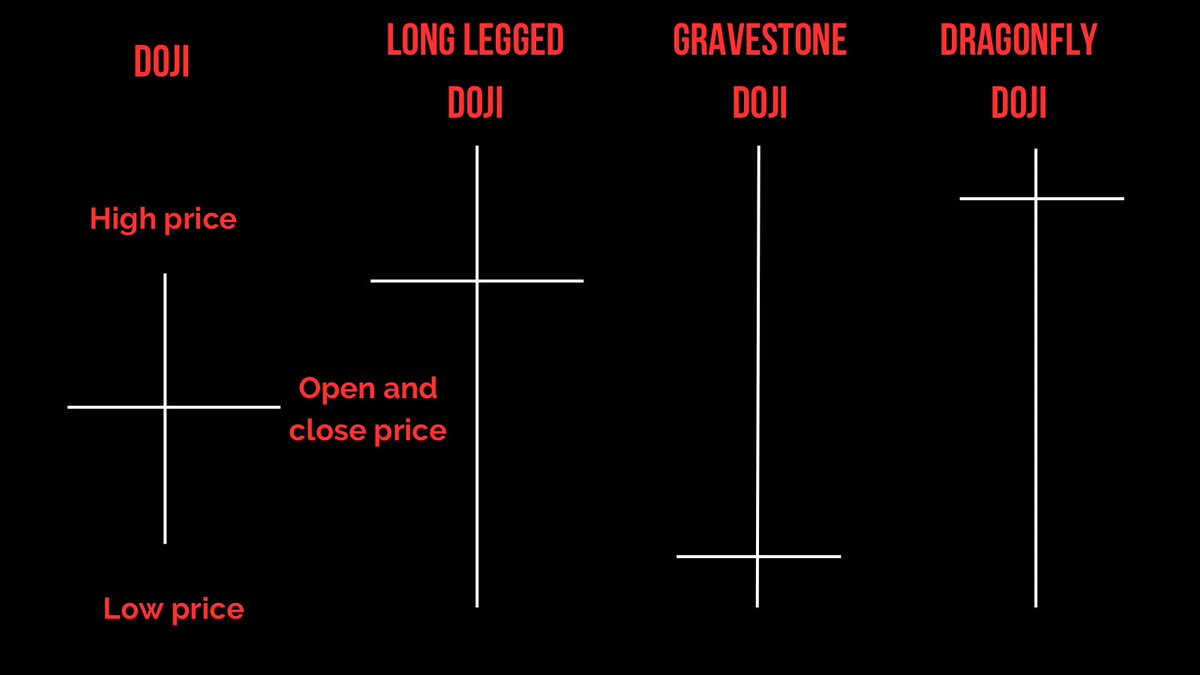

~ Doji ~

Doji candles indicate uncertainty in the market: there’s no winner between bulls and bears.

The candle after the doji could dictate the next trend.

• Green candle after doji ➩ bull

• Red candle after doji ➩ bear

It's always prudent to wait the candle post doji.

~ Doji ~

Doji candles indicate uncertainty in the market: there’s no winner between bulls and bears.

The candle after the doji could dictate the next trend.

• Green candle after doji ➩ bull

• Red candle after doji ➩ bear

It's always prudent to wait the candle post doji.

5.

Doji indicates uncertainty and possible trend reversal, but not always.

It depends on what phase of the current trend you are in:

1. At the beginning of a trend, a doji is not reliable, better not to bet on the reversal of the trend.

Doji indicates uncertainty and possible trend reversal, but not always.

It depends on what phase of the current trend you are in:

1. At the beginning of a trend, a doji is not reliable, better not to bet on the reversal of the trend.

6.

2. In the middle of a trend it is possible that a doji indicates a correction of the trend, not an actual reversal.

3. After big rises or falls, if a doji is formed, it is a very reliable signal of trend reversal.

As said, it’s always better to wait for the post doji candle.

2. In the middle of a trend it is possible that a doji indicates a correction of the trend, not an actual reversal.

3. After big rises or falls, if a doji is formed, it is a very reliable signal of trend reversal.

As said, it’s always better to wait for the post doji candle.

8.

To summarize a potential entry.

Yes if: ✅

• Next candle confirms the signal

• Few dojis in the chart

• First candle is long

• Trend has been going on for a long time

No if: ❌

• Many dojis in the chart

• Multiple dojis in a row

• Trend has just started

To summarize a potential entry.

Yes if: ✅

• Next candle confirms the signal

• Few dojis in the chart

• First candle is long

• Trend has been going on for a long time

No if: ❌

• Many dojis in the chart

• Multiple dojis in a row

• Trend has just started

10.

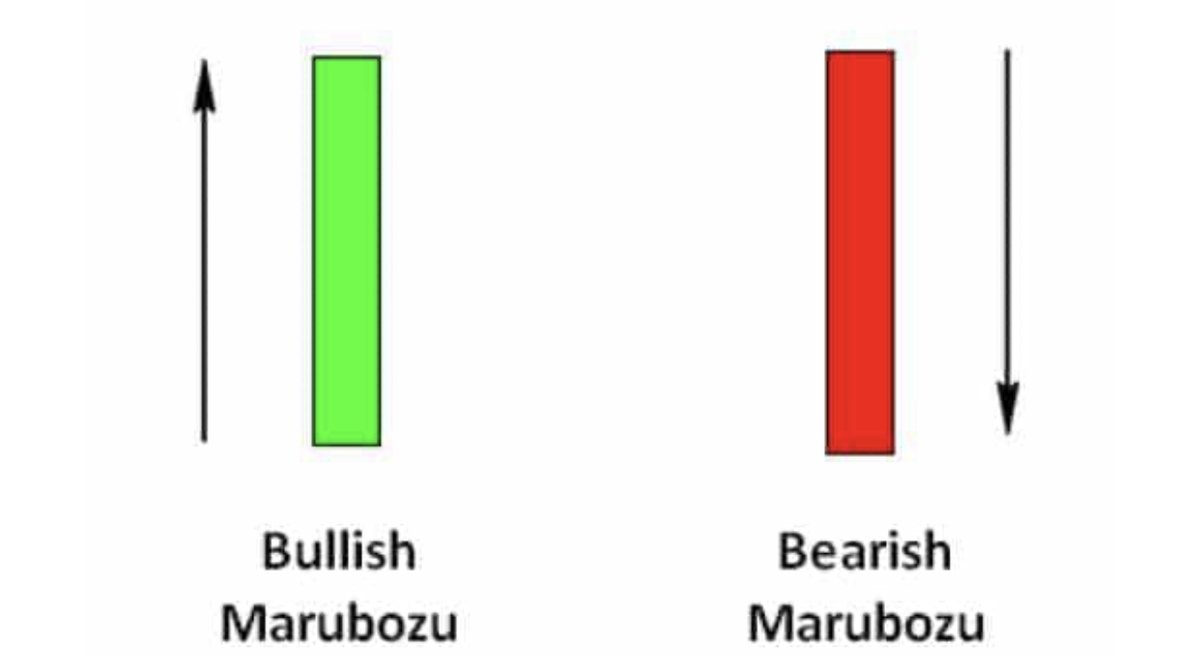

• Bullish marubozu ➩ solid buying strength that paves the way for an uptrend.

• Bearish marubozu ➩ bearish forces are very strong at the moment ➩ strong signal of a future downtrend.

• Bullish marubozu ➩ solid buying strength that paves the way for an uptrend.

• Bearish marubozu ➩ bearish forces are very strong at the moment ➩ strong signal of a future downtrend.

11.

Take note that everything depends on the trend.

At the beginning of a trend ➩ strength of the new trend.

At the end of a trend ➩ can be the last acceleration of the current trend to then see the start of a reversal with an opposite marubozu.

Take note that everything depends on the trend.

At the beginning of a trend ➩ strength of the new trend.

At the end of a trend ➩ can be the last acceleration of the current trend to then see the start of a reversal with an opposite marubozu.

14.

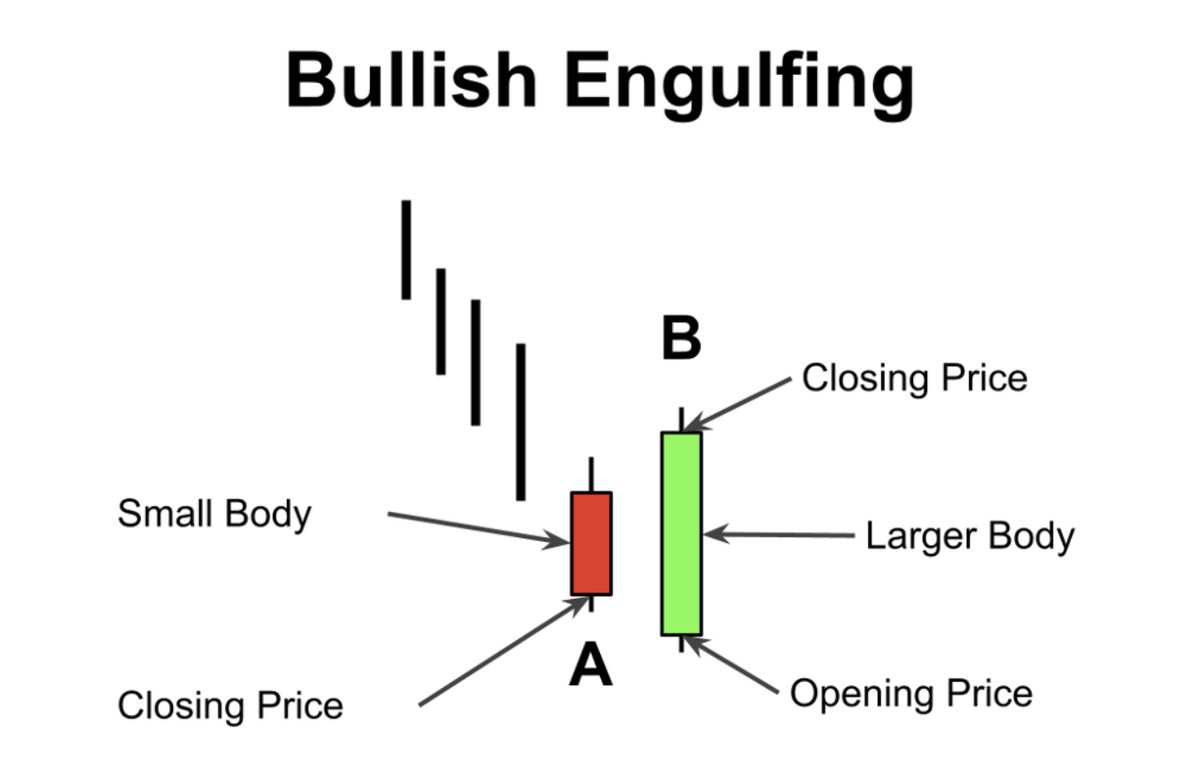

They're a trend reversal indicator.

My tips:

• Do not take into consideration trends that have just started.

• Take into consideration only well-established trends.

This will strengthen the reliability of the pattern, thus potential profitability.

They're a trend reversal indicator.

My tips:

• Do not take into consideration trends that have just started.

• Take into consideration only well-established trends.

This will strengthen the reliability of the pattern, thus potential profitability.

15.

~ Opposite trend ~

What happens if we find bearish engulfing in a downtrend and bullish engulfing in an uptrend?

It means that opposing forces have tried to reverse the trend, but the current trend is still too strong and has reacted.

Therefore a strong continuation sign.

~ Opposite trend ~

What happens if we find bearish engulfing in a downtrend and bullish engulfing in an uptrend?

It means that opposing forces have tried to reverse the trend, but the current trend is still too strong and has reacted.

Therefore a strong continuation sign.

17.

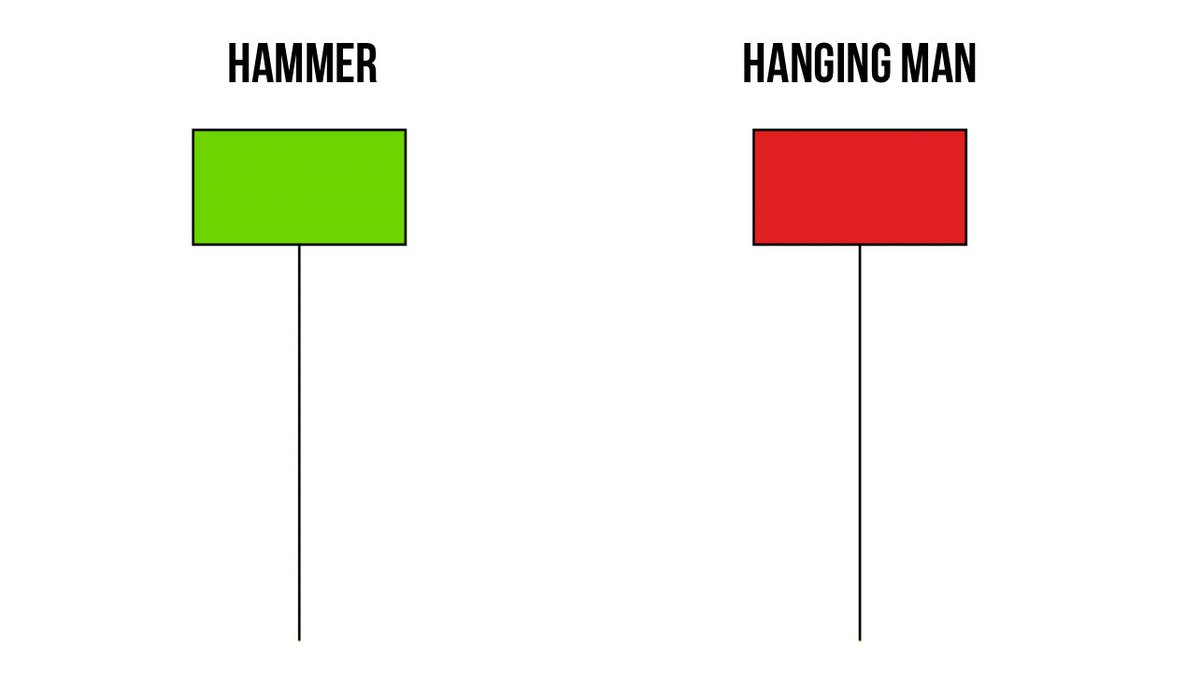

Take note:

It doesn't matter the color of the candle, both hammer and hanging man are efficient figures.

You can therefore use these candles to gauge potential trend reversals and position yourself accordingly.

Take note:

It doesn't matter the color of the candle, both hammer and hanging man are efficient figures.

You can therefore use these candles to gauge potential trend reversals and position yourself accordingly.

20.

~ Conclusion ~

We tend to rarely take the single candle as a signal, but we combine it with the next one or in groups of three, so as to make the signal stronger and with more confirmations.

They do not have to be used lonely, but together with classic indicators.

~ Conclusion ~

We tend to rarely take the single candle as a signal, but we combine it with the next one or in groups of three, so as to make the signal stronger and with more confirmations.

They do not have to be used lonely, but together with classic indicators.

21.

This helps us to make better decisions, spotting potential uptrends/downtrends and understanding if is the time to buy/wait/sell.

These types of candles are better to be used on a daily timeframe and, as said above, used to gauge the trend direction looking for closures.

This helps us to make better decisions, spotting potential uptrends/downtrends and understanding if is the time to buy/wait/sell.

These types of candles are better to be used on a daily timeframe and, as said above, used to gauge the trend direction looking for closures.

22.

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

Loading suggestions...