Many people are confused about Elecon's results, and don't know what caused the sudden fall in stock price.

In this thread I will teach you how to read results correctly with the example of Elecon.

🧵🧵🧵🧵🧵

In this thread I will teach you how to read results correctly with the example of Elecon.

🧵🧵🧵🧵🧵

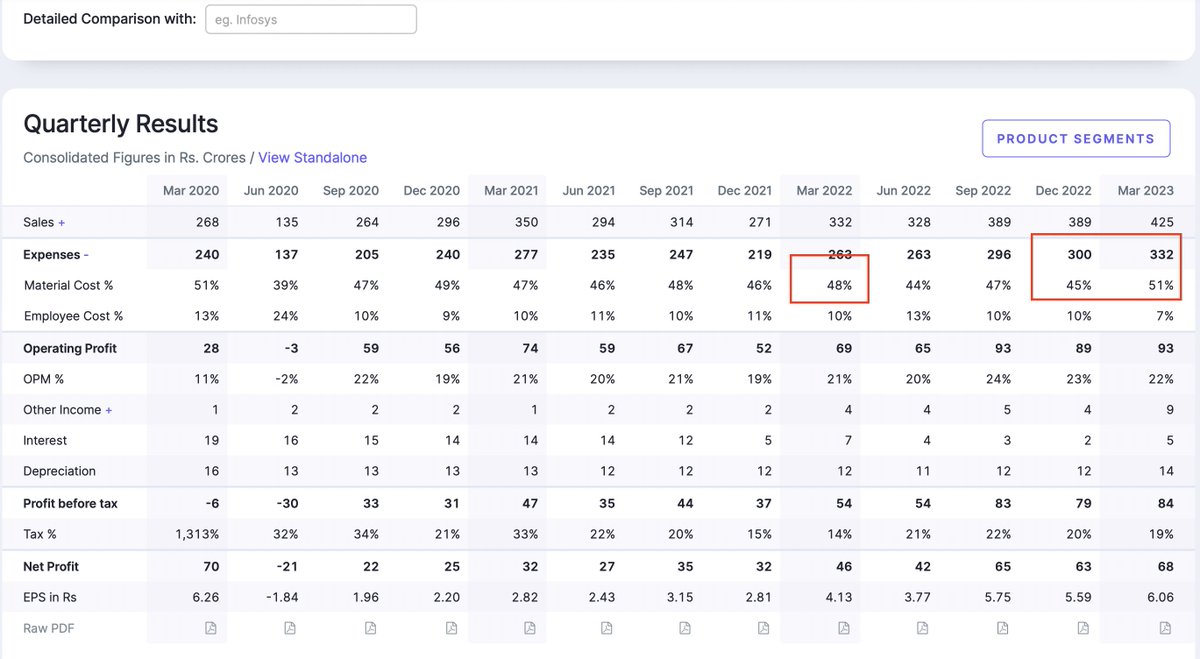

There are two ways to look at Quarterly results:-

1. YoY= Year on year comparison means that we are comparing Q4FY23 with Q4FY22

2. QoQ= Quarter on Quarter comparison means that we are comparing Q4FY23 with Q3FY23. This is also known as sequential growth.

1. YoY= Year on year comparison means that we are comparing Q4FY23 with Q4FY22

2. QoQ= Quarter on Quarter comparison means that we are comparing Q4FY23 with Q3FY23. This is also known as sequential growth.

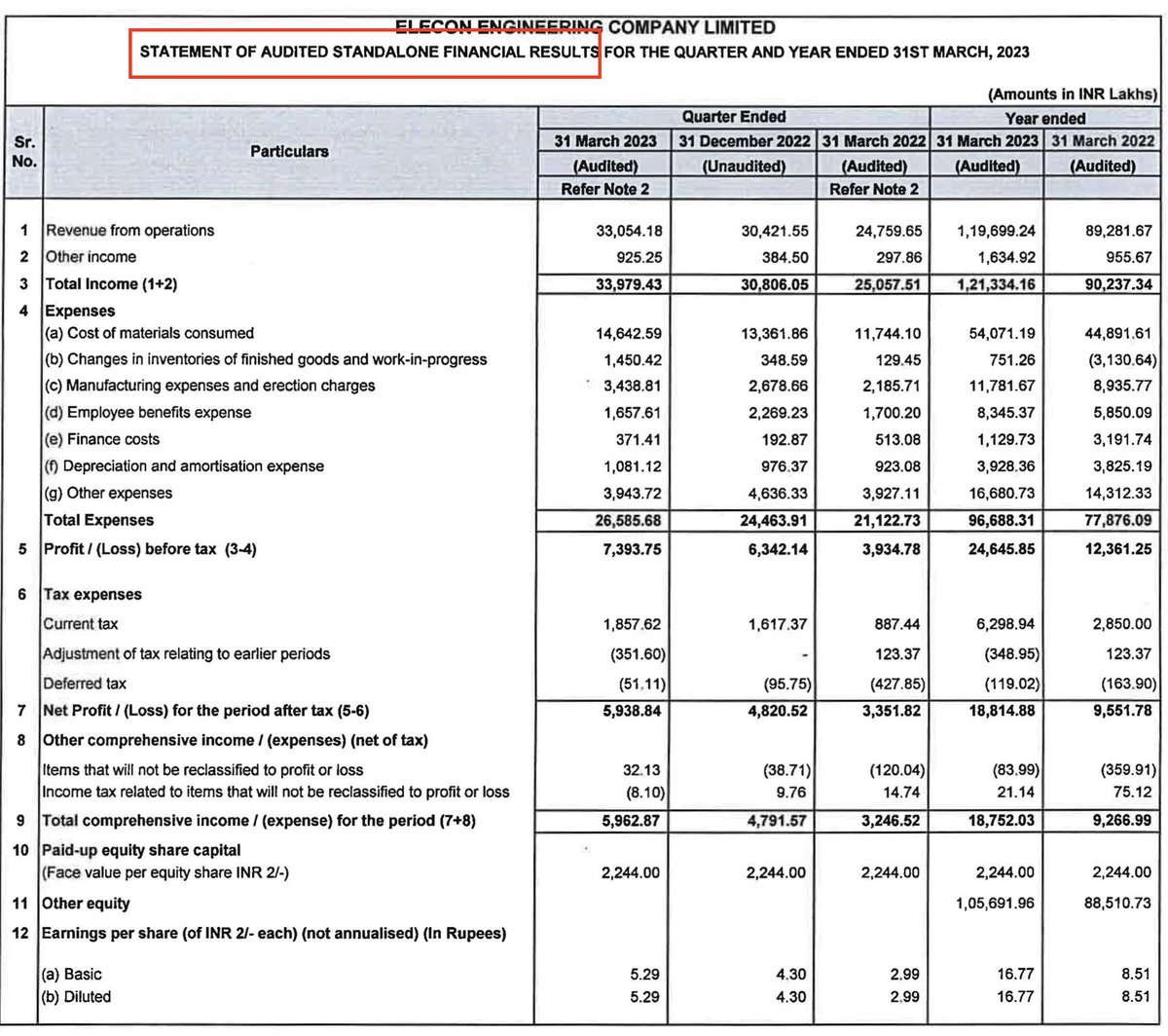

First key thing to look out for in Income statement of the company are the gross margins=

Gross margins simply mean Sales-the Cost of Goods sold or the money spent on Raw material.

It gives you an indication on how comfortably the company has passed on RM price hikes

Gross margins simply mean Sales-the Cost of Goods sold or the money spent on Raw material.

It gives you an indication on how comfortably the company has passed on RM price hikes

Now coming to absolute Gross Profit Growth=

Gross profit for Elecon in Q4FY23= Sales*Gross Margins

Q4FY23=425 Cr * 49%= 208.25 crores

Q3FY23= 389*55% = 213.95 crores

Q4FY22= 172.64 crores

YOY growth of 20.6% and QOQ de growth of 2%

Gross profit for Elecon in Q4FY23= Sales*Gross Margins

Q4FY23=425 Cr * 49%= 208.25 crores

Q3FY23= 389*55% = 213.95 crores

Q4FY22= 172.64 crores

YOY growth of 20.6% and QOQ de growth of 2%

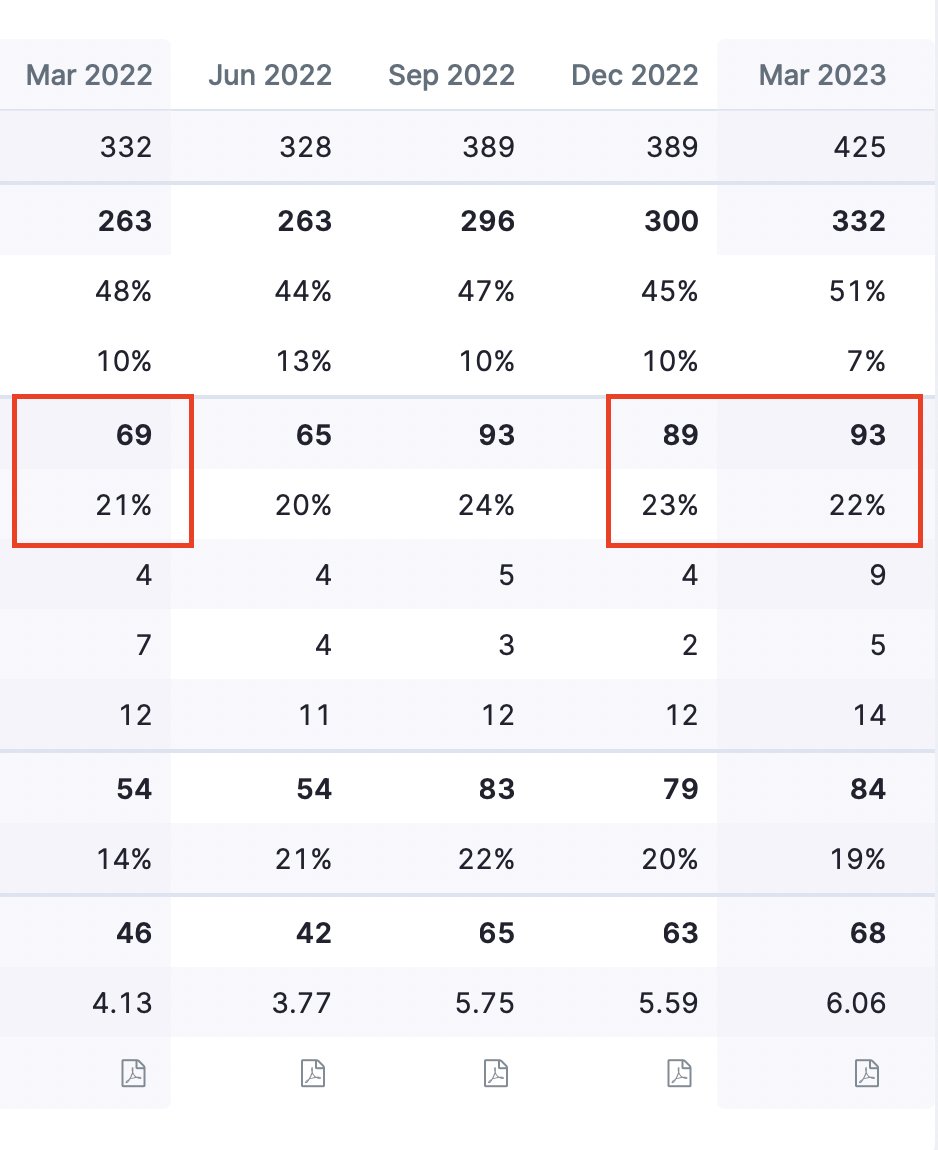

Therefore,

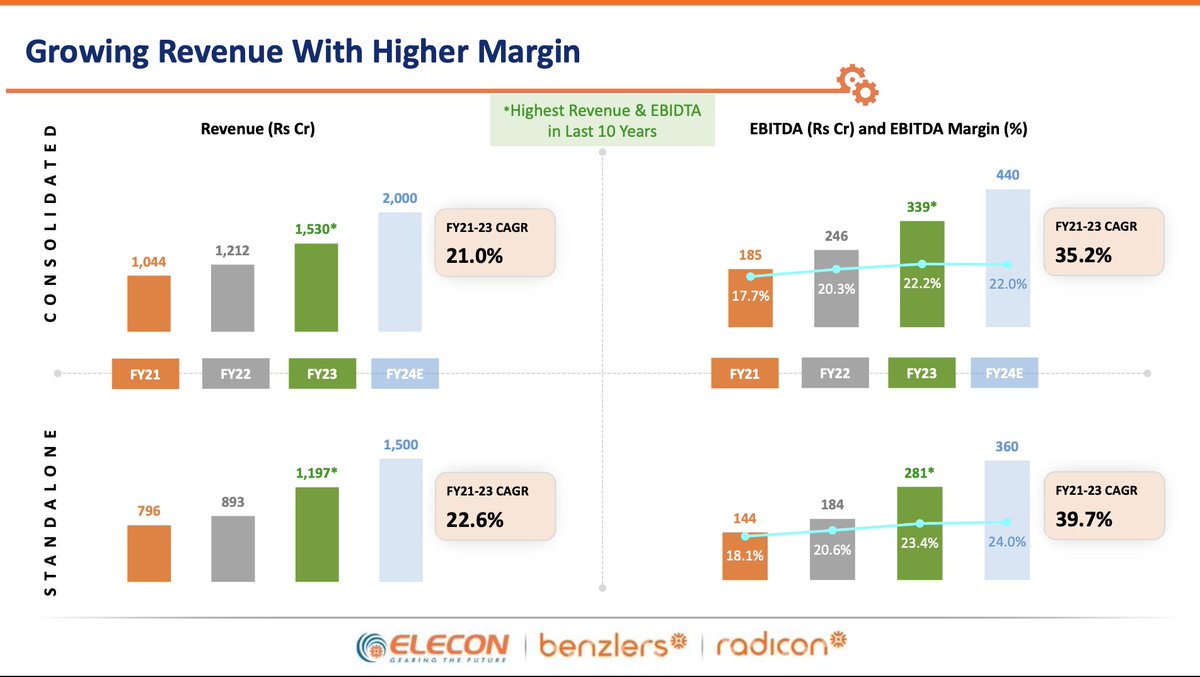

YOY Ebitda has grown by 34.7% (93-69/69)

QoQ Ebitda has grown by 4.4% (93-89/89)

YOY Ebitda has grown by 34.7% (93-69/69)

QoQ Ebitda has grown by 4.4% (93-89/89)

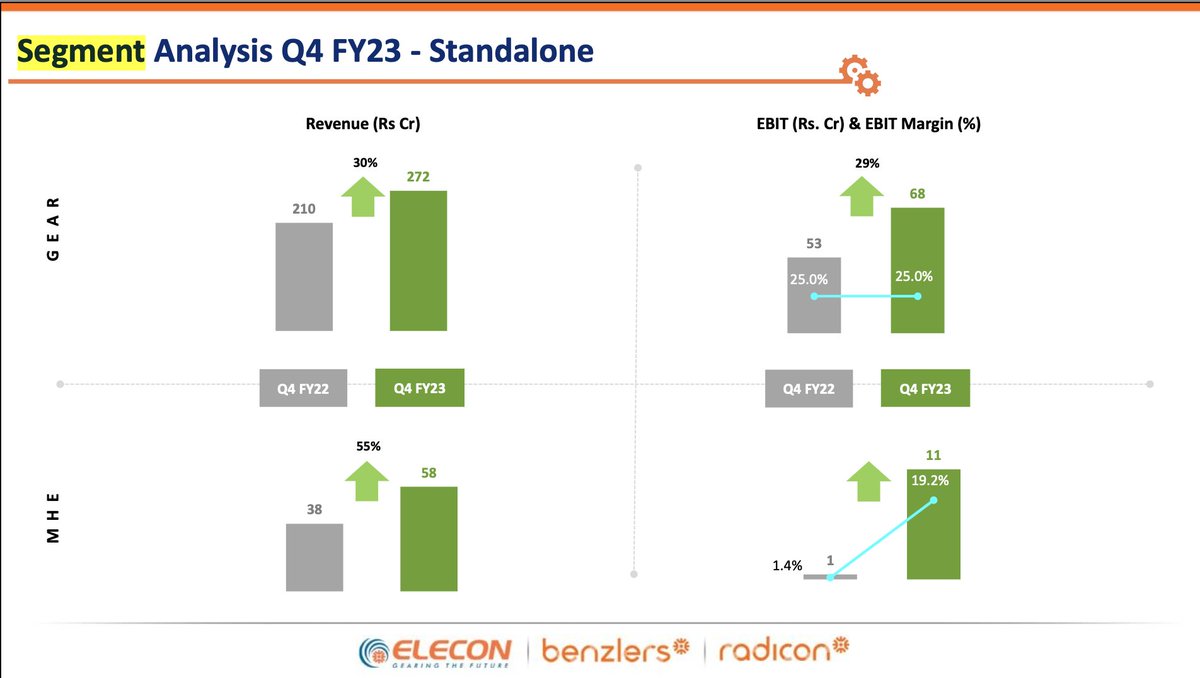

In the Material & Handling business.

The guidance is for 300 odd crores. Listen to this interview from 1min21 seconds-

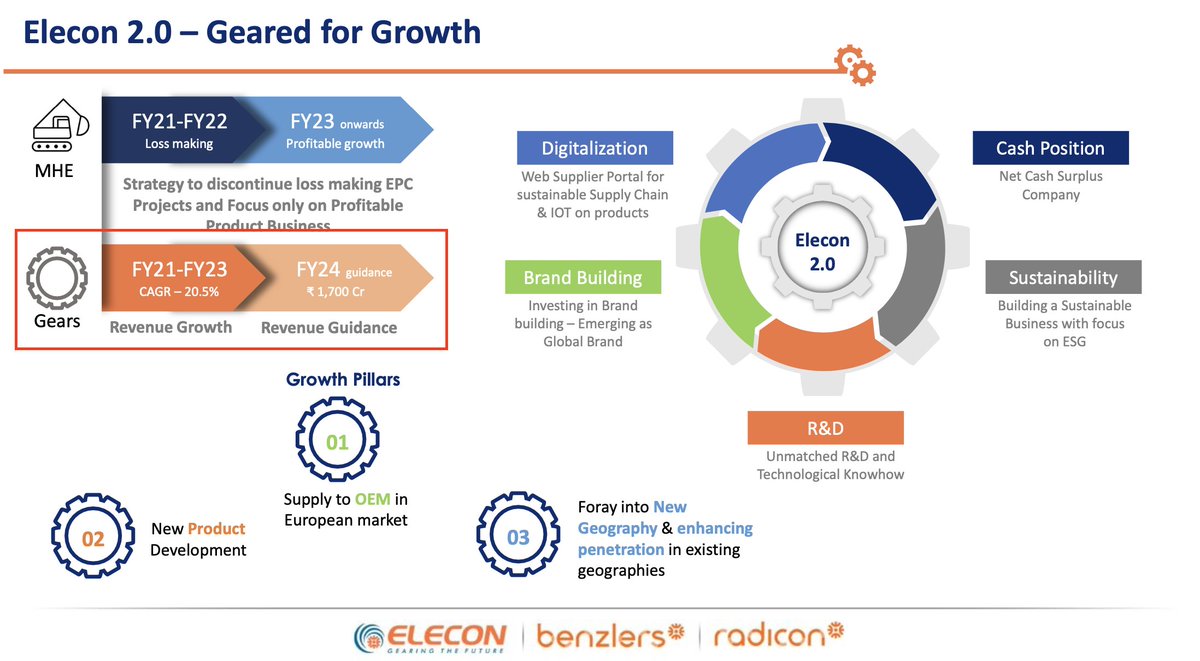

Thus, M&H=300 Crores Gears= 1700 crores =2000 crores on Consol basis.

Still you should attend the concall to clarify this..

The guidance is for 300 odd crores. Listen to this interview from 1min21 seconds-

Thus, M&H=300 Crores Gears= 1700 crores =2000 crores on Consol basis.

Still you should attend the concall to clarify this..

Thus, overall results have been good. Will be interesting to see how Elecon does..

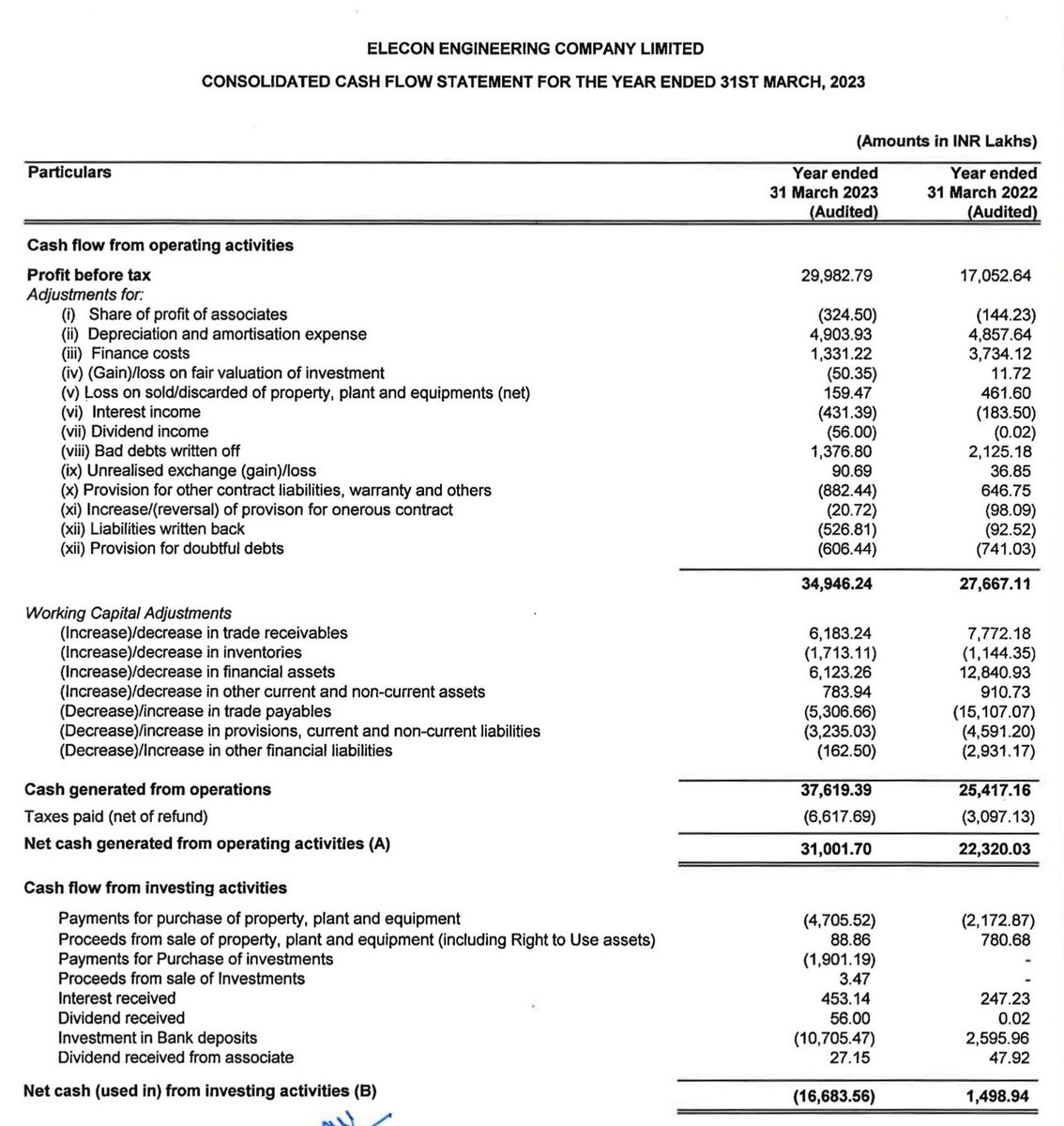

For a retail investor, this is an example of how to read results of a company looking at YOY, QOQ, ORDER BOOK, CASH FLOWS, MARGINS and Overall Fundamental changes which go unnoticed.

For a retail investor, this is an example of how to read results of a company looking at YOY, QOQ, ORDER BOOK, CASH FLOWS, MARGINS and Overall Fundamental changes which go unnoticed.

Disc: This is by no means a buy or sell reco. Have no conflicting views about the business.

Posted on request of one of the students 🙏

Risks remain: that it is a proxy to capex in cement, steel, sugar and Power. One needs to understand the cyclicality.

Posted on request of one of the students 🙏

Risks remain: that it is a proxy to capex in cement, steel, sugar and Power. One needs to understand the cyclicality.

Another Point to add:- Elecon includes manufacturing expenses to GM Calculation.

Ebitda Margin guide was maintaining it between 22%-24%.

Entire reaction is possibly driven by miss on Gross margins, as pointed above ^^

Ebitda Margin guide was maintaining it between 22%-24%.

Entire reaction is possibly driven by miss on Gross margins, as pointed above ^^

Loading suggestions...