2/n

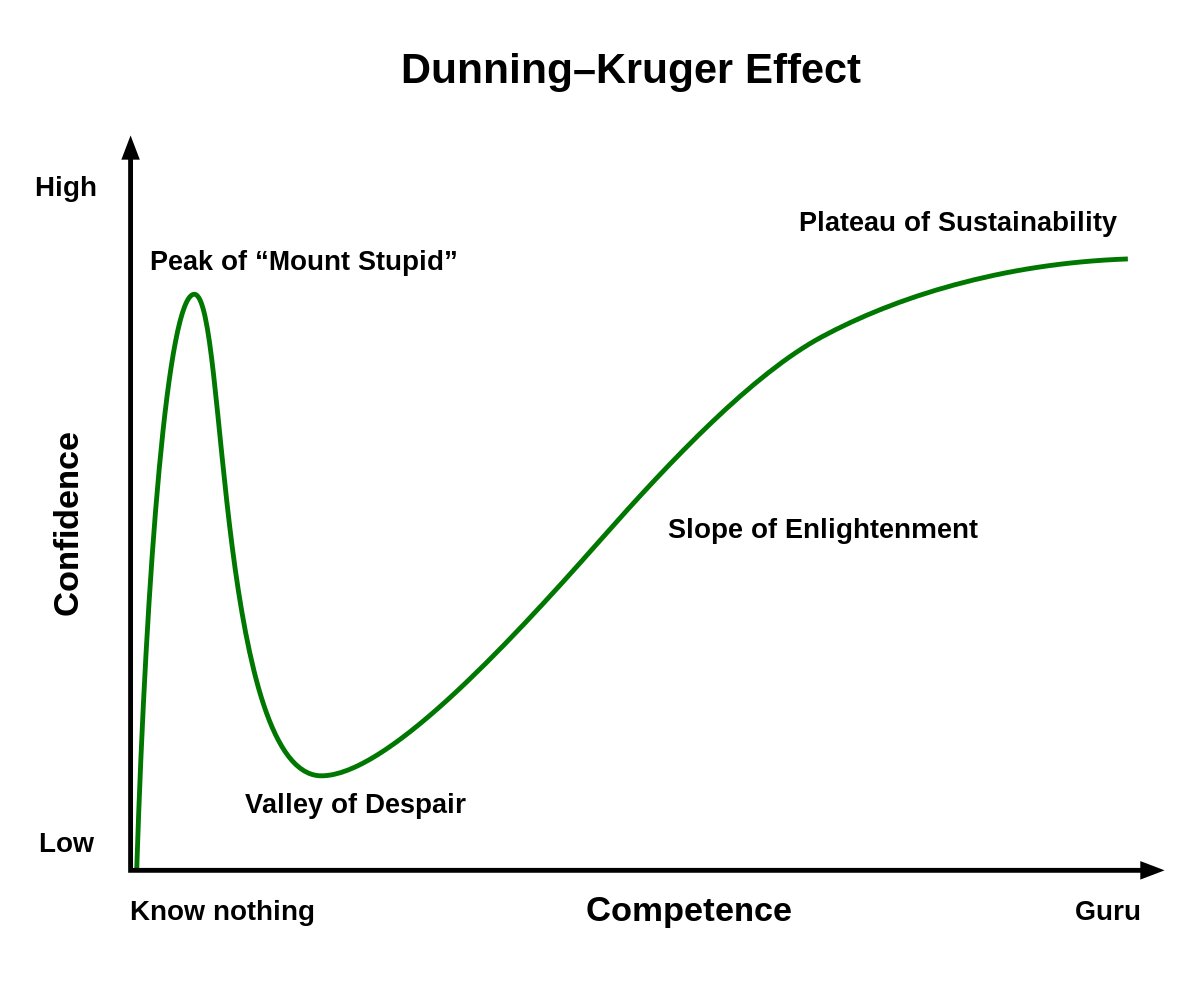

Every trader comes into the market with a lot of optimism and hopes of getting rich. A few lucky trades and they think they know how to trade.

👉 "Phony Confidence"

Every trader comes into the market with a lot of optimism and hopes of getting rich. A few lucky trades and they think they know how to trade.

👉 "Phony Confidence"

3/n

When markets change, the trader may struggle & start losing money. The majority quits at this point, but some turn to books, courses, and "finfluencers" for guidance.

👉 "Despair"

When markets change, the trader may struggle & start losing money. The majority quits at this point, but some turn to books, courses, and "finfluencers" for guidance.

👉 "Despair"

4/n

With every finfluencer building his own tools & indicators, the trader tries on every tool that he likes like a new kid in a toy store.

With every finfluencer building his own tools & indicators, the trader tries on every tool that he likes like a new kid in a toy store.

5/n

Once the trader has tried everything they have an appetite for, they go on the hunt using the new tools.

But when the time comes to make a kill, the hunter is busy analyzing all his new tools and the prey evades

👉 "Analysis Paralysis"

Once the trader has tried everything they have an appetite for, they go on the hunt using the new tools.

But when the time comes to make a kill, the hunter is busy analyzing all his new tools and the prey evades

👉 "Analysis Paralysis"

6/n

With time & experience, the trader learns to use only a few best tools that suit their style and realizes that they need to be confident that they can make a killing.

👉 "Sustainable / Expert Confidence"

With time & experience, the trader learns to use only a few best tools that suit their style and realizes that they need to be confident that they can make a killing.

👉 "Sustainable / Expert Confidence"

7/n

Expert confidence, borne of deep fluency, allows us to understand the risks we are taking. 🧠

Expert confidence, borne of deep fluency, allows us to understand the risks we are taking. 🧠

9/n

No amount of Technical Analysis or indicators in the world will make you a good Trader.

The edge of Technical Analysis is Win Rate.

The edge of Trading is Risk/Reward.

No amount of Technical Analysis or indicators in the world will make you a good Trader.

The edge of Technical Analysis is Win Rate.

The edge of Trading is Risk/Reward.

10/n

A good Technical Analyst can be a bad Trader.

A good Trader can be a bad Technical Analyst.

Understand the difference.

A good Technical Analyst can be a bad Trader.

A good Trader can be a bad Technical Analyst.

Understand the difference.

Loading suggestions...