1.

♦️Market structure.

Market structure is, as the name suggests, the current structure of the market.

It could be divided into the classic forms:

• Bullish.

• Bearish.

• Neutral/ranging.

♦️Market structure.

Market structure is, as the name suggests, the current structure of the market.

It could be divided into the classic forms:

• Bullish.

• Bearish.

• Neutral/ranging.

2.

~ Why you should be interested ~

• Understanding when to stay out of the market.

• Understanding if you have to buy dips or not.

• Understanding potential market trend reversal.

Being able to recognize the market structure is like having a compass to sail tumultuous seas.

~ Why you should be interested ~

• Understanding when to stay out of the market.

• Understanding if you have to buy dips or not.

• Understanding potential market trend reversal.

Being able to recognize the market structure is like having a compass to sail tumultuous seas.

4.

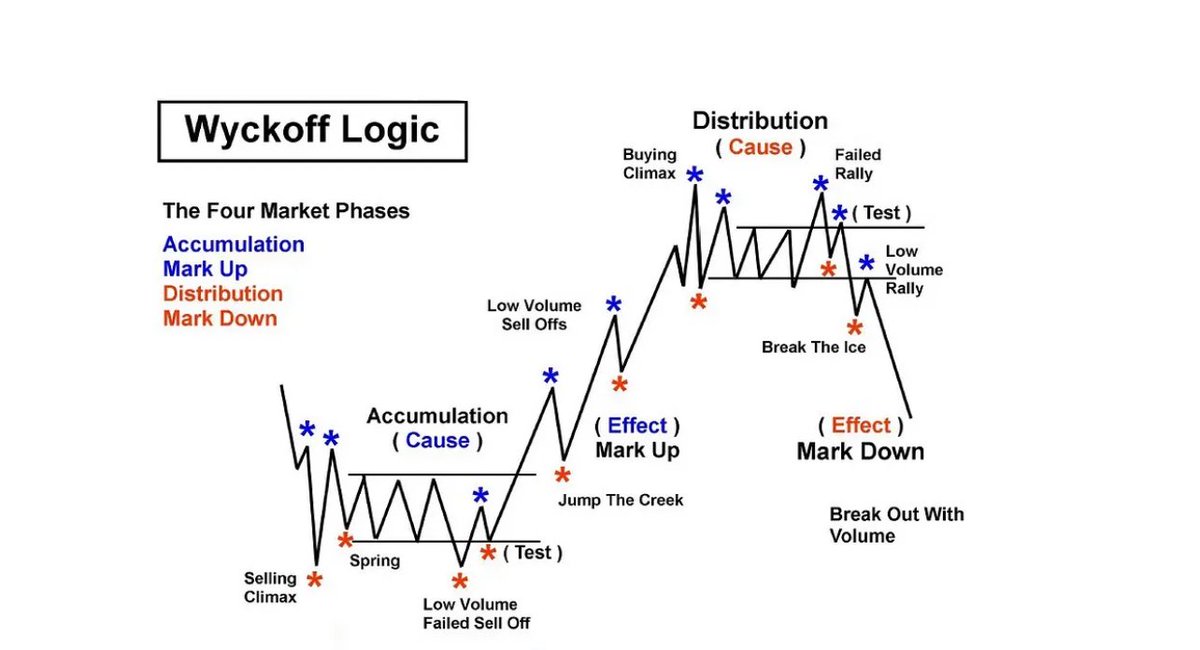

~ Accumulation ~

Accumulation is a sideways market activity that happens after an extended downtrend and that can last for months or even years.

This is the phase where smart money tries to accumulate or acquire positions without moving the prices too much.

~ Accumulation ~

Accumulation is a sideways market activity that happens after an extended downtrend and that can last for months or even years.

This is the phase where smart money tries to accumulate or acquire positions without moving the prices too much.

5.

~ Mark-up ~

Mark-up is the phase where the price of an asset breaks out off the accumulation range and starts to rip higher, feeded by the retailers that continue to buy.

It is usually sustained by frenzy, hype and strong positive emotions.

~ Mark-up ~

Mark-up is the phase where the price of an asset breaks out off the accumulation range and starts to rip higher, feeded by the retailers that continue to buy.

It is usually sustained by frenzy, hype and strong positive emotions.

6.

~ Distribution ~

Distribution is the exact opposite of Accumulation.

It’s a sideways market activity that happens after an extended uptrend.

This is the phase where smart money tries to sell off their positions without moving the prices too much to the downside.

~ Distribution ~

Distribution is the exact opposite of Accumulation.

It’s a sideways market activity that happens after an extended uptrend.

This is the phase where smart money tries to sell off their positions without moving the prices too much to the downside.

7.

~ Mark Down ~

Mark-down is instead the phase where the price of an asset break down from the distribution phase and starts to being a prolonged downtrend.

Smart money liquidates all of the positions injecting massive sell pressure and trapping late buyers.

~ Mark Down ~

Mark-down is instead the phase where the price of an asset break down from the distribution phase and starts to being a prolonged downtrend.

Smart money liquidates all of the positions injecting massive sell pressure and trapping late buyers.

12.

~ Being able to filter the noise ~

If you pay attention to hourly/daily chart it

might be confusing to understand which is the trend ongoing.

Multiple patterns could overlap with each other.

So how to have a better outlook?

Move your attention to higher timeframes (HTFs).

~ Being able to filter the noise ~

If you pay attention to hourly/daily chart it

might be confusing to understand which is the trend ongoing.

Multiple patterns could overlap with each other.

So how to have a better outlook?

Move your attention to higher timeframes (HTFs).

13.

Weekly gives you the advantage of focusing on the predominant longer-term trend, while ignoring the “noise” and volatility of the day-to-day fluctuations.

This will make it easier to hold an asset for a longer period without panicking.

Weekly gives you the advantage of focusing on the predominant longer-term trend, while ignoring the “noise” and volatility of the day-to-day fluctuations.

This will make it easier to hold an asset for a longer period without panicking.

14.

Big hedge funds that have multi-million dollar positions can’t move fast enough to react to daily fluctuations.

They use weekly charts to buy or sell.

Why not take advantage of this situation?

The higher the timeframe, the clearer the outlook.

Big hedge funds that have multi-million dollar positions can’t move fast enough to react to daily fluctuations.

They use weekly charts to buy or sell.

Why not take advantage of this situation?

The higher the timeframe, the clearer the outlook.

15.

♦️Final takeaways.

~ Apply EMAs ~

To help you in understanding a market shift use EMAs.

Which ones?

I use 9-EMA and 21-EMA on both daily and weekly timeframes.

Above ➩ bullish.

Below ➩ bearish.

This strategy should be used along with price action and RELEVANT levels.

♦️Final takeaways.

~ Apply EMAs ~

To help you in understanding a market shift use EMAs.

Which ones?

I use 9-EMA and 21-EMA on both daily and weekly timeframes.

Above ➩ bullish.

Below ➩ bearish.

This strategy should be used along with price action and RELEVANT levels.

16.

~ Fitting attitudes ~

Whether you're a trend rider or an investor, understanding market structure is KEY.

I proved on my skin the pain of holding assets with a broken market structure.

When you see confirmations of a break in MS as mentioned above, sell.

~ Fitting attitudes ~

Whether you're a trend rider or an investor, understanding market structure is KEY.

I proved on my skin the pain of holding assets with a broken market structure.

When you see confirmations of a break in MS as mentioned above, sell.

17.

To conclude, remember that market structure rules above everything.

Fundamentals, indicators, sentiment etc.

That's why it's so important and fortunately, quite simple.

To conclude, remember that market structure rules above everything.

Fundamentals, indicators, sentiment etc.

That's why it's so important and fortunately, quite simple.

18.

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info subscribe to my FREE newsletter!

(Link in bio).

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info subscribe to my FREE newsletter!

(Link in bio).

Loading suggestions...