Subhasish Pani from Power of Stocks usually makes ₹1,50,00,000 profit on Strong Trending days.

Here's a breakdown of his Options Selling Trading Strategy in Trending Market:

Collaborated with @niki_poojary

Here's a breakdown of his Options Selling Trading Strategy in Trending Market:

Collaborated with @niki_poojary

1) This thread will cover Option selling in trending markets with:

1. Logics

2. Concept

3. Trades

4. Pyramiding

5. Exit

All explained, transfer all knowledge you can because he understands price action on a very deep level.

Let's begin ↓

1. Logics

2. Concept

3. Trades

4. Pyramiding

5. Exit

All explained, transfer all knowledge you can because he understands price action on a very deep level.

Let's begin ↓

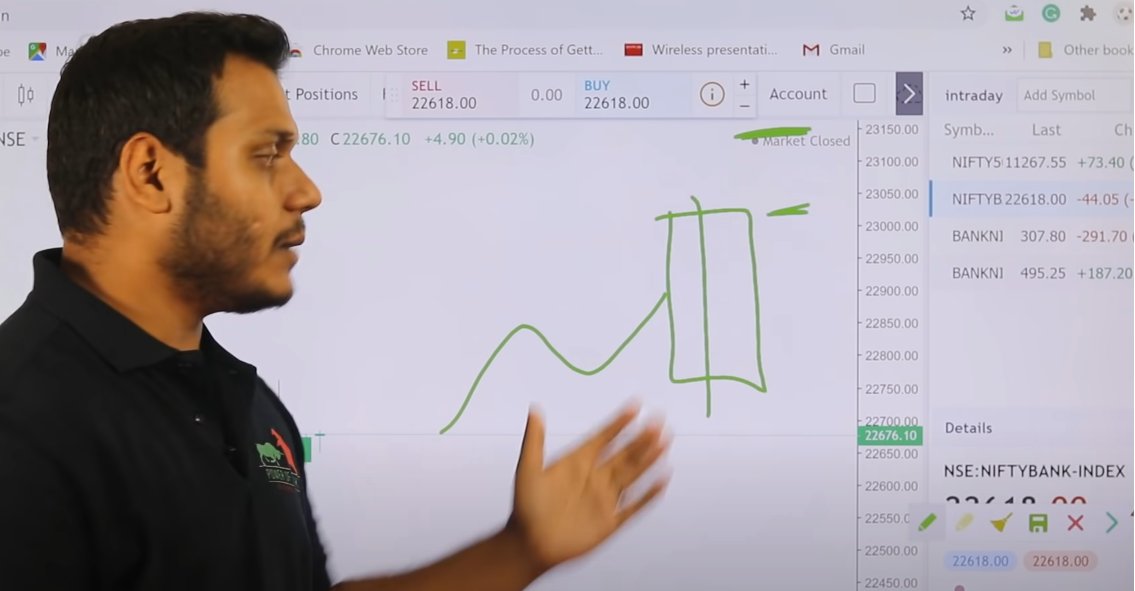

2) Prerequisite:

You should know how to spot a trending market.

As...

The first thing is before the market you should know whether the market is trending or not.

But...

ow do we know this?

You should know how to spot a trending market.

As...

The first thing is before the market you should know whether the market is trending or not.

But...

ow do we know this?

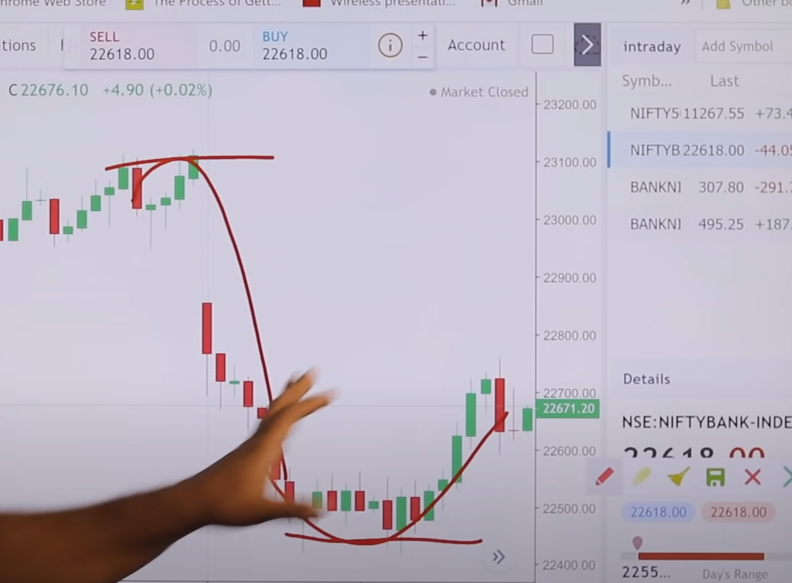

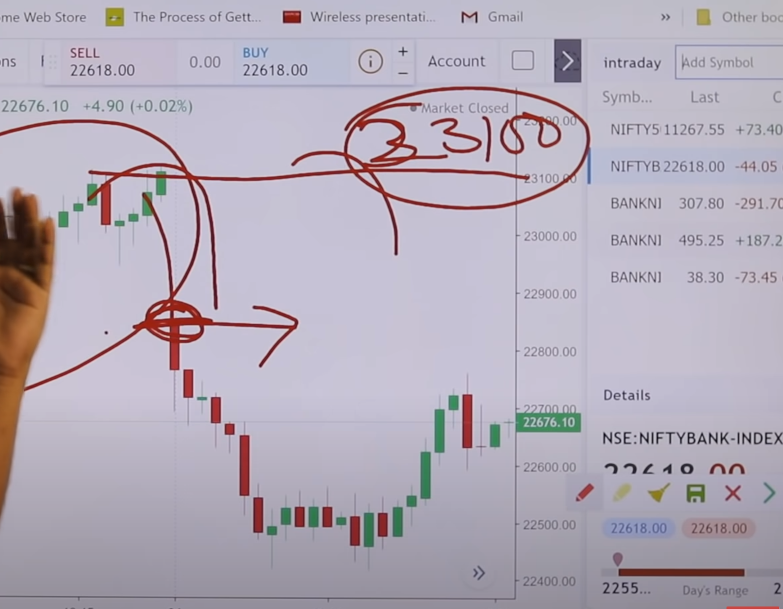

Only in case of a gap down will he be interested in selling.

As there is a good probability that the market can fall sharply as buyers would be trapped.

If it opens gap down means it's a breakout failure and a good down move is possible.

As there is a good probability that the market can fall sharply as buyers would be trapped.

If it opens gap down means it's a breakout failure and a good down move is possible.

3) High Probability

So now we have learned at least one scenario where we can identify when the market can trend.

That is critical before we implement his technique for going directional.

As whenever we use this setup there should be a high probability of a trending day.

So now we have learned at least one scenario where we can identify when the market can trend.

That is critical before we implement his technique for going directional.

As whenever we use this setup there should be a high probability of a trending day.

Now finally lets come to the setup.

For this we need to know how to find out support and resistance.

For this we need to know how to find out support and resistance.

Always remember in Option Selling, whenever you've identified a downside trending market.

You have to sell the nearest Resistance.

You have to sell the nearest Resistance.

6) Timeframe to be used:

Should be 15 min.

5 min will be too volatile.

Paisa kamane see matlab, naki jyada trade lene se.

Should be 15 min.

5 min will be too volatile.

Paisa kamane see matlab, naki jyada trade lene se.

7) Using Price Action to aid us

Now wait for the market to make price action supporting your trade.

Downward price action means lower lows.

When the market does make a Lower Low (LL) you will go and short the nearest resistance strike again.

Now wait for the market to make price action supporting your trade.

Downward price action means lower lows.

When the market does make a Lower Low (LL) you will go and short the nearest resistance strike again.

8) Pyramiding

In this case, it would be the gap-down opening as the price couldn't break the first 15 min high.

Now every lower low you get, you will keep adding 1 lot of option short of the resistance again.

In this case, it would be the gap-down opening as the price couldn't break the first 15 min high.

Now every lower low you get, you will keep adding 1 lot of option short of the resistance again.

9) How to exit?

Have multiple charts on the screen.

Instead of paying 5k on Stop losses in markets, he advises buying another screen in that 5k so that trading becomes easier.

Have multiple charts on the screen.

Instead of paying 5k on Stop losses in markets, he advises buying another screen in that 5k so that trading becomes easier.

10) 2 Screens to observe 2 charts

In 15 min charts you will watch Bank Nifty.

In 5 min charts you will watch the Option Charts.

In 15 min charts you will watch Bank Nifty.

In 5 min charts you will watch the Option Charts.

11) When will we exit?

Anytime in Option Charts, if it makes a higher high, we are going to exit.

Higher highs means buying is coming and if we have sold the option we only want it to go down.

We don't want to fight with buyers so we will exit.

Anytime in Option Charts, if it makes a higher high, we are going to exit.

Higher highs means buying is coming and if we have sold the option we only want it to go down.

We don't want to fight with buyers so we will exit.

Since we short options that are very close to the spot we end up making 100-150 points in a good trade.

But even after we exit the market can still go down.

But even after we exit the market can still go down.

12) When to enter again?

So what do we do?

The moment it makes a new low, we will sell another call on the nearest resistance again.

So what do we do?

The moment it makes a new low, we will sell another call on the nearest resistance again.

13) Firefighting mistakes?

The moment a trade goes against them majority will try to sell puts to firefight the calls in case of an upmove.

He hates firefighting.

It's either Target or Stop Loss for him.

The moment a trade goes against them majority will try to sell puts to firefight the calls in case of an upmove.

He hates firefighting.

It's either Target or Stop Loss for him.

14) Max Stop loss

Maximum Stop loss should be 20-25% of the premium you have sold.

Also, he avoids far OTM's as in them the R: R is too bad.

A 50 rs option will become only 30 by day end and SL will also be 70 so only 1:1 R:R.

Maximum Stop loss should be 20-25% of the premium you have sold.

Also, he avoids far OTM's as in them the R: R is too bad.

A 50 rs option will become only 30 by day end and SL will also be 70 so only 1:1 R:R.

15) How to play bullish markets?

For a bullish market just do the opposite of what we have done for bearish.

This is exactly how you can play directional in trending markets with Option Selling.

For a bullish market just do the opposite of what we have done for bearish.

This is exactly how you can play directional in trending markets with Option Selling.

I hope this thread was helpful to all of you.

He has taught lakhs of people how to analyze price action.

This is my absolute favorite video on his channel, hope you liked it too.

He has taught lakhs of people how to analyze price action.

This is my absolute favorite video on his channel, hope you liked it too.

and that's it!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

Loading suggestions...