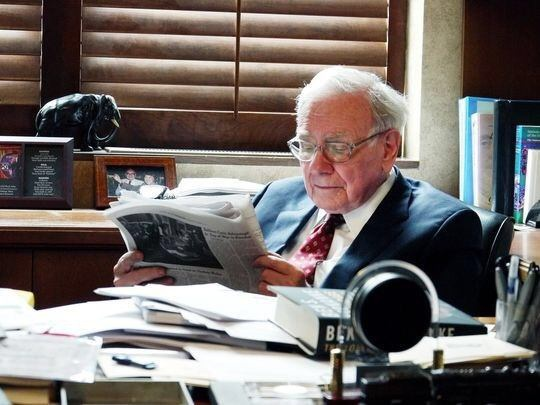

1. It's all about the long term

Warren Buffett stated that Berkshire will still own most of their stocks 10 and 20 years from now.

Even at age 92 Buffett still thinks on the long term.

"We make our decisions as to whether to own part of a company for the next 20 years."

Warren Buffett stated that Berkshire will still own most of their stocks 10 and 20 years from now.

Even at age 92 Buffett still thinks on the long term.

"We make our decisions as to whether to own part of a company for the next 20 years."

2. A good investing philosophy

To invest successfully, it all starts with your philosophy.

Focus on a good strategy you feel comfortable with.

"Berkshire is still doing all the same things we did 5 years ago, and we will still use the approach to the way forward."

To invest successfully, it all starts with your philosophy.

Focus on a good strategy you feel comfortable with.

"Berkshire is still doing all the same things we did 5 years ago, and we will still use the approach to the way forward."

3. Capital allocation

Capital allocation is the most important task of management.

When management knows how to allocate capital well, magical things can happen.

"My job is to allocate the capital within Berkshire Hathaway the way I would do it for my sister."

Capital allocation is the most important task of management.

When management knows how to allocate capital well, magical things can happen.

"My job is to allocate the capital within Berkshire Hathaway the way I would do it for my sister."

4. Managers should LOVE what they do

When you love what you do, you never have to work a day in your life.

"Greg is not looking to retire at 65, or 75 and we don't want anybody at Berkshire that's thinking about, you know, what their package will be when they get to be 65."

When you love what you do, you never have to work a day in your life.

"Greg is not looking to retire at 65, or 75 and we don't want anybody at Berkshire that's thinking about, you know, what their package will be when they get to be 65."

5. Value creation

You want to invest in companies which put the creation of shareholder value first.

"I always will continue to invest in Berkshire. I strongly believe in Berkshire. I believe in what's been created and I strongly believe that the future looks bright."

You want to invest in companies which put the creation of shareholder value first.

"I always will continue to invest in Berkshire. I strongly believe in Berkshire. I believe in what's been created and I strongly believe that the future looks bright."

6. Keep learning

Everyone makes mistakes.

As long as you learn from them, it's not a big deal.

"I've made so many mistakes in my life and that's why I became so succesful."

Everyone makes mistakes.

As long as you learn from them, it's not a big deal.

"I've made so many mistakes in my life and that's why I became so succesful."

7. Skin in the game

Management incentives should be aligned with the ones of you as a shareholder.

"I've invested more than 99% of my net worth in Berkshire, but I've also got all my relatives in. I've got everybody in."

Management incentives should be aligned with the ones of you as a shareholder.

"I've invested more than 99% of my net worth in Berkshire, but I've also got all my relatives in. I've got everybody in."

8. Stocks are the best investment

In the long term, not investing is risky.

"I’d rather own stocks and bonds over many years. I’d rather own part of America than try to squirrel my money away somehow other place."

In the long term, not investing is risky.

"I’d rather own stocks and bonds over many years. I’d rather own part of America than try to squirrel my money away somehow other place."

9. Never make forecasts

"I would say that I’ve been in business, running Berkshire for 58 years, and I’ve never opined an economic forecast of any use to the company. If I depended on economic forecasts, I don't think we'd make any money."

"I would say that I’ve been in business, running Berkshire for 58 years, and I’ve never opined an economic forecast of any use to the company. If I depended on economic forecasts, I don't think we'd make any money."

10. Buy companies with a moat

It's very hard to create a moat. That's why Charlie Munger and Warren Buffett just buy companies with a wide moat.

"It's a wonderful business (Apple). How the hell could we develop a business like that? And that's why we own a lot of it."

It's very hard to create a moat. That's why Charlie Munger and Warren Buffett just buy companies with a wide moat.

"It's a wonderful business (Apple). How the hell could we develop a business like that? And that's why we own a lot of it."

11. Always keep some cash on the sideline

Having cash allows you to invest heavily during market corrections.

"Berkshire had almost $128 billion in cash at the end of the year."

Having cash allows you to invest heavily during market corrections.

"Berkshire had almost $128 billion in cash at the end of the year."

13. Bitcoin

Bitcoin is pure speculation.

"Bitcoin is a gambling token. I've seen people do stupid things all my life. I don't know when this speculation will end, or when the gambling instinct will go away."

Bitcoin is pure speculation.

"Bitcoin is a gambling token. I've seen people do stupid things all my life. I don't know when this speculation will end, or when the gambling instinct will go away."

14. Own good businesses

The best companies are those with high margins and low capital intensity which can reinvest a lot in organic growth opportunities.

"Over time, we want to buy good businesses. It's that simple."

The best companies are those with high margins and low capital intensity which can reinvest a lot in organic growth opportunities.

"Over time, we want to buy good businesses. It's that simple."

That's it for today.

If you liked this, you'll love all public writings of Warren Buffett (> 5.000 pages).

We are sharing this PDF for those interested.

Sign up here:

eepurl.com

If you liked this, you'll love all public writings of Warren Buffett (> 5.000 pages).

We are sharing this PDF for those interested.

Sign up here:

eepurl.com

Loading suggestions...