Let's talk Arbitrum (SHOCKER) for another second. What is part of the reason that Arbi has taken off?

I have to think its because of the amount of projects that are native to the chain. Think Dopex, Camelot, Plutus and the like.

Let's add one more to the list: @parallaxfin!

I have to think its because of the amount of projects that are native to the chain. Think Dopex, Camelot, Plutus and the like.

Let's add one more to the list: @parallaxfin!

The best way I can describe Parallax is like this: Yearn on Crack.

But, if you ask them, they aim to provide liquidity infrastructure that let users, DAOs, and other protocols generate yield on Arbitrum.

But, if you ask them, they aim to provide liquidity infrastructure that let users, DAOs, and other protocols generate yield on Arbitrum.

Parallax has 4 core products they plan to use to achieve these lofty goals:

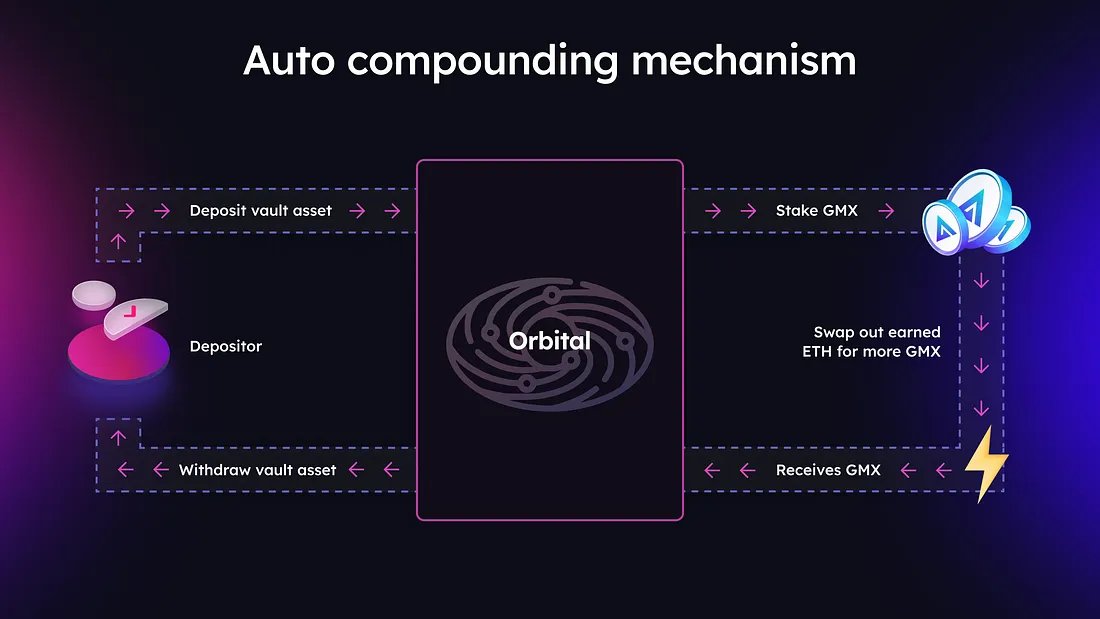

1. Orbital - which is their Yield Optimizer

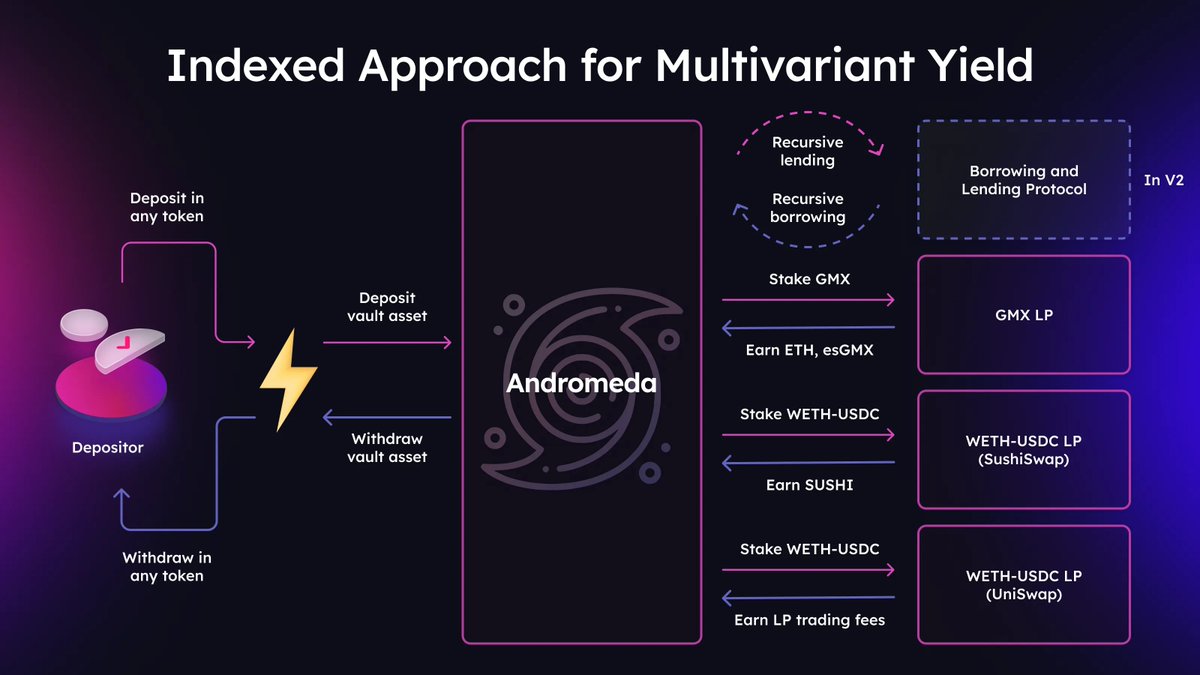

2. Andromeda - Multivariant yield thru vaults

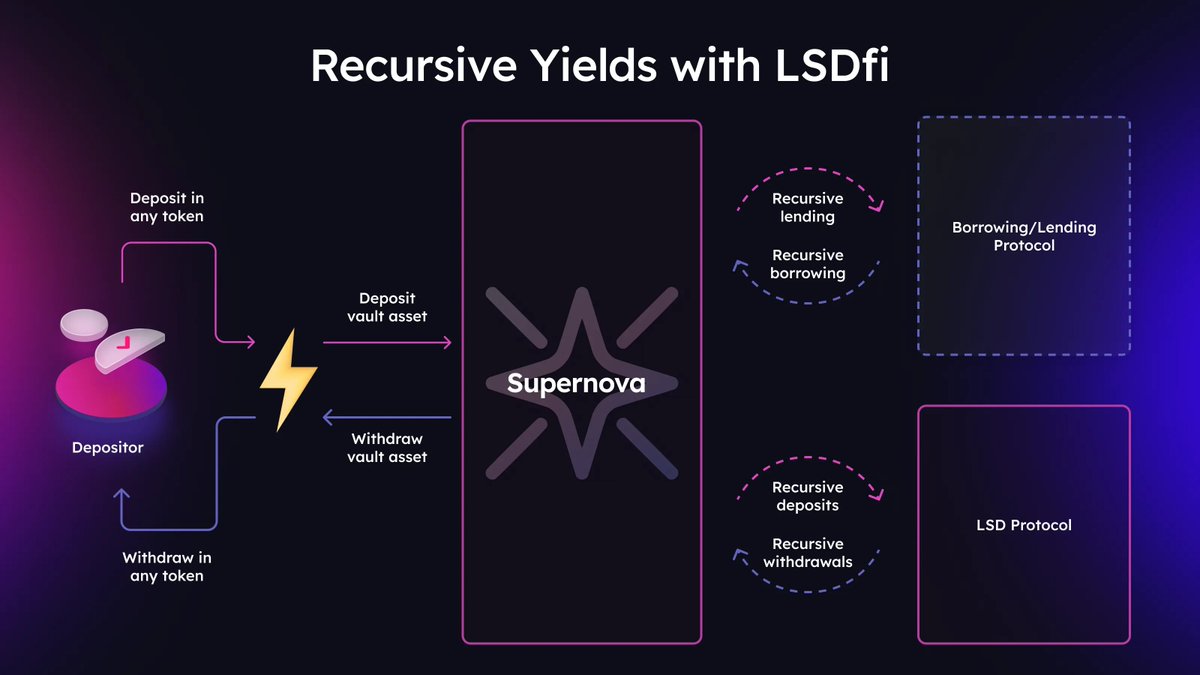

3. Supernova - Powering LSDfi

4. Black Hole - Liquidity Marketplace

1. Orbital - which is their Yield Optimizer

2. Andromeda - Multivariant yield thru vaults

3. Supernova - Powering LSDfi

4. Black Hole - Liquidity Marketplace

Trading fees generated by LPs are shared equally among all participants in the pool. The more LP tokens a user holds, the larger their share of the fees.

One thing that Parallax is doing a bit differently, is the plans to incorporate a "boost" system for their vaults.

This will let partnering protocols incentivize pools with more rewards, thereby increasing APY.

This will let partnering protocols incentivize pools with more rewards, thereby increasing APY.

Why partner with Parallax? Simple anon!

To receive marketing support or to hold initial bootstrapping events that require deeper LP liquidity. In return, Parallax will reward protocols with additional incentives in token emission.

To receive marketing support or to hold initial bootstrapping events that require deeper LP liquidity. In return, Parallax will reward protocols with additional incentives in token emission.

Currently they have a Blue Chip Index vault and a Degen Index vault.

The current Blue Chip index utilizes:

GMX/GLP - GMX

WETH/USDC - Uniswap

WETH/USDC - Sushiswap

Projected APY of 30-37%

Users can zap into and/or exit the vault with any stablecoin

The current Blue Chip index utilizes:

GMX/GLP - GMX

WETH/USDC - Uniswap

WETH/USDC - Sushiswap

Projected APY of 30-37%

Users can zap into and/or exit the vault with any stablecoin

The Degen vaults are just that, degen. They will have a higher risk rating but won't compromise on security.

Essentially most of the vault will be compromised of blue chip protocols like Uniswap or Sushiswap but might have integrations from newer, higher APY protocols.

Essentially most of the vault will be compromised of blue chip protocols like Uniswap or Sushiswap but might have integrations from newer, higher APY protocols.

Example being: You have 10 ETH and want to stake them for rewards. But you wish you had more than 10 ETH but don't have the funds.

The strategy would then borrow more ETH and automate it by looping that ETH into LSDs, to stake and deposit, creating this recursive strategy.

The strategy would then borrow more ETH and automate it by looping that ETH into LSDs, to stake and deposit, creating this recursive strategy.

Black Hole is a marketplace for bonded assets that are interest bearing with flywheel mechanisms. Partner protocols can use this to build up their POL.

For users however, it means you can get predictable yields on your favorite assets.

For users however, it means you can get predictable yields on your favorite assets.

Any protocol can use the Black Hole to create bonds for their asset to help build out their liquidity war chest.

The cool thing about Black Hole is that is permissionless, modular, and composable allowing anyone to trade and sell bonds.

The cool thing about Black Hole is that is permissionless, modular, and composable allowing anyone to trade and sell bonds.

Wen token sers?

Well...no token yet. But I do have some info about it worth sharing!

PLX stakers will receive the majority of the platform rewards including harvest fees and fund management fees.

Parallax only takes enough fees to themselves to maintain basic operating costs.

Well...no token yet. But I do have some info about it worth sharing!

PLX stakers will receive the majority of the platform rewards including harvest fees and fund management fees.

Parallax only takes enough fees to themselves to maintain basic operating costs.

And talk about narratives, these guys are also going to deploy on zkSync!

They plan on first deploying Orbital and Andromeda and if LSDs can gain more traction on ZK, then maybe deploy Supernova as well.

They plan on first deploying Orbital and Andromeda and if LSDs can gain more traction on ZK, then maybe deploy Supernova as well.

The thing that Parallax has going for them, when they move to zkSync, is they'll most likely be the first project of their kind over there. First mover advantage y'all!

But ideally, they find their home in the hearts of all lazy investors (like me).

But ideally, they find their home in the hearts of all lazy investors (like me).

I think projects that cater to the lazy investor or even, the dreaded couch investor., will do well in the future. Half of Tradfi is geared towards the idiots who want to dump money and forget about it for years.

Fill that niche I say!

Fill that niche I say!

Also slight disclaimer: This was a paid thread by my frens @parallaxfin. These fine gents allowed me to get diapers and formula for another week!

Seriously, you know how much a baby eats and shits? Its a wonder they grow up to be people.

Seriously, you know how much a baby eats and shits? Its a wonder they grow up to be people.

Hopefully this thread fired you up, to remain on your couch and let smarter people do all the work for you.

Follow me @schizoxbt for mildly entertaining takes and a few 76 IQ ones

Like/Retweet the first tweet below if you want other projects to pay for my child's diapers!

Follow me @schizoxbt for mildly entertaining takes and a few 76 IQ ones

Like/Retweet the first tweet below if you want other projects to pay for my child's diapers!

Locusts (Bonus points if you guess the game)

@0xSalazar

@WinterSoldierxz

@_FabianHD

@jake_pahor

@kindahangry

@Slappjakke

@arndxt_xo

@CryptoShiro_

@ThisIsM1NH

@crypto_linn

@rektfencer

@NNovaDefi

@OvrCldJonny

@0xShinChannn

@DefiIgnas

@Auri_0x

@0xFastLife

@0xSalazar

@WinterSoldierxz

@_FabianHD

@jake_pahor

@kindahangry

@Slappjakke

@arndxt_xo

@CryptoShiro_

@ThisIsM1NH

@crypto_linn

@rektfencer

@NNovaDefi

@OvrCldJonny

@0xShinChannn

@DefiIgnas

@Auri_0x

@0xFastLife

Loading suggestions...