Before I discuss the different ways on how to use a FVG, I will go over the anatomy of the FVG, what it is, and why it forms.

There are two types of Fair Value Gaps (FVG).

BISI = Buyside Imbalance Sellside Inefficiency

SIBI = Sellside Imbalance Buyside Inefficiency

There are two types of Fair Value Gaps (FVG).

BISI = Buyside Imbalance Sellside Inefficiency

SIBI = Sellside Imbalance Buyside Inefficiency

Now that you understand what a Fair Value Gap is, I will now discuss the 3 different ways on how I use the FVG:

1. Entry Model

2. Draw On Liquidity

3. Point of Interest (POI) / PD Array

1. Entry Model

2. Draw On Liquidity

3. Point of Interest (POI) / PD Array

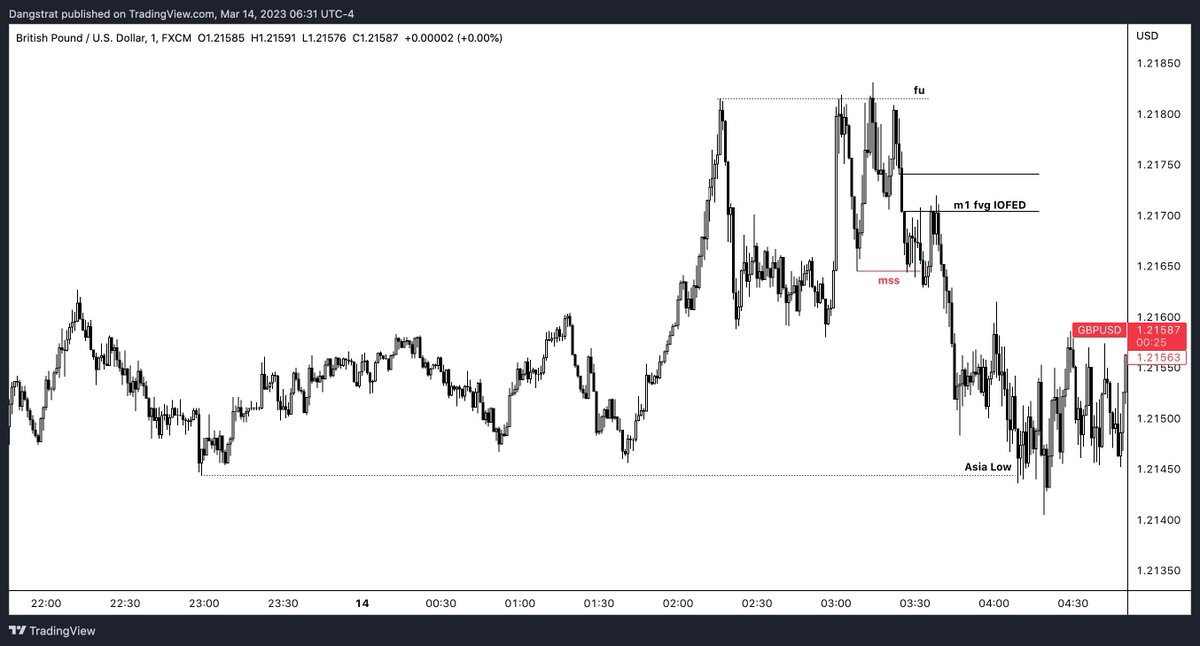

For my entry model I stay on the M15 TF or below to look for the FVG. Typically my entries are inside of FVGs on M1-M5 timeframe after a HTF + LTF raid, and M5/M15 MSS.

If you're using the FVG as a DOL look at the HTF, preferably M15 or higher. The higher it is the more significant it is. A randon FVG on the M1 timeframe shouldn't be used as a DOL unless there is other confluence backing it up as in there's a key high/low near it for DOL as well

Other helpful things to know about FVGs are: ICT's Paint Brush Analogy, IOFED, & Consequent Encroachment.

ICT Paint Brush Analogy:

Here is my Linktree to become a Lifetime or Gold Member! Join our Discord Community to grow as traders, share trade ideas, and see price action how I see it. Sign up for Lifetime Membership to get my trade signals. linktr.ee

If you want to improve your discipline & trading edge you can purchase my Trading Journal Template to easily track all of your trades! dangstratify.gumroad.com

I spend hours just to make one thread so if this thread helped, please like and retweet for more educational content and for others to see! Thank you🧡

Loading suggestions...