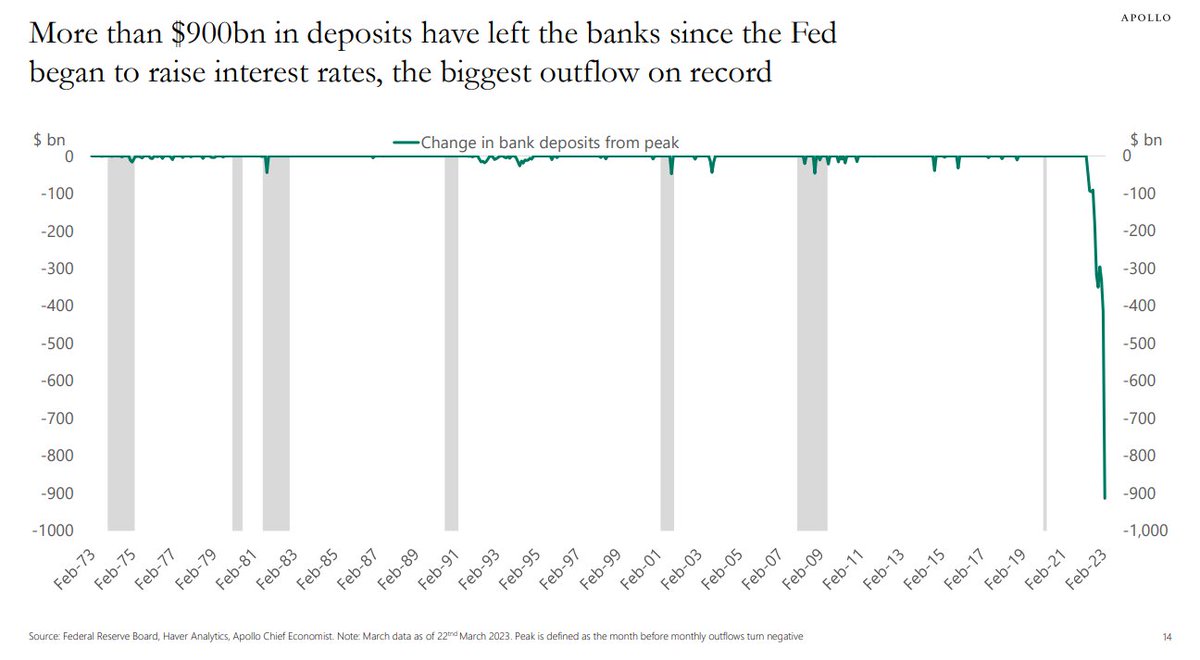

But inflation gauges aren't deflating much. The effects of this credit tightening will take some time. In fact, used car prices started rising again in Marh, which will push the Fed to raise rates more, all things being equal: publish.manheim.com

So the dilemma for the Fed: keep raising rates in the face of still-hot inflation data, even though that could cause more significant economic damage, or hold steady and possibly allow inflation to get more entrenched.

*March

Loading suggestions...