A thesis in the 90s:

People would pay for the convenience of having groceries delivered.

WebVan was the first grocery delivery company in 1996. It went bankrupt a few years later because:

• Wrong target audience

• Complex infrastructure

• Burning the money too fast

People would pay for the convenience of having groceries delivered.

WebVan was the first grocery delivery company in 1996. It went bankrupt a few years later because:

• Wrong target audience

• Complex infrastructure

• Burning the money too fast

While WebVan failed, people STILL wanted groceries delivered to them.

The thesis was still valid.

Eventually, Instacart (2012) figured it out and is now worth ~$24b.

Lesson: One product's failure doesn't invalidate a thesis.

The thesis was still valid.

Eventually, Instacart (2012) figured it out and is now worth ~$24b.

Lesson: One product's failure doesn't invalidate a thesis.

The Decentralized Perps Thesis

When I entered DeFi (2020), the trend was to decentralize everything: exchanges, stablecoins, and more.

Degens love leverage. I knew that sooner or later, decentralized perps would take off.

Like a DeFi version of Bitmex.

When I entered DeFi (2020), the trend was to decentralize everything: exchanges, stablecoins, and more.

Degens love leverage. I knew that sooner or later, decentralized perps would take off.

Like a DeFi version of Bitmex.

I kept researching decentralized perps and found my winners a YEAR later.

1) GMX - Real yield tokenomics, ETH L2, large influencers shilling, & a referral program.

2) GNS - Metrics were undervalued compared to GMX. There was differentiation + going multichain.

1) GMX - Real yield tokenomics, ETH L2, large influencers shilling, & a referral program.

2) GNS - Metrics were undervalued compared to GMX. There was differentiation + going multichain.

Lessons so far:

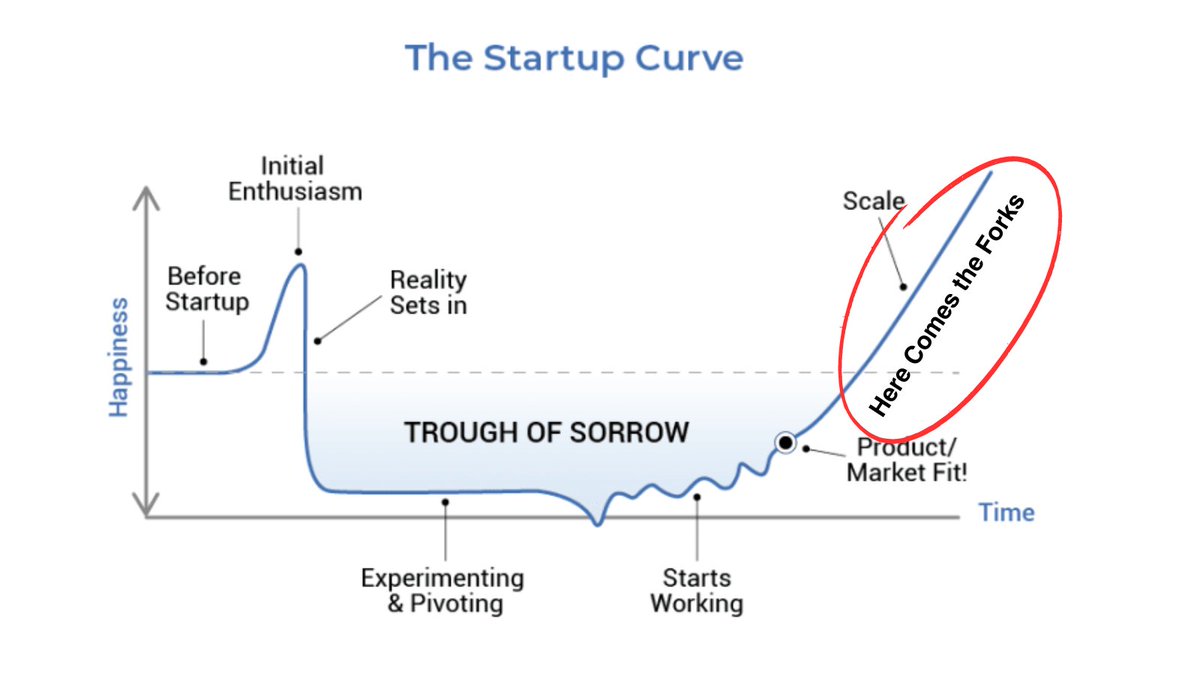

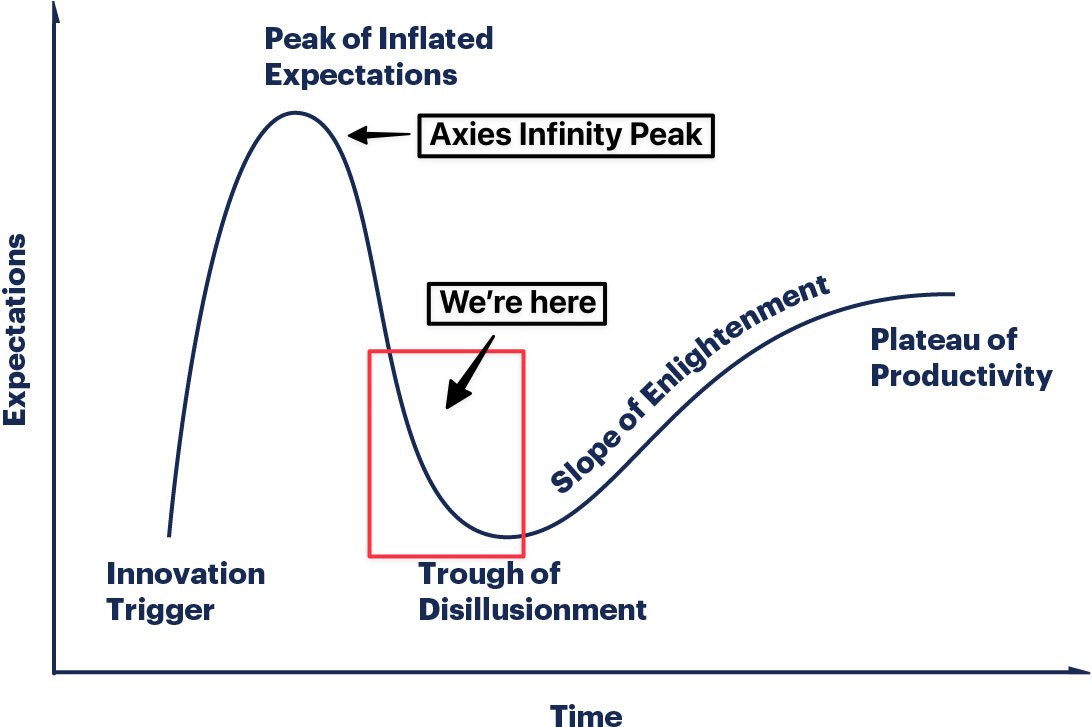

1) You can be "too early" to a narrative (just like investors were to WebVan).

2) Protocols iterate and learn from the 1st movers

3) You can create a thesis before there are any protocols. You have to be patient for them to play out.

1) You can be "too early" to a narrative (just like investors were to WebVan).

2) Protocols iterate and learn from the 1st movers

3) You can create a thesis before there are any protocols. You have to be patient for them to play out.

What happens next with this narrative?

Decentralized Perps still have plenty of legs.

1) Most leverage trading is still done on centralized exchanges, and there has been a tremendous loss of trust since FTX's demise.

2) New protocols will launch & keep innovating

Decentralized Perps still have plenty of legs.

1) Most leverage trading is still done on centralized exchanges, and there has been a tremendous loss of trust since FTX's demise.

2) New protocols will launch & keep innovating

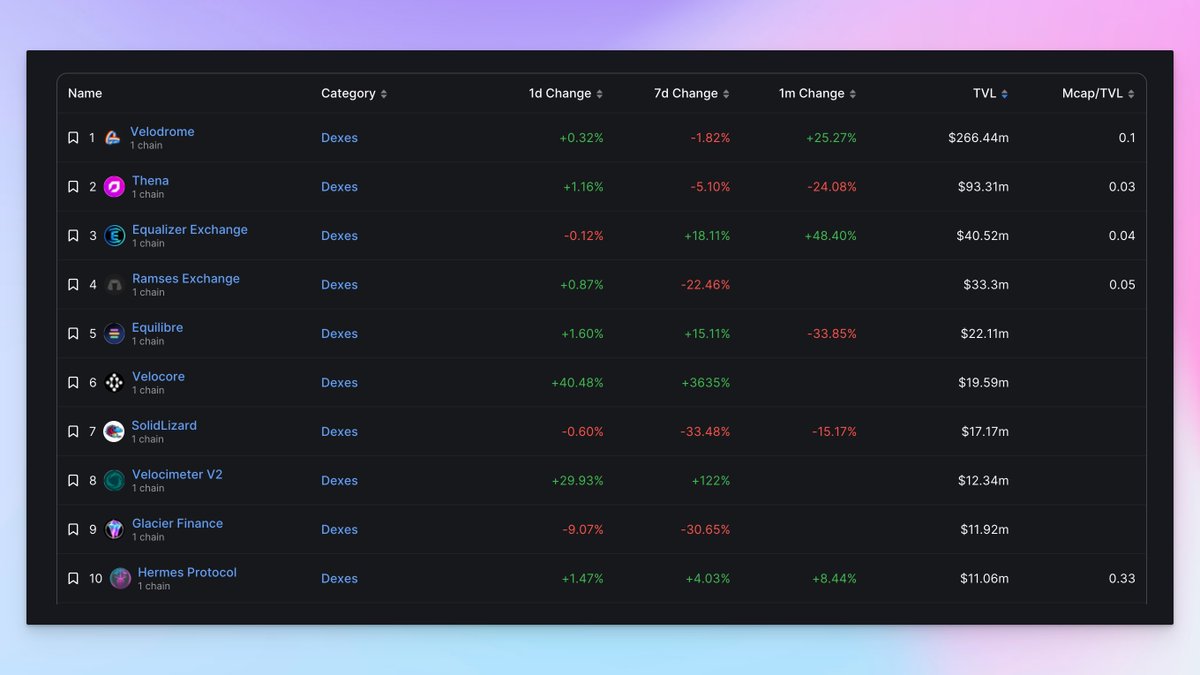

Options now:

1) Follow the "hot ball of money." You can rotate to newer protocols (new mechanisms, undervalued, or new chains).

2) Exit the thesis completely and find new narratives.

3) Stick to strength. This is what I prefer to do when the market's uncertain.

1) Follow the "hot ball of money." You can rotate to newer protocols (new mechanisms, undervalued, or new chains).

2) Exit the thesis completely and find new narratives.

3) Stick to strength. This is what I prefer to do when the market's uncertain.

I've seen variations of this framework play out in different narratives.

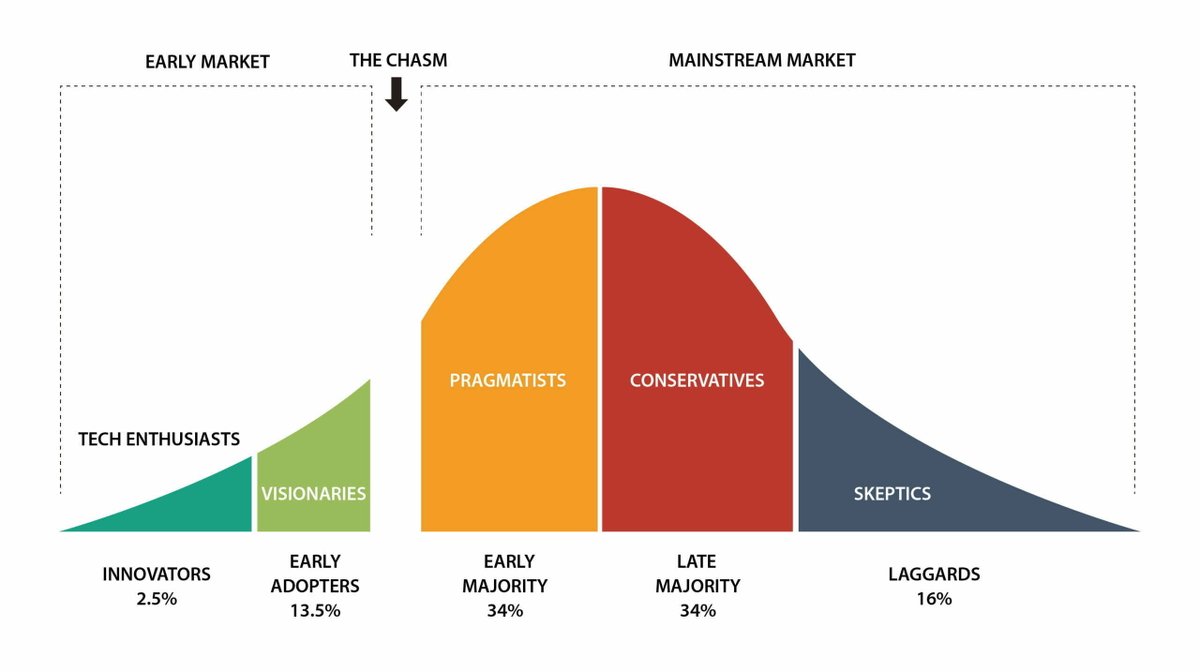

So I avoid going into a narrative "too early."

In general, I find that the most profit potential is in the "2nd" wave.

• Velodrome

• GMX / GNS

• Alt L1s in 2021 (Well, if you took profits)

So I avoid going into a narrative "too early."

In general, I find that the most profit potential is in the "2nd" wave.

• Velodrome

• GMX / GNS

• Alt L1s in 2021 (Well, if you took profits)

Why don't innovators do as well, price-wise? (OG DeFi protocols).

1) Good projects get forked quickly with new catalysts (upgraded mechanisms or deployments to other chains)

2) Investors would rather be "early" to a new project than invest in an older one.

1) Good projects get forked quickly with new catalysts (upgraded mechanisms or deployments to other chains)

2) Investors would rather be "early" to a new project than invest in an older one.

For a narrative to succeed, it needs:

• Timing

• Catalysts

• The right protocols w/ the right execution

• The right actors (Influencers, VCs, Whales) to bring attention to it

"You can always spot the pioneers by the arrows in their back"

• Timing

• Catalysts

• The right protocols w/ the right execution

• The right actors (Influencers, VCs, Whales) to bring attention to it

"You can always spot the pioneers by the arrows in their back"

Long Term Narratives

A few narratives I'm paying attention to in the next few YEARS:

• A.I.

• RWA

• GameFi

• ZK-rollups

• Omnichain

These make sense to me - I'm waiting patiently for the right protocols before jumping in.

By paying attention, it helps me be "early."

A few narratives I'm paying attention to in the next few YEARS:

• A.I.

• RWA

• GameFi

• ZK-rollups

• Omnichain

These make sense to me - I'm waiting patiently for the right protocols before jumping in.

By paying attention, it helps me be "early."

Does it feel like there are new narratives weekly?

People have short attention spans, so threadoors force new narratives for maximum engagement.

• Good narratives have long shelf lives & product/market fit

• Short narratives are more storytelling / pumpmentals

People have short attention spans, so threadoors force new narratives for maximum engagement.

• Good narratives have long shelf lives & product/market fit

• Short narratives are more storytelling / pumpmentals

My most successful investments happened when I did my own research.

I've noticed a lot of people just following others' advice, but I guess that's just human nature, right?

But seriously, take some risks and trust yourself.

Following the herd leads to mediocre results.

I've noticed a lot of people just following others' advice, but I guess that's just human nature, right?

But seriously, take some risks and trust yourself.

Following the herd leads to mediocre results.

Key Takeaways:

1) Create your Theses so you're not constantly reacting.

2) Narratives require timing, products, and attention to take off.

3) Protocols get feedback and iterate based on each other.

4) Think about which narratives in the past came in waves.

1) Create your Theses so you're not constantly reacting.

2) Narratives require timing, products, and attention to take off.

3) Protocols get feedback and iterate based on each other.

4) Think about which narratives in the past came in waves.

Alright, that's it for now.

If you like this content style with stories/examples, help me by liking/retweeting the 1st tweet linked below.

I'm data-driven, so the engagement numbers let me know if you enjoyed this and want more similar.

If you like this content style with stories/examples, help me by liking/retweeting the 1st tweet linked below.

I'm data-driven, so the engagement numbers let me know if you enjoyed this and want more similar.

p.s. If you like tweets like this, you’ll love my weekly newsletter (it’s free).

Every Thursday, I share new strategies, narratives, and the latest news in DeFi.

Join 30,000+ subscribers here: TheDeFiEdge.com

Every Thursday, I share new strategies, narratives, and the latest news in DeFi.

Join 30,000+ subscribers here: TheDeFiEdge.com

جاري تحميل الاقتراحات...