#MintPlainFacts | High interest rates hurt credit growth: that’s the basis of monetary policy.

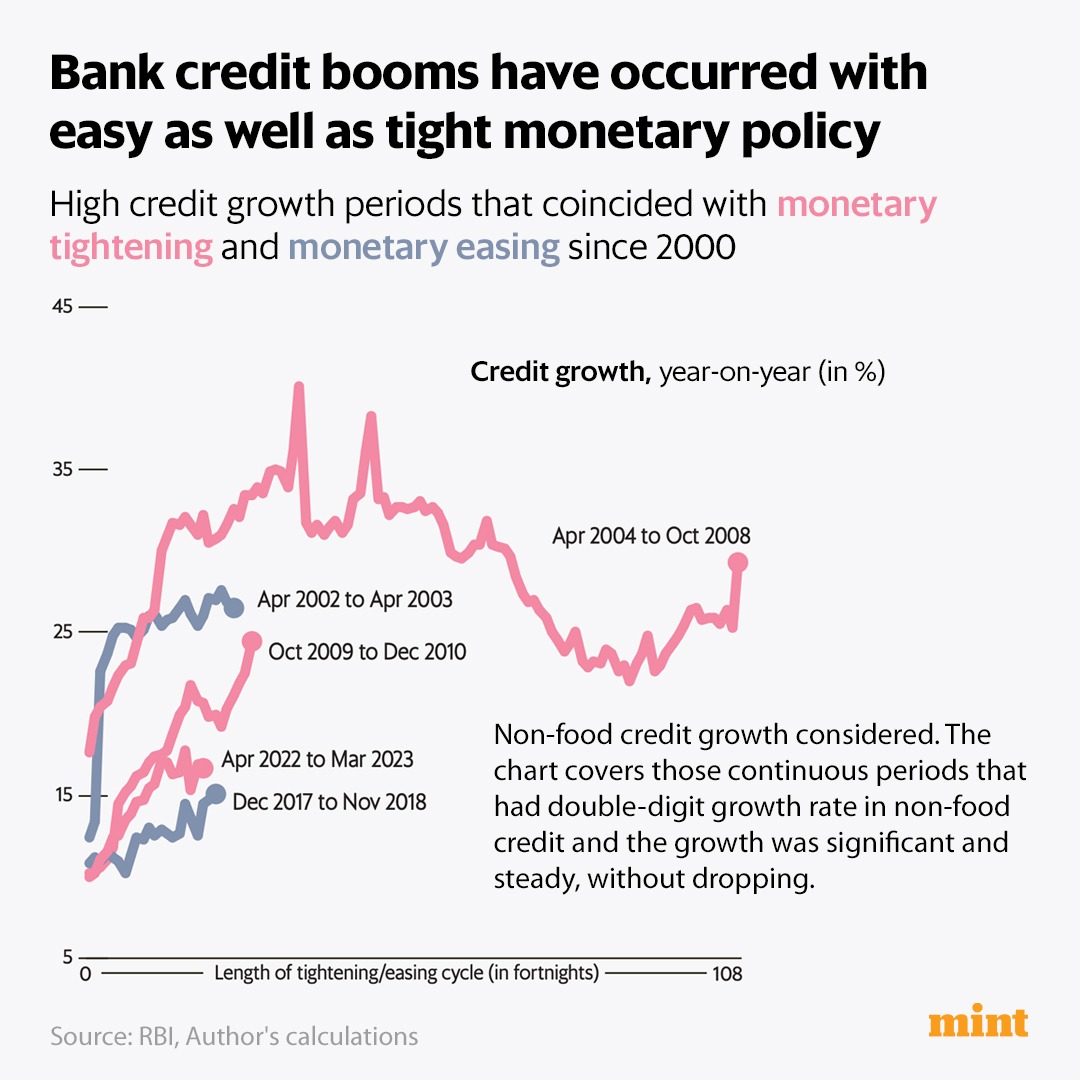

But in the past two decades, periods of growth in bank credit have, counter-intuitively, often coincided with monetary tightening in India.

Read here: livemint.com

But in the past two decades, periods of growth in bank credit have, counter-intuitively, often coincided with monetary tightening in India.

Read here: livemint.com

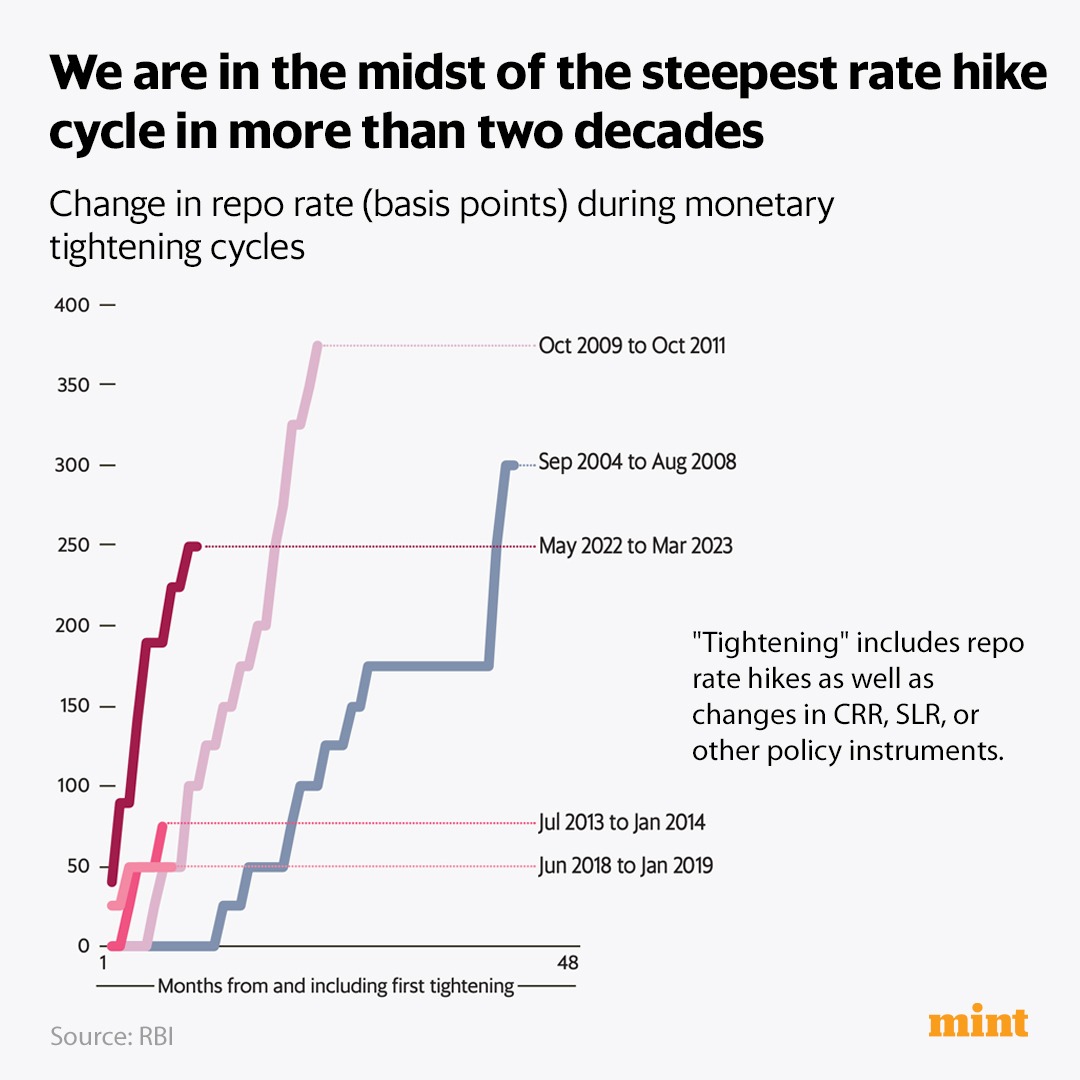

#MintPlainFacts | In 2009, bank credit made a quick recovery after the global crisis, despite rates being rapidly hiked back to pre-crisis levels.

There have been as many credit growth episodes during monetary easing as during tightening.

Read here: livemint.com

There have been as many credit growth episodes during monetary easing as during tightening.

Read here: livemint.com

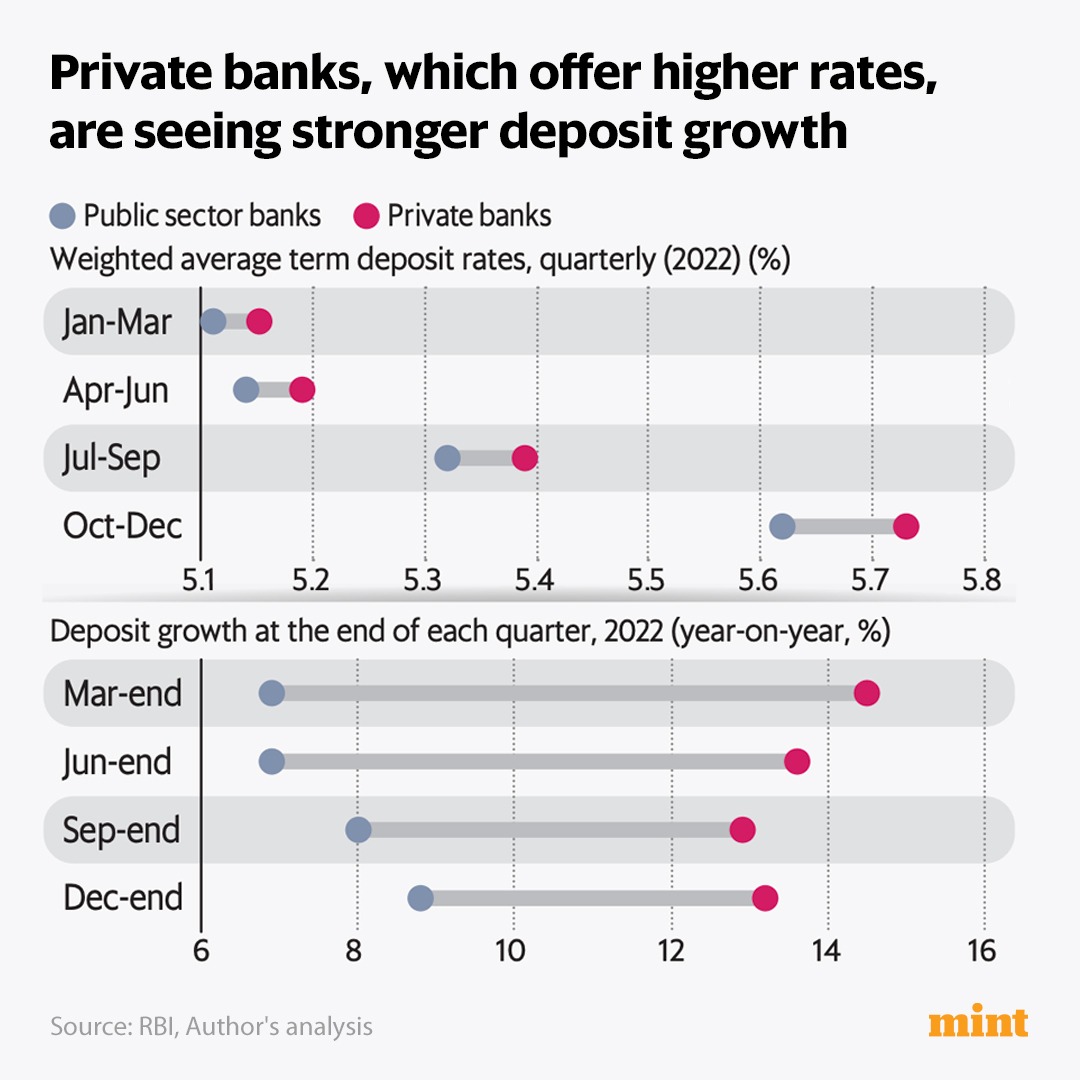

#MintPlainFacts | Whether bank credit can grow robustly in this environment will depend on other factors that influence the supply of and demand for credit.

Read here: livemint.com

Read here: livemint.com

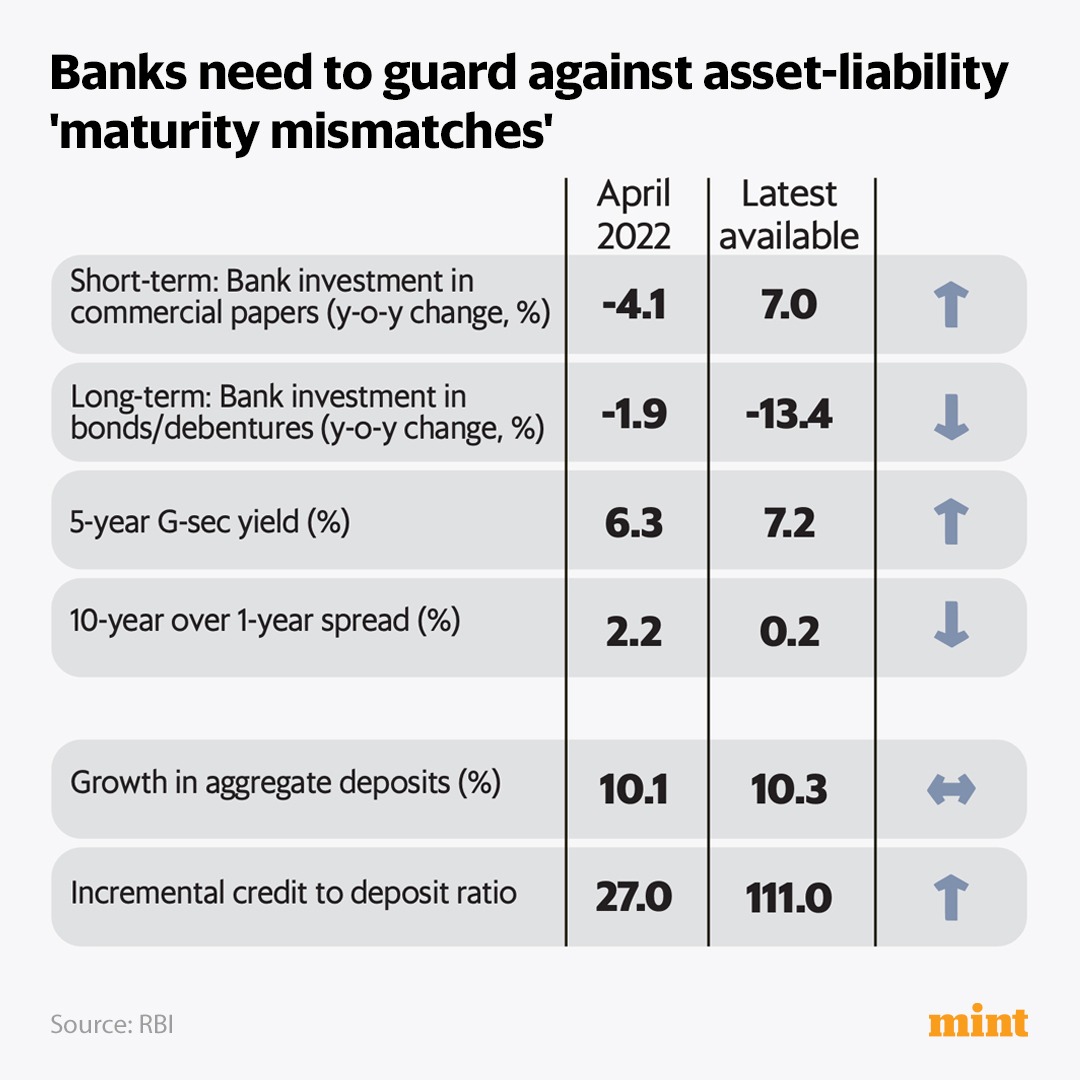

#MintPlainFacts | In March 2022, individual deposits, which tend to be “sticky", accounted for 53% of bank deposits, and a bulk were term deposits of longer than a year, which are typically held to maturity.

Read here: livemint.com

Read here: livemint.com

#MintPlainFacts | Higher rates discourage borrowing and push up defaults on existing loans. Together, these can dry up the demand for credit.

Bank credit is seeing a broad-based growth across population groups, states, loan types & sectors.

Read here: livemint.com

Bank credit is seeing a broad-based growth across population groups, states, loan types & sectors.

Read here: livemint.com

#MintPlainFacts | A bank that holds deposits that are payable on demand but invests in long-term fixed-rate assets faces what is called a ‘maturity mismatch’, as seen during the insolvency of Silicon Valley Bank.

Read here: livemint.com

Read here: livemint.com

Loading suggestions...