2.

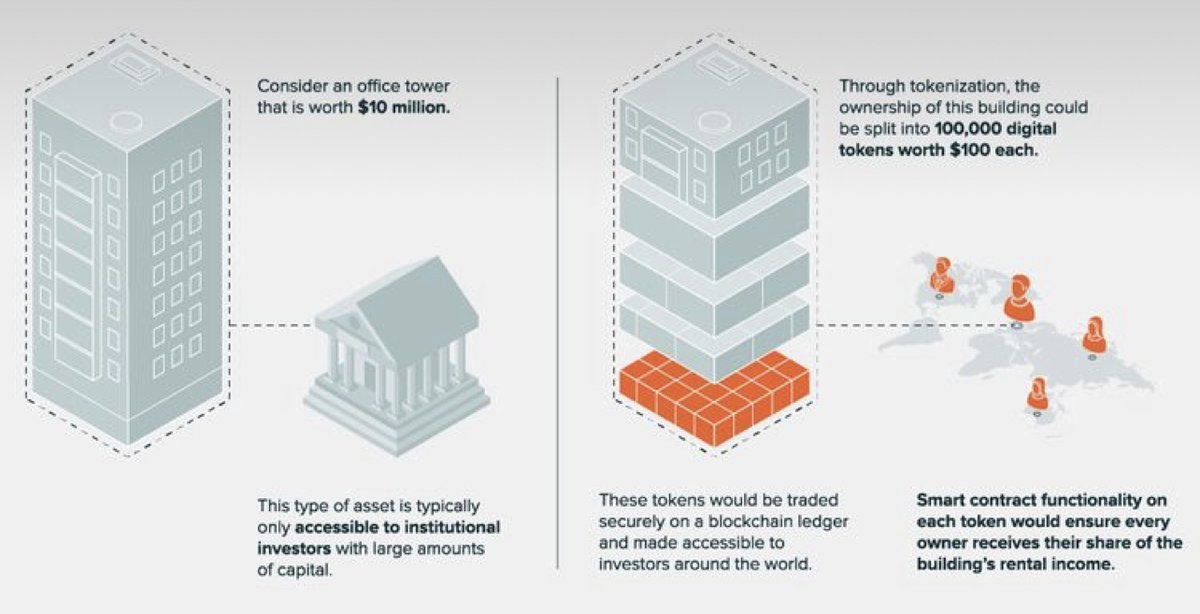

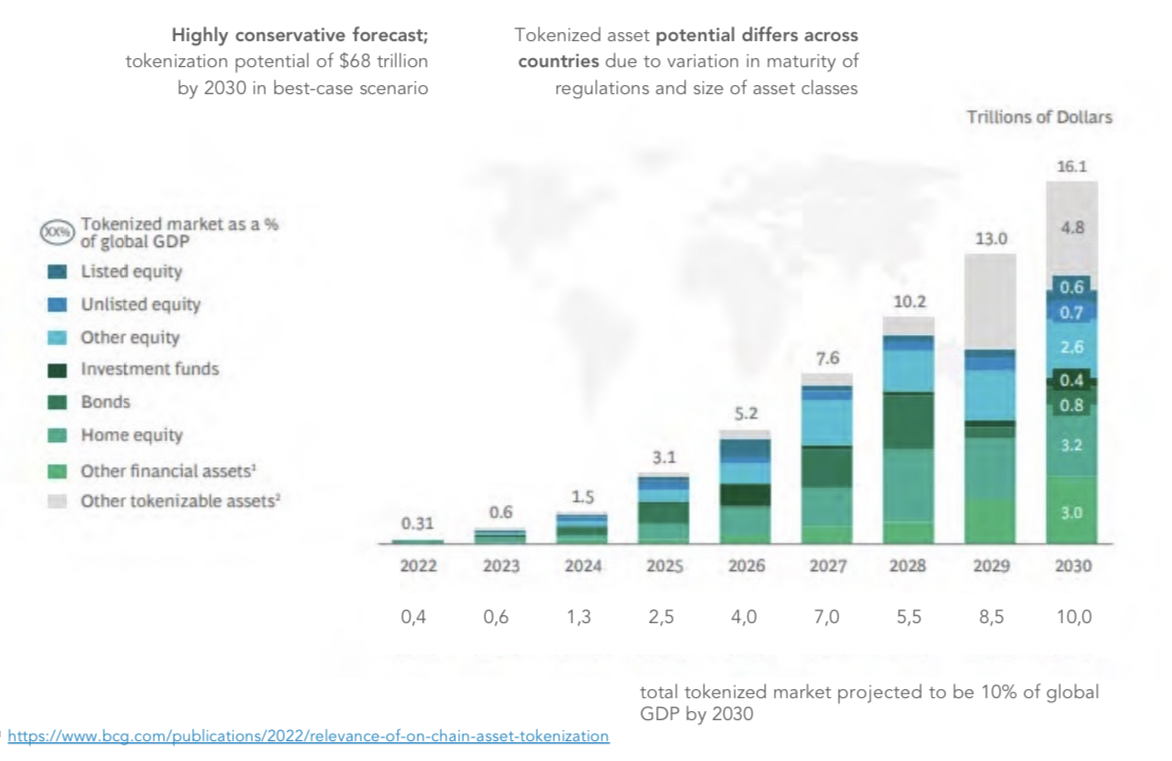

The possibilities are endless as any category can be tokenized:

• Lands

• Real Estate

• Cars

• Stocks

• Metals

• Art

• Luxury goods

Imagine how much money can flow into the blockchain space considering the global financial asset net worth.

Huge opportunity.

The possibilities are endless as any category can be tokenized:

• Lands

• Real Estate

• Cars

• Stocks

• Metals

• Art

• Luxury goods

Imagine how much money can flow into the blockchain space considering the global financial asset net worth.

Huge opportunity.

4.

♦️Benefits.

• Democratization of access ~ Fractionalizing real-world assets give anyone the possibility to invest, no matter the capital.

• Full ownership ~ As each transaction is written on the blockchain, no one can claim to own assets fraudulently.

♦️Benefits.

• Democratization of access ~ Fractionalizing real-world assets give anyone the possibility to invest, no matter the capital.

• Full ownership ~ As each transaction is written on the blockchain, no one can claim to own assets fraudulently.

5.

• Bureaucracy efficiency ~ By reducing the need for intermediaries, both costs and time are significantly reduced (atomic settlement).

• Increase in liquidity ~ By opening up the market to global purchasers, illiquid assets can find liquidity via increased participants.

• Bureaucracy efficiency ~ By reducing the need for intermediaries, both costs and time are significantly reduced (atomic settlement).

• Increase in liquidity ~ By opening up the market to global purchasers, illiquid assets can find liquidity via increased participants.

7.

♦️Disadvantages.

• Hacks ~ Potential loopholes in smart contracts can become a fertile ground for hackers.

• Licensing ~ Obtaining a regulated license for asset tokenization could be an unwieldy process, together with the undefined tax regime.

♦️Disadvantages.

• Hacks ~ Potential loopholes in smart contracts can become a fertile ground for hackers.

• Licensing ~ Obtaining a regulated license for asset tokenization could be an unwieldy process, together with the undefined tax regime.

8.

• KYC/AML ~ Tokenization involves KYC and AML processes, something that many crypto participants would disagree with.

• Asset sizing ~ Governments could freeze RWAs.

• Liquidation issues ~ Crypto could be sold in an instant, RWAs require change of ownership to do so.

• KYC/AML ~ Tokenization involves KYC and AML processes, something that many crypto participants would disagree with.

• Asset sizing ~ Governments could freeze RWAs.

• Liquidation issues ~ Crypto could be sold in an instant, RWAs require change of ownership to do so.

10.

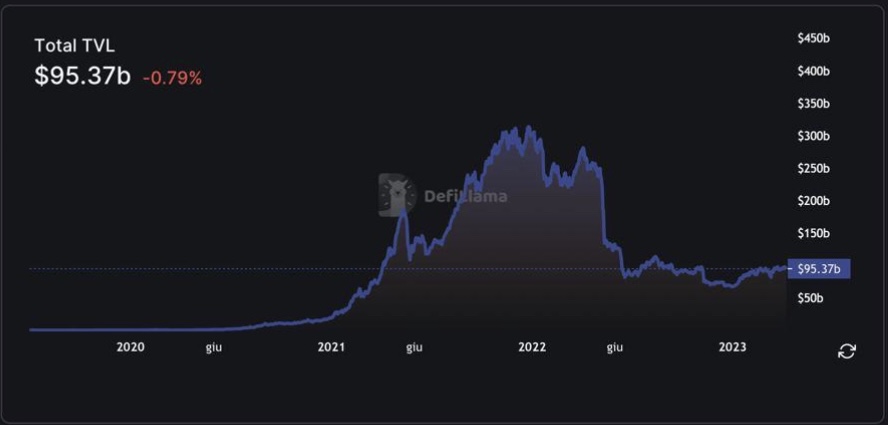

RWA assets can help the DeFi world to offer more sustainable and reliable yields backed by traditional asset classes, therefore independently from the volatility of the crypto market.

Furthermore, it's important to offer higher yields, otherwise fresh capital won't flow in.

RWA assets can help the DeFi world to offer more sustainable and reliable yields backed by traditional asset classes, therefore independently from the volatility of the crypto market.

Furthermore, it's important to offer higher yields, otherwise fresh capital won't flow in.

11.

♦️RWA protocols.

The road toward RWA adoption is long and complicated but there are already some protocols working in this sector that I’m looking at.

I'm sure that there will be other good players so don't be upset if you don't find your favorite ones.

♦️RWA protocols.

The road toward RWA adoption is long and complicated but there are already some protocols working in this sector that I’m looking at.

I'm sure that there will be other good players so don't be upset if you don't find your favorite ones.

12.

• @realSologenic

Sologenic is a DEX built on the XRP ledger that aims to provide access to stocks, crypto, ETF and tokenized assets.

Users can tokenize 40,000+ stocks, ETFs, and commodities from 30 global stock exchanges.

• @realSologenic

Sologenic is a DEX built on the XRP ledger that aims to provide access to stocks, crypto, ETF and tokenized assets.

Users can tokenize 40,000+ stocks, ETFs, and commodities from 30 global stock exchanges.

13.

• @RealTPlatform

RealT is a platform powered by AAVE that operates in the Real Estate sector allowing people to buy fractionalized properties in the U.S.

As mentioned before you can buy a property starting with 50$.

• @RealTPlatform

RealT is a platform powered by AAVE that operates in the Real Estate sector allowing people to buy fractionalized properties in the U.S.

As mentioned before you can buy a property starting with 50$.

14.

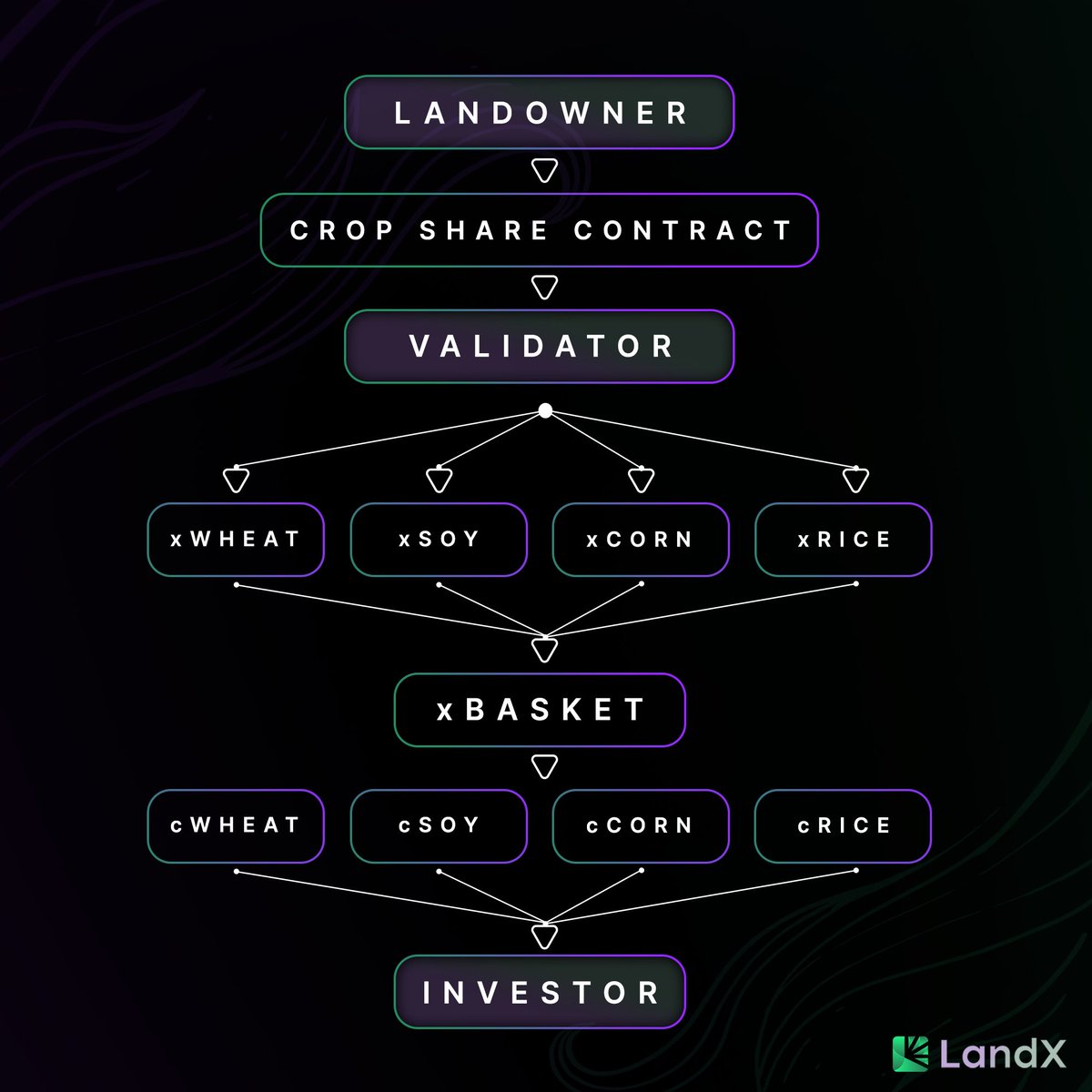

• @landxfinance

A protocol that brings agriculture on chain, allowing people to buy and sell agricultural commodities.

Investors can receive real yield from their crops, diversifying their portfolios with assets uncorrelated to the crypto market.

• @landxfinance

A protocol that brings agriculture on chain, allowing people to buy and sell agricultural commodities.

Investors can receive real yield from their crops, diversifying their portfolios with assets uncorrelated to the crypto market.

15.

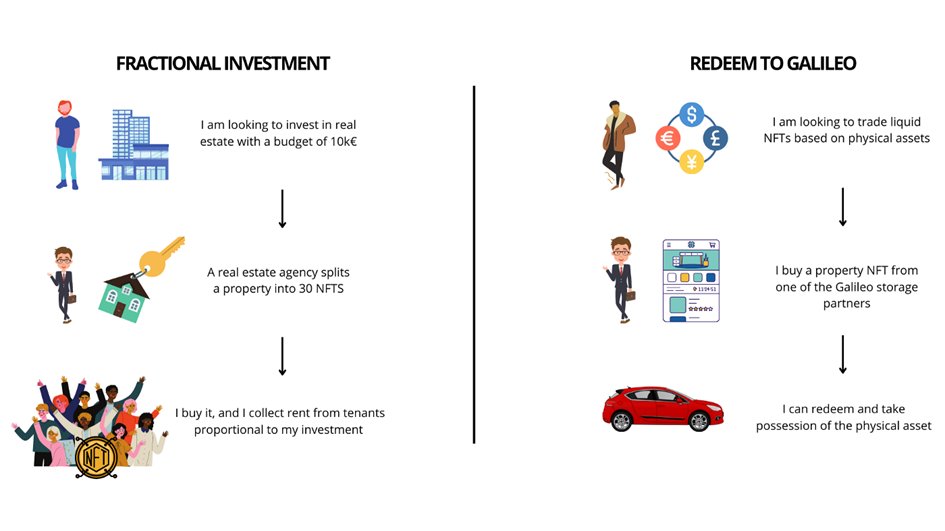

• @galileoprotocol

Galileo Network enables luxury brands to combat counterfeiting by accompanying their authentic products with immutable pNFTs, proving their ownership, condition, and origin on the blockchain.

pNFTs stands for physical NFTs.

• @galileoprotocol

Galileo Network enables luxury brands to combat counterfeiting by accompanying their authentic products with immutable pNFTs, proving their ownership, condition, and origin on the blockchain.

pNFTs stands for physical NFTs.

16.

Other mentions:

• GoldFinch ~ Uncollateralized loans

• Securitize ~ Private funds tokenization

• TrueFi ~ Uncollateralized Lending

• Liquefi ~ Digital securities blockchain provider

• PaxGold ~ Gold tokenization

A lot of players are emerging.

Other mentions:

• GoldFinch ~ Uncollateralized loans

• Securitize ~ Private funds tokenization

• TrueFi ~ Uncollateralized Lending

• Liquefi ~ Digital securities blockchain provider

• PaxGold ~ Gold tokenization

A lot of players are emerging.

17.

♦️Adoption key.

The tokenization of real-world assets is one of the most amazing concepts in crypto.

It can not only ease the bureaucratic processes and bring trillions of liquidity to the crypto market but can also become the key to mass adoption.

♦️Adoption key.

The tokenization of real-world assets is one of the most amazing concepts in crypto.

It can not only ease the bureaucratic processes and bring trillions of liquidity to the crypto market but can also become the key to mass adoption.

18.

People continue to remain skeptical about our world because they cannot see tangible use cases.

Being able to see physical real-world assets tokenized, should change the overall perspective tied to the idea of the “scammy” world of crypto.

People continue to remain skeptical about our world because they cannot see tangible use cases.

Being able to see physical real-world assets tokenized, should change the overall perspective tied to the idea of the “scammy” world of crypto.

19.

♦️Good things take time.

As said, the whole concept is amazing.

But we're still in an experimental phase that requires time before reaching global adoption, we're not there yet.

Before this happens, a lot needs to be done, especially behind the regulatory framework.

♦️Good things take time.

As said, the whole concept is amazing.

But we're still in an experimental phase that requires time before reaching global adoption, we're not there yet.

Before this happens, a lot needs to be done, especially behind the regulatory framework.

20.

Most of the RWA tokens pump due to the narrative, not because they have a mass utility that justifies the price increase.

This can be seen as a massive and early opportunity to monitor this emerging and fascinating sector.

A sector that could revolutionize DeFi and TradFi.

Most of the RWA tokens pump due to the narrative, not because they have a mass utility that justifies the price increase.

This can be seen as a massive and early opportunity to monitor this emerging and fascinating sector.

A sector that could revolutionize DeFi and TradFi.

21.

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Do you want to have access to deeper guides and info?

Subscribe to my FREE newsletter.👇

extensivevision.substack.com

That's it!

• If you liked this thread follow me @IamZeroIka for more crypto insights.

• Do you want to have access to deeper guides and info?

Subscribe to my FREE newsletter.👇

extensivevision.substack.com

Loading suggestions...