1️⃣ A penny that doubles every day

Let’s say that you have the choice between two sums of money:

▪️$1 million in cash

▪️A penny that doubles every day for a month

Which one would you choose?

Let’s say that you have the choice between two sums of money:

▪️$1 million in cash

▪️A penny that doubles every day for a month

Which one would you choose?

Does the above sound like a difficult question to you?

Let’s give you a hint.

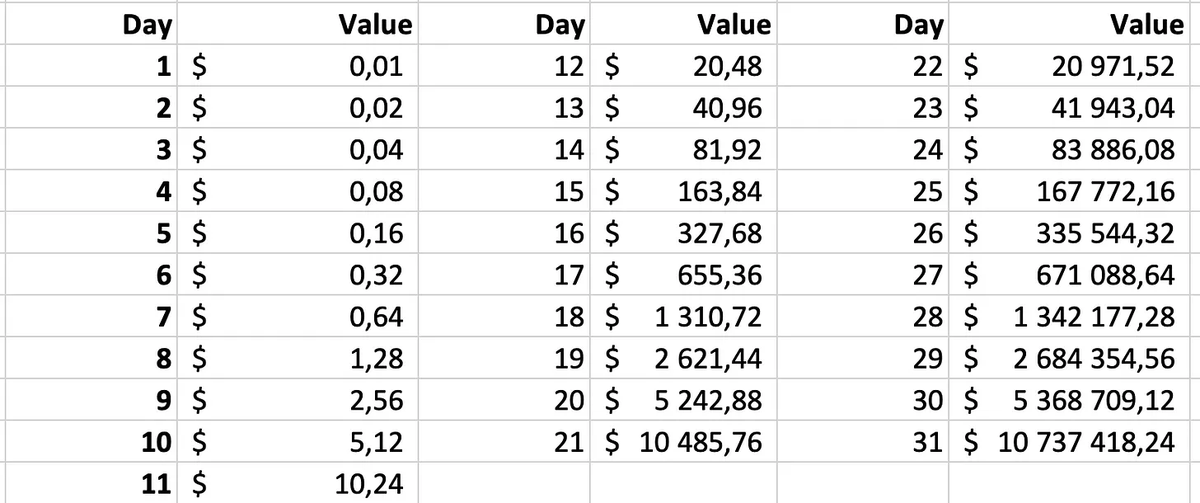

A penny that doubles every day would be worth $0.16 on day 5 and $5.12 on day 10.

Let’s give you a hint.

A penny that doubles every day would be worth $0.16 on day 5 and $5.12 on day 10.

Please note that in this example it took until the 27th day (!) for the penny to be worth more than $1 million.

The fact that it took until the 27th day shows you why patience and a long-term perspective are crucial to let the compounding work like magic.

The fact that it took until the 27th day shows you why patience and a long-term perspective are crucial to let the compounding work like magic.

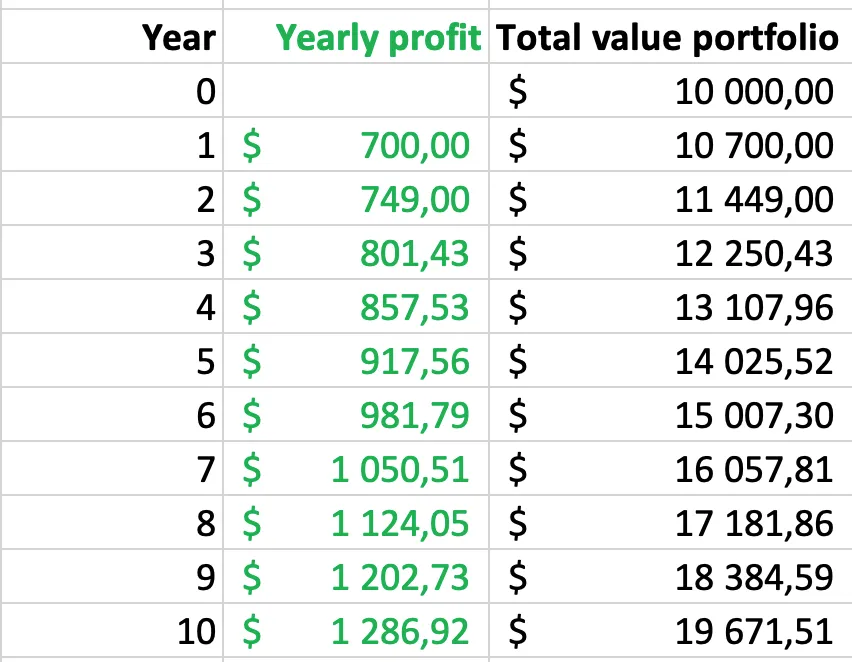

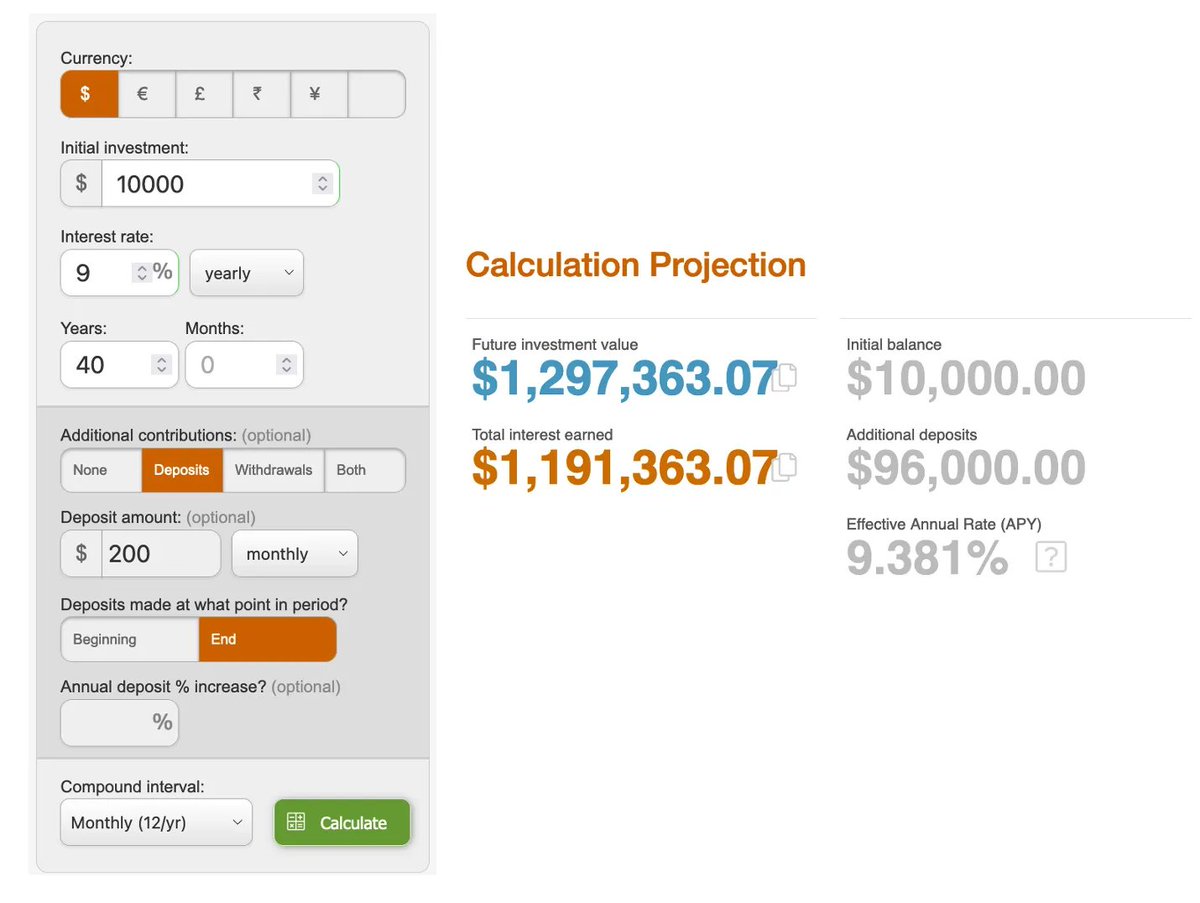

Let’s say that you invest $10,000 and you are able to compound your money at 7% per year.

In year 1, you’ll make $700 ($10,000 * 7%). As a result, the value of your portfolio is equal to $10,700.

In year 1, you’ll make $700 ($10,000 * 7%). As a result, the value of your portfolio is equal to $10,700.

In year 2, you’ll make more than $700. Why? Because you also make money on the $700 you earned the year before. As a result, you’ll make $749 ($10,700 * 7%) in year 2 and the value of your portfolio increases to $11,449.

When you would invest for very long periods of time (> 20 years), something magical happens.

Remember that you made $700 in year 1 and $1,286.92 in year 10.

Remember that you made $700 in year 1 and $1,286.92 in year 10.

Here’s what happens if you keep investing:

▪️ In year 20, you'll gain $2,531.57

▪️ In year 30, you'll gain $4,979.98

▪️ In year 40, you'll gain $9,796.37

▪️ In year 50, you'll gain $19,270.95

▪️ In year 20, you'll gain $2,531.57

▪️ In year 30, you'll gain $4,979.98

▪️ In year 40, you'll gain $9,796.37

▪️ In year 50, you'll gain $19,270.95

3️⃣ Formula compound interest

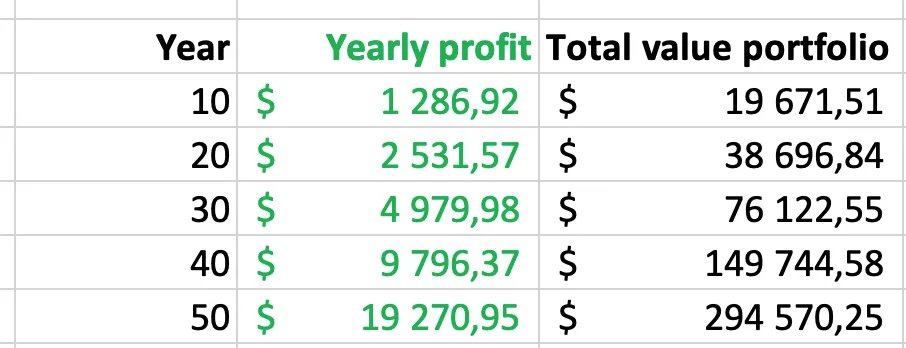

On the internet, there are a lot of compound interest calculators you can use. The Calculator Site is a good example.

On the internet, there are a lot of compound interest calculators you can use. The Calculator Site is a good example.

Obviously, you can also calculate it yourself.

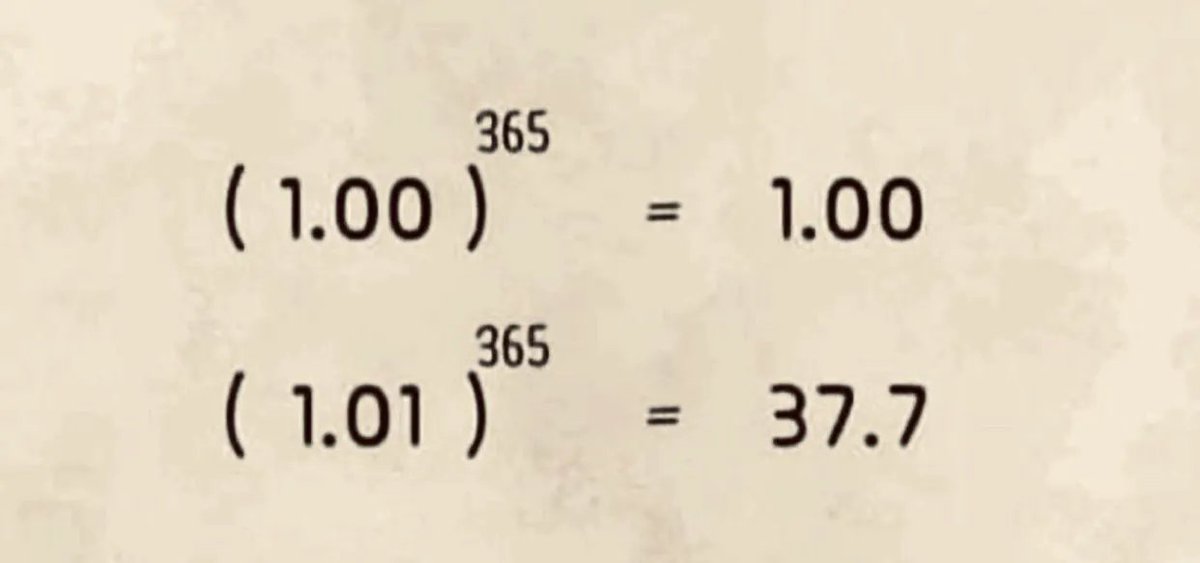

Here is the formula for compound interest:

Final amount = beginning amount * (1 + yearly return)^number of periods

Here is the formula for compound interest:

Final amount = beginning amount * (1 + yearly return)^number of periods

If you would invest $10,000 for 20 years at a yearly return of 9%, it would look as follows:

Final amount = $10,000 * (1,09)^20

Final amount = $56,044

Final amount = $10,000 * (1,09)^20

Final amount = $56,044

Let’s use an example to make this even more clear.

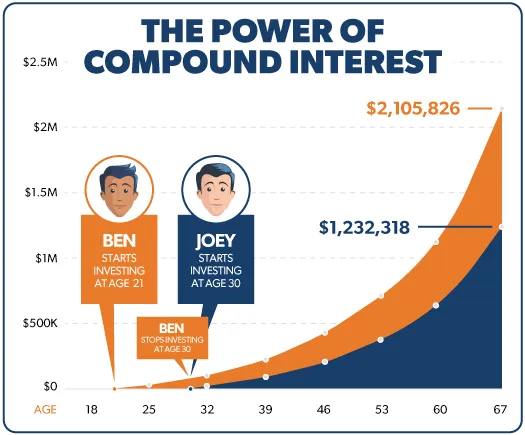

In our example we have 2 men (Ben and Joey) who start investing:

Ben

- Starts investing at age 21

- Monthly investment: $200

- Stops contributing money at age 30 (added money to his account for 9 years)

In our example we have 2 men (Ben and Joey) who start investing:

Ben

- Starts investing at age 21

- Monthly investment: $200

- Stops contributing money at age 30 (added money to his account for 9 years)

Joey

- Starts investing at age 30

- Monthly investment: $200

- Keeps investing until age 67 (added money to his account for 37 years)

In total, Ben will have contributed $21,600 while Joey will have contributed $88,800 to their investment account.

- Starts investing at age 30

- Monthly investment: $200

- Keeps investing until age 67 (added money to his account for 37 years)

In total, Ben will have contributed $21,600 while Joey will have contributed $88,800 to their investment account.

When Ben and Joey both keep their investment until age 67 and manage to compound at an average annual return of 11%, Ben would have $2.1 million while Joey would have grown his account to $1.2 million.

5️⃣ Never interrupt compounding

Charlie Munger once said that the first rule of compounding is to never interrupt it unnecessarily.

You don’t believe Charlie?

You should. Let’s use one more example.

Charlie Munger once said that the first rule of compounding is to never interrupt it unnecessarily.

You don’t believe Charlie?

You should. Let’s use one more example.

Olivier

- Starts investing at age 21

- Monthly investment: $200

Emma

- Starts investing at age 21

- Monthly investments: $200

- Stops investing at age 30 and starts again at age 40

- Starts investing at age 21

- Monthly investment: $200

Emma

- Starts investing at age 21

- Monthly investments: $200

- Stops investing at age 30 and starts again at age 40

This is how their wealth would like if they both keep investing until age 67 and achieve a yearly return of 11%:

- Olivier: $3,3 million

- Emma: $1,1 million

- Olivier: $3,3 million

- Emma: $1,1 million

6️⃣ Conclusion

That’s it for today. Here’s what you should remember:

- Compound interest is the eight wonder of the world

- Start investing as early as possible

- You can calculate compound interest via this formula:

That’s it for today. Here’s what you should remember:

- Compound interest is the eight wonder of the world

- Start investing as early as possible

- You can calculate compound interest via this formula:

If you liked this, you'll love our free course.

The course will teach you how to read Financial Statements like a professional.

Sign up here to receive it:

eepurl.com

The course will teach you how to read Financial Statements like a professional.

Sign up here to receive it:

eepurl.com

Loading suggestions...