But first, if you need a refresher on what happened previously with another earlier user, here's the thread 👇🏻

Yesterday, the Implied Yield for @StargateFinance USDT on Arbitrum broke below the previous ATL to 4.16%, which essentially means that the price of YT was the cheapest it has been.

Noticing this, 0x733 swooped in for the opportunity.

Noticing this, 0x733 swooped in for the opportunity.

With 9,879 $USDC, the user initiated a transaction to purchase 182,400 YT-USDT, essentially buying the rights to collect all the yield generated by 182,400 @StargateFinance USDT

🔗arbiscan.io

🔗arbiscan.io

If the Underlying APY remains at the current level (5.72% APY), the user is on track to earn ~$2,849 in profit, more so if Stargate USDT yield goes up.

Annualized, that's 22.9% APY - not bad for a stablecoin position.

Annualized, that's 22.9% APY - not bad for a stablecoin position.

And that's not all!

As it appears, this Pendle user is also a practitioner of the "free money arts", courtesy of @Flashstake and yours truly.

If you're in need of a refresher, here's the strategy by yield master @gabavineb 👇🏻

As it appears, this Pendle user is also a practitioner of the "free money arts", courtesy of @Flashstake and yours truly.

If you're in need of a refresher, here's the strategy by yield master @gabavineb 👇🏻

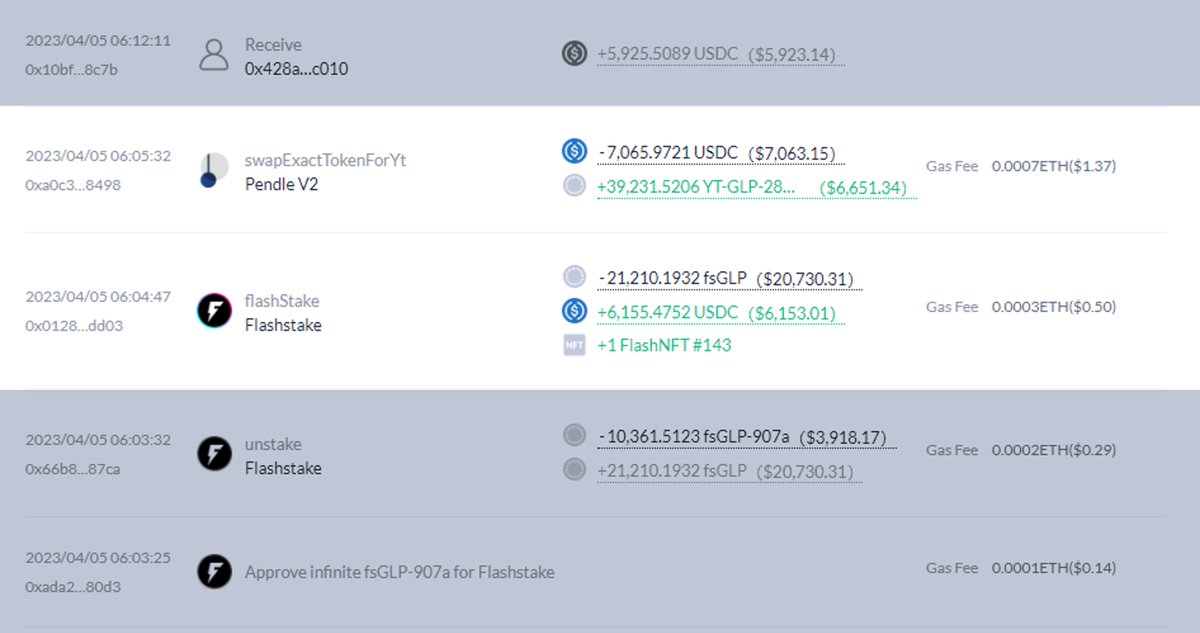

TL;DR of what the user did:

1️⃣ Flashstaked 21,210 $GLP on @Flashstake for 6,155 $USDC upfront

2️⃣ Purchased 39,231 YT-GLP with 7,065 $USDC on Pendle

1️⃣ Flashstaked 21,210 $GLP on @Flashstake for 6,155 $USDC upfront

2️⃣ Purchased 39,231 YT-GLP with 7,065 $USDC on Pendle

Doing so lets the user essentially earn extra yield for free (plus a little top-up in the YT purchase), getting 39,231 GLP's yield instead of just 21,210 GLP 🔥

With Pendle, you have the tools on hand to control and manipulate yield - hedging, leveraged exposure, optimization, yield stacking... you add the element of #DeFi composability in there and possibilities become endless, even more powerful

You just have to start looking 👀

You just have to start looking 👀

Loading suggestions...