@ethereum @LidoFinance @fraxfinance Did you know that ONLY 15% of all ETH is staked?

Staking ratios for comparison:

- Solana 70%

- Cardano 68%

- Cosmos Hub 66%

We can conclude that only a TINY amount of ETH is currently staked.

DeFiInvestor already pointed this out in January 👇

Staking ratios for comparison:

- Solana 70%

- Cardano 68%

- Cosmos Hub 66%

We can conclude that only a TINY amount of ETH is currently staked.

DeFiInvestor already pointed this out in January 👇

The problem with staking Ethereum:

Right now you literally can't unstake your ETH.

This is a huge contributor to the low staking ratio if you ask me.

But!

This is changing with an upgrade that is happening in exactly 7 days!

Right now you literally can't unstake your ETH.

This is a huge contributor to the low staking ratio if you ask me.

But!

This is changing with an upgrade that is happening in exactly 7 days!

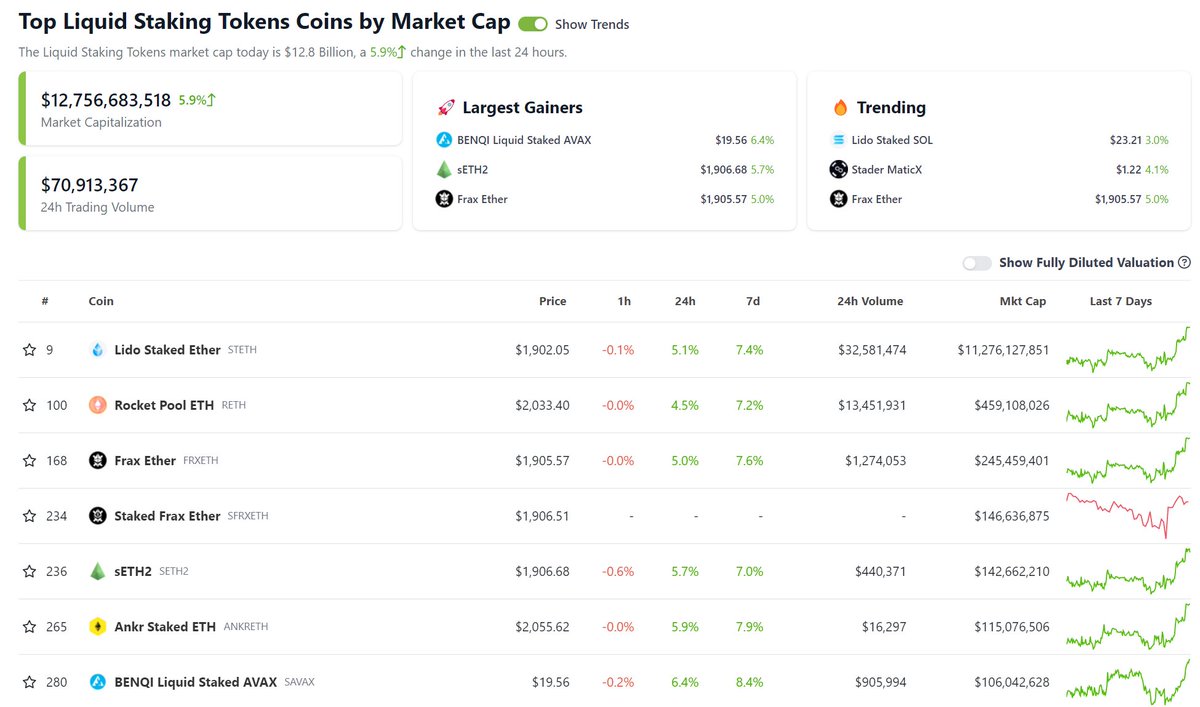

What is liquid Staking:

Ethereum has many Liquid Staking providers:

- Lido

- RocketPool

- Frax

You stake your ETH, earn yield, and receive a liquid staking derivative.

This means you can basically sell your staked ETH & earn yield at the same time.

Why would I not stake it?

Ethereum has many Liquid Staking providers:

- Lido

- RocketPool

- Frax

You stake your ETH, earn yield, and receive a liquid staking derivative.

This means you can basically sell your staked ETH & earn yield at the same time.

Why would I not stake it?

Liquid Staking ratio will increase:

We have seen the adoption of liquid staking explode in Ecosystems other than Ethereum.

A good example is the Cosmos

In less than 1 year Stride's adoption exploded & their LSDs are featured on any major project.

We have seen the adoption of liquid staking explode in Ecosystems other than Ethereum.

A good example is the Cosmos

In less than 1 year Stride's adoption exploded & their LSDs are featured on any major project.

What does this mean?

Ethereum is now ready to adopt Liquid staking derivatives.

We will see:

- Listings on CEX's

- Adoption in DeFi

- Protocol revenue increase

In a year from now, you might be able to use stETH to trade on Binance.

Here is how you can profit from this 👇

Ethereum is now ready to adopt Liquid staking derivatives.

We will see:

- Listings on CEX's

- Adoption in DeFi

- Protocol revenue increase

In a year from now, you might be able to use stETH to trade on Binance.

Here is how you can profit from this 👇

Which liquid staking protocol will win:

A good idea is to compare the market cap of the protocol with the amount of staked ETH.

Mochi already did that for us!

Keep in mind some of these protocols offer additional products.

A good idea is to compare the market cap of the protocol with the amount of staked ETH.

Mochi already did that for us!

Keep in mind some of these protocols offer additional products.

My personal favorites are:

- Frax because they share revenue

- Lido because it's the blue chip

- RocketPool as a blue chip alternative

If you are looking for other options, check out this tweet 👇

- Frax because they share revenue

- Lido because it's the blue chip

- RocketPool as a blue chip alternative

If you are looking for other options, check out this tweet 👇

Here is a list of awesome accounts, all of them inspire me in some way.

@UtilityChad

@Cryptotrissy

@LouisCooper_

@Flowslikeosmo

@defi_mochi

@crypthoem

@crypto_linn

@Axel_bitblaze69

@0x_gremlin

@ardizor

@wacy_time1

Check out their content! :)

@UtilityChad

@Cryptotrissy

@LouisCooper_

@Flowslikeosmo

@defi_mochi

@crypthoem

@crypto_linn

@Axel_bitblaze69

@0x_gremlin

@ardizor

@wacy_time1

Check out their content! :)

@UtilityChad @Cryptotrissy @LouisCooper_ @Flowslikeosmo @defi_mochi @crypthoem @crypto_linn @Axel_bitblaze69 @0x_gremlin @ardizor @wacy_time1 Ready for another airdrop strategy?

Keep reading about @vertex_protocol

(Don't forget to follow)

Keep reading about @vertex_protocol

(Don't forget to follow)

Loading suggestions...