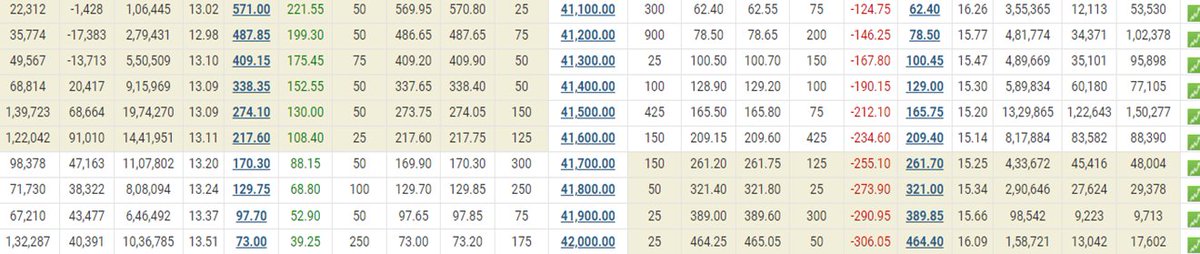

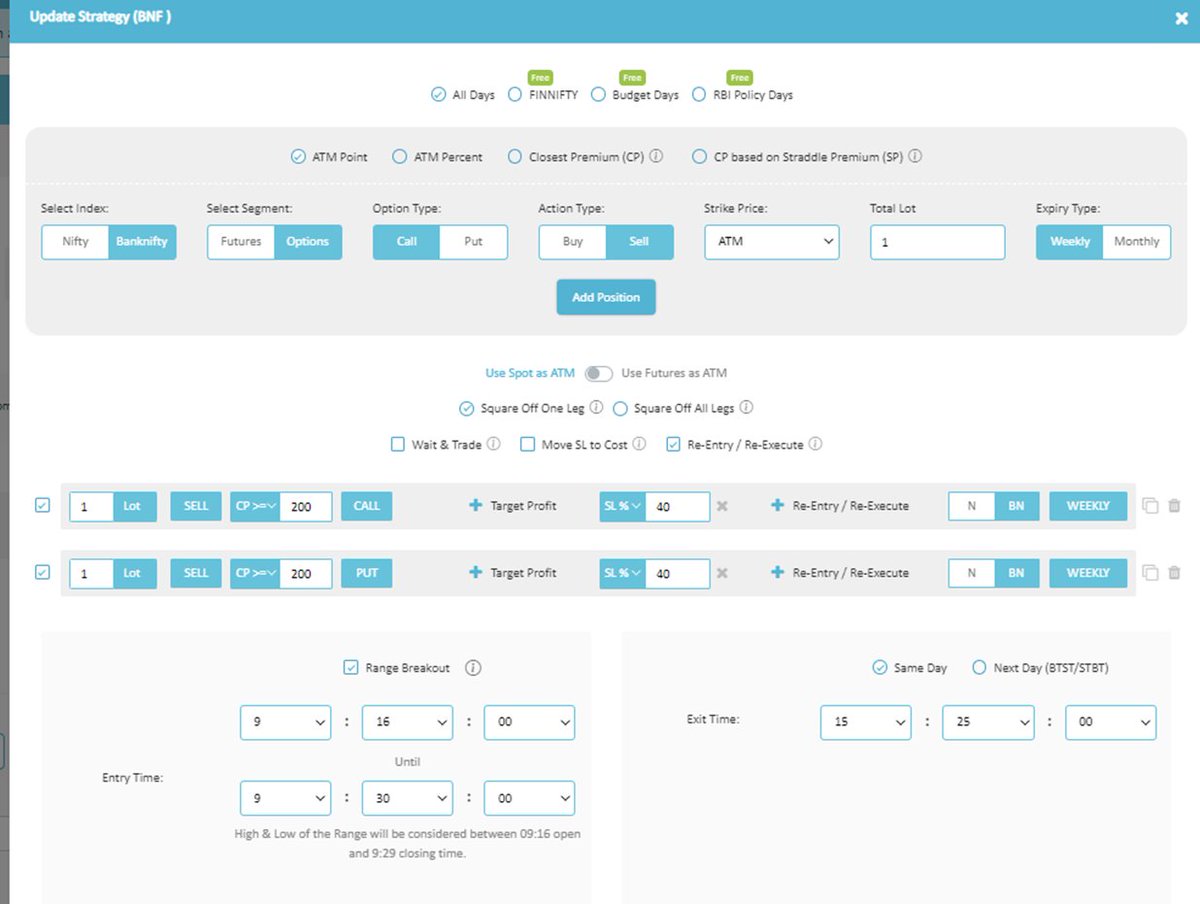

𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗥𝘂𝗹𝗲𝘀

🔸 Option Premium > 200

🔸 Instrument : Banknifty

🔸 Days to Trade : All days

🔸 Stoploss : 40% on each leg

🔸 Range Breakout from 9:16 to 9:30 AM

🔸 Exit time : 3:25 pm

🔸 Trend Following System

🔸 Option sell on range breakout of opp side

[4/14]

🔸 Option Premium > 200

🔸 Instrument : Banknifty

🔸 Days to Trade : All days

🔸 Stoploss : 40% on each leg

🔸 Range Breakout from 9:16 to 9:30 AM

🔸 Exit time : 3:25 pm

🔸 Trend Following System

🔸 Option sell on range breakout of opp side

[4/14]

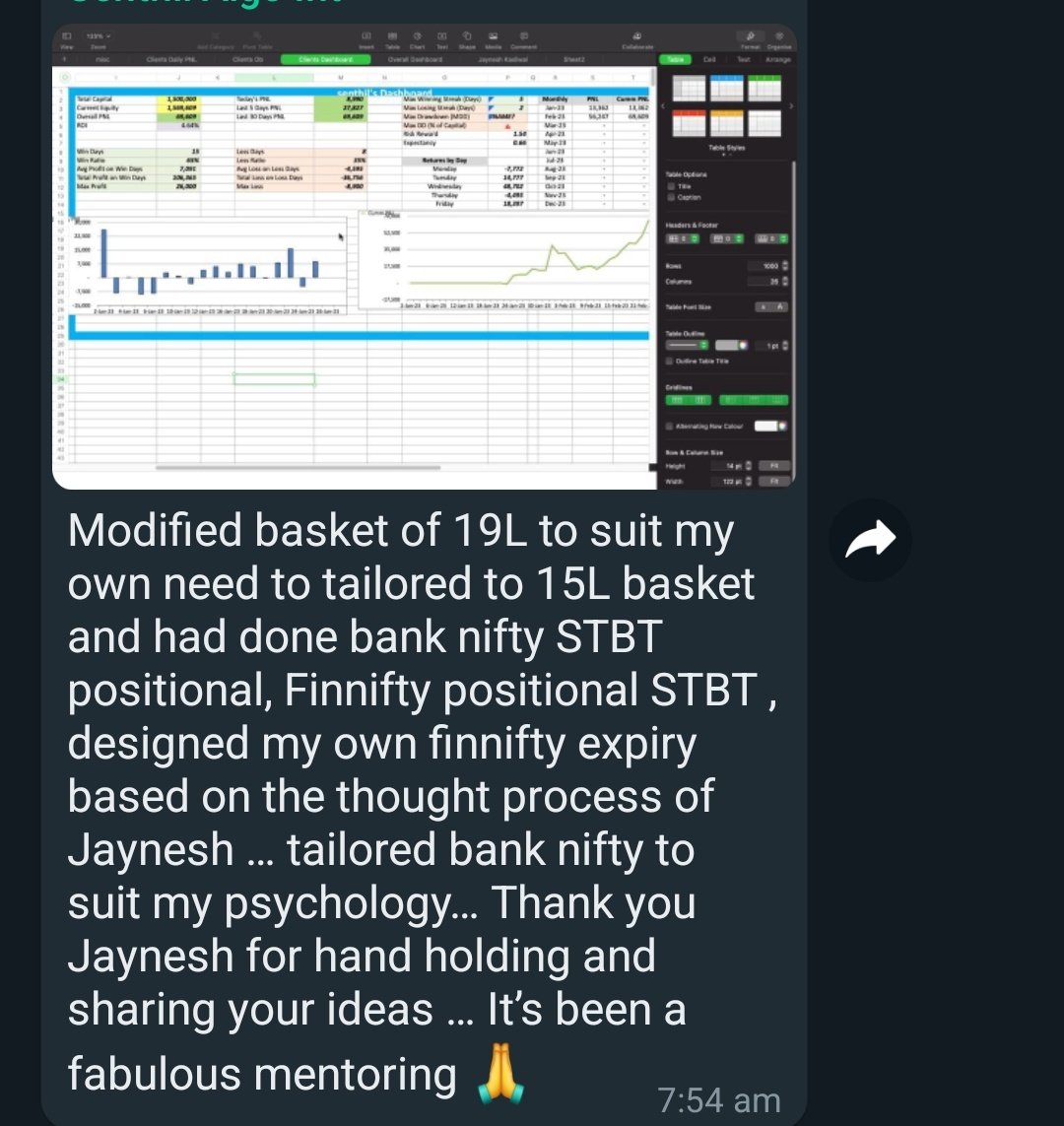

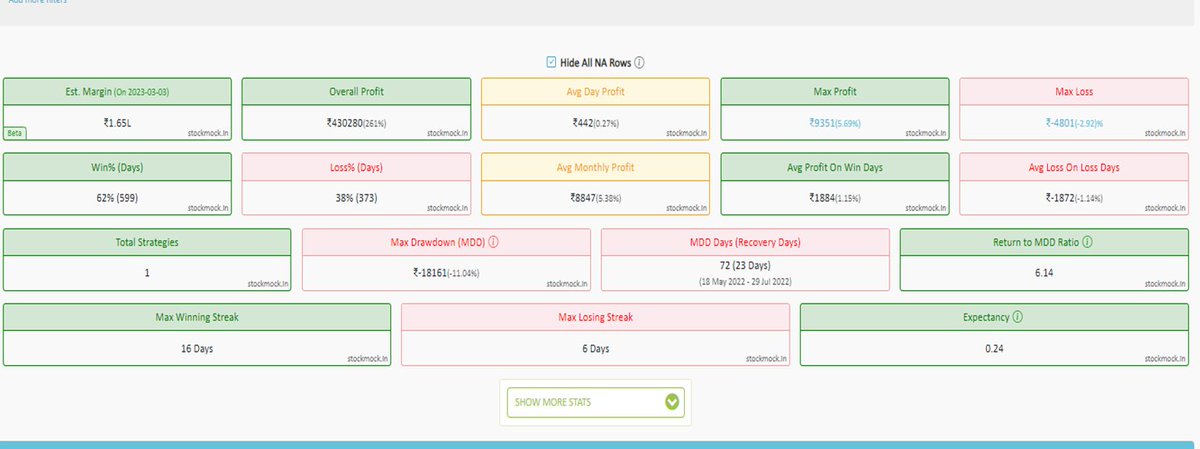

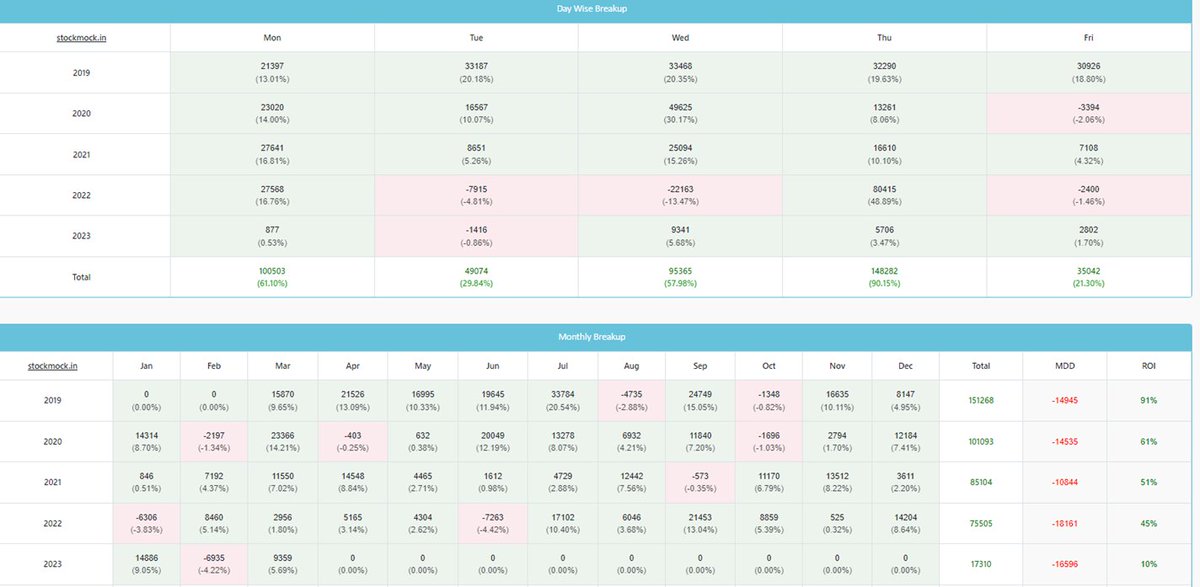

𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁 𝗗𝗮𝘁𝗮 :

Stockmock Link :stockmock.in

Quantiply Link ( Coming in few Months ) :app.quantiply.tech

[7/14]

Stockmock Link :stockmock.in

Quantiply Link ( Coming in few Months ) :app.quantiply.tech

[7/14]

app.quantiply.tech/auth/signup?re…

Quantiply.tech - Fully automated F&O trading

Fully automated & configurable algos for Nifty & Banknifty, futures & options

stockmock.in/#!/share/2js9g…

Stock Mock | Backtest Index Strategies

Welcome to the world of backtesting nifty and banknifty futures & options strategies

𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗖𝗵𝗮𝗿𝗮𝗰𝘁𝗲𝗿𝗶𝘀𝘁𝗶𝗰𝘀

🔸 Capital Req : 2 Lakh including 2x DD of 40k

🔸 You can start with 2.5L as well

🔸 Works great in trending markets

🔸 In deep pullbacks stoploss may hit hence one can add re entry feature

[9/14]

🔸 Capital Req : 2 Lakh including 2x DD of 40k

🔸 You can start with 2.5L as well

🔸 Works great in trending markets

🔸 In deep pullbacks stoploss may hit hence one can add re entry feature

[9/14]

🔸 In Volatile markets will be loss making strategy

🔸 Can combine this with other Option selling strategies to reduce DD and Improve System

🔸 You can also change strikes , timing of range and instrument to diversify and form new strategies

[10/14]

🔸 Can combine this with other Option selling strategies to reduce DD and Improve System

🔸 You can also change strikes , timing of range and instrument to diversify and form new strategies

[10/14]

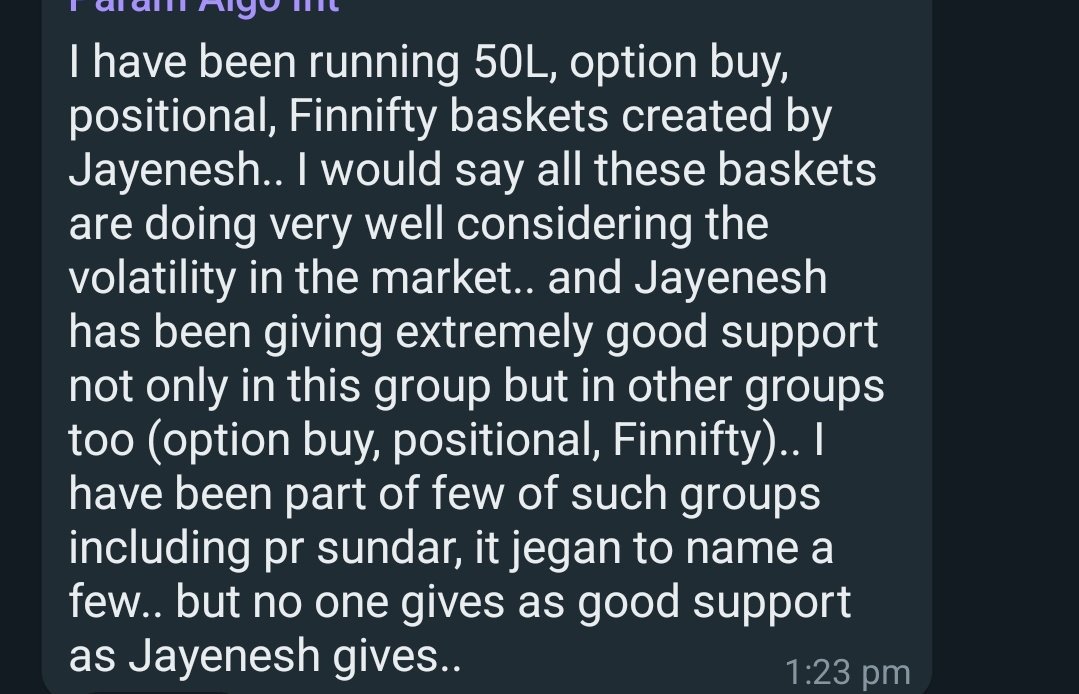

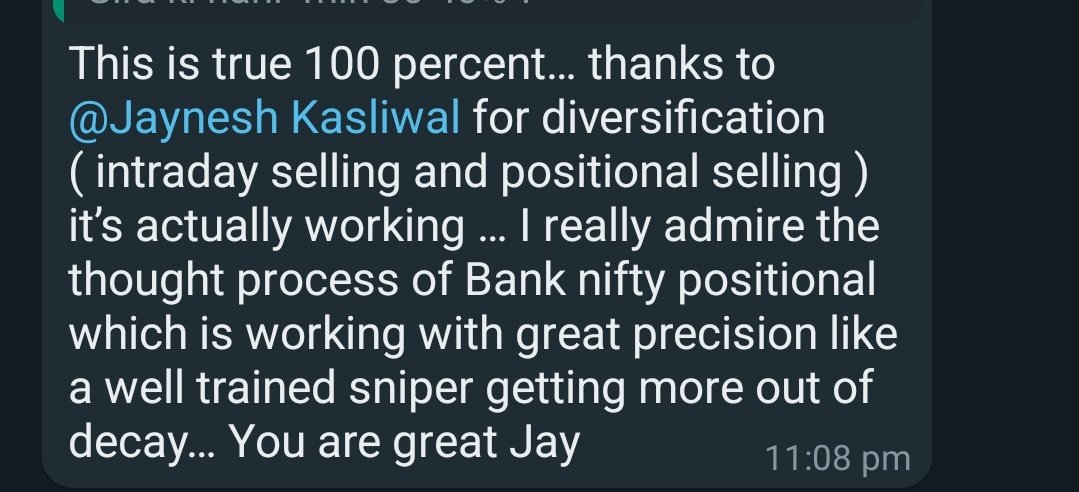

𝗢𝘂𝗿 𝗔𝗹𝗴𝗼 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗦𝘂𝗯𝘀𝗰𝗿𝗶𝗯𝗲𝗿𝘀 𝗙𝗲𝗲𝗱𝗯𝗮𝗰𝗸

𝘋𝘮 7674007938 𝘧𝘰𝘳 𝘈𝘭𝘨𝘰 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘋𝘦𝘵𝘢𝘪𝘭𝘴 !

Whatsapp for Algo Trading Details : wa.link

[12/14]

𝘋𝘮 7674007938 𝘧𝘰𝘳 𝘈𝘭𝘨𝘰 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘋𝘦𝘵𝘢𝘪𝘭𝘴 !

Whatsapp for Algo Trading Details : wa.link

[12/14]

Check out ROBOMATIC @robomatic_com for executing Range Breakout , Indicator Based Strategies

bit.ly

[13/14]

bit.ly

[13/14]

[14/14]

جاري تحميل الاقتراحات...

![23rd Feb : Loss Day Reversal Market2nd and 3rd March : Profit Day Trending Market

[8/14] https://t....](https://pbs.twimg.com/media/Fsd_lhuX0AEHpgY.jpg)

![23rd Feb : Loss Day Reversal Market2nd and 3rd March : Profit Day Trending Market

[8/14] https://t....](https://pbs.twimg.com/media/Fsd_luTXwAQgDVh.jpg)

![23rd Feb : Loss Day Reversal Market2nd and 3rd March : Profit Day Trending Market

[8/14] https://t....](https://pbs.twimg.com/media/Fsd_l5jX0AA0kol.jpg)