Strategy Vault + Solidly like Voting Emission?

@newoderDAO 's latest incubation

@camelotDEX 's next launchpad

@sector_fi

Lambro unverified twitter account's thought on it

@newoderDAO 's latest incubation

@camelotDEX 's next launchpad

@sector_fi

Lambro unverified twitter account's thought on it

TLDR

@sector_fi is strategy vault with single /aggregator vaults $SECT n $veSECT for governance, boosted emission &fee sharing

In thread

1️⃣ What is sector's strategies

2️⃣ My Concern about tokenomics

3️⃣ Launch Detail

4️⃣ My valuation & how i play it

unroll

2lambroz.substack.com

@sector_fi is strategy vault with single /aggregator vaults $SECT n $veSECT for governance, boosted emission &fee sharing

In thread

1️⃣ What is sector's strategies

2️⃣ My Concern about tokenomics

3️⃣ Launch Detail

4️⃣ My valuation & how i play it

unroll

2lambroz.substack.com

1️⃣ What is sector's strategies

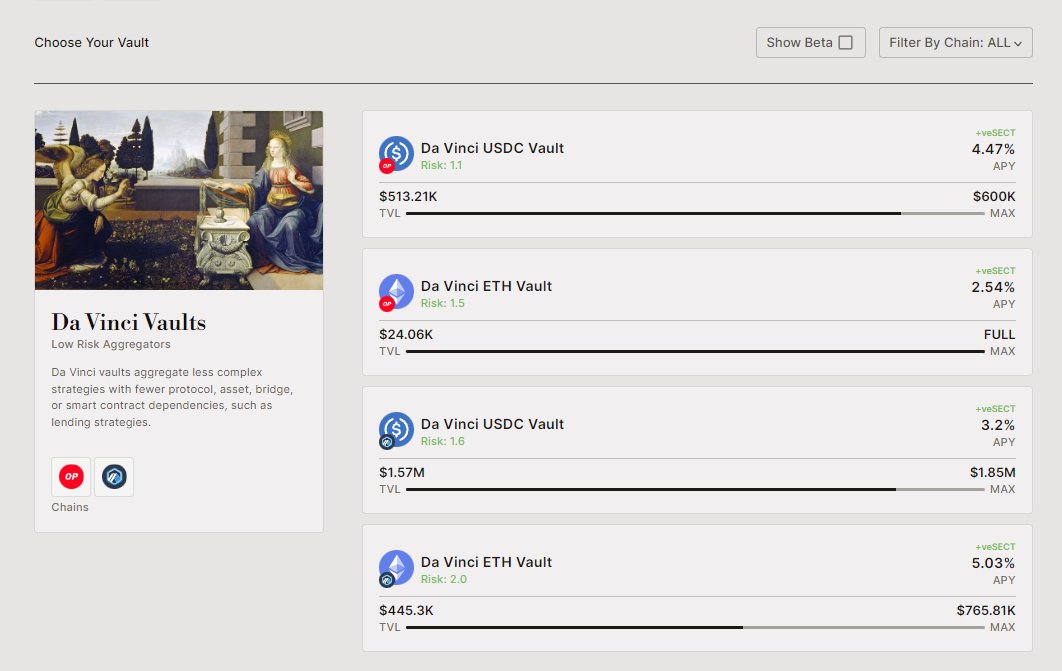

🔹What is Sector finance

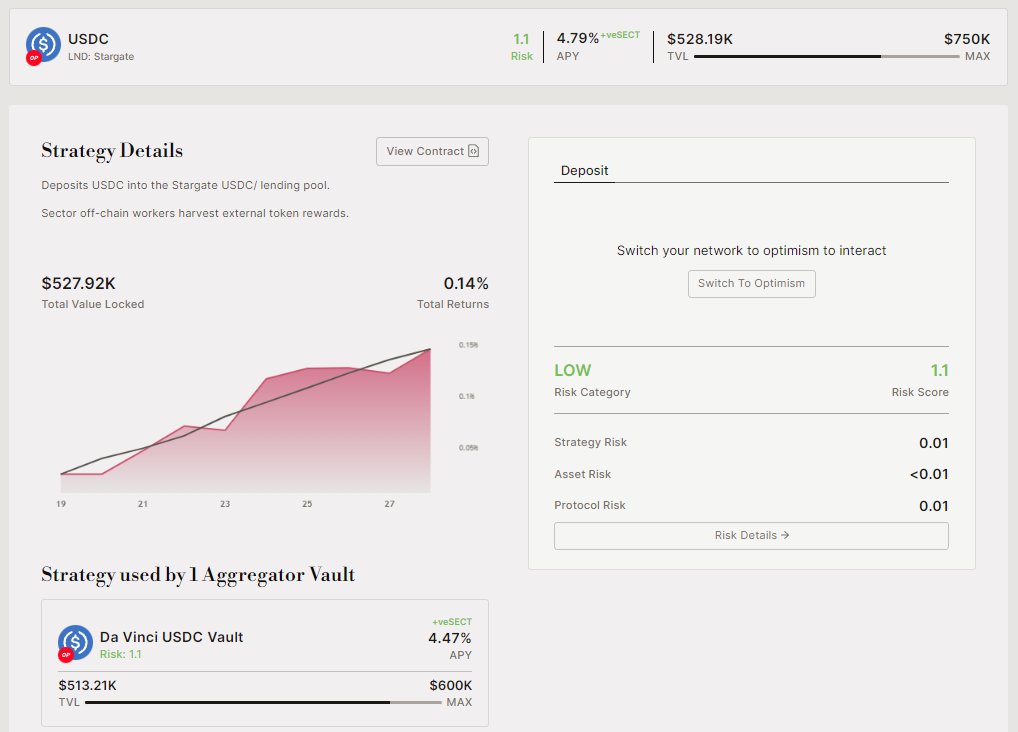

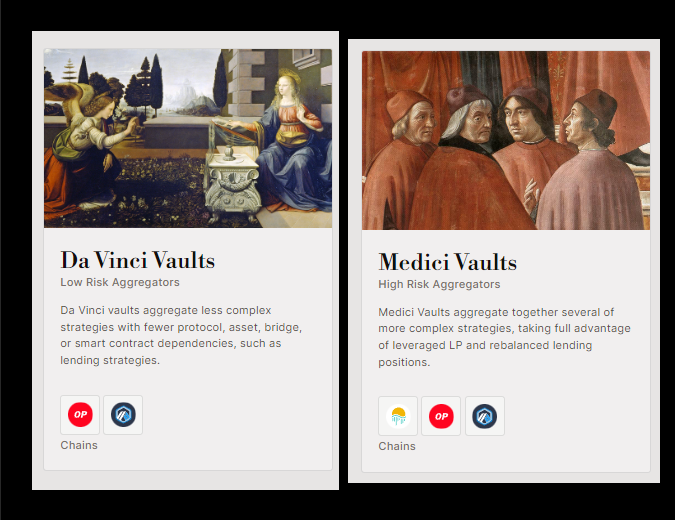

They have Single or Aggregator vaults with risk scores.

They Aggregate by the main token and Chain invovle in the strategy

- $USDC ( @optimismFND )

- $USDC ( arbitrum )

- $ETH ( @optimismFND )

- $ETH ( arbitrum )

🔹What is Sector finance

They have Single or Aggregator vaults with risk scores.

They Aggregate by the main token and Chain invovle in the strategy

- $USDC ( @optimismFND )

- $USDC ( arbitrum )

- $ETH ( @optimismFND )

- $ETH ( arbitrum )

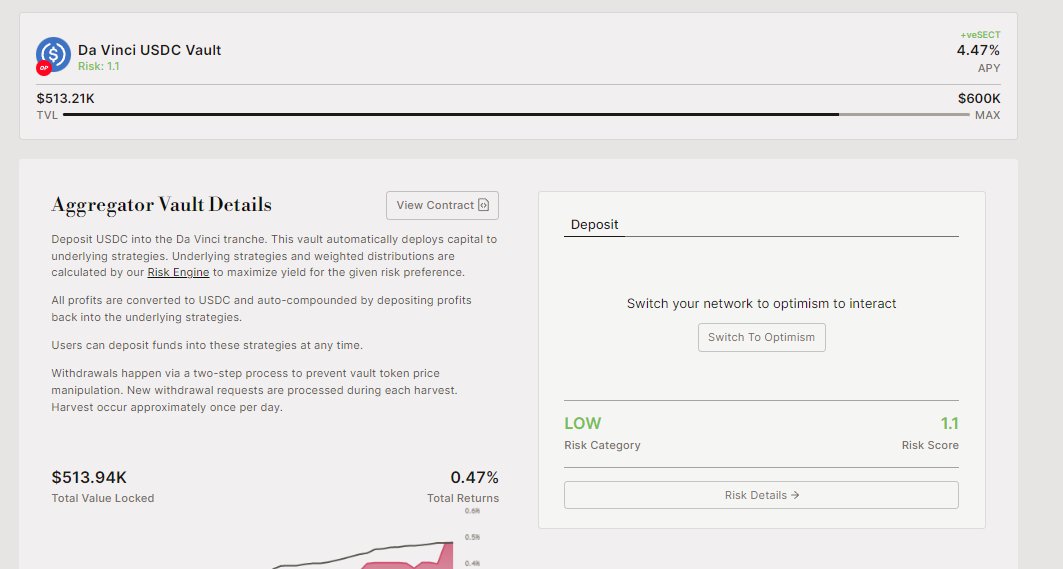

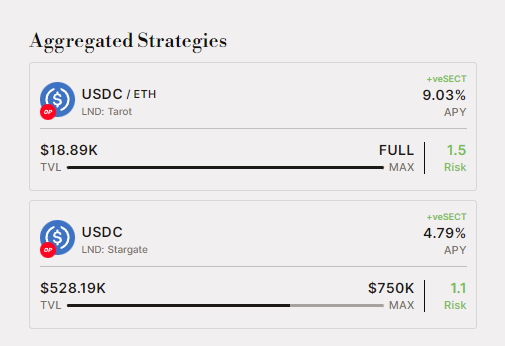

"Da Vinci USDC Vault" on OP as example

is a mix of

USDC/ETH on @TarotFinance LP

USDC on @StargateFinance lending

is a mix of

USDC/ETH on @TarotFinance LP

USDC on @StargateFinance lending

More detail on

@crypto_linn 's thread

@Slappjakke 's thread

@jediblocmates 's thread

@crypthoem 's thread

@crypto_linn 's thread

@Slappjakke 's thread

@jediblocmates 's thread

@crypthoem 's thread

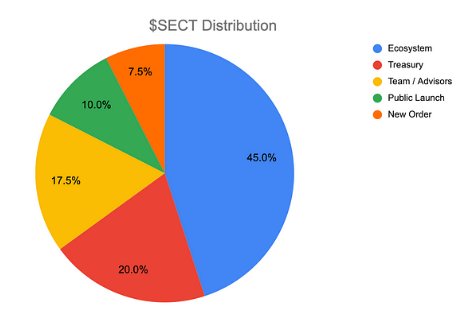

2️⃣ My Concern about tokenomics

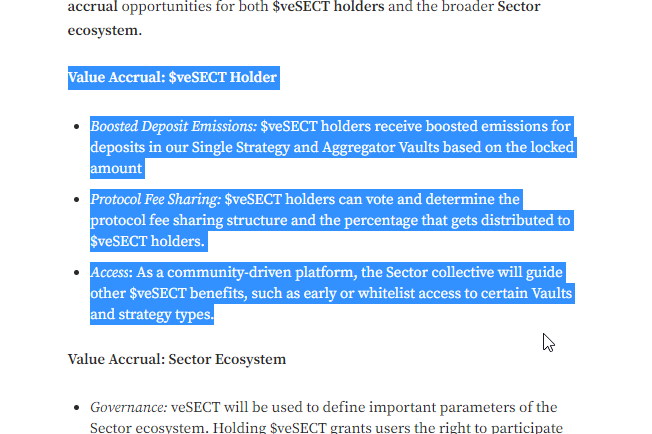

🔹Boosted emission

🔹Protocol fee sharing

🔹Whitelist access to new vaults

🔹Boosted emission

🔹Protocol fee sharing

🔹Whitelist access to new vaults

i have great respect & hopium for @neworderDAO

If not i will think $sect might end up being a farm token

Really love more detail on this on gitbook or medium post

@Sector_Fi/sect-value-accrual-40750df37c74" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

If not i will think $sect might end up being a farm token

Really love more detail on this on gitbook or medium post

@Sector_Fi/sect-value-accrual-40750df37c74" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

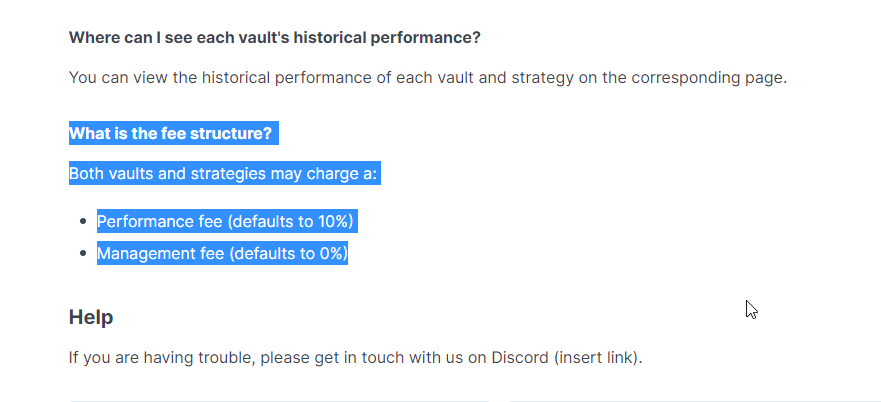

🔹Protocol fee sharing

Low fee compare to other strategy vaults

10% perormance fee in compare to @AlpacaFinance 's 19% fee is quite little.

sector-finance.gitbook.io

Low fee compare to other strategy vaults

10% perormance fee in compare to @AlpacaFinance 's 19% fee is quite little.

sector-finance.gitbook.io

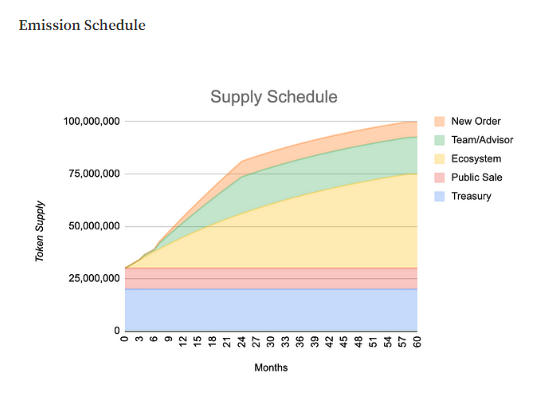

🔹Launch detail

• Launch Model: Fair launch Auction

• Max Total Commitment: 4.0M $USDC

• Whitelist: Wed 29 March 1:00 PM EST

• Public: Thursday 30 March 1:00 PM EST (48hours)

• Allocation: 10,000,000 $SECT (10% of total supply)

• Vesting: ⅓ in veTokens staked for 3 months

• Launch Model: Fair launch Auction

• Max Total Commitment: 4.0M $USDC

• Whitelist: Wed 29 March 1:00 PM EST

• Public: Thursday 30 March 1:00 PM EST (48hours)

• Allocation: 10,000,000 $SECT (10% of total supply)

• Vesting: ⅓ in veTokens staked for 3 months

🤔Utility, Hard Market Demand

• No strong traction in their strategy

• No strategy interest me so far

• Maybe when the voting emission starts i will be more interested.

• i heard @GearboxProtocol will launch something on sector, interesting?@mugglesect alpha?

• No strong traction in their strategy

• No strategy interest me so far

• Maybe when the voting emission starts i will be more interested.

• i heard @GearboxProtocol will launch something on sector, interesting?@mugglesect alpha?

🤔Valuation, ✅Initial mcap

i assume max commitment for auction so 40m valuation

so 0.04 per token

initial mcap:

Treasury : 20,000,000

public 2/3 unstaked : 6,666,666

26,666,666 * 0.04 = 1.06m

quite small mcap, might be a good short term play?

i assume max commitment for auction so 40m valuation

so 0.04 per token

initial mcap:

Treasury : 20,000,000

public 2/3 unstaked : 6,666,666

26,666,666 * 0.04 = 1.06m

quite small mcap, might be a good short term play?

🔹Valuation References

@AlpacaFinance 46mcap, 57fdv TVL200m

Not much direct comparison, there are a few leverage yield farm or vault type of protocols. but all has some additional feature into it.

@AlpacaFinance 46mcap, 57fdv TVL200m

Not much direct comparison, there are a few leverage yield farm or vault type of protocols. but all has some additional feature into it.

But in general given its a fee driven protocol it will highly depend on its TVL n fee it is collecting from.

Also this is the first VE voting base yield aggregator i know, some PvP element of yield farming might change the mcap in short period of time.

🤔But 40m fdv is high

Also this is the first VE voting base yield aggregator i know, some PvP element of yield farming might change the mcap in short period of time.

🤔But 40m fdv is high

✅Speculation ✅Investors profile

• Raising DeFi yield since market going up

• @neworderDAO product

• @camelotDex launchpad product

• arbitrum is still hot

• Raising DeFi yield since market going up

• @neworderDAO product

• @camelotDex launchpad product

• arbitrum is still hot

🤔Tokenomics

i worry about yield aggregator or strategy vault as underlaying does not have enough hard buy pressure to support voting emission incentives.

i worry about yield aggregator or strategy vault as underlaying does not have enough hard buy pressure to support voting emission incentives.

Summary

i like @neworderDAO products also the market is picking up a bit. My degen moonboy side its telling me its a 1m mcap with some PvP farming games that can be interesting.

The logical safu investor side is telling me there woud be enough hard buy pressure.

i like @neworderDAO products also the market is picking up a bit. My degen moonboy side its telling me its a 1m mcap with some PvP farming games that can be interesting.

The logical safu investor side is telling me there woud be enough hard buy pressure.

right now im not bullshit or bearish on this. it is a 50/50 gamble.

i prob pass on this sale but keep an eye on different farming incentives on it to farm some $SECT token

Learn more about my "Multi Investor Personality theory" here

i prob pass on this sale but keep an eye on different farming incentives on it to farm some $SECT token

Learn more about my "Multi Investor Personality theory" here

Loading suggestions...