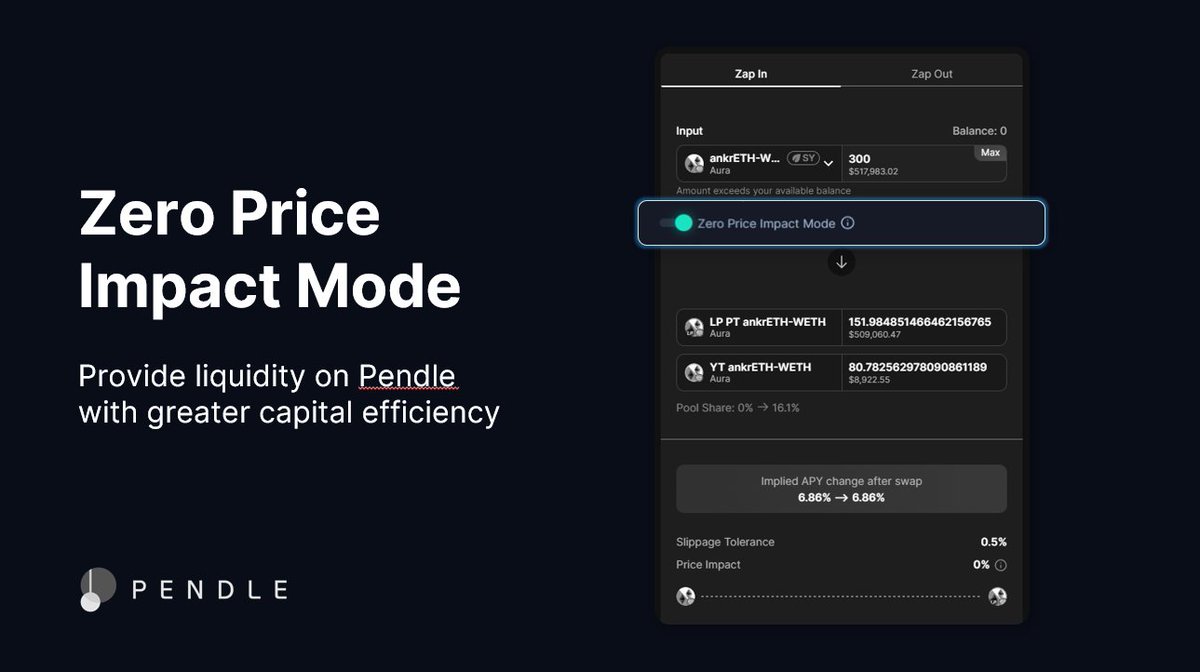

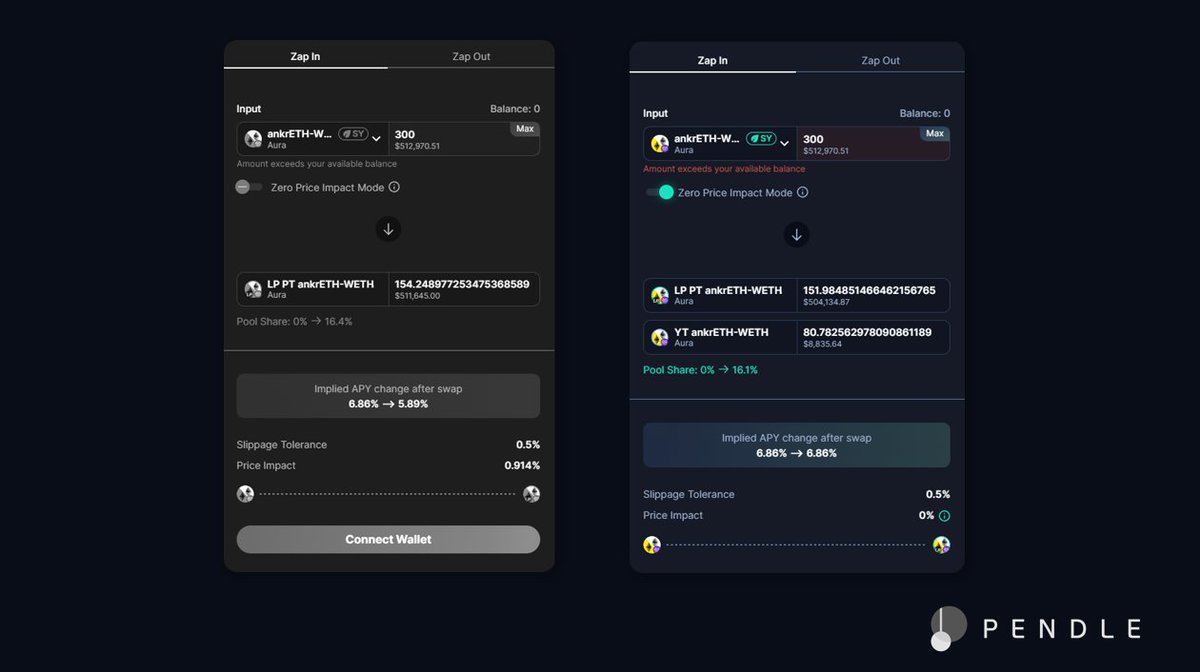

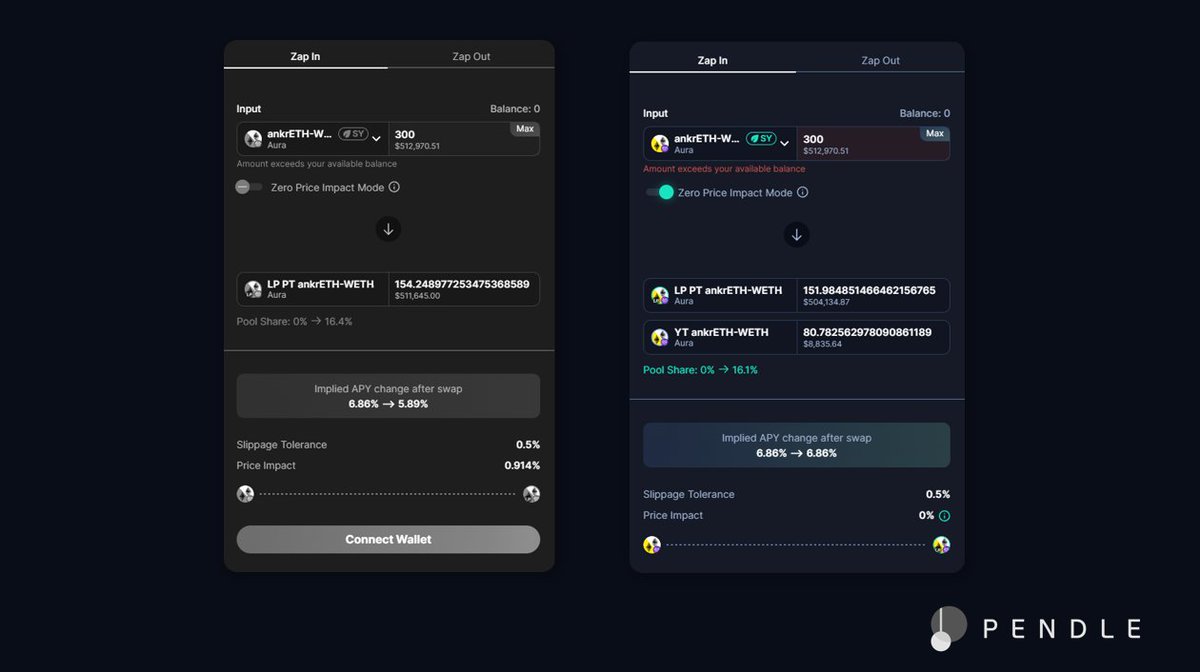

With Shanghai just around the corner and #LSDfi heating up, you can fully utilize the Zero Price Impact Mode to make the most out of your LSDs.

Pendle offers some of the highest, most consistent APYs in high liquidity pools, up to 69% boosted APY in the $ankrETH pool

Pendle offers some of the highest, most consistent APYs in high liquidity pools, up to 69% boosted APY in the $ankrETH pool

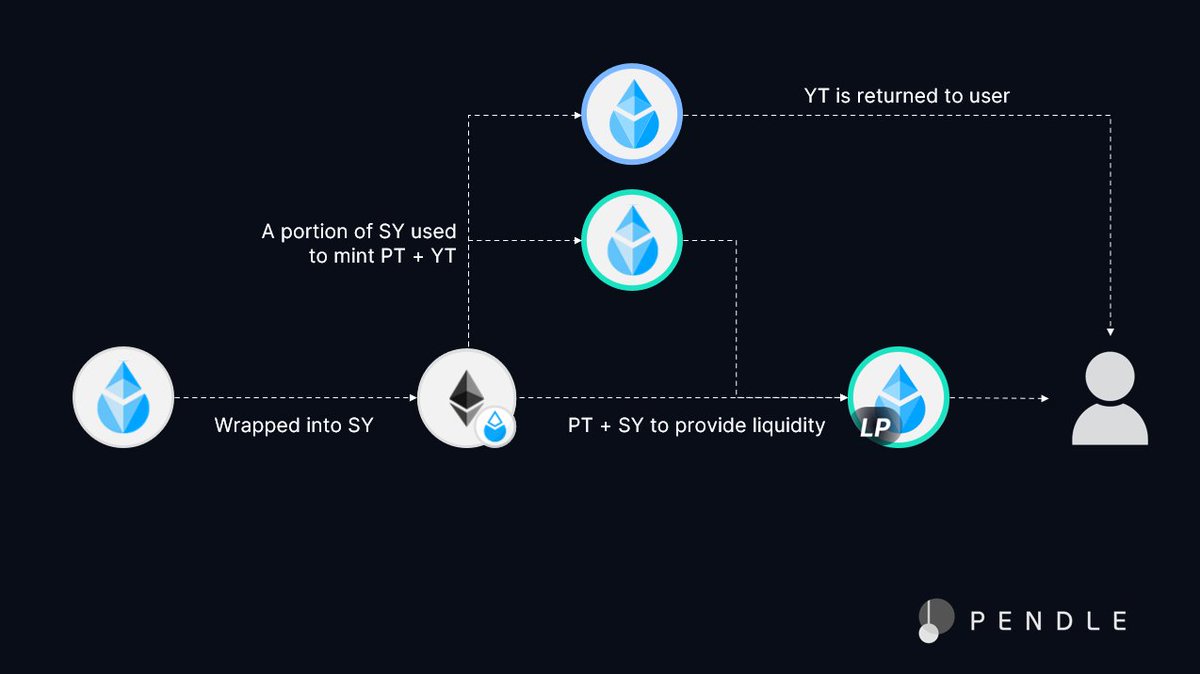

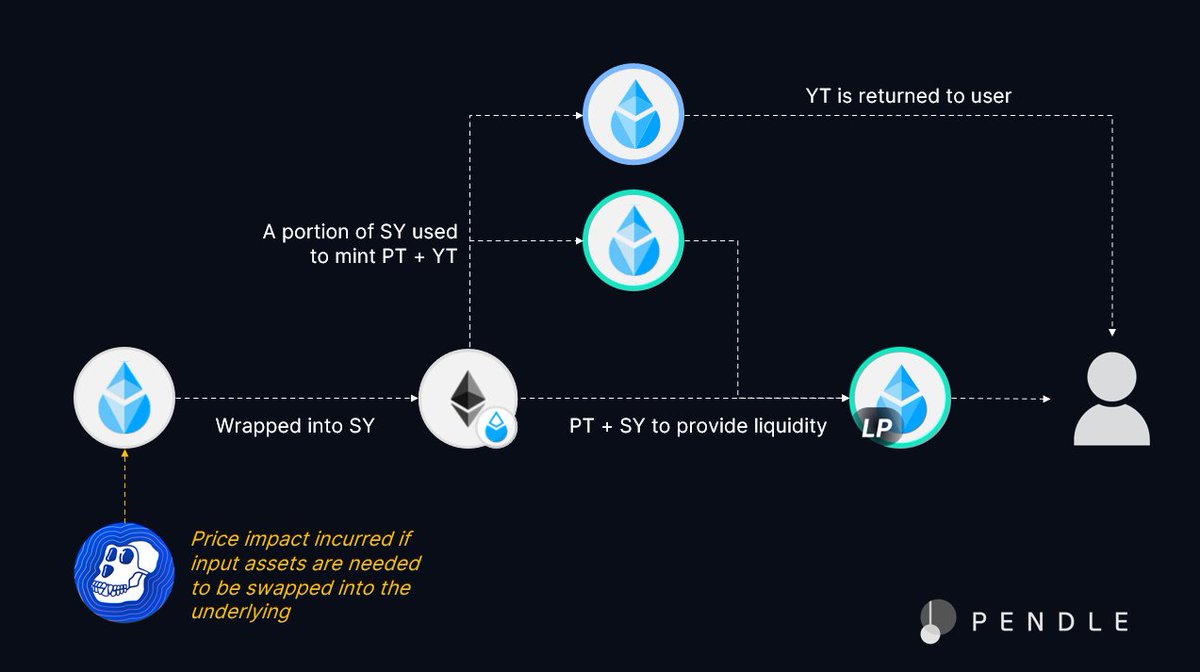

"And what exactly do I do with my YT then?"

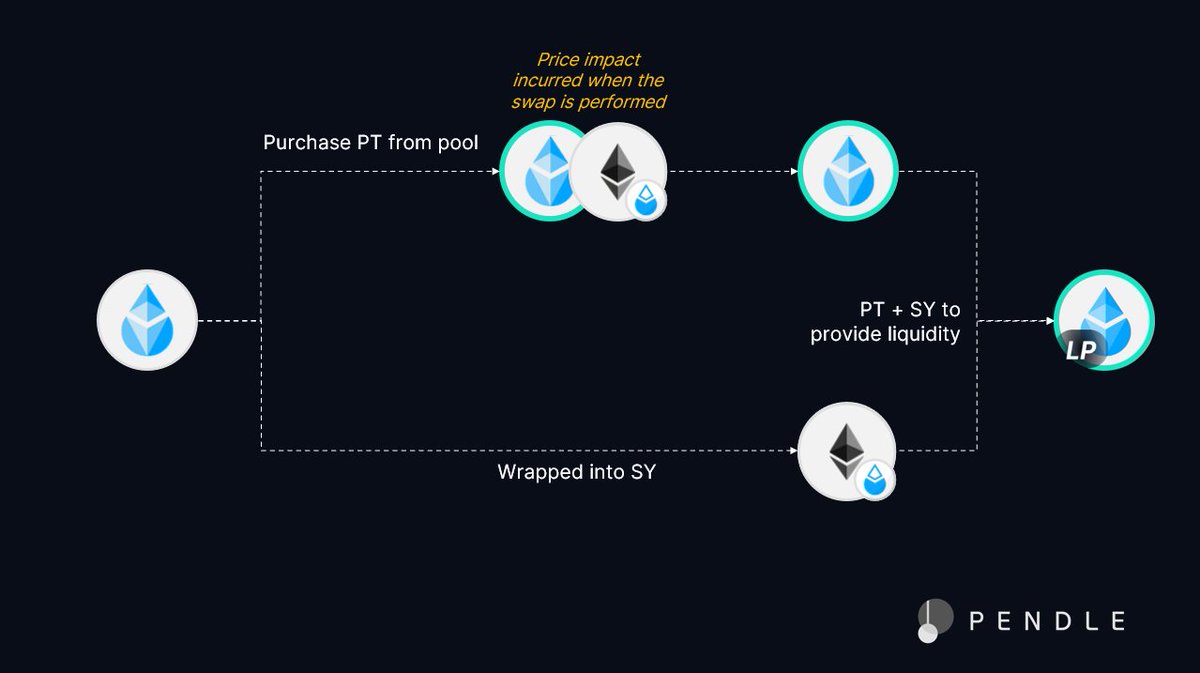

Perhaps this ELI5 guide can help you get started on your yield-trading journey

Perhaps this ELI5 guide can help you get started on your yield-trading journey

Zero Price Impact Mode - try it out on Pendle today!

app.pendle.finance

app.pendle.finance

Loading suggestions...