Rule 1: Investing is fun and exciting, but dangerous if you don't do any work.

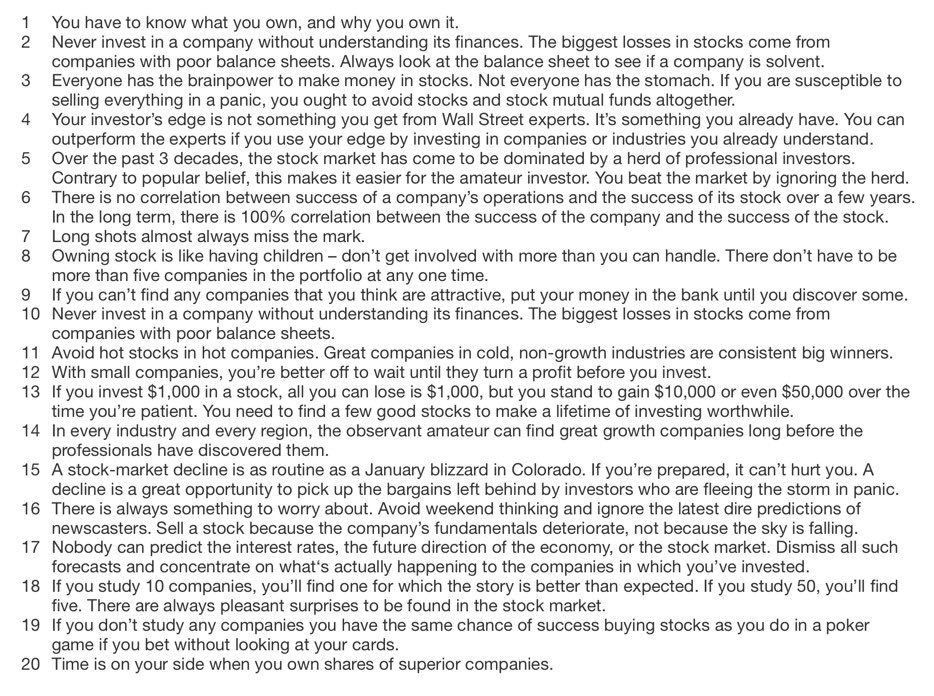

Rule 2: Your investor's edge is not something you get from Wall Street experts. It's something you already have.

Rule 2: Your investor's edge is not something you get from Wall Street experts. It's something you already have.

Rule 3: Over the past decades, stocks have been dominated by a herd of professional investors. This makes it easier for the amateur investor. You can beat the market by ignoring the herd.

Rule 4: Behind every stock is a company. Find out what it's doing.

Rule 4: Behind every stock is a company. Find out what it's doing.

Rule 5: In the short term, there is no correlation between the success of a company's operations and its stock price. In the long term, there is a 100% correlation between the success of the company and its stock price.

Rule 6: You have to know what you own, and why you own it.

Rule 6: You have to know what you own, and why you own it.

Rule 7: Long shots almost always miss the mark.

Rule 8: Owning stocks is like having children — don't get involved with more than you can handle.

Rule 8: Owning stocks is like having children — don't get involved with more than you can handle.

Rule 9: If you can't find any companies that you think are attractive, put your money in the bank until you discover some.

Rule 10: Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.

Rule 10: Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.

Rule 11: Avoid hot stocks in hot industries. Great companies in cold, non-

growth industries are consistent big winners.

Rule 12: With small companies, you are better off to wait until they are profitable before you invest.

growth industries are consistent big winners.

Rule 12: With small companies, you are better off to wait until they are profitable before you invest.

Rule 13: If you want to invest in a troubled industry, buy the

companies with staying power and wait for the industry to show signs of revival.

Rule 14: If you invest $1000 in a stock, all you can lose is $1000, but you stand to gain $50,000 over time if you are patient.

companies with staying power and wait for the industry to show signs of revival.

Rule 14: If you invest $1000 in a stock, all you can lose is $1000, but you stand to gain $50,000 over time if you are patient.

Rule 15: In every industry and every region of the country, the observant

amateur can find great growth companies long before the professionals did.

Rule 16: A stock market decline is as routine as a January blizzard in Colorado. If you are prepared, it can't hurt you.

amateur can find great growth companies long before the professionals did.

Rule 16: A stock market decline is as routine as a January blizzard in Colorado. If you are prepared, it can't hurt you.

Rule 17: Everyone has the brainpower to make money in stocks. Not everyone has the stomach.

Rule 18: There is always something to worry about. Avoid weekend thinking and ignore the latest dire predictions of the newscasters.

Rule 18: There is always something to worry about. Avoid weekend thinking and ignore the latest dire predictions of the newscasters.

Rule 19: Nobody can predict interest rates or the future direction of the

economy. Dismiss all such forecasts and concentrate on what matters.

Rule 20: If you study 10 companies, you will find 1 for which the story is better than expected. If you study 50, you'll find 5.

economy. Dismiss all such forecasts and concentrate on what matters.

Rule 20: If you study 10 companies, you will find 1 for which the story is better than expected. If you study 50, you'll find 5.

Rule 21: If you don't study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.

Rule 22: Time is on your side when you own shares of superior companies.

Rule 22: Time is on your side when you own shares of superior companies.

Rule 23: If you have the stomach for stocks, but neither the time nor the

inclination to do the homework, invest in index funds.

Rule 24: Invest a bit of your money in faster-growing economies by investing some portion of your assets in overseas stocks with a good record.

inclination to do the homework, invest in index funds.

Rule 24: Invest a bit of your money in faster-growing economies by investing some portion of your assets in overseas stocks with a good record.

Rule 25: In the long run, a portfolio of well-chosen stocks will always outperform a portfolio of bonds or a money-market account.

If you liked this, you'll love our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Learn more about Peter Lynch here:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Learn more about Peter Lynch here:

qualitycompounding.substack.com

Loading suggestions...