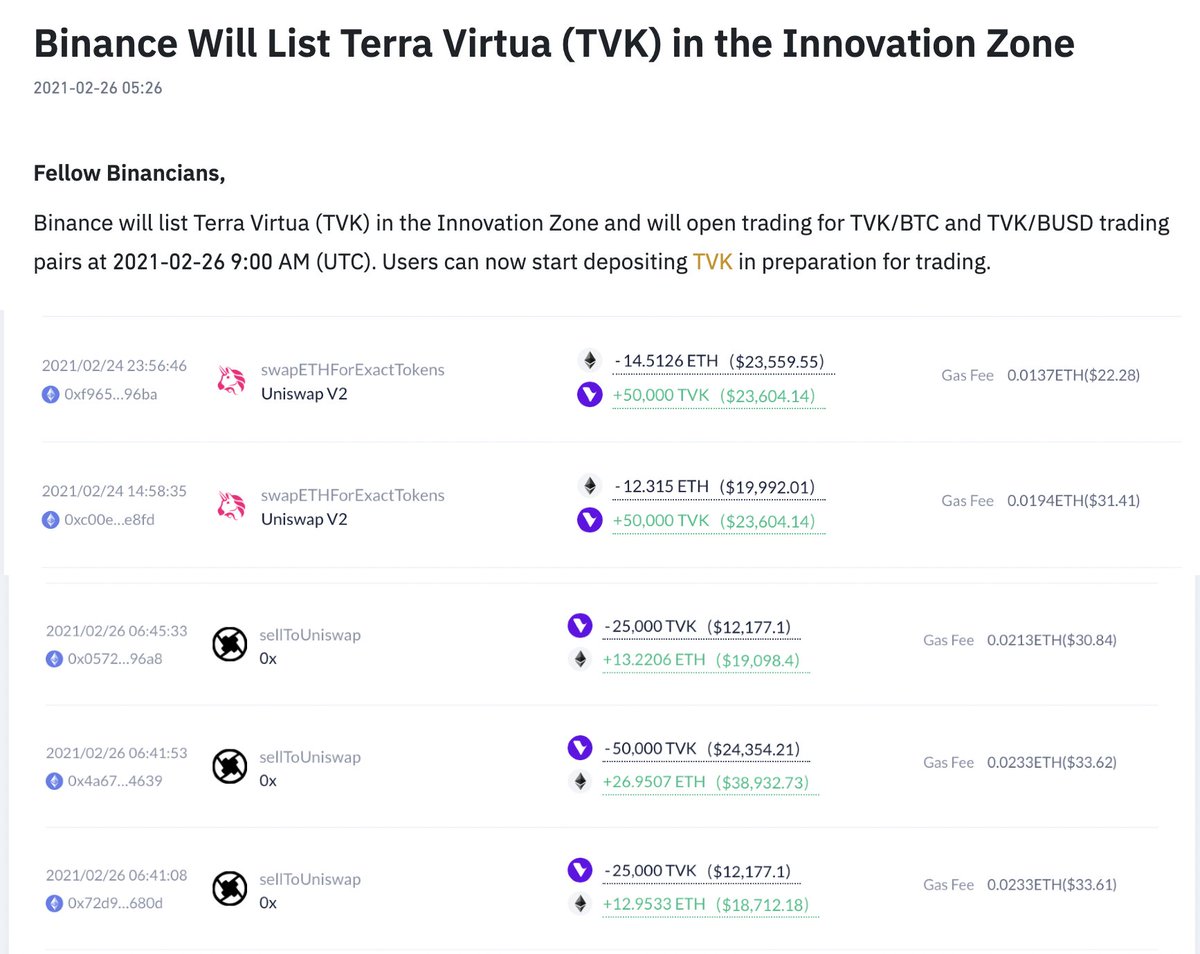

🧵 On-chain data reveals the covert operations of a Binance listings insider. Over the course of several months, this anonymous individual front-ran the infamous Binance listing pumps of multiple altcoins, booking a 7-figure profit. And he left a trail for us to follow... (1/9)

The full research, conducted and submitted by @spssnft, outlines 16 instances of potential insider trading with a net profit of about $1.4m. This article has flown under the radar, and, IMO, must be publicized further for market awareness. @OverlordsO/the-binance-insider-47f7890da47e" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com (5/9)

The consequences of insider trading to retail investors are invisible yet crucial. A coin that would otherwise have gone up 20% may only move up by 10%, and nobody ever finds out that someone is secretly stealing edge from the market using an unethical advantage. (6/9)

Conversely, insider trading causes many profitable trades to become unprofitable (for example, an originally break even trade may result in a 10% loss due to exploitative insider activities), and the trader will never find out what happened to them. (7/9)

Binance's relationship to the insider is unknown, but it is clear that this individual had foreknowledge of Binance listings several days in advance. Also, this was one of the more unsophisticated (okay - dumber) criminals, as he didn't cover his tracks well at all. (8/9)

The positive side is that the blockchain is immortal, and these trades from years ago can never be wiped. I am optimistic that after these trades are made public, either Binance or law enforcement can take swift action against the offender. Here's to free & fair markets. 🫡 (9/9)

Loading suggestions...