A quick question before we proceed:

do you also cringe like I do when I see mentors/tutors telling their students to avoid the M1 timeframe instead of teaching them how to do it?

Yes it can be full of noise, but does that make it un-tradable?

NO!!

Here's what to do instead👇

do you also cringe like I do when I see mentors/tutors telling their students to avoid the M1 timeframe instead of teaching them how to do it?

Yes it can be full of noise, but does that make it un-tradable?

NO!!

Here's what to do instead👇

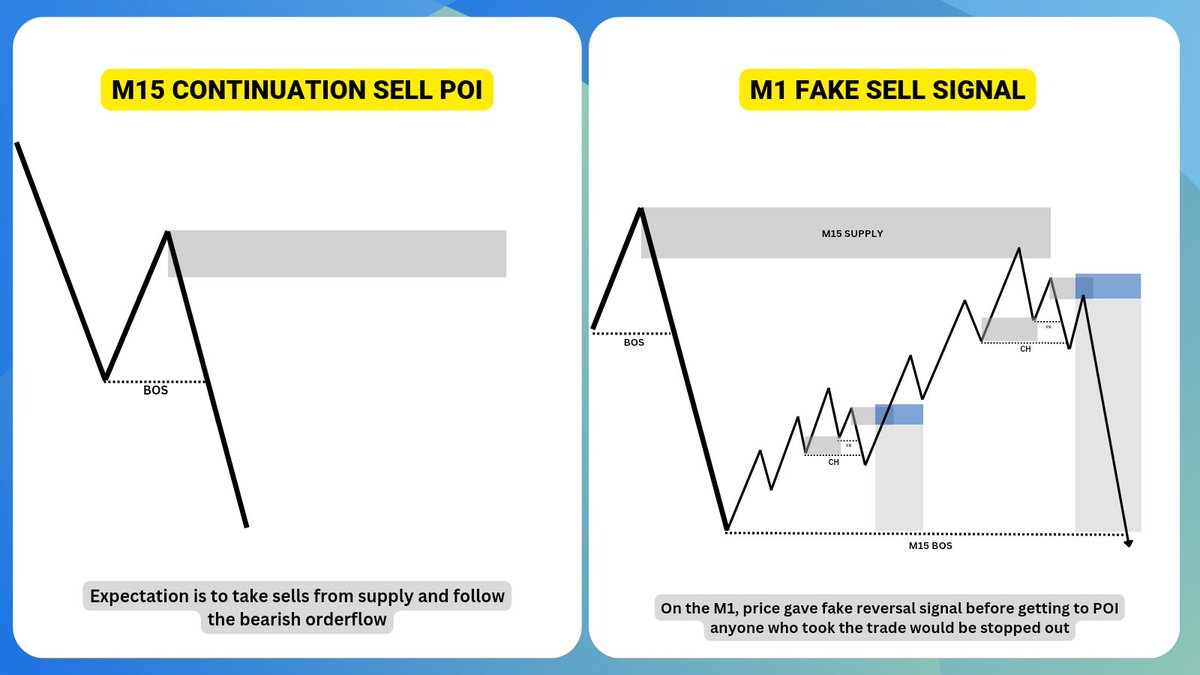

When you have a POI (point of interest) on the M15 for example, don't just jump straight down to the M1 ❌

Stay on the M15 and wait until price reaches that zone first, before you then drop down to M1 and look for your confirmations..

But why is this so important?

Stay on the M15 and wait until price reaches that zone first, before you then drop down to M1 and look for your confirmations..

But why is this so important?

Also, you're likely not to execute the second trade when it eventually hits your POI..

Because the initial loss 'could' have affected your psychology and cause you to hesitate,

And that's how you not only miss out on the big winner, but also took an unnecessary loss.

Sad!

Because the initial loss 'could' have affected your psychology and cause you to hesitate,

And that's how you not only miss out on the big winner, but also took an unnecessary loss.

Sad!

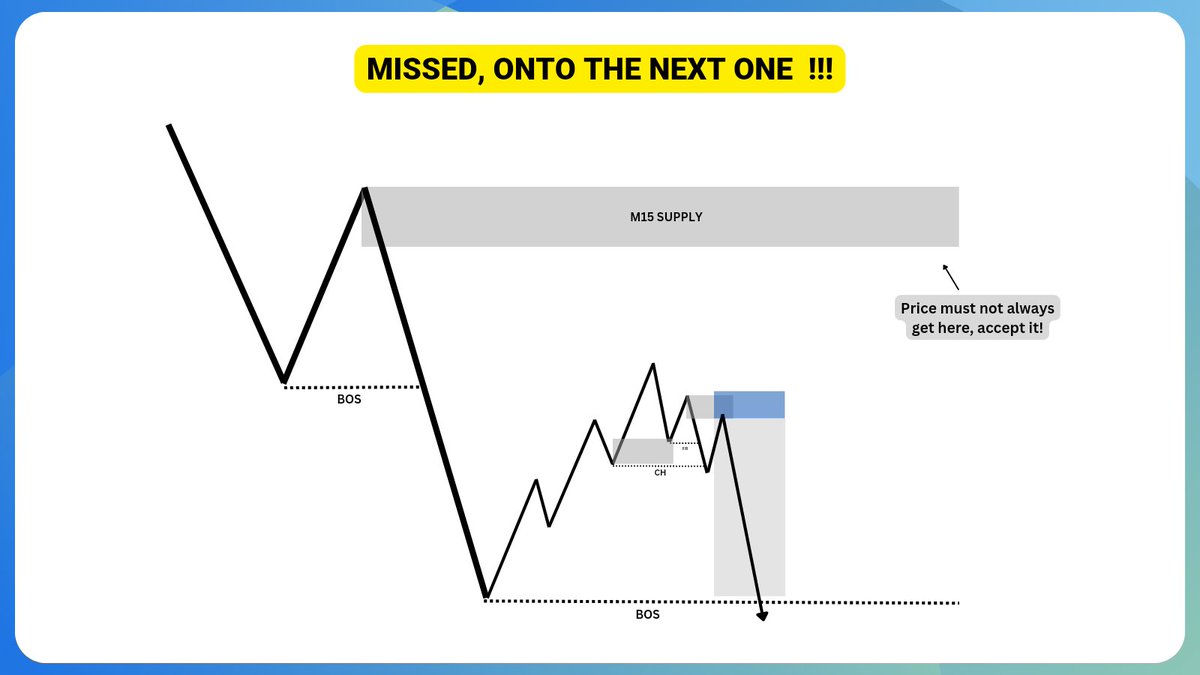

You're better off missing those ones that didn't get to your POI.

Because wanting to catch every move is more like trying to catch a falling (hot) knife.

Your psychology will get so fu*ked from back-to-back loss, and leave you with zero confidence to execute the next trade.

Because wanting to catch every move is more like trying to catch a falling (hot) knife.

Your psychology will get so fu*ked from back-to-back loss, and leave you with zero confidence to execute the next trade.

You must accept the fact that:

• price will not always get to you zone

• and you don't have to catch every price movement

This will help you remain calm and focused on catching only high probability moves - from your high timeframe POIs.

• price will not always get to you zone

• and you don't have to catch every price movement

This will help you remain calm and focused on catching only high probability moves - from your high timeframe POIs.

In summary, always:

• pick your zones from higher tineframes

• set alerts to be notified when price gets there

• drop lower and look for entry confirmations - only when price has mitigated your HTF zone.

That way you'll maintain a high win-rate plus healthy psychology.

• pick your zones from higher tineframes

• set alerts to be notified when price gets there

• drop lower and look for entry confirmations - only when price has mitigated your HTF zone.

That way you'll maintain a high win-rate plus healthy psychology.

And that's a wrap!

If this made an atom of sense to you:

1. Consider following the nerd who made it happen (@dnatechbro)

2. Like & Retweet this so that other traders will learn

3. Don't just learn, implement and get better.

Cheers 🥂

If this made an atom of sense to you:

1. Consider following the nerd who made it happen (@dnatechbro)

2. Like & Retweet this so that other traders will learn

3. Don't just learn, implement and get better.

Cheers 🥂

Loading suggestions...