First off, mastering the art of yield-trading isn't a pipe dream.

The concept is actually very similar to price trading - the goal is to buy YT when the price is low, and sell YT when the price is high.

The concept is actually very similar to price trading - the goal is to buy YT when the price is low, and sell YT when the price is high.

Refresher - YT stands for Yield Tokens, which gives you the right to collect all the yield generated by the underlying asset up till the maturity date.

For example, buying 5 YT-stETH lets you collect all the yield from 5 $stETH up to maturity.

For example, buying 5 YT-stETH lets you collect all the yield from 5 $stETH up to maturity.

Underlying APY is also the rate at which your YT will pump out yield for you.

Unlike regular tokens, yield tokens give you an established basis of comparison to make better, informed decisions when trading, in the form of Underlying APY.

Unlike regular tokens, yield tokens give you an established basis of comparison to make better, informed decisions when trading, in the form of Underlying APY.

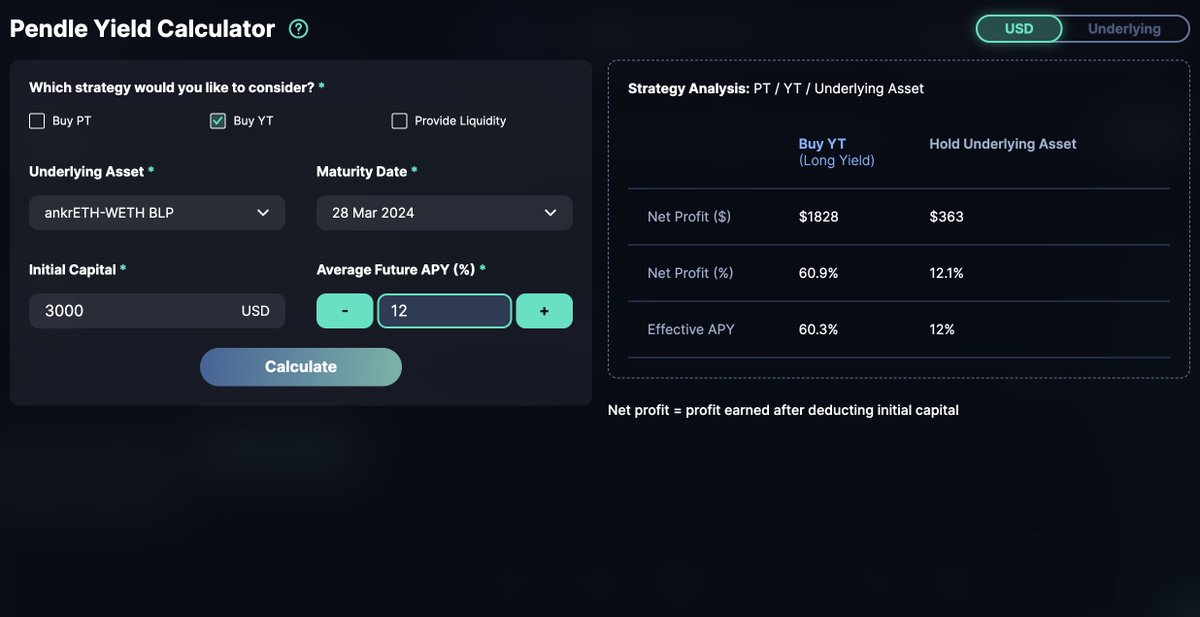

Even if the price of YT (i.e. Implied APY) goes below your entry price, as long as the Underlying APY stays well above the Implied APY you bought at, you will be in profit by simply holding and collecting all the yield till maturity.

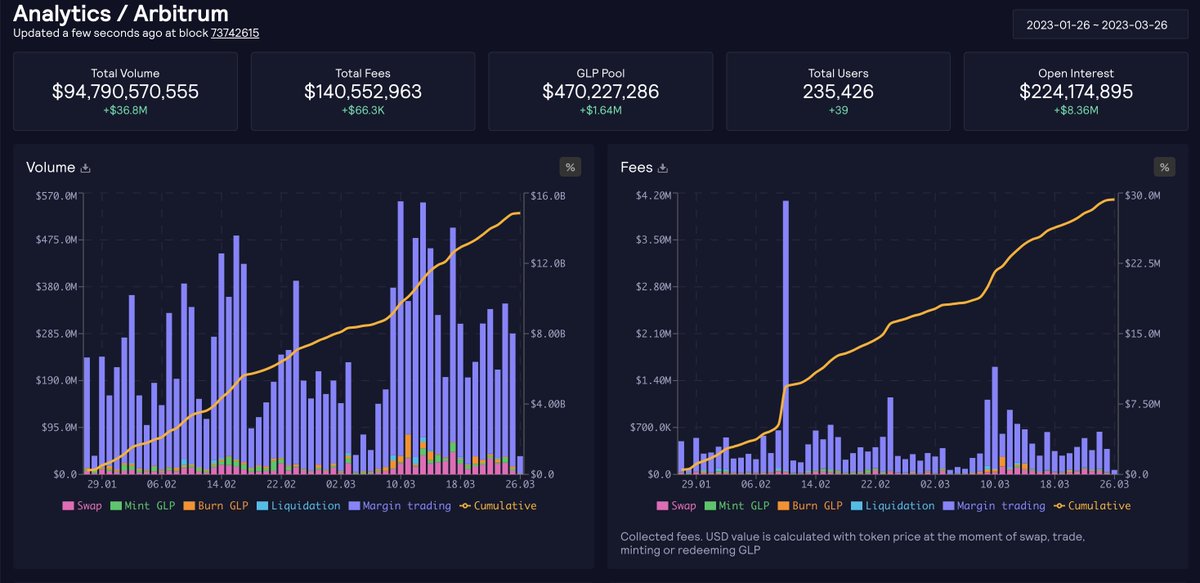

Plus, there are a several data points to help you make the best informed, prediction when it comes to yield.

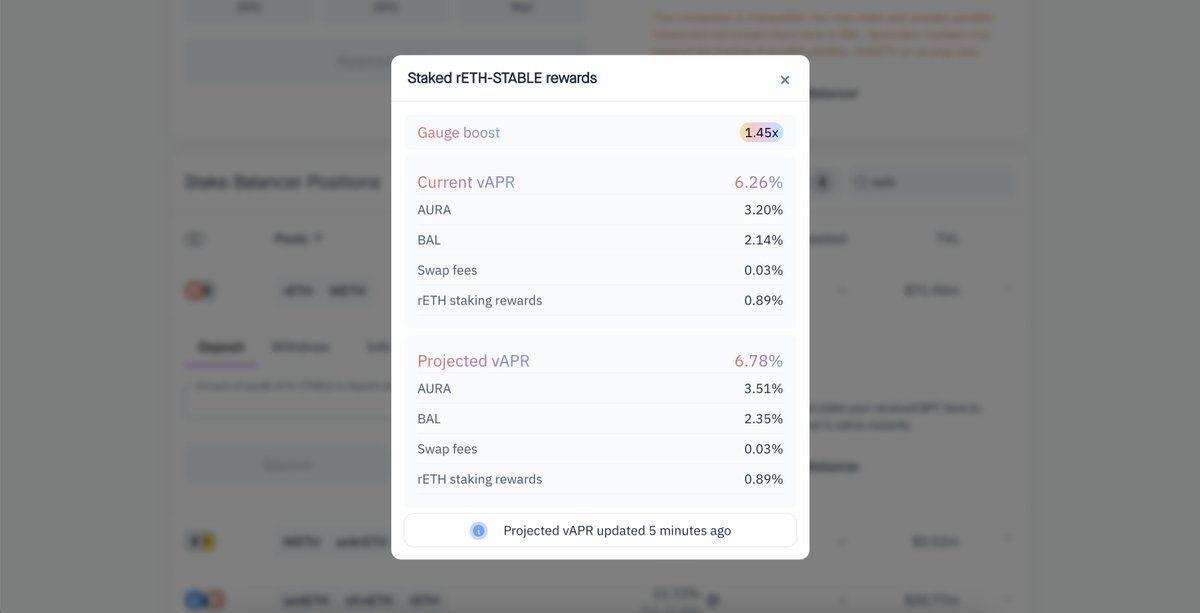

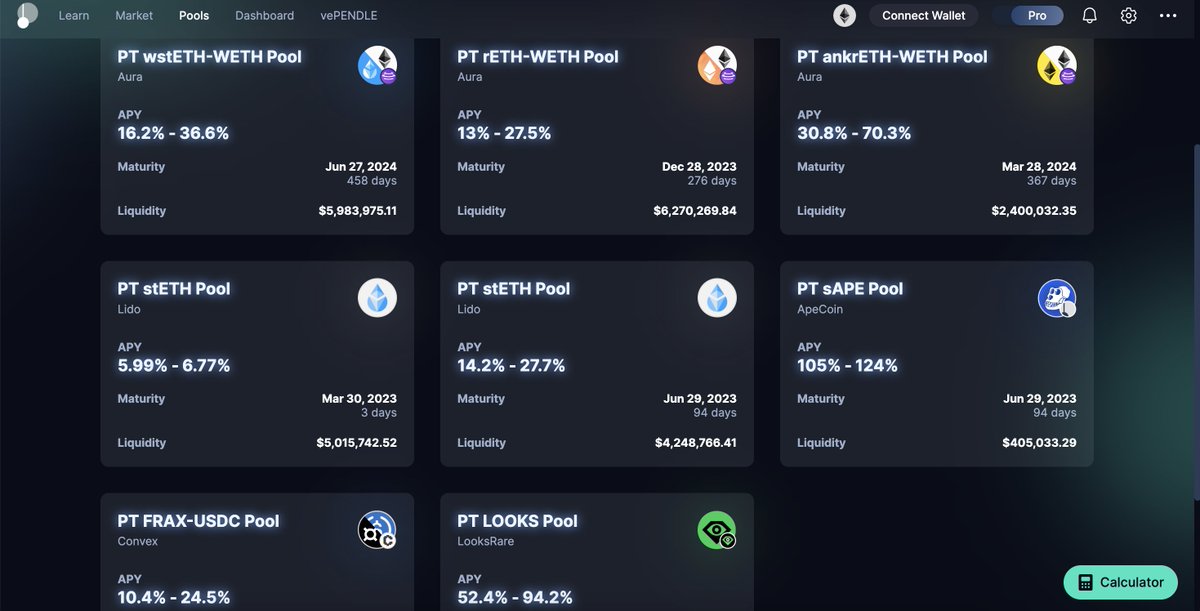

The APY of Aura pools for instance are predicated upon the amount of incentives directed to them plus the fees collected, and their projections are shown on @AuraFinance

The APY of Aura pools for instance are predicated upon the amount of incentives directed to them plus the fees collected, and their projections are shown on @AuraFinance

In a way, yield-trading can be more lenient because:

1. You profit as long as Underlying APY stays well above your Implied APY entry, even when Underlying APY and/or Implied APY go down

2. More data points for you to establish informed predictions

1. You profit as long as Underlying APY stays well above your Implied APY entry, even when Underlying APY and/or Implied APY go down

2. More data points for you to establish informed predictions

Be right when you're wrong. Do more with your assets on Pendle.

yield.pendle.finance

yield.pendle.finance

Loading suggestions...