It’s been slightly over a month since #Arbitrum warmly welcomed Pendle as one of their own 🧡💙

In the spirit of Arbitrum season, it's a good time to reflect on our journey so far in this new homeland

In the spirit of Arbitrum season, it's a good time to reflect on our journey so far in this new homeland

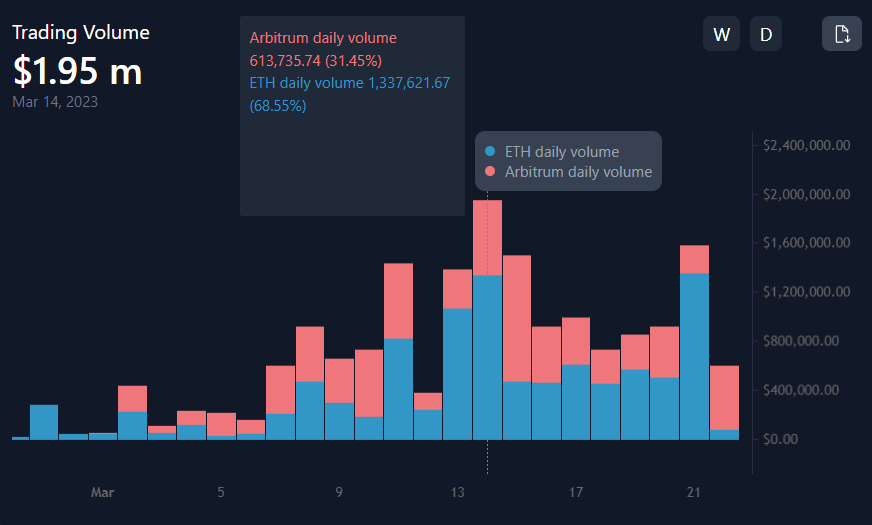

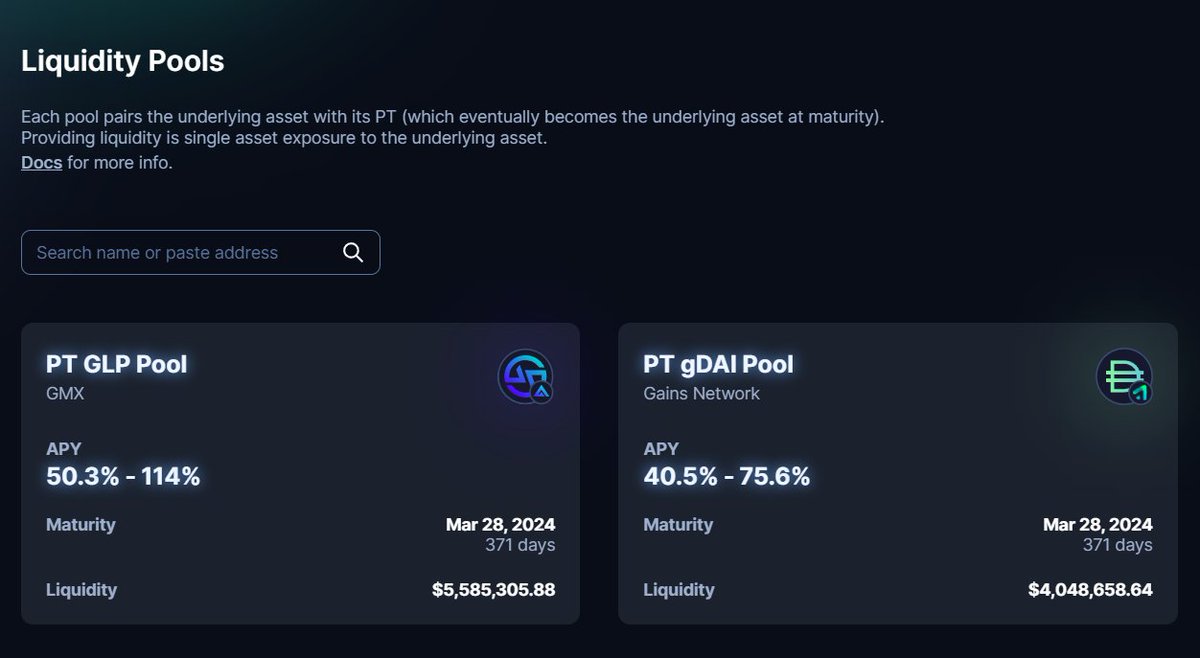

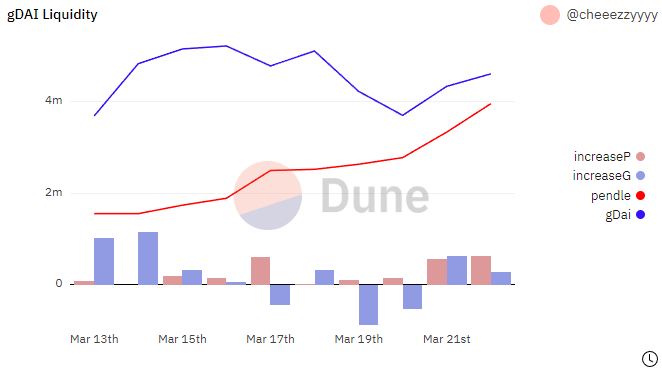

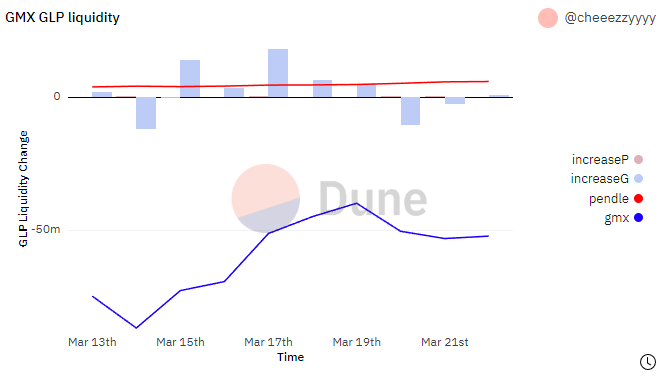

Our two Arbitrum pools, $GLP and $gDAI have amassed over $8.5M of liquidity and $7.4M of trading volumes in this span of time.

Whatever liquidity that is captured by Pendle here also flows 1:1 back to the underlying protocols @GMX_IO and @GainsNetwork_io

Whatever liquidity that is captured by Pendle here also flows 1:1 back to the underlying protocols @GMX_IO and @GainsNetwork_io

The low fees + lightning-quick transactions of #Arbitrum open up yield-trading to more users.

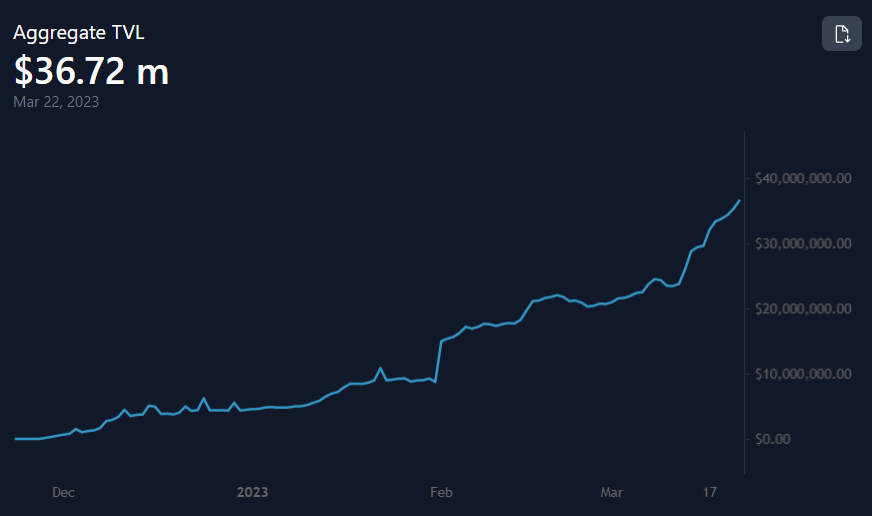

Through Pendle, protocols are able to harness stickier, deeper liquidity and more utility for their assets, drive up traffic and fees on Pendle, allowing all to grow synergistically

Through Pendle, protocols are able to harness stickier, deeper liquidity and more utility for their assets, drive up traffic and fees on Pendle, allowing all to grow synergistically

Additionally, by providing liquidity, users will be able to earn up to 129% of boosted APY.

The case for providing liquidity on Pendle is that on top of the yield generated by the base assets, you’ll also get to stack $PENDLE incentives, fees, fixed yield on top - with zero IL

The case for providing liquidity on Pendle is that on top of the yield generated by the base assets, you’ll also get to stack $PENDLE incentives, fees, fixed yield on top - with zero IL

With the combination of yield-trading + yield-farming through liquidity provision, users have been able to capitalize on Pendle to amplify their returns, the most famous recent example being @gabavineb

But that’s just one of many on the ever-growing Pendle Honour Board, of which includes 0x20e who’s on track to score ~136% of profit off $GLP trades alone, or a cumulative profit of $640k through the #Arbitrum pools

Active trades, high fees, more liquidity - all of these value contribute to uplifting the entire Arbitrum x Pendle stack in a positive feedback cycle 🚀

Not forgetting also how this all began - with our induction into the Round Table of @CamelotDex which officially marked the rise of $PENDLE as an #Arbitrum coin.

With ~$900K of liquidity and consistently high volumes, the PENDLE/ETH pool on Camelot has been a massive success

With ~$900K of liquidity and consistently high volumes, the PENDLE/ETH pool on Camelot has been a massive success

Knights will also be pleased to learn that the farming rewards for PENDLE/ETH have been extended till 16 April, allowing you to continue earning up to ~113% in APY.

Want more? Stay tuned when Pendle joins in on the quest for the holy grail 😉

Want more? Stay tuned when Pendle joins in on the quest for the holy grail 😉

Thanks to @CelerNetwork, you can also bridge $PENDLE between our two homes in Ethereum and Arbitrum quickly, effortlessly and affordably, in just a matter of minutes

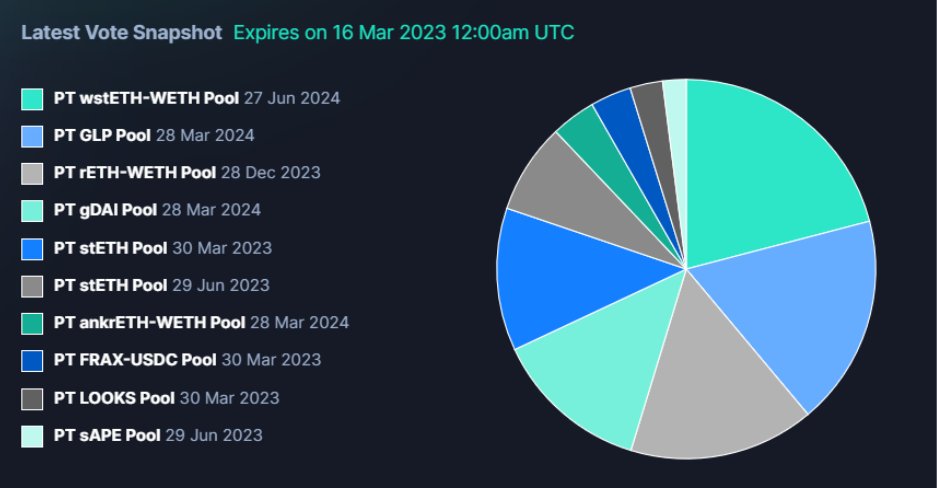

With the help of @LayerZero_Labs’ omnichain tech, we also launched the first ever cross-chain veTokenomics to support seamless cross-chain voting and reward boosting for our Arbitrum pools.

And last but not least, our most recent partnership with Bond Protocol also means we can leverage $ETH bonds to deepen our protocol-owned liquidity in Arbitrum and @CamelotDEX.

Users on the other hand will have until April 4th to acquire $PENDLE at a vested discount

Users on the other hand will have until April 4th to acquire $PENDLE at a vested discount

Pendle’s launch on Arbitrum is a microcosm of what we do best, that is nurturing, complementing the growth of various ecosystems in a mutualistic manner.

With all the necessary infrastructure in place, we’re set to support even more assets, more protocols, more ecosystems soon

With all the necessary infrastructure in place, we’re set to support even more assets, more protocols, more ecosystems soon

It’s Arbitrum season and Pendle is thrilled to be a part of it 💙

Can’t wait to see what else is in store for us in the near future.

If you wanna try your hands at mastering the art of yield trading, check out the Tweet below!

Can’t wait to see what else is in store for us in the near future.

If you wanna try your hands at mastering the art of yield trading, check out the Tweet below!

$9.5M*

Locked the intern in cram school for half a year for not knowing how to math

Locked the intern in cram school for half a year for not knowing how to math

Loading suggestions...