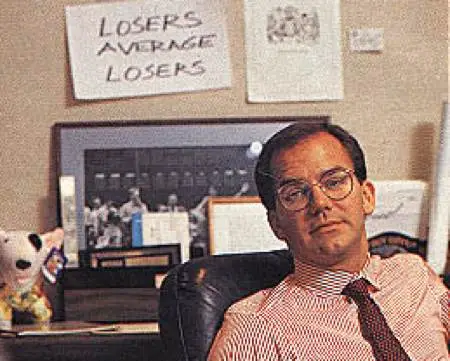

1. "Losers average losers".

- Jones' most famous quote. He kept this above his computer screen to remind himself that only losers double down on stocks that are going against them.

- Jones' most famous quote. He kept this above his computer screen to remind himself that only losers double down on stocks that are going against them.

2. "I’m always thinking about losing money as opposed to making money. Don’t focus on making money, focus on protecting what you have".

- Focus on not losing money, and the rest will take care of itself.

- Focus on not losing money, and the rest will take care of itself.

3. "Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead".

- Don’t be a hero. Don’t have an ego.

- Don’t be a hero. Don’t have an ego.

4. "The most important thing is how good are you at risk control. Ninety per cent of any great trader is going to be the risk control".

- Jones famously blew up several accounts before learning this lesson the hard way.

- Jones famously blew up several accounts before learning this lesson the hard way.

5. "Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control".

- Use your emotions to advantage, and as signals for when to press and when to rest.

- Use your emotions to advantage, and as signals for when to press and when to rest.

6. "It is not that we had any unfair knowledge that other people didn’t have, it is just that we did our homework. People just don’t want to believe that anyone can break away from the crowd and rise above mediocrity".

- Always do your homework.

- Always do your homework.

7. "The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge".

- You have to love what you do to have an edge.

- You have to love what you do to have an edge.

8. "Intellectual capital will always trump financial capital".

- Jones believed that anyone with a sharp mind and emotional edge could work their way up to having financial capital.

- Jones believed that anyone with a sharp mind and emotional edge could work their way up to having financial capital.

9. "I always believe that prices move first and fundamentals come second".

- In the short term, the market is a voting machine. In the long term, it is a weighing machine.

- In the short term, the market is a voting machine. In the long term, it is a weighing machine.

10. "If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in".

- Cut losers fast and move on.

- Cut losers fast and move on.

11. "Trading is very competitive and you have to be able to handle getting your butt kicked".

- Pick yourself up, and get back in the ring.

- Pick yourself up, and get back in the ring.

Loading suggestions...