What is leverage firstly

Leverage to me is simply a tool that give traders the opportunity to control higher positions whilst trading that ordinarily their account size would not control on a normal day

Say to say,A Trader who trades without lev has his entire margin active

Leverage to me is simply a tool that give traders the opportunity to control higher positions whilst trading that ordinarily their account size would not control on a normal day

Say to say,A Trader who trades without lev has his entire margin active

On a trade

Whilst a trader who uses lev has only a portion of his trade margin magnified by the leverage to look Like his entire margin active on a trade per time

If Trader A with 0 lev can open a position size with $500

Trader B on a 100x lev can open same equal position with

Whilst a trader who uses lev has only a portion of his trade margin magnified by the leverage to look Like his entire margin active on a trade per time

If Trader A with 0 lev can open a position size with $500

Trader B on a 100x lev can open same equal position with

$5 this time

Simple maths (Position ÷ lev = Margin required) 500/100 = $5

Now that's out of the way..

People tend to criticize high lev trading so much, calling traders who use it out as irresponsible or gamblers , but this isn't necessarily true if you have knowledge of PS

Simple maths (Position ÷ lev = Margin required) 500/100 = $5

Now that's out of the way..

People tend to criticize high lev trading so much, calling traders who use it out as irresponsible or gamblers , but this isn't necessarily true if you have knowledge of PS

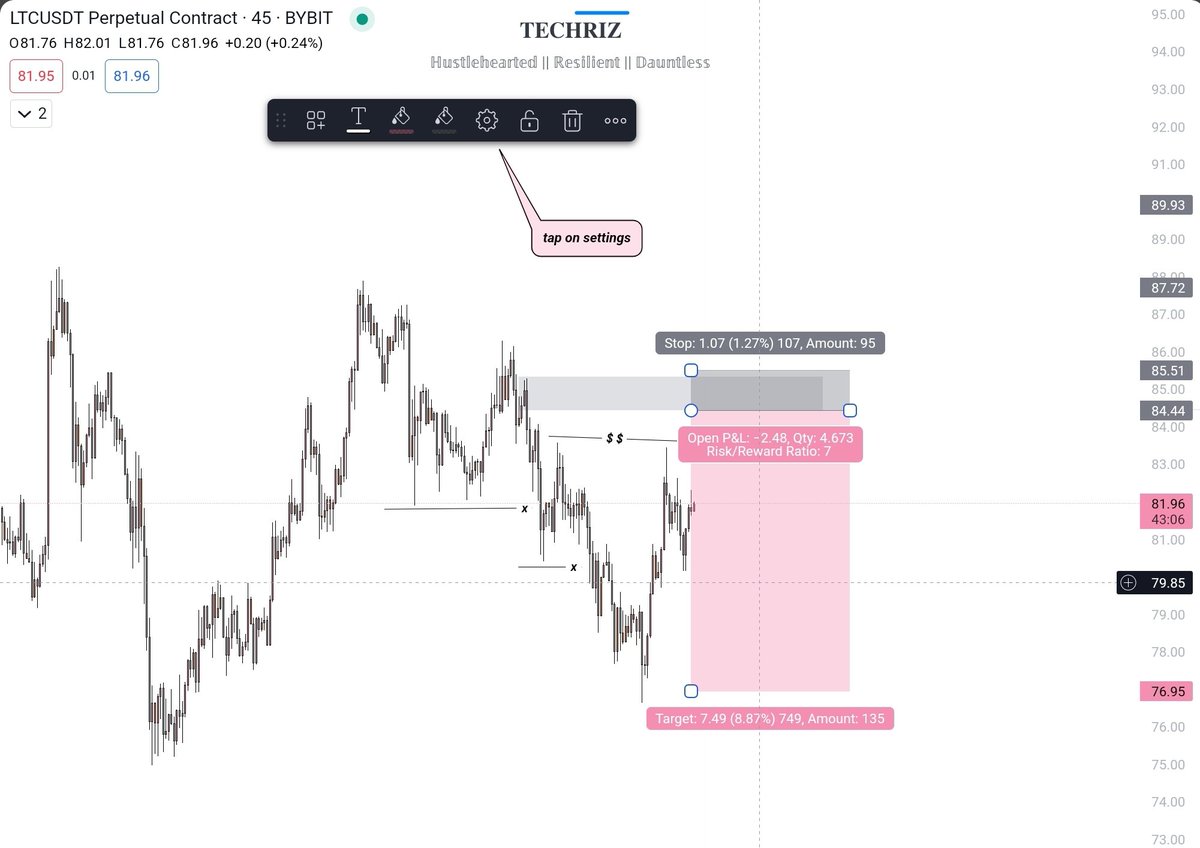

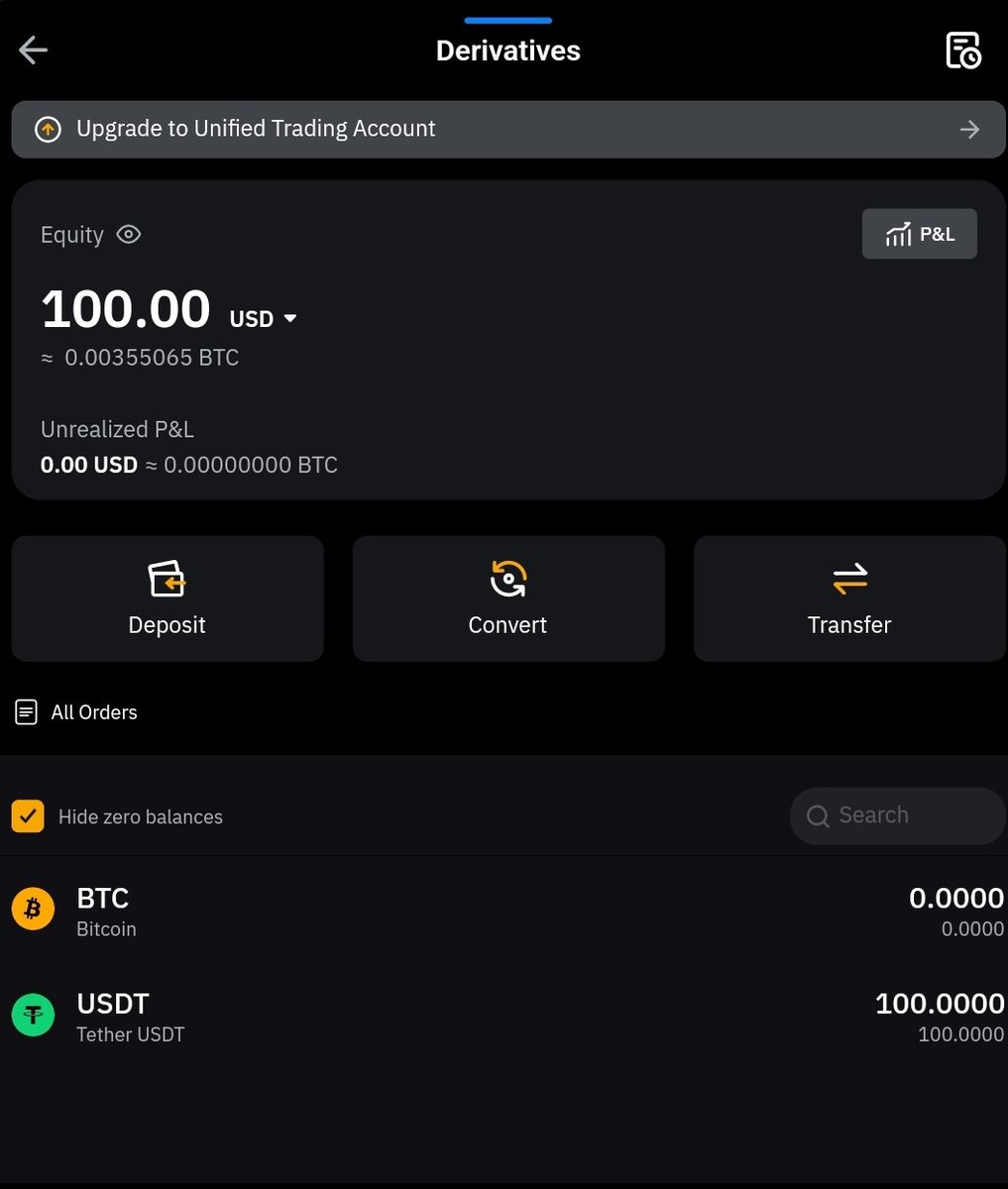

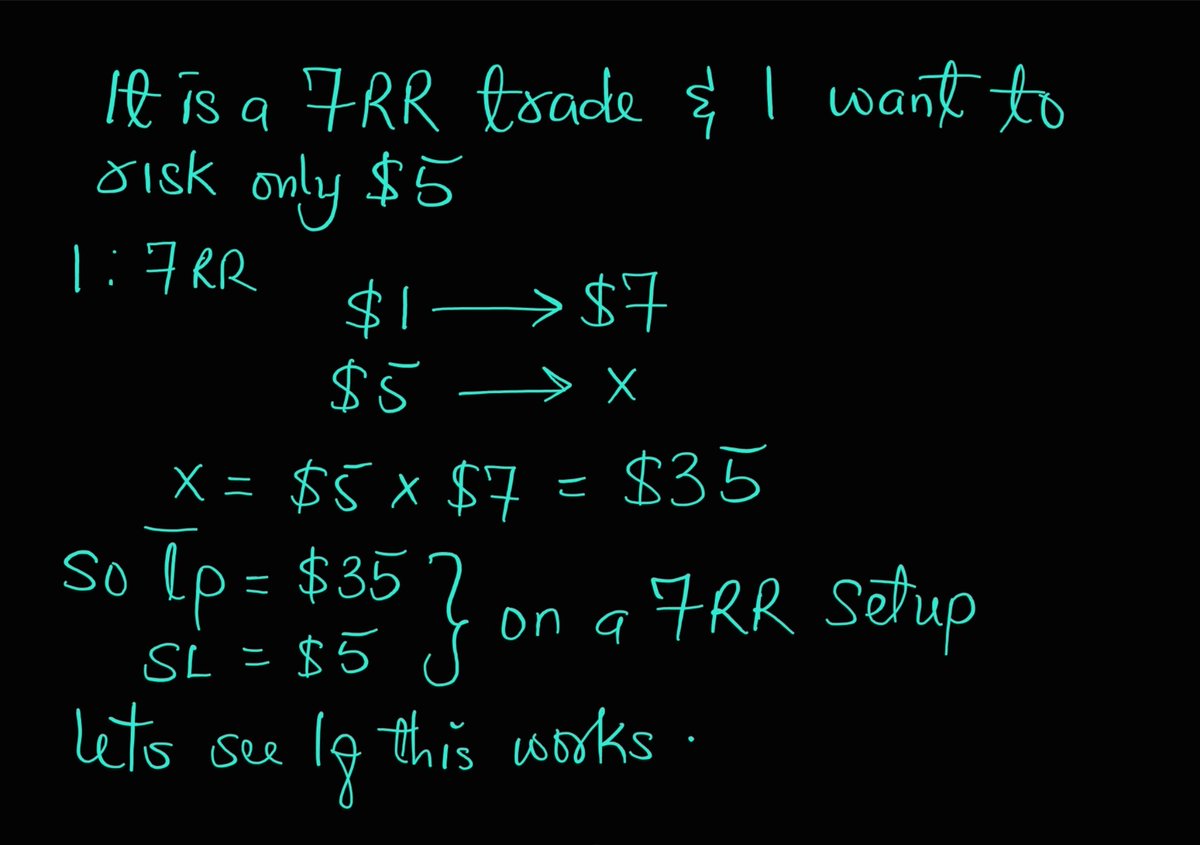

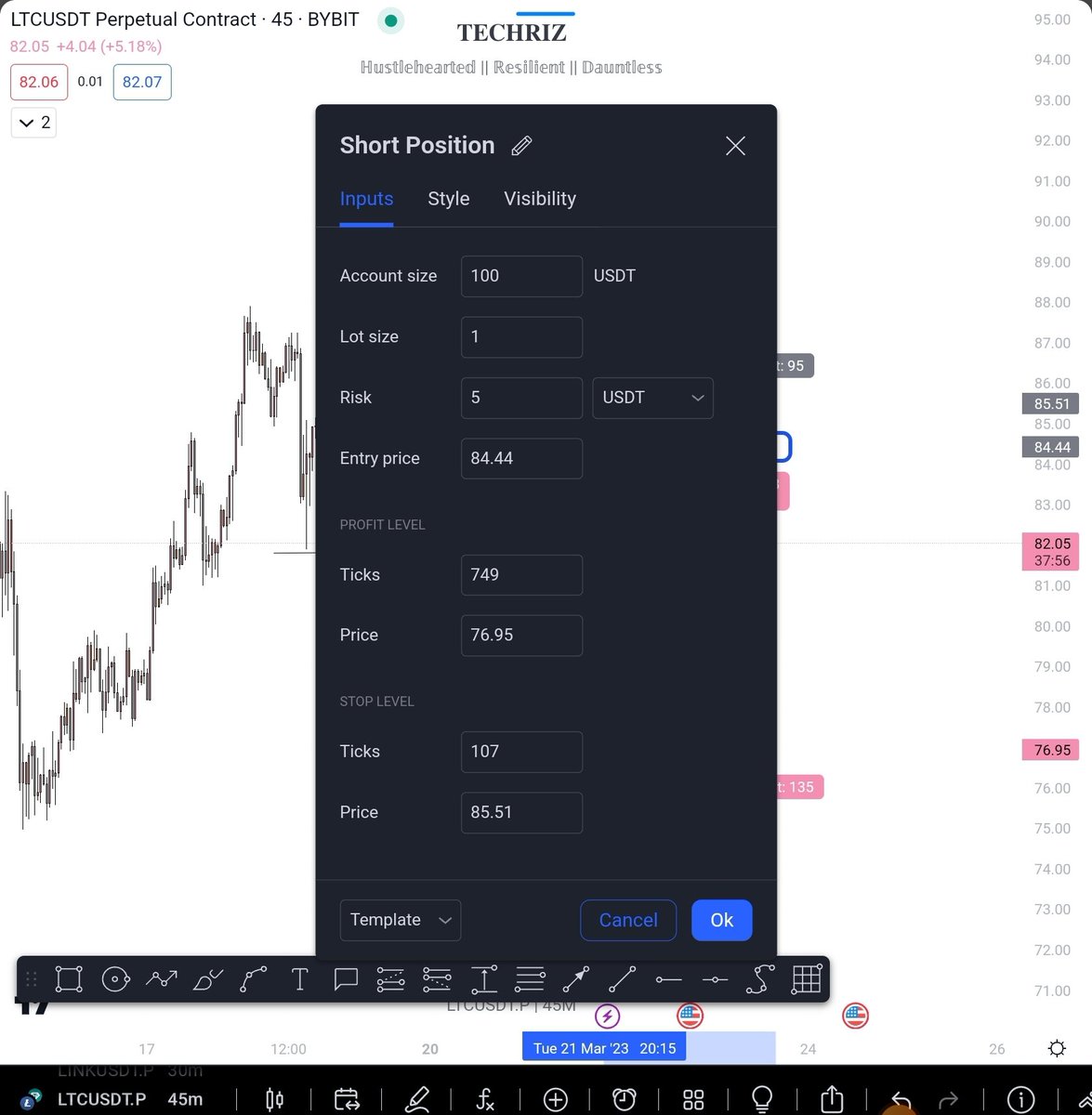

Position sizing is a method of predetermining your risk & Reward per trade without necessarily keeping into account your leverage

And trust me some persons would be shocked by what they see in this Thread

So How do I Position size ??

For this we'd be using TV & an Exchange

And trust me some persons would be shocked by what they see in this Thread

So How do I Position size ??

For this we'd be using TV & an Exchange

Let's sum it all up there

So next time you see someone printing 1000% plus on 125x lev don't necessarily think they're gamblers, their % ROE might be higher than a person with only a 100% ROE , but as long as their RR & Risks are they same, they still made same amount

So next time you see someone printing 1000% plus on 125x lev don't necessarily think they're gamblers, their % ROE might be higher than a person with only a 100% ROE , but as long as their RR & Risks are they same, they still made same amount

I hope that's cleared now ?

And if that isn't still understood by you

Here's also a Thread from @Starr_gael below saying same thing to help you understand better ⬇️

And if that isn't still understood by you

Here's also a Thread from @Starr_gael below saying same thing to help you understand better ⬇️

And here's also a Thread from @neehyeehwah hammering on same thing

If you did get enlightenment & Clarity from this thread

Follow me @Techriztm for more & plsssss don't forget to like & Retweet for others to see

I'd be reading your comments for questions & contributions

This is 1/3 for this week so it's important you're following

Follow me @Techriztm for more & plsssss don't forget to like & Retweet for others to see

I'd be reading your comments for questions & contributions

This is 1/3 for this week so it's important you're following

Twitter is a vast library of knowledge & these are amongst the few elite traders you can never regret following

Their handles👉 @Alh_Myke1 @ProsperoApril @Starr_gael @Kelvintalent_ @thissdax @_Krypto_Khan @TraderRozay @dnatechbro @CharlesAk_son @_InvestorBen @neehyeehwah

❤️❤️

Their handles👉 @Alh_Myke1 @ProsperoApril @Starr_gael @Kelvintalent_ @thissdax @_Krypto_Khan @TraderRozay @dnatechbro @CharlesAk_son @_InvestorBen @neehyeehwah

❤️❤️

Loading suggestions...