My Banknifty Option Trade Plan for 23/03/23

(1/n)

#banknifty #StockMarketindia #StockMarket #optionbuying

(1/n)

#banknifty #StockMarketindia #StockMarket #optionbuying

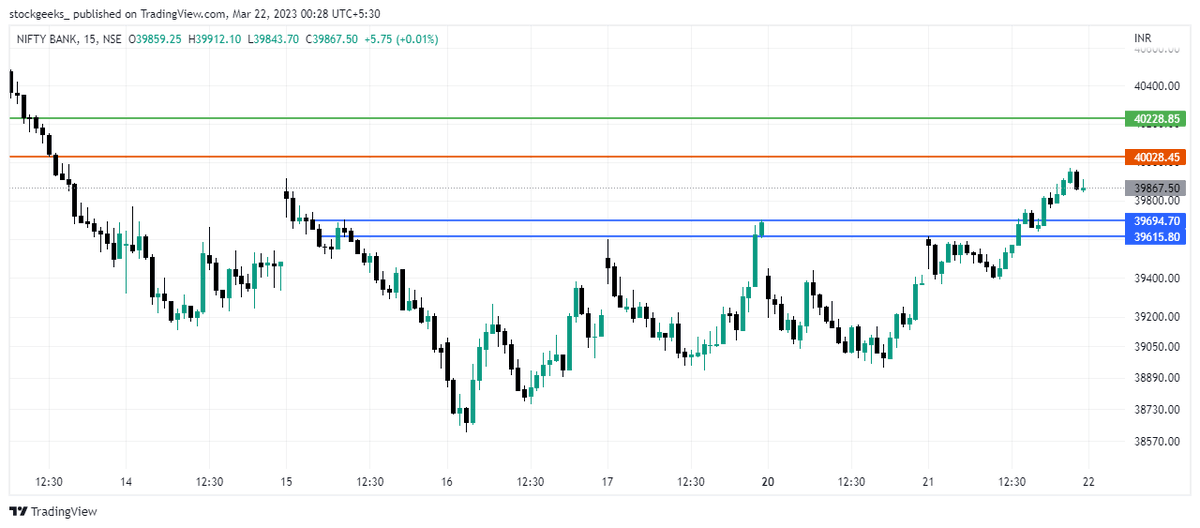

Scenario 2 : Gap Up

Will treat a small gap up same as flat opening

But I do not want it to give a gapup and open straight at the resistance zone

If that happens I will avoid taking any options trade in the first half and observe how the market behaves

(3/n)

Will treat a small gap up same as flat opening

But I do not want it to give a gapup and open straight at the resistance zone

If that happens I will avoid taking any options trade in the first half and observe how the market behaves

(3/n)

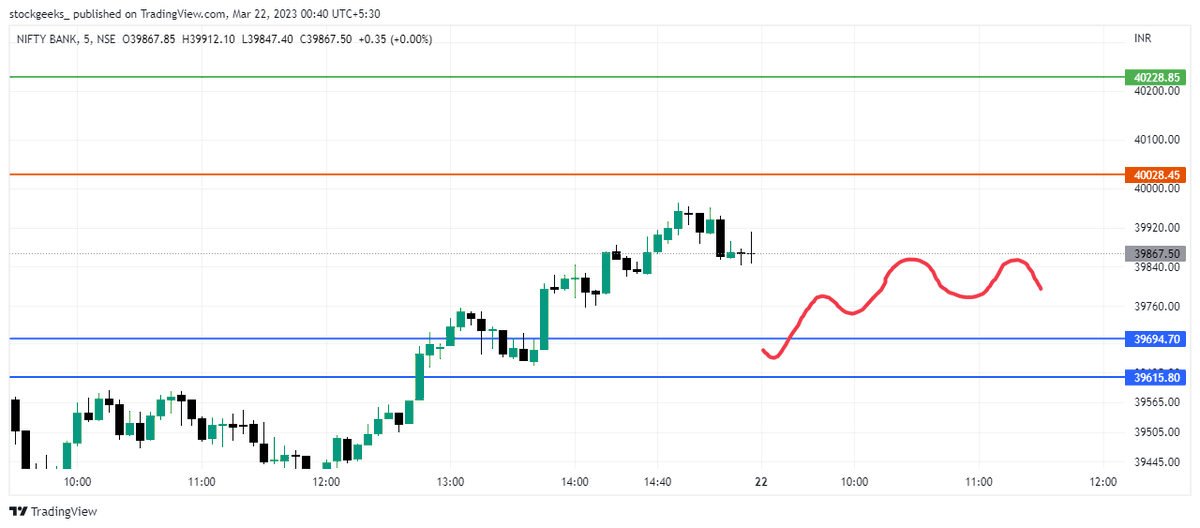

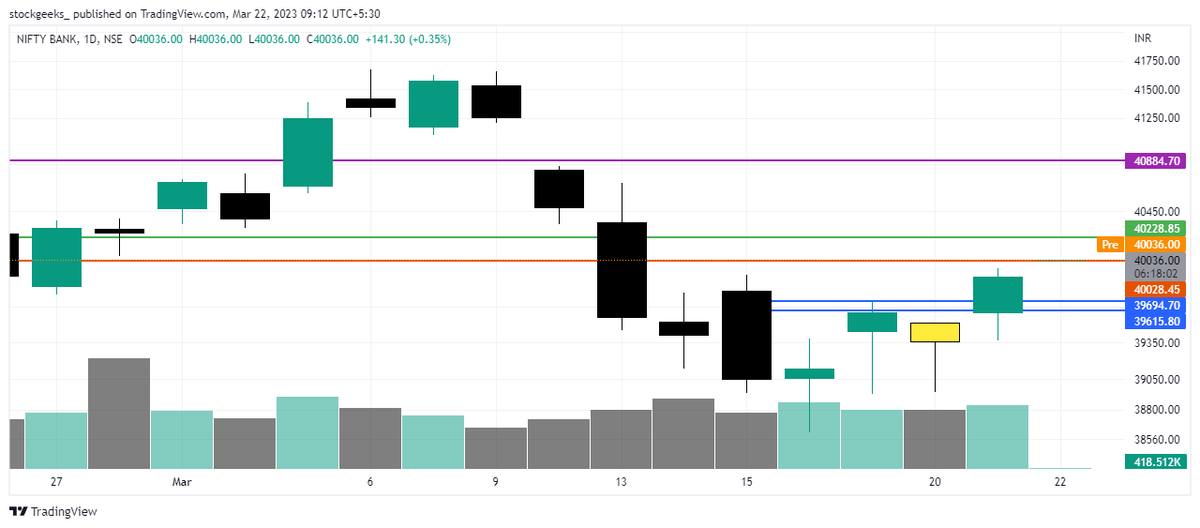

As of now, I have no plan of going short tomorrow

Only two trade plans

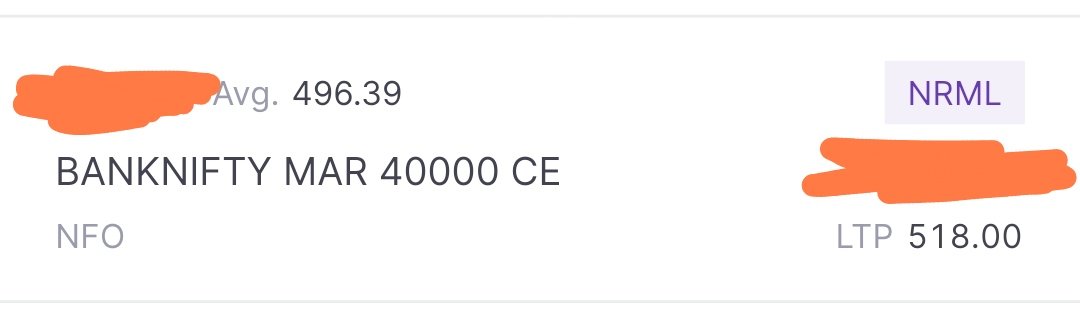

1. Go long after range BO above 40030-40050

2. Go Long based on Doji/Hammer or 5Ema strategy at support zone of 39600-39700

(5/n)

Only two trade plans

1. Go long after range BO above 40030-40050

2. Go Long based on Doji/Hammer or 5Ema strategy at support zone of 39600-39700

(5/n)

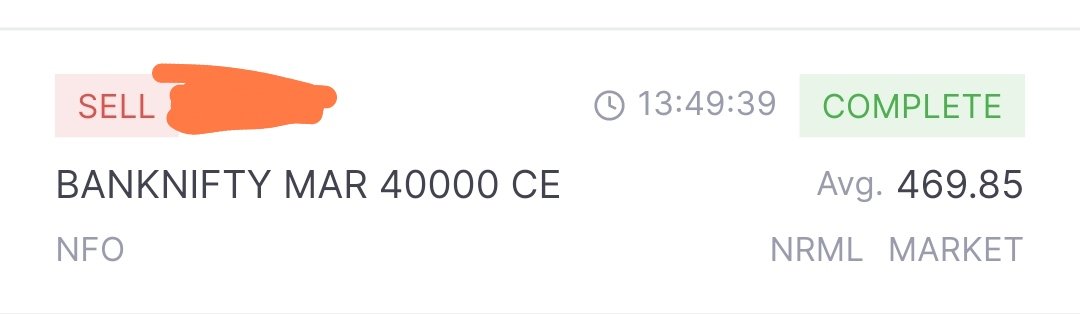

I always try to keep SL below 100 points

And I generally do not have any particular target in mind apart from 4RR where I book Half position

And I trail rest as per momentum

(n/n)

And I generally do not have any particular target in mind apart from 4RR where I book Half position

And I trail rest as per momentum

(n/n)

BANKNIFTY

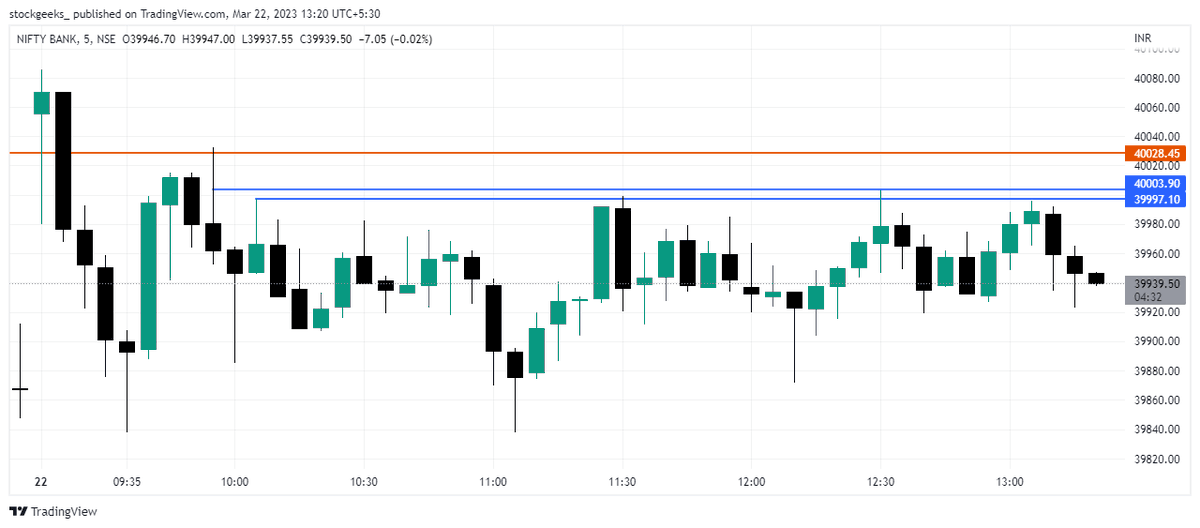

As I said buying at the open was not favorable

I need at least 2 contractions here to get a low-risk entry, 3 would be even better

#StockMarketindia #StockMarket #OptionsTrading #banknifty

As I said buying at the open was not favorable

I need at least 2 contractions here to get a low-risk entry, 3 would be even better

#StockMarketindia #StockMarket #OptionsTrading #banknifty

Loading suggestions...