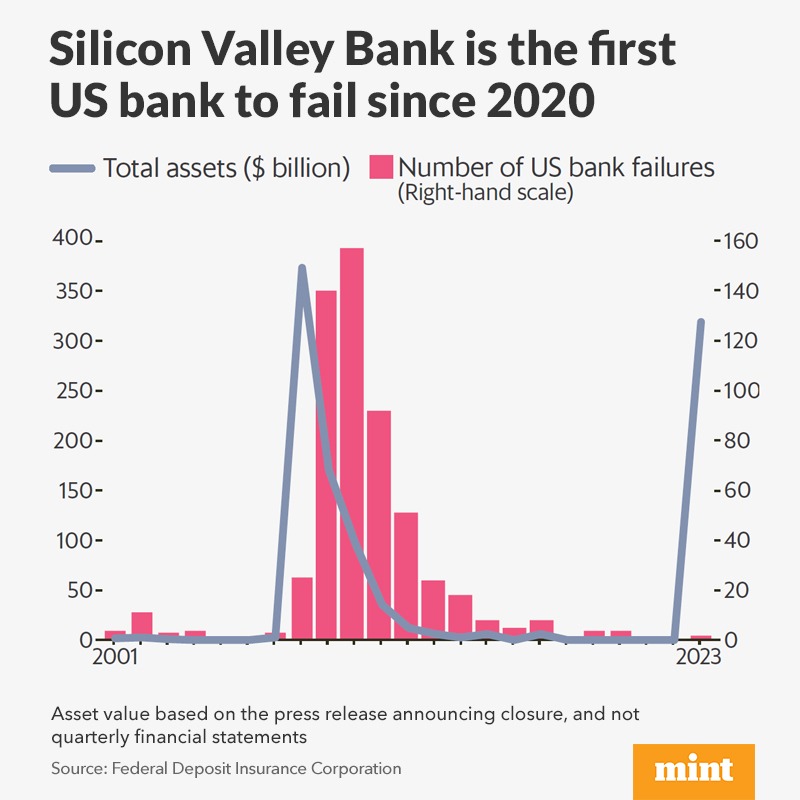

#MintPlainFacts | The US financial crisis of 2008 ripped through its banking system—& had a cascading effect on the world economy.

Between 2008 and 2012, 465 American banks with $689 billion in assets shut down. #BankingCrisis

Read here: livemint.com

Between 2008 and 2012, 465 American banks with $689 billion in assets shut down. #BankingCrisis

Read here: livemint.com

#MintPlainFacts | The number of US bank failures has consistently fallen since, with 2018, 2021 and 2022 registering no shutdowns. Even the size was small, with average assets of $333 million.

Read here: livemint.com

Read here: livemint.com

#MintPlainFacts | #SVB is the largest bank failure since 2008, when Washington Mutual closed with deposits of $188 billion.

JPMorgan Chase acquired Washington Mutual’s banking operations and its deposits.

Read here: livemint.com

JPMorgan Chase acquired Washington Mutual’s banking operations and its deposits.

Read here: livemint.com

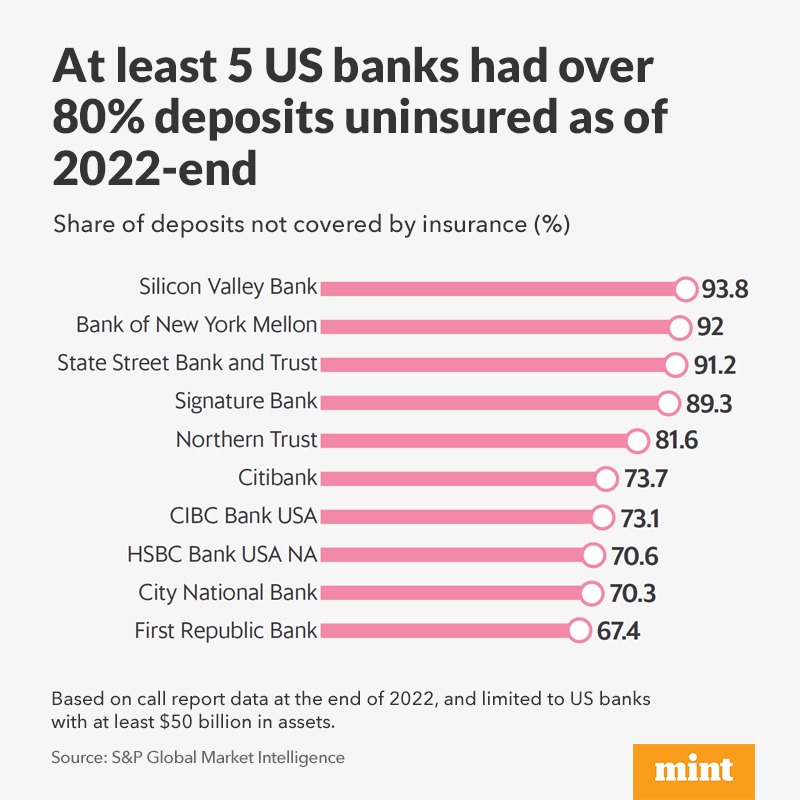

#MintPlainFacts | Among US banks with over $50 billion in assets, these were some of the highest proportion of estimated uninsured domestic deposits.

Read here: livemint.com

Read here: livemint.com

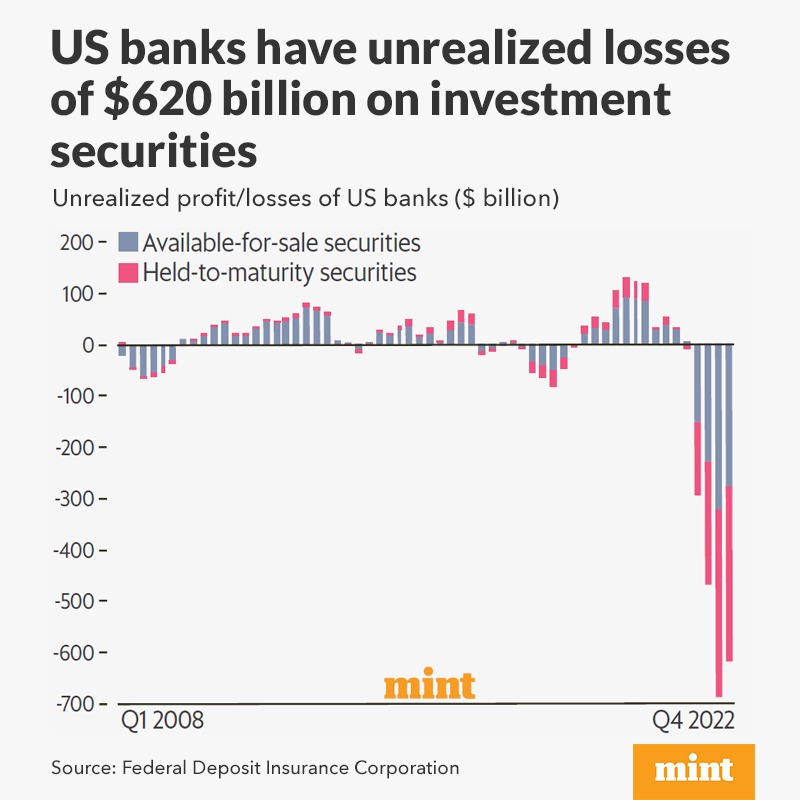

#MintPlainFacts | It’s one of the reasons why there is a concern about the US #banking sector, & rating agency #Moody’s has changed its outlook on them to ‘negative’.

Read here: livemint.com

Read here: livemint.com

#MintPlainFacts | When #SVB announced its $1.8-billion loss, there were hopes it would manage. But when customers started withdrawing deposits in large numbers, its fate was sealed.

Read here: livemint.com

Read here: livemint.com

Loading suggestions...