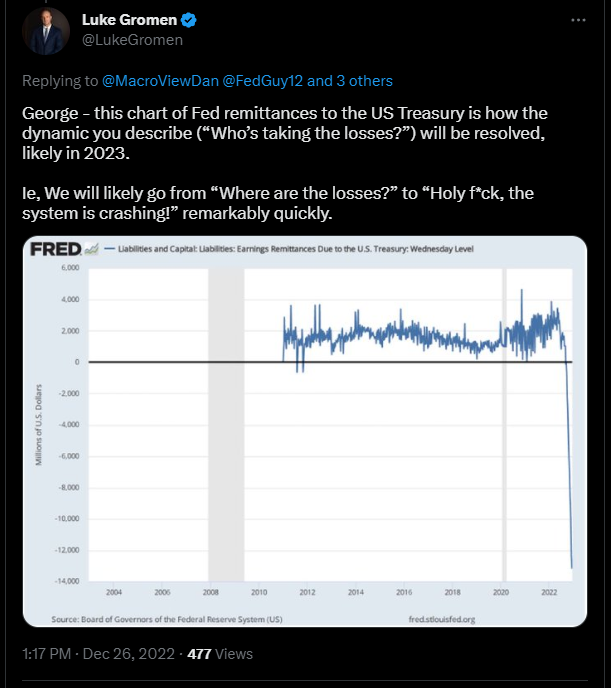

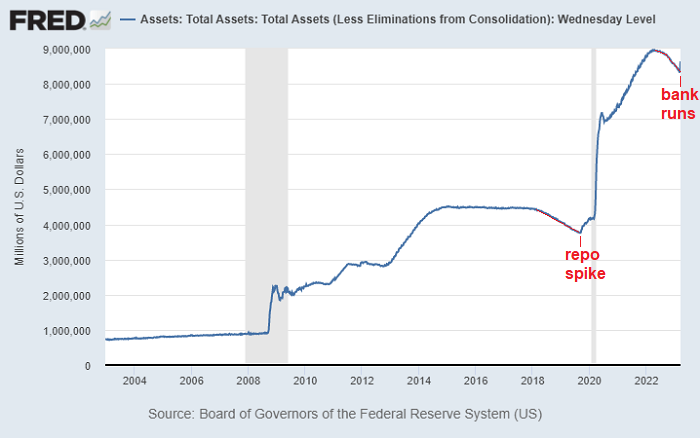

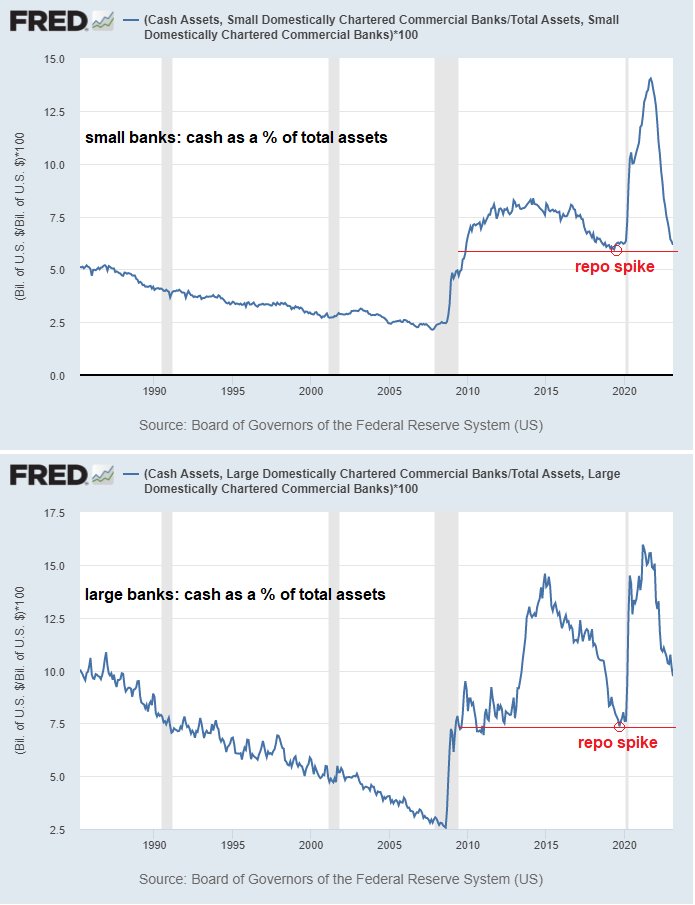

Unsurprisingly, @LukeGromen identified the duration problems and unrealized losses in the banking system in recent months more accurately than most.

Loading suggestions...