Market Breadth Indicator

How to use it to find tops and bottoms

And also to know when to trade and when to wait

This indicator can save you a lot of money if you understand how to use it

How to use it to find tops and bottoms

And also to know when to trade and when to wait

This indicator can save you a lot of money if you understand how to use it

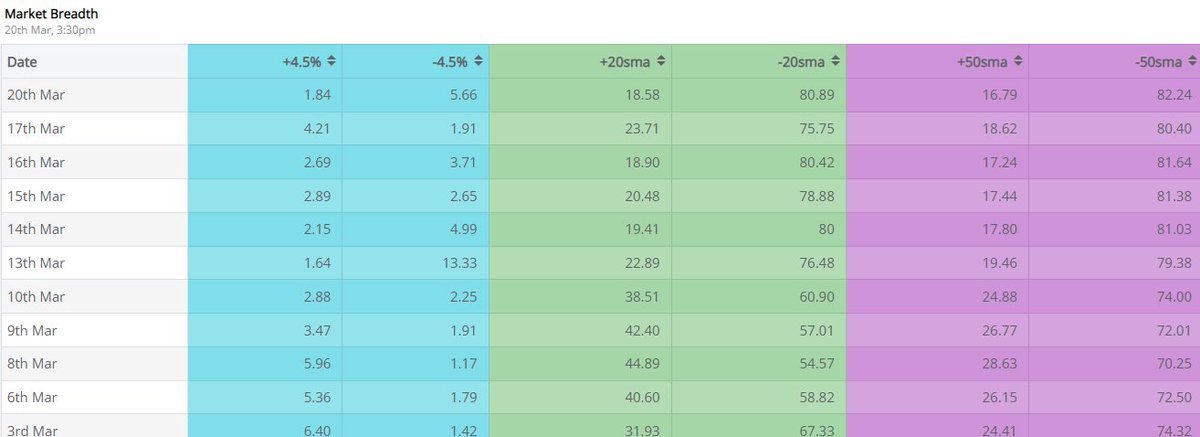

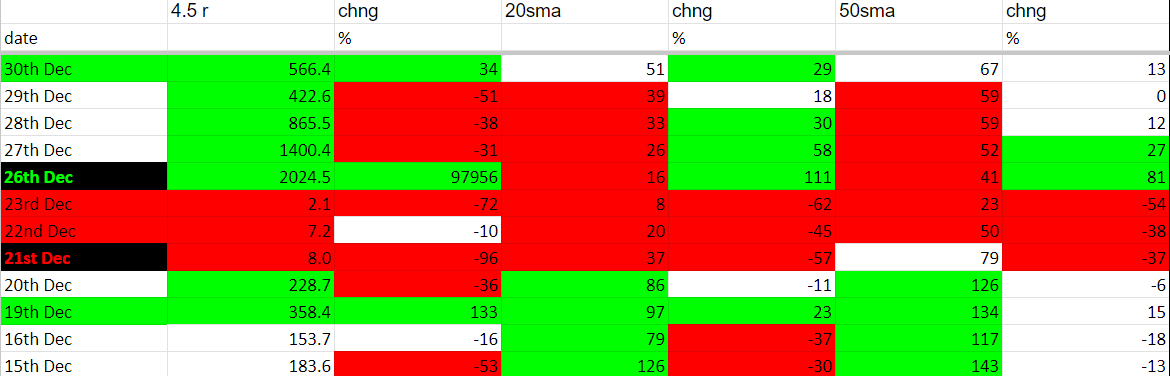

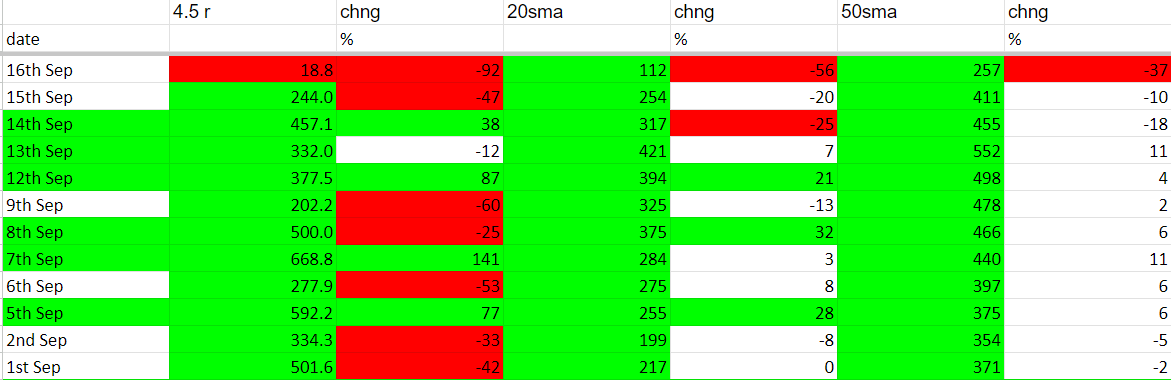

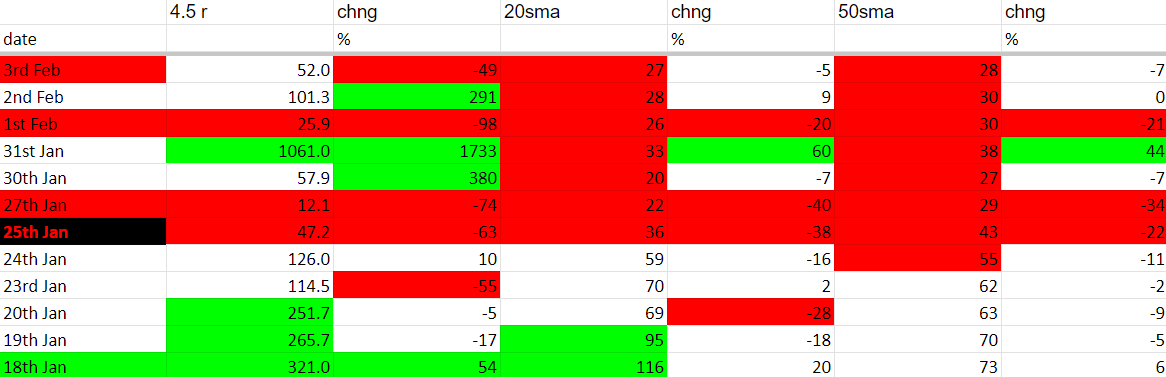

Now you have to look at extremely high or extremely low values in these columns

Extremely High means that the broader market is overbought and we may see a cool down

We can use this to do some profit booking and wait before making a new position

Extremely High means that the broader market is overbought and we may see a cool down

We can use this to do some profit booking and wait before making a new position

Extremely low means that the overall market is oversold

And the probability of a bounce/reversal is higher

Keep in mind that this is for the overall market and not Nifty or any index

And the probability of a bounce/reversal is higher

Keep in mind that this is for the overall market and not Nifty or any index

The 4.5r column should be used by ultra short-term momentum traders whose holding period is mostly less than a week

The 20sma column should be used by swing traders and 50 sma for positional trading

Keep in mind that 50sma is the slowest indicator

The 20sma column should be used by swing traders and 50 sma for positional trading

Keep in mind that 50sma is the slowest indicator

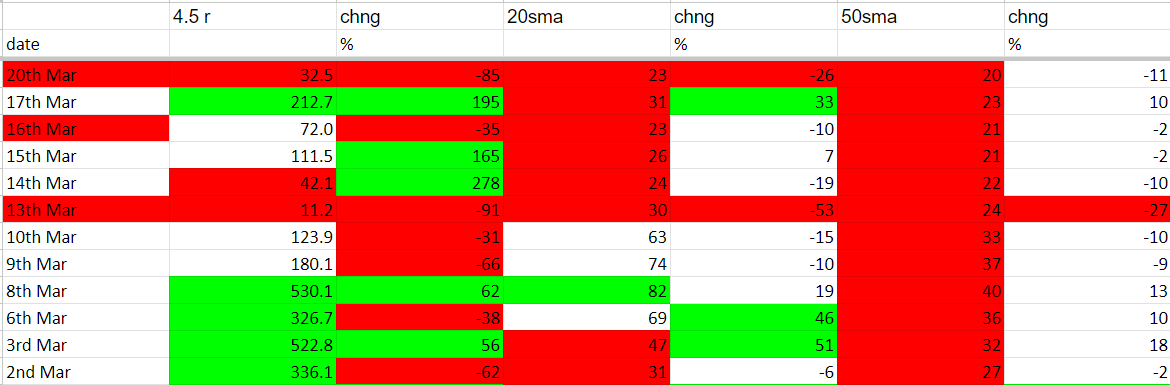

How I have colored the sheet

Colomn B : Abv200 Green, Blw50 Red

Colomn C : Abv20 Green, Blw-20 Red

Colomn D : Abv75 Green, Blw50 Red

Colomn E : Abv20 Green, Blw-20 Red

Colomn F : Abv85 Green, Blw60 Red

Colomn G : Abv20 Green, Blw-20 Red

Colomn B : Abv200 Green, Blw50 Red

Colomn C : Abv20 Green, Blw-20 Red

Colomn D : Abv75 Green, Blw50 Red

Colomn E : Abv20 Green, Blw-20 Red

Colomn F : Abv85 Green, Blw60 Red

Colomn G : Abv20 Green, Blw-20 Red

Column A :

Green if Net color of Green(Column B-G) - Net Colour of Red(Column B-G) is greater than equal to 3

Red if Net color of Green(Column B-G) - Net Colour of Red(Column B-G) is less than equal to -3

Eg : 20th March the net value color is -5 hence it is a red day

Green if Net color of Green(Column B-G) - Net Colour of Red(Column B-G) is greater than equal to 3

Red if Net color of Green(Column B-G) - Net Colour of Red(Column B-G) is less than equal to -3

Eg : 20th March the net value color is -5 hence it is a red day

Column A is the easiest and the best indicator of when breakout trading is working and when to wait before making new positions

If the last time we got a color day and it was green then you are good to trade breakouts and if it was red then don't trade

If the last time we got a color day and it was green then you are good to trade breakouts and if it was red then don't trade

The red day green day signal will work best for most traders

The veterans and ultra short-term traders can use 4.5r column as long as they know when to book profits and cut losses as it is mainly used to play for momentum and momentum can go out anytime

The veterans and ultra short-term traders can use 4.5r column as long as they know when to book profits and cut losses as it is mainly used to play for momentum and momentum can go out anytime

You can also add columns like 20% up/down in 5 days, a month, or a certain percentage up move or down move in a quarter to understand the market breadth better as per your trading style

I find adding too much overcomplicates things hence I prefer this basic setup

I find adding too much overcomplicates things hence I prefer this basic setup

Loading suggestions...