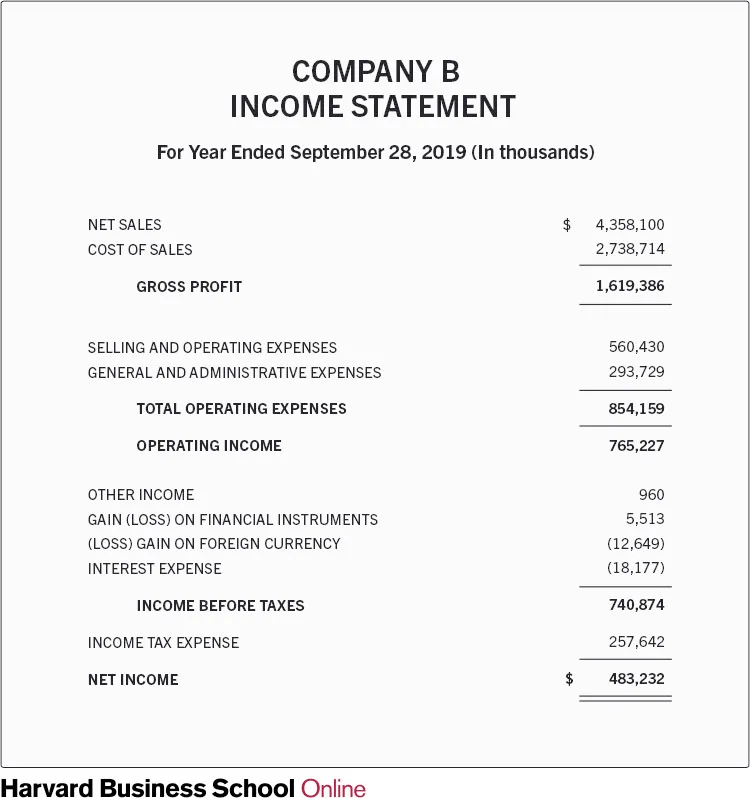

What is an income statement?

An income statement is also called a profit and loss account.

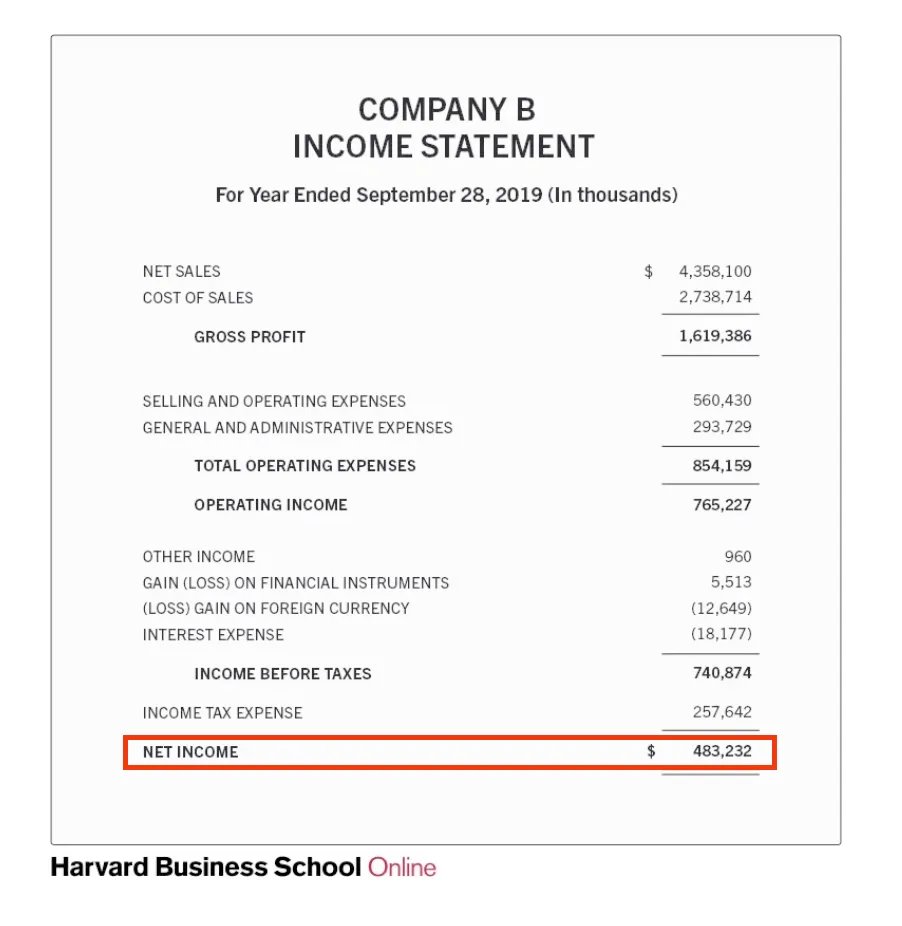

It shows the company's revenue and expenses over a certain period.

An income statement is also called a profit and loss account.

It shows the company's revenue and expenses over a certain period.

I will now show you step by step how you can go from revenue to net income.

Revenue

For a company, it all starts with its revenue or sales.

Revenue is the money a company receives from selling its products and/or services.

For a company, it all starts with its revenue or sales.

Revenue is the money a company receives from selling its products and/or services.

Let’s say that a fictional company Drink Inc sells 2,179,050 drinks at a price of $2 per drink.

In this example, the company’s revenue is equal to $4,358,100 ($2 * 2,179,050 drinks).

In this example, the company’s revenue is equal to $4,358,100 ($2 * 2,179,050 drinks).

Cost Of Goods Sold (COGS)

The section cost of sales or costs of goods sold (COGS) shows you all the costs a company makes to produce its products and/or services.

The section cost of sales or costs of goods sold (COGS) shows you all the costs a company makes to produce its products and/or services.

When Drink Inc. would need $1.25684 to produce a drink, its COGS would be equal to $2,738,714 million (2,179,050 million drinks * $1.25684 per drink).

▪️Revenue Drink Inc. : $4,358,100

▪️COGS Drink Inc: : $2,738,714

▪️Revenue Drink Inc. : $4,358,100

▪️COGS Drink Inc: : $2,738,714

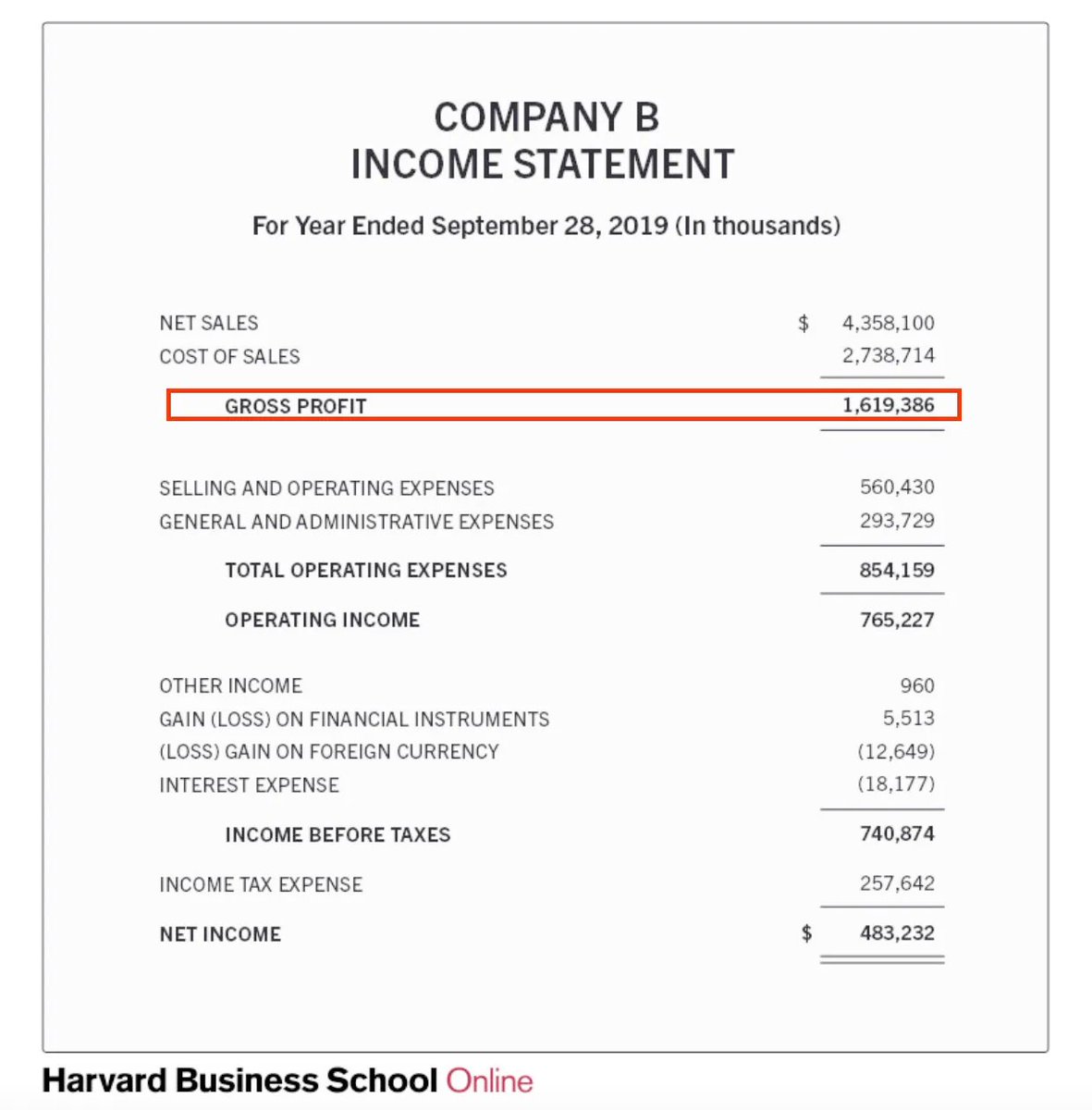

Gross profit

After you know the revenue and COGS of a company, you can calculate the company’s gross profit.

After you know the revenue and COGS of a company, you can calculate the company’s gross profit.

Gross margin

Now you know the gross profit, you can also calculate the gross margin:

▪️ Gross margin = Gross profit / Revenue

▪️ Gross margin Drink. Inc = $1,619,386 / $4,358,100 = 37.2%

Now you know the gross profit, you can also calculate the gross margin:

▪️ Gross margin = Gross profit / Revenue

▪️ Gross margin Drink. Inc = $1,619,386 / $4,358,100 = 37.2%

A gross margin of 37.2% means that a company needs $0.628 to produce its products while it can sell them for $1.

The higher the gross margin, the better.

When a company has a very stable and high gross margin, it is often an indication that the company has pricing power.

The higher the gross margin, the better.

When a company has a very stable and high gross margin, it is often an indication that the company has pricing power.

Operating expenses (OPEX)

The operating expenses or OPEX show you all the expenses a company makes to run its daily operations.

The operating expenses or OPEX show you all the expenses a company makes to run its daily operations.

Operating expenses consist out of 4 pillars:

▪️ Sales & Marketing

▪️ Depreciation & Amortization

▪️ Research & Development (R&D)

▪️ General & Administrative expenses

▪️ Sales & Marketing

▪️ Depreciation & Amortization

▪️ Research & Development (R&D)

▪️ General & Administrative expenses

In our example Drink Inc. has $560,430 in selling and operating expenses and has $293,729 in general and administrative expenses.

As a result, OPEX is equal to $854,159.

As a result, OPEX is equal to $854,159.

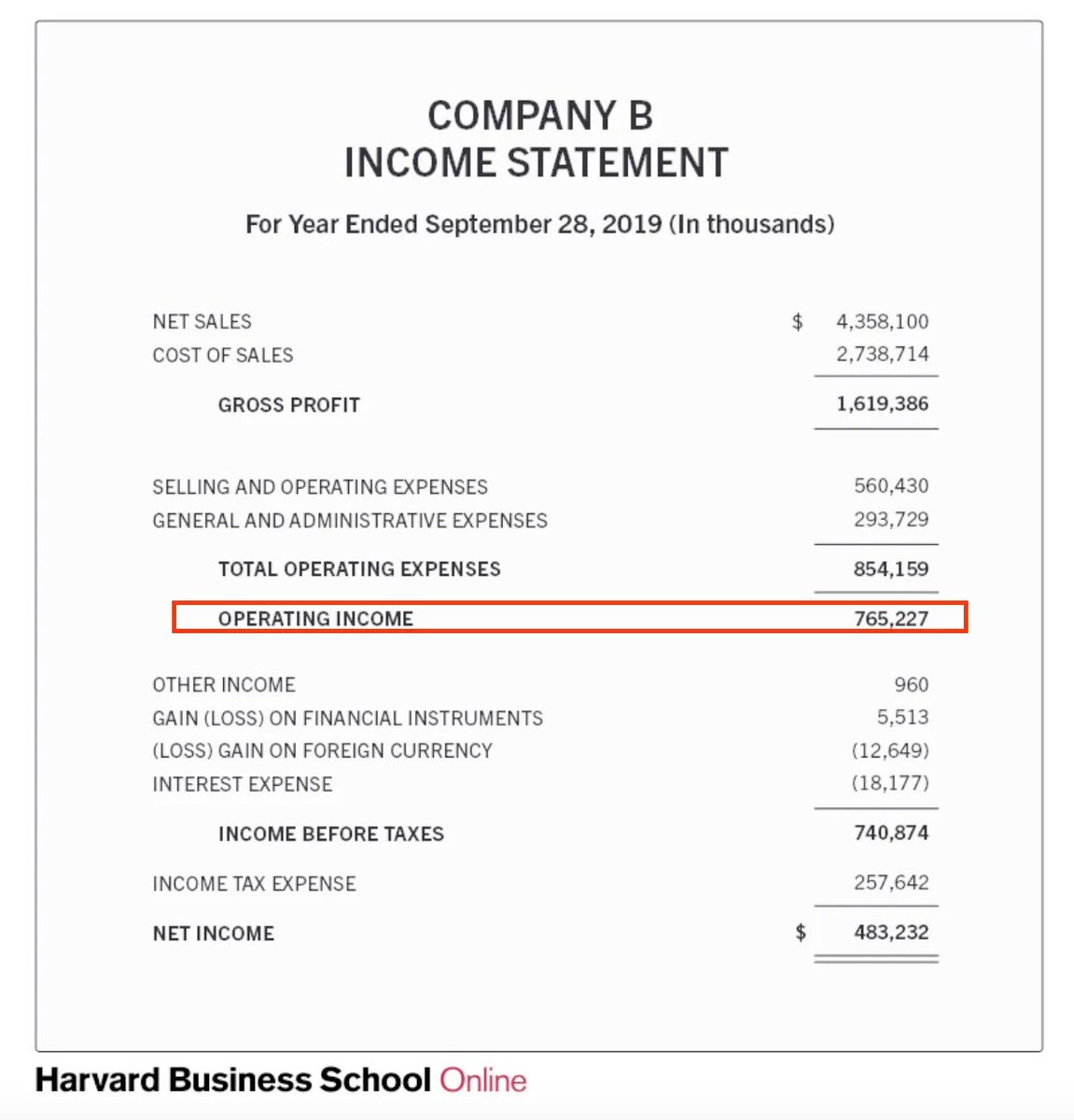

Operating income

Now you’ve taken a look at the operating expenses, you can calculate the operating income or EBIT of a company.

The operating income shows you how much money a company earns from its normal business activities.

Now you’ve taken a look at the operating expenses, you can calculate the operating income or EBIT of a company.

The operating income shows you how much money a company earns from its normal business activities.

Non-operating income and expenses

Income and expenses that aren’t related to the normal business activities of the company are classified under non-operating income and expenses.

Income and expenses that aren’t related to the normal business activities of the company are classified under non-operating income and expenses.

Non-operating income and expenses consist of 4 parts:

▪️ Other income

▪️ Gain (loss) on financial instruments

▪️ Gain (loss) on foreign currency

▪️ Interest expenses

▪️ Other income

▪️ Gain (loss) on financial instruments

▪️ Gain (loss) on foreign currency

▪️ Interest expenses

Drink Inc. gained $5,513 from financial instruments and $960 in other income.

Drink Inc. also made a loss on FX of $12,649 and has interest expenses of $18,177.

This mean non-operating expenses are equal to $24,353 (+5,513 + $960 - $18,177 -$12,649).

Drink Inc. also made a loss on FX of $12,649 and has interest expenses of $18,177.

This mean non-operating expenses are equal to $24,353 (+5,513 + $960 - $18,177 -$12,649).

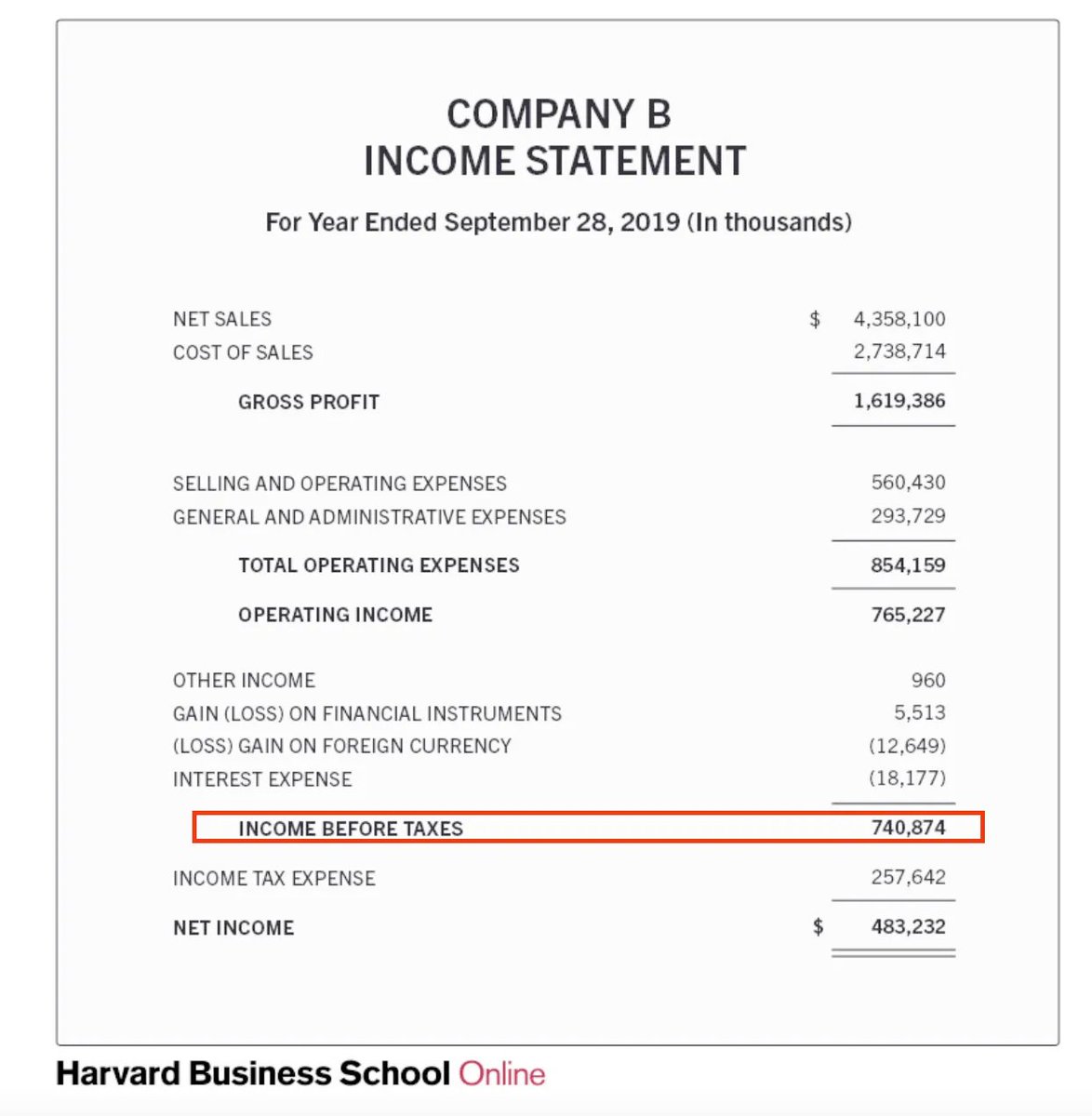

Income before taxes

The income before taxes or earnings before taxes (EBT) shows you how much profit the company has made before taxes.

All other costs have now already been taken into account .

The income before taxes or earnings before taxes (EBT) shows you how much profit the company has made before taxes.

All other costs have now already been taken into account .

Income tax expense

It goes without saying that every company needs to pay taxes.

These taxes are paid to federal, state and local governments.

Drink Inc. needs to pay 34,7754% in taxes (rounded). With an income before taxes of $740,874, this is equal to $257,642.

It goes without saying that every company needs to pay taxes.

These taxes are paid to federal, state and local governments.

Drink Inc. needs to pay 34,7754% in taxes (rounded). With an income before taxes of $740,874, this is equal to $257,642.

Net income

The bottom line or net income of an income statement shows you how much money the company has made after subtracting all costs and taxes.

Net income is also known as ‘earnings’ or ‘profit’.

The bottom line or net income of an income statement shows you how much money the company has made after subtracting all costs and taxes.

Net income is also known as ‘earnings’ or ‘profit’.

Profit margin

You can now also calculate the company’s profit margin:

▪️Profit margin = Net income / Revenue

▪️Profit margin Drink Inc. = $483,232 / $4,358,100 = 11,1%

You can now also calculate the company’s profit margin:

▪️Profit margin = Net income / Revenue

▪️Profit margin Drink Inc. = $483,232 / $4,358,100 = 11,1%

The higher the profit margin, the better.

Why? Because you want to invest in companies that manage to translate most sales into earnings.

Why? Because you want to invest in companies that manage to translate most sales into earnings.

Earnings per share

For shareholders, it is very handy to take a look at the earnings per share of a company.

For shareholders, it is very handy to take a look at the earnings per share of a company.

Let’s say that Drink Inc. has 100,000 shares outstanding.

▪️Earnings per share = Earnings / Outstanding shares

▪️Earnings per share Drink Inc = $483,232/ 100,000 = $4.83

▪️Earnings per share = Earnings / Outstanding shares

▪️Earnings per share Drink Inc = $483,232/ 100,000 = $4.83

Looking at the earnings per share of a company is handy as it allows you to take a look a the valuation by comparing the stock price with its earnings per share.

In our example Drink Inc. has a stock price of $90.

▪️P/E ratio = Stock price / earnings per share

▪️P/E ratio Drink Inc = $90 / $4.83 = 18.6

The lower, the P/E ratio, the cheaper the stock.

▪️P/E ratio = Stock price / earnings per share

▪️P/E ratio Drink Inc = $90 / $4.83 = 18.6

The lower, the P/E ratio, the cheaper the stock.

Questions to ask yourself about an income statement

▪️Are revenues and net income predictable and robust?

▪️ Does the company have a high gross margin?

▪️ Is the company structurally profitable?

▪️ How much revenue is translated into net income

▪️Are revenues and net income predictable and robust?

▪️ Does the company have a high gross margin?

▪️ Is the company structurally profitable?

▪️ How much revenue is translated into net income

That's it for today!

If you want to read the full article, take a look here:

qualitycompounding.substack.com

If you want to read the full article, take a look here:

qualitycompounding.substack.com

Loading suggestions...