On today's episode of "Let's do #Defi"

Let's talk about Yield farming, How & where you can capitalize and make the best out of it.

A Thread 🧵

Let's talk about Yield farming, How & where you can capitalize and make the best out of it.

A Thread 🧵

First, what is yield farming?

Now, you can also call it "liquidity mining"

See in the world of decentralized finance (DeFi), People like me & you can provide cryptocurrency to a DeFi protocol's liquidity pool, to earn rewards in the form of additional cryptocurrency...

Now, you can also call it "liquidity mining"

See in the world of decentralized finance (DeFi), People like me & you can provide cryptocurrency to a DeFi protocol's liquidity pool, to earn rewards in the form of additional cryptocurrency...

...tokens or fees generated by the protocol.

Now, these rewards are often distributed to us in the form of governance tokens, which grant us voting rights in the DeFi protocol's decision-making processes.

Now, these rewards are often distributed to us in the form of governance tokens, which grant us voting rights in the DeFi protocol's decision-making processes.

And the more liquidity a person provides to the protocol, the more rewards they can earn.

Now the yields earned are represented in annual interest (APR).

APR is a way of measuring the rate of return on investment over the course of a year, and it is commonly used in the...

Now the yields earned are represented in annual interest (APR).

APR is a way of measuring the rate of return on investment over the course of a year, and it is commonly used in the...

...financial industry to compare the return on different investments.

While in yield farming, the APR represents the expected rate of return on the investment of providing liquidity to a DeFi protocol.

While in yield farming, the APR represents the expected rate of return on the investment of providing liquidity to a DeFi protocol.

But, in DeFi, it's important to know that the actual yield earned in yield farming can be influenced by a number of factors, by influenced here I mean the APRs can increase and decrease due to some reasons...

...like changes in the price of the tokens being provided as liquidity, change in the demand for those tokens, and changes in the rewards offered by the DeFi protocol.

Now, While yield farming is a part of the DeFi ecosystems, it's important to note that not all farming protocols adhere to DeFi principles. Some protocols may offer misleadingly high APRs to attract users, but fail to deliver on those promises.

And this is why today I bring to you @Stablzone

What is @Stablzone?

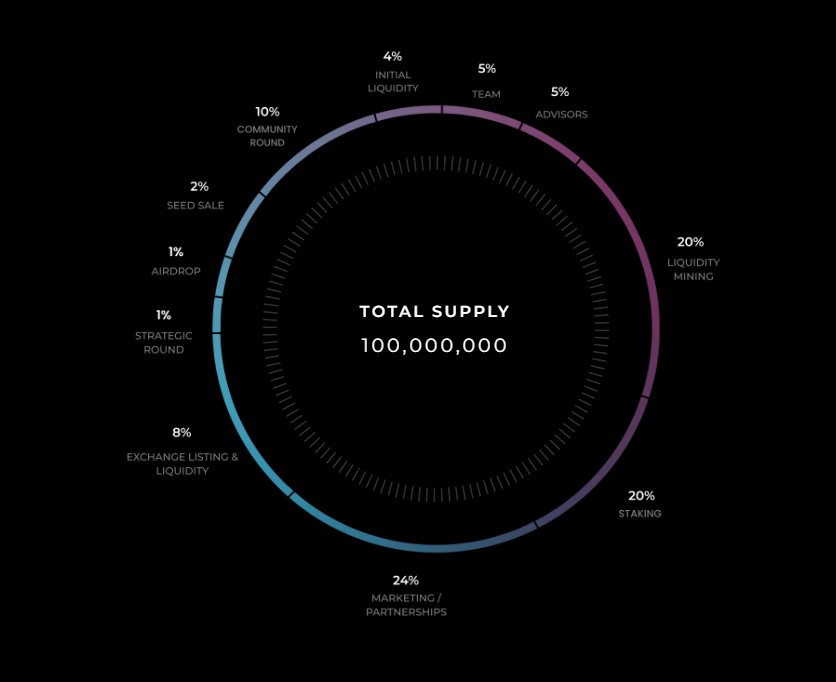

Stablz is an ever-evolving yield-capturing protocol built on top of existing farming protocols. their goal is to simplify yield earning both in terms of searching for safe places to store liquidity,

What is @Stablzone?

Stablz is an ever-evolving yield-capturing protocol built on top of existing farming protocols. their goal is to simplify yield earning both in terms of searching for safe places to store liquidity,

and earn as much real yield as possible, delivered directly to depositors, and you can also earn rewards in Stables.

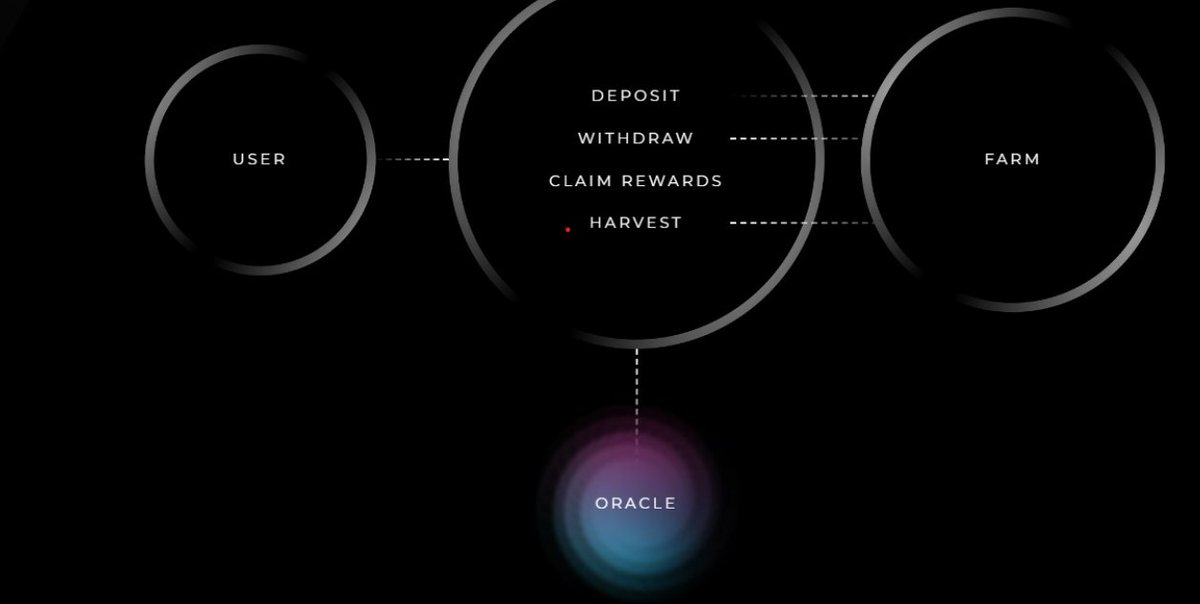

@Stablzone is first built on top of the @CurveFinance and for example, you can deposit USDT in the Stablz farming pool(3CRV POOL) were yield is harvested in $CRV & $CRV converted to stables by Stablz Smart Contracts & stored in 3CRV LP & you can easily withdraw USDT, USDC e.t.c

The Stablz farming pools provide benefits such as depeg protection by automated monitoring of prices in USD vaults, Emergency withdraws when an asset loses its peg sharply, & converting it into a Safe asset e.g (USDT, DAI e.t.c) & periodic auto-claim features convert CRV to USDT

And Stablz is bringing another pool live on 16 Mar, 9 PM UTC,

"Cannavest": RWA (real-world asset) pool that will allow you to deposit USDT and earn a USDT yield of 30% APR. The pool will be locked for 1-year and depositors will be given non-tradable receipt tokens

"Cannavest": RWA (real-world asset) pool that will allow you to deposit USDT and earn a USDT yield of 30% APR. The pool will be locked for 1-year and depositors will be given non-tradable receipt tokens

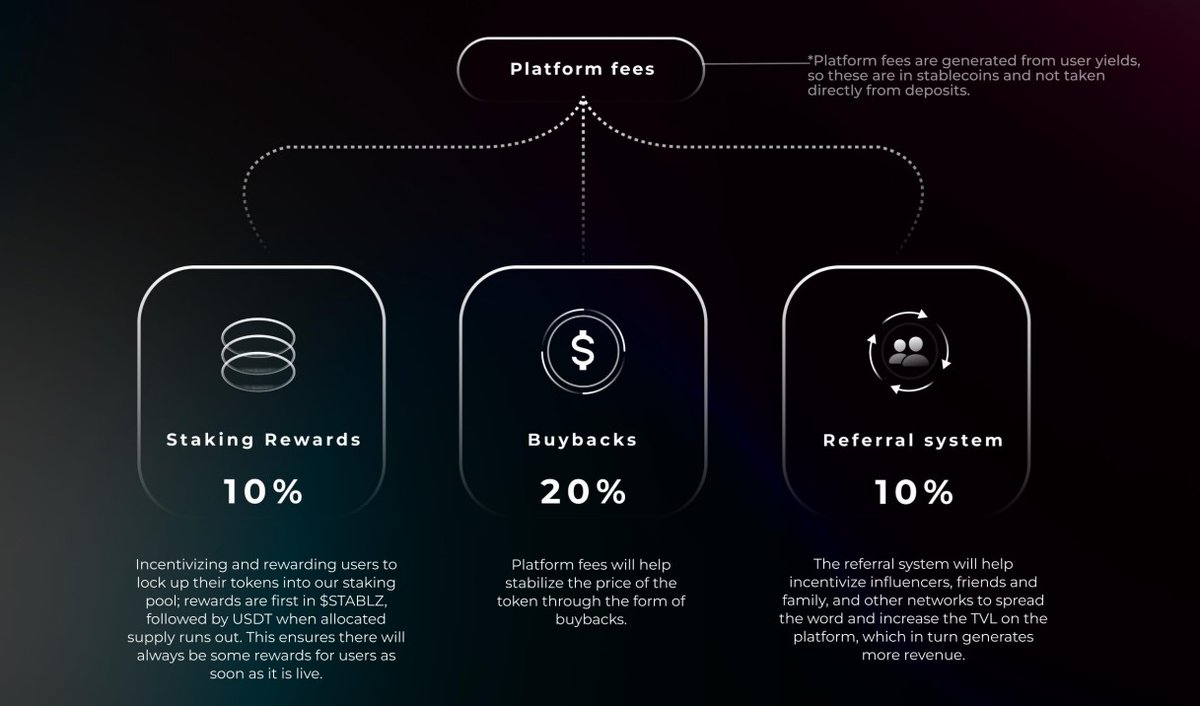

The revenue model of @Stablzone is quite simple as well,

they earn platform fee's on users' generated yield.

Currently, it is set to a 20% performance and automation fee, and the depositor earns 80% of their yield & The 20% is then distributed as follows:

they earn platform fee's on users' generated yield.

Currently, it is set to a 20% performance and automation fee, and the depositor earns 80% of their yield & The 20% is then distributed as follows:

Well, @Stablzone has undergone multiple security audits from

@hacken & even @AssureDefi with trading available on @BitMartExchange.

@hacken & even @AssureDefi with trading available on @BitMartExchange.

And there you have it, the end of today's episode, see you next time.

Please do well to follow, like, retweet, and tag your friends so they do not miss out, And don't forget to turn on posts 🔔too. Thank you😌.

Please do well to follow, like, retweet, and tag your friends so they do not miss out, And don't forget to turn on posts 🔔too. Thank you😌.

Loading suggestions...