21 must-know DeFiLlama features you should be using:

DeFiLlama is the most popular tool in DeFi.

But most people are probably using around 10% of its features.

They've been continuously shipping this past year, and some of their best updates have flown under the radar.

I've gathered some of my favorites.

Here's your Edge 🗡️:

But most people are probably using around 10% of its features.

They've been continuously shipping this past year, and some of their best updates have flown under the radar.

I've gathered some of my favorites.

Here's your Edge 🗡️:

Long-Short Strategies

You short AND long a token in different places. This gives you no price exposure, but you earn rewards.

DL aggregates the various opportunities.

The thread linked goes into more detail.

You short AND long a token in different places. This gives you no price exposure, but you earn rewards.

DL aggregates the various opportunities.

The thread linked goes into more detail.

DeFiLlama Chrome Extension

This just released (safe - it's open source)

• Show prices of tokens that aren't priced on etherscan

• Enhances your etherscan research

• Behavior-based wallet tagging

• Protects you from scams

This just released (safe - it's open source)

• Show prices of tokens that aren't priced on etherscan

• Enhances your etherscan research

• Behavior-based wallet tagging

• Protects you from scams

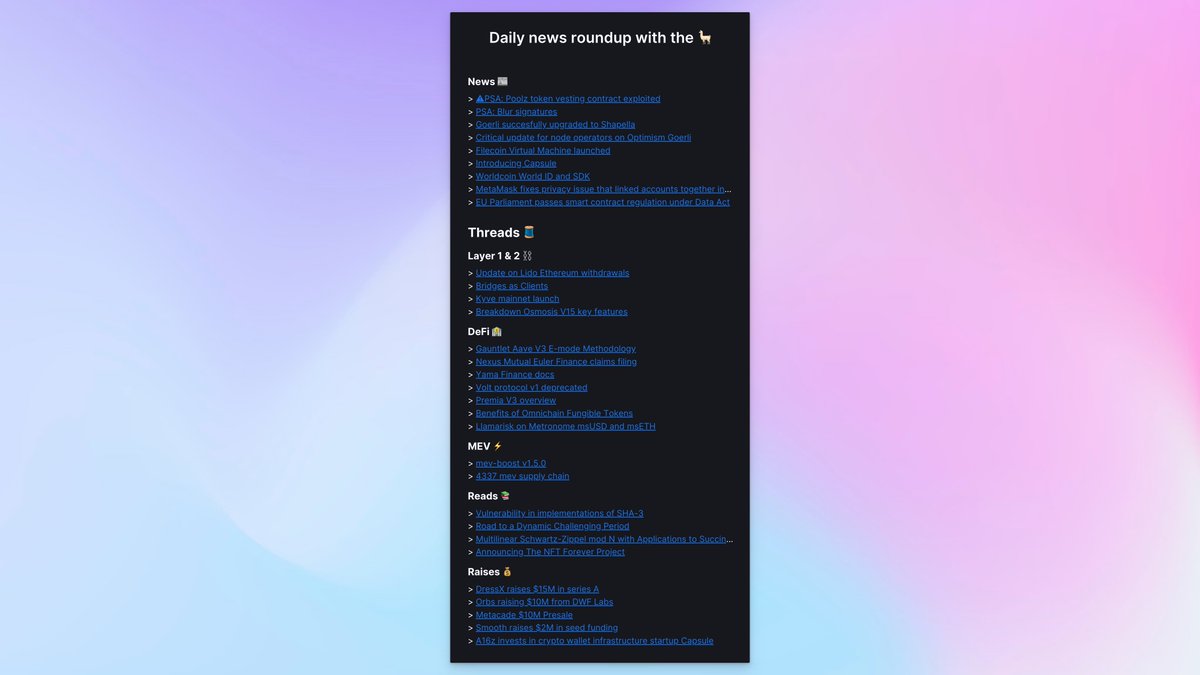

DL Roundup

The Daily Ape was my go-to for daily news curation, but they've been on a hiatus.

I'm filling the void with DL's Roundup - curated by @LlamaIntern.

You can see it on the site or subscribe to their Telegram channel.

The Daily Ape was my go-to for daily news curation, but they've been on a hiatus.

I'm filling the void with DL's Roundup - curated by @LlamaIntern.

You can see it on the site or subscribe to their Telegram channel.

Additional Features

I can't cover every single DL feature because everyone has A.D.D.

1) I left off airdrops, cex transparency, hacks, etc., because they're self-explanatory.

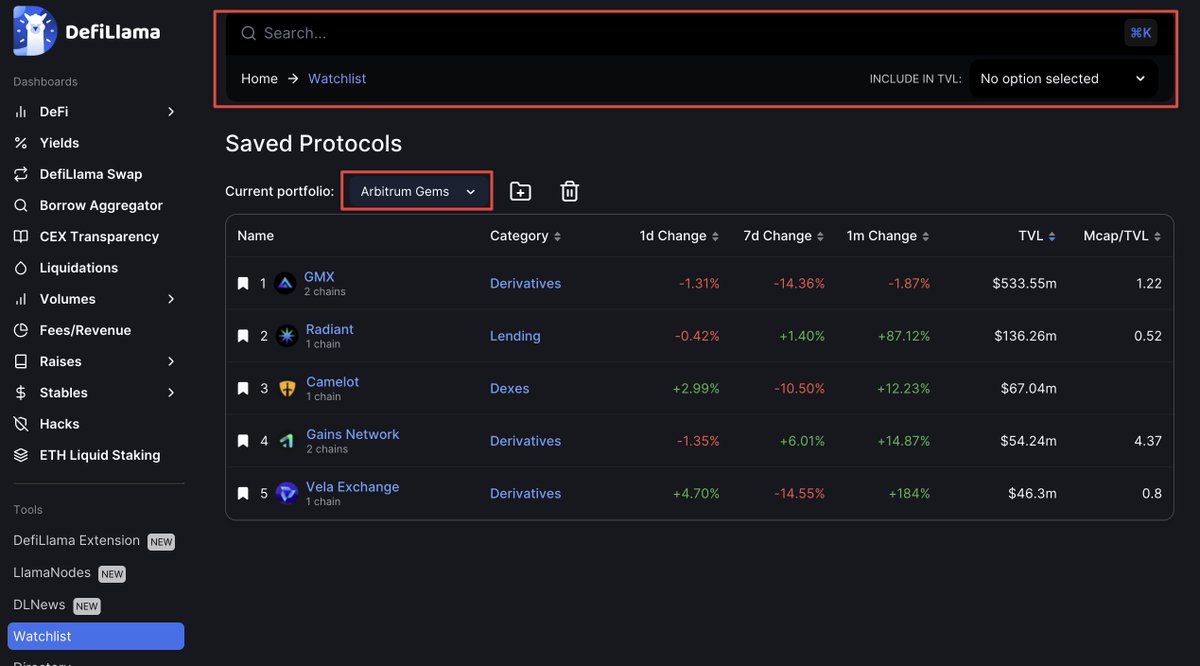

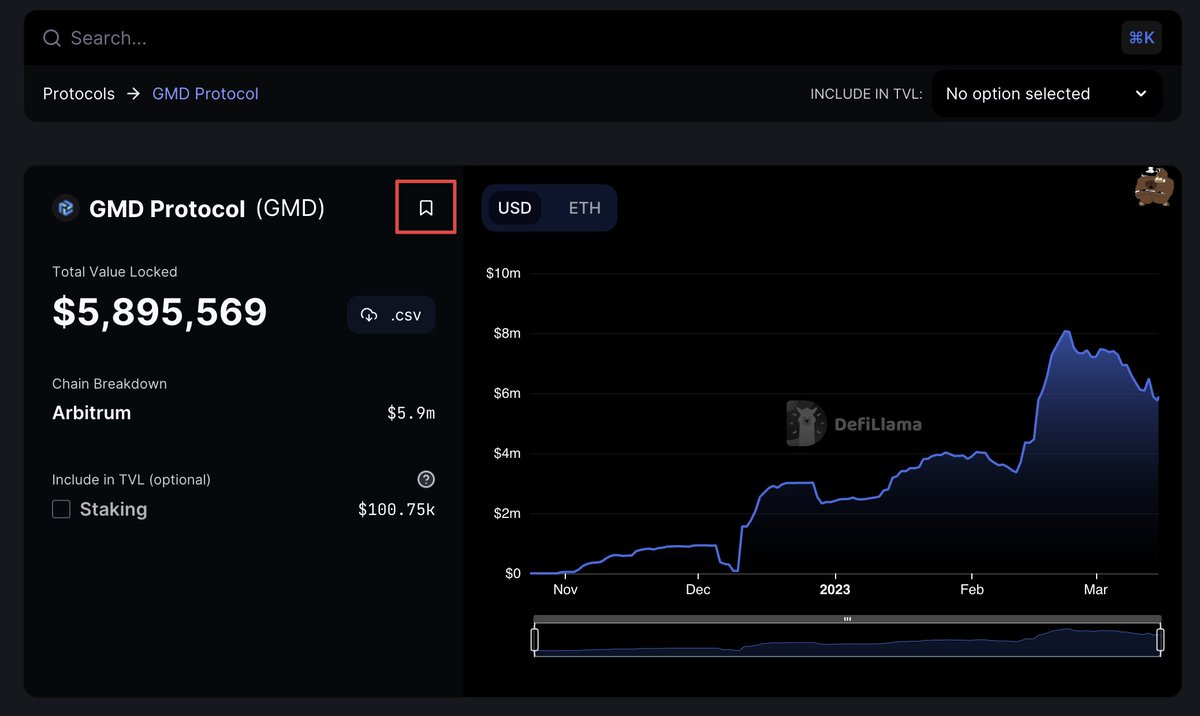

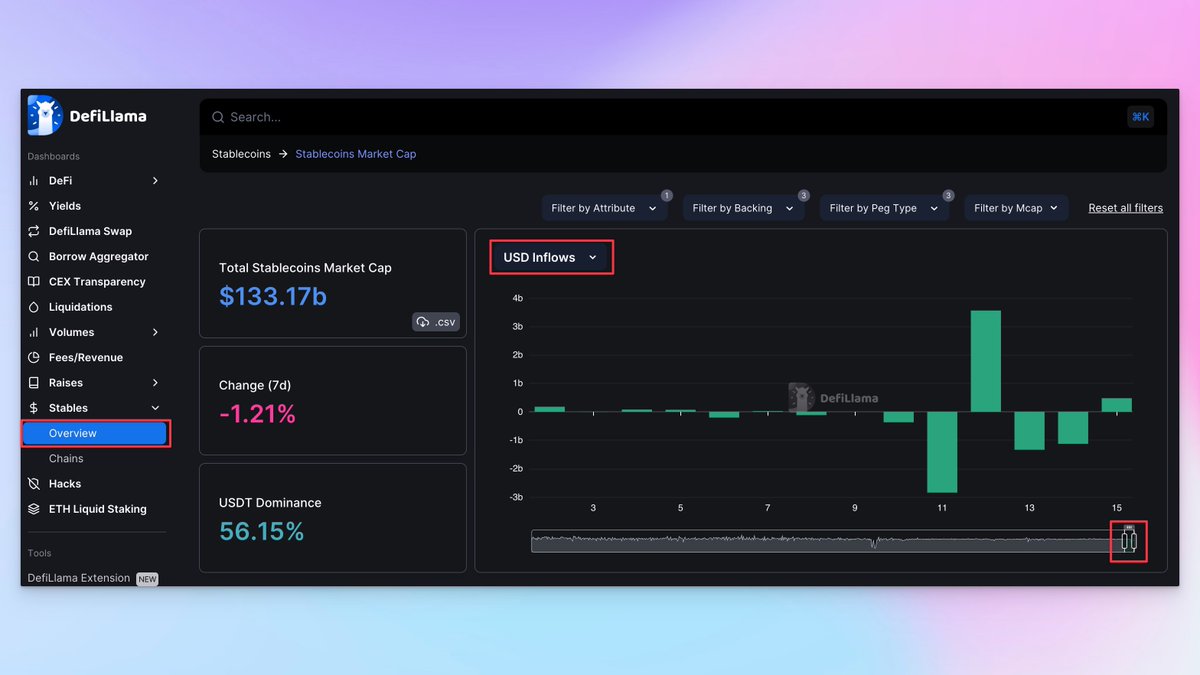

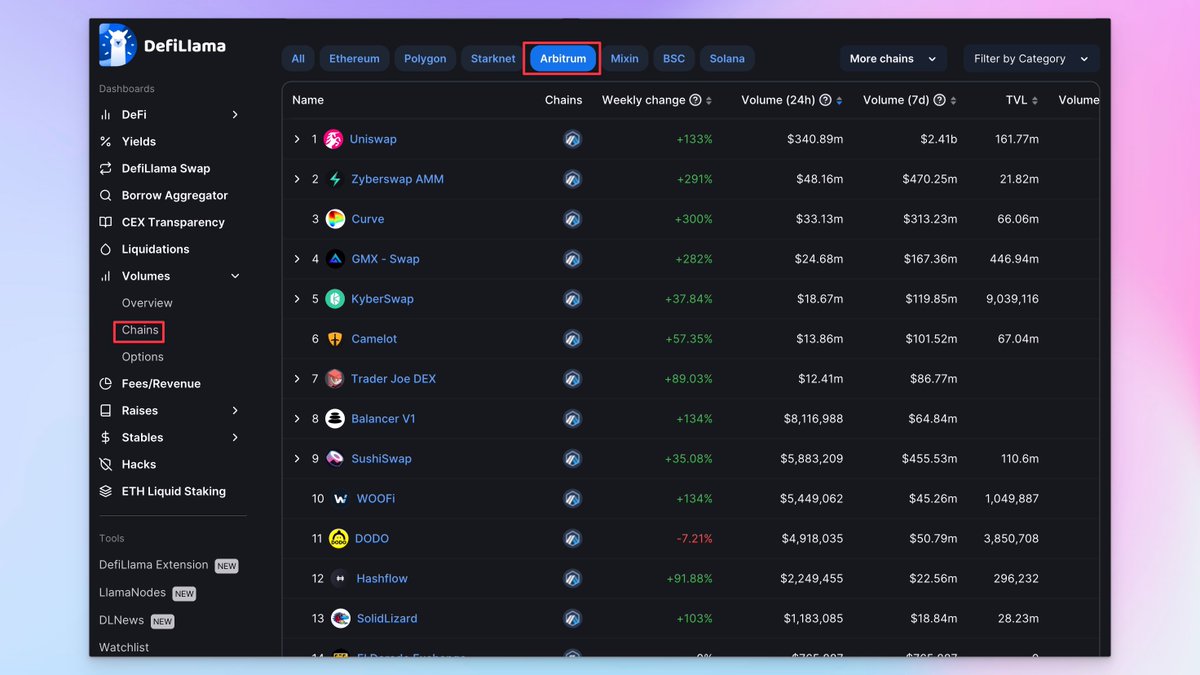

2) Finding gem features are shared on this thread linked below.

I can't cover every single DL feature because everyone has A.D.D.

1) I left off airdrops, cex transparency, hacks, etc., because they're self-explanatory.

2) Finding gem features are shared on this thread linked below.

Risks

I'm sharing different features of DeFiLllama.

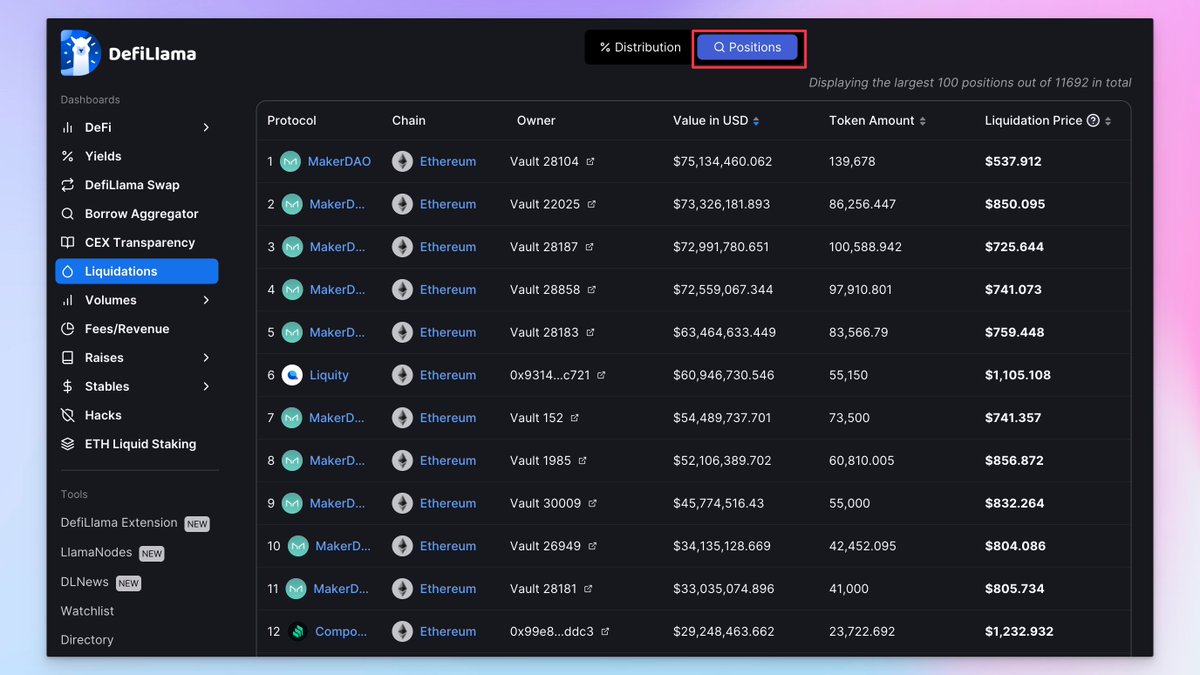

1) Some strategies require active management (so you don't get liquidated)

2) Combining strategies of multiple platforms = additional risks.

So make sure you do your research before you ape into any strategies.

I'm sharing different features of DeFiLllama.

1) Some strategies require active management (so you don't get liquidated)

2) Combining strategies of multiple platforms = additional risks.

So make sure you do your research before you ape into any strategies.

I hope you enjoyed this thread.

I spend hours each day observing & analyzing what I see on DL.

It's much better to find your own alpha than to rely on others who may dump on you.

Please retweet the 1st tweet in the thread if you think your audience would enjoy it 🥺.

I spend hours each day observing & analyzing what I see on DL.

It's much better to find your own alpha than to rely on others who may dump on you.

Please retweet the 1st tweet in the thread if you think your audience would enjoy it 🥺.

جاري تحميل الاقتراحات...