Education

Technology

Business

Startups

Employee Benefits

Growth

Venture Capital

Private Equity

Promotions

Word of Mouth

Edtech

Variable Cost

Cash Burn

Loss Making

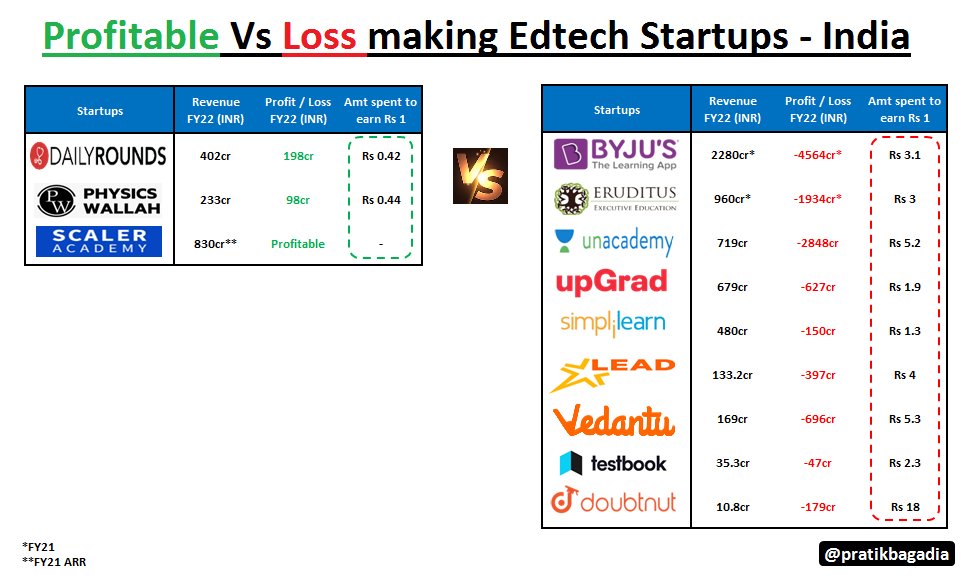

#edtech saw exponential growth during Covid yet the no# of profitable startups are handful

The amt spend for earning Re1 in Rev is just 40Paise for profitable startups vs >Rs5 for #unicorns like Vendantu/Unacademy

Why PW and DR profitable?

🧵

#venturecapital #PrivateEquity

The amt spend for earning Re1 in Rev is just 40Paise for profitable startups vs >Rs5 for #unicorns like Vendantu/Unacademy

Why PW and DR profitable?

🧵

#venturecapital #PrivateEquity

Reasons why DailyRounds (DR) and PhysicsWallah (PW) profitable:

-Growth through Word of Mouth:

DR and PW spend <Rs10cr in Promotions whereas Byjus spent Rs2000cr+ Eruditus spent Rs500cr+ of promotions

Word of Mouth publicity is far more impactful than paid promotions

(2/n)

-Growth through Word of Mouth:

DR and PW spend <Rs10cr in Promotions whereas Byjus spent Rs2000cr+ Eruditus spent Rs500cr+ of promotions

Word of Mouth publicity is far more impactful than paid promotions

(2/n)

Variable cost:

60% of Byjus expenses while 84% of Unacademy expenses are on Employee benefits+ promotion

Whereas

for DR it is just 39% of total expense

Cash Burn of Loss making Unicorns are at crazy levels as their Business Model doesnt support growth through CashFlows

(3/n)

60% of Byjus expenses while 84% of Unacademy expenses are on Employee benefits+ promotion

Whereas

for DR it is just 39% of total expense

Cash Burn of Loss making Unicorns are at crazy levels as their Business Model doesnt support growth through CashFlows

(3/n)

Unit Economics:

Profitable Startups like PW, DR and Scaler Academy depends on Cashflows for their growth

On a unit level, DR/PW spent just Re 0.42 to earn a rupee

The Ebidta margins are >55% of these startups while for startups like Doubtnut it is -1100%

(4/n)

Profitable Startups like PW, DR and Scaler Academy depends on Cashflows for their growth

On a unit level, DR/PW spent just Re 0.42 to earn a rupee

The Ebidta margins are >55% of these startups while for startups like Doubtnut it is -1100%

(4/n)

Revenue Model:

DR follows Subscription based Revenue Model while making loss making startups like Testbook / Doubtnut have Freemium model

Converting students from Free model to Paid model is super tough, which is why these startups end up spending more on unit level

(5/n)

DR follows Subscription based Revenue Model while making loss making startups like Testbook / Doubtnut have Freemium model

Converting students from Free model to Paid model is super tough, which is why these startups end up spending more on unit level

(5/n)

Post Covid Edtech startups are now moving towards Offline + Online model which is likely to add up their Rental cost

Growth driven startups generally ends up burning Millions of dollars

It will be interesting to see if these startups think about Profitability anytime soon

Growth driven startups generally ends up burning Millions of dollars

It will be interesting to see if these startups think about Profitability anytime soon

Loading suggestions...