2. Buffett's admiration for Graham would go so far that he became his pupil at Columbia Business School, and would later work for his firm.

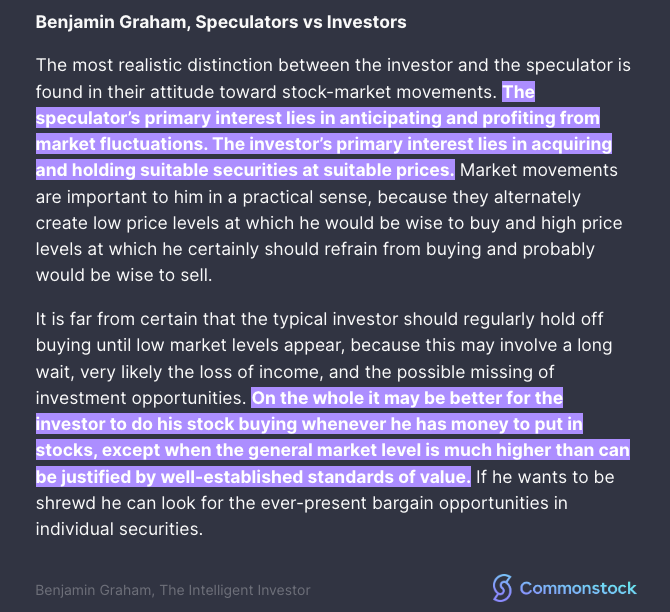

Someone in the Commonstock community kindly curated a series of 10 lectures that Graham gave in 1946/47.

commonstock.com

Someone in the Commonstock community kindly curated a series of 10 lectures that Graham gave in 1946/47.

commonstock.com

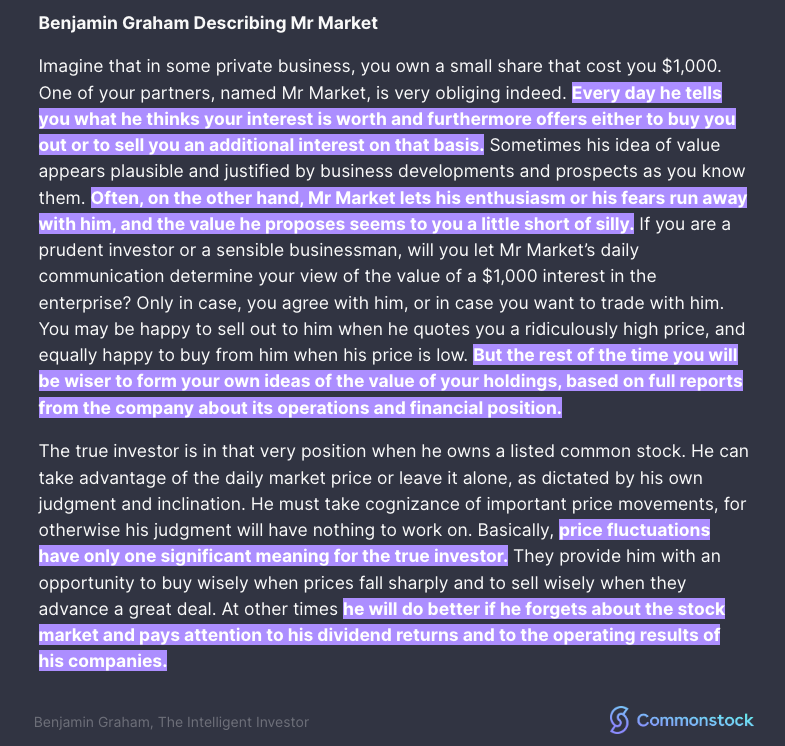

3. “In the short run, the market is a voting machine but in the long run, it is a weighing machine".

- Graham's most famous quote. Stocks are traded on popularity in the short term, but the best businesses are valued appropriately over the long term.

- Graham's most famous quote. Stocks are traded on popularity in the short term, but the best businesses are valued appropriately over the long term.

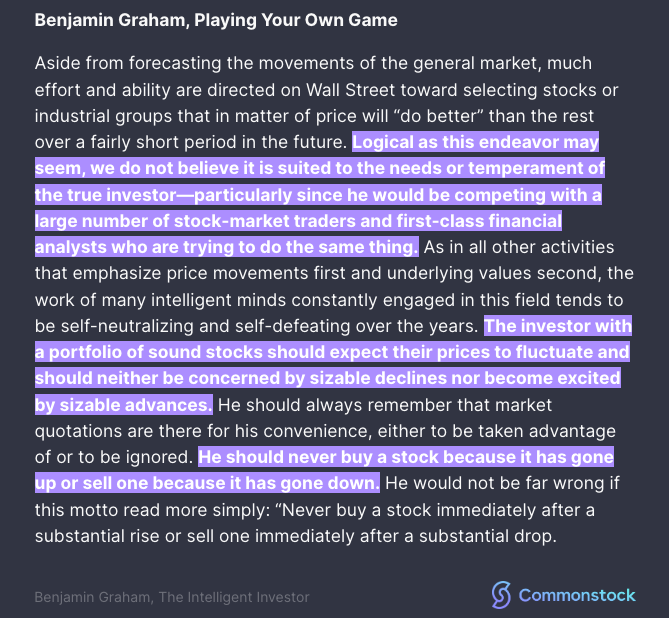

6. "People who invest make money for themselves; people who speculate make money for their brokers".

- The investment industry is designed to induce trading volume. Ignore the noise.

- The investment industry is designed to induce trading volume. Ignore the noise.

7. “Invest only if you would be comfortable owning a stock even if you had no way of knowing its daily share price".

- Buffett often echoes this sentiment, saying that we should buy stocks that we would be comfortable owning if the market closed for a decade.

- Buffett often echoes this sentiment, saying that we should buy stocks that we would be comfortable owning if the market closed for a decade.

8. "You must thoroughly analyze a company, and the soundness of its underlying businesses, before you buy its stock; you must deliberately protect yourself against serious losses; you must aspire to “adequate,” not extraordinary, performance.”

- Know what you own and aim high.

- Know what you own and aim high.

10. “A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price".

- Consider yourself the part owner of the businesses you invest in.

- Consider yourself the part owner of the businesses you invest in.

11. “If the reason people invest is to make money, then in seeking advice they are asking others to tell them how to make money. That idea has some element of naïveté".

- Equip yourself with the tools to identify quality companies. Borrowed conviction can be dangerous.

- Equip yourself with the tools to identify quality companies. Borrowed conviction can be dangerous.

Loading suggestions...