I think the Fed is close to being done QT.

That doesn't mean rate cuts or anything like that, but it seems like the balance sheet drawdown is likely to end prior to rate cuts being initiated.

That doesn't mean rate cuts or anything like that, but it seems like the balance sheet drawdown is likely to end prior to rate cuts being initiated.

If there's a rapid drawdown in the TGA then that could give the Fed a few more months of QT runway.

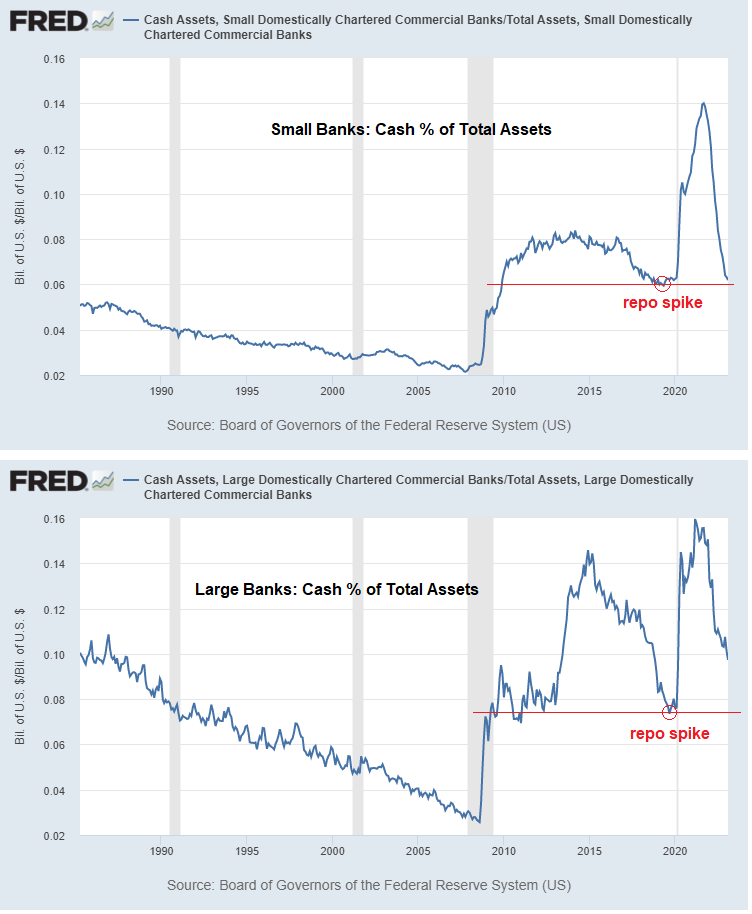

But in terms of total liquidity, it seems hard to pull much more out than these levels.

But in terms of total liquidity, it seems hard to pull much more out than these levels.

Loading suggestions...