Tesla is the world's largest electric car company, but there's more to Tesla than cars.

It generated $1.46 bn revenue by selling regulatory Carbon Credits to legacy car companies such as GM & Fiat in 2021!

So what're Carbon Credits, & how do they help Tesla reap huge dividends?

It generated $1.46 bn revenue by selling regulatory Carbon Credits to legacy car companies such as GM & Fiat in 2021!

So what're Carbon Credits, & how do they help Tesla reap huge dividends?

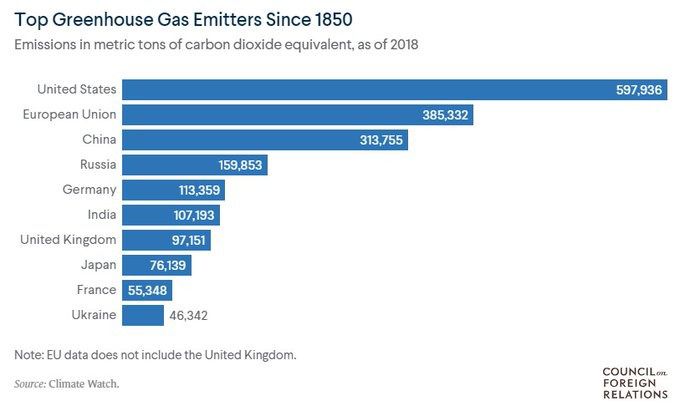

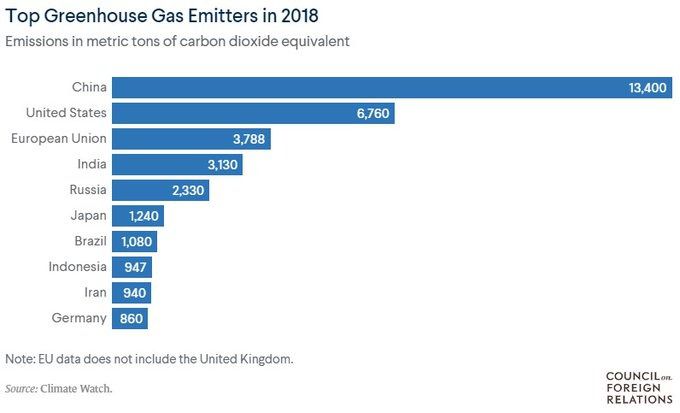

We’ve been increasingly feeling the impact of climate change due to increasing greenhouse gas (GHG) emissions.

And we have a lot of great solutions to combat it, such as burying CO2 in the seabed.

But the scale at which we need to reduce emissions is not economical at the time.

And we have a lot of great solutions to combat it, such as burying CO2 in the seabed.

But the scale at which we need to reduce emissions is not economical at the time.

— Because most of these solutions are expensive, and

— they don’t generate revenue for the companies capable of implementing these solutions.

Hence, there was a need for an economic driver to fight climate change, and the good news is that we do have one.

CARBON MARKETS!

— they don’t generate revenue for the companies capable of implementing these solutions.

Hence, there was a need for an economic driver to fight climate change, and the good news is that we do have one.

CARBON MARKETS!

Under Kyoto Protocol, several mechanisms were introduced to help countries reach their targets.

One of them was Emissions Trading, also known as Cap and Trade, which led to the establishment of global carbon markets.

The oldest active market today is the EU ETS launched in '05.

One of them was Emissions Trading, also known as Cap and Trade, which led to the establishment of global carbon markets.

The oldest active market today is the EU ETS launched in '05.

Now, this market-based system placed an economic value on GHG emissions and a new way of cutting emissions was born.

Moreover, it provides incentives for countries and businesses to reduce their carbon footprint, so it’s a win-win.

What are the characteristics of these markets?

Moreover, it provides incentives for countries and businesses to reduce their carbon footprint, so it’s a win-win.

What are the characteristics of these markets?

— These are REGULATED MARKETS with regulations at the regional and state levels.

— Government sets a “cap” on the amount of emission permitted across an industry, and this cap keeps getting stricter every year.

— Government sets a “cap” on the amount of emission permitted across an industry, and this cap keeps getting stricter every year.

— Now, these permits are allocated in the form of CARBON CREDITS where

one credit permits 1 ton of CO2 or equivalent GHG emissions.

— Some companies produce less emissions than permitted, while some produce more emissions. They are allowed to “trade” credits as and when needed.

one credit permits 1 ton of CO2 or equivalent GHG emissions.

— Some companies produce less emissions than permitted, while some produce more emissions. They are allowed to “trade” credits as and when needed.

This supply and demand determines the price of a carbon credit.

The global markets for carbon credits increased by almost 164% in 2021, and the price of credits could rise significantly in future.

The total size of the sector is expected to breach the $100 bn mark by 2030.

The global markets for carbon credits increased by almost 164% in 2021, and the price of credits could rise significantly in future.

The total size of the sector is expected to breach the $100 bn mark by 2030.

Now, apart from the regulatory market which is mandated, we also have a VOLUNTARY MARKET which is optional.

See, almost every activity, even ours, contributes to the greenhouse effect — causing climate change.

But we can do our part to act on fighting it by purchasing offsets.

See, almost every activity, even ours, contributes to the greenhouse effect — causing climate change.

But we can do our part to act on fighting it by purchasing offsets.

— Companies which removes carbon from the atmosphere as a part of their usual business, or reduction/removal projects such as reforestation can generate offsets.

For ex, carbon sequestration on agricultural lands could offset 4% of annual global human-induced GHG emissions.

For ex, carbon sequestration on agricultural lands could offset 4% of annual global human-induced GHG emissions.

However, farmers need an incentive as this practice can be time-consuming and expensive.

They can benefit from participating in the carbon market.

A farmer who sequesters one offset can earn approximately INR 780 at current market prices, but rates are likely to get better.

They can benefit from participating in the carbon market.

A farmer who sequesters one offset can earn approximately INR 780 at current market prices, but rates are likely to get better.

— Not only businesses, but also individuals like us can purchase CARBON OFFSETS to offset our carbon footprint.

— The basic unit traded is the same: 1 Carbon Offset = 1 Carbon Credit

But like every other system, the carbon market system also had several loopholes.

— The basic unit traded is the same: 1 Carbon Offset = 1 Carbon Credit

But like every other system, the carbon market system also had several loopholes.

There were widespread reports of corruption and abuse of under the Kyoto Protocol which is believed to have actually enabled the emissions to increase by 600 million metric tons.

— 80% projects that claimed to offset carbon were questionable.

— 80% projects that claimed to offset carbon were questionable.

— Developed countries are able to invest in low-carbon tech and have reoriented their economies to less carbon-intensive activities unlike poor countries.

The carbon market crashed in 2012 and that led to the Kyoto Protocol being fully replaced by the Paris Agreement in 2015.

The carbon market crashed in 2012 and that led to the Kyoto Protocol being fully replaced by the Paris Agreement in 2015.

Its goal is to limit global warming to well below 2, preferably to 1.5°C, compared to pre-industrial levels.

So, how did the Paris Agreement improve upon Kyoto?

Firstly, it recognized that climate change is a shared problem and called on ALL countries to set emissions targets.

So, how did the Paris Agreement improve upon Kyoto?

Firstly, it recognized that climate change is a shared problem and called on ALL countries to set emissions targets.

Secondly, it specified that developed countries should provide financial aid to those that are less endowed and more vulnerable.

Lastly, it also encouraged voluntary contributions.

As a result, the voluntary market took off in 2017, more than doubling in size in the last 5 yrs.

Lastly, it also encouraged voluntary contributions.

As a result, the voluntary market took off in 2017, more than doubling in size in the last 5 yrs.

The Paris Agreement and Carbon Markets are not perfect, but the best we could.

What if doing business gets expensive because of this system? Won't it ultimately trickle down and impact the consumers — i.e., us?

There are many such shortcomings which still need to be addressed.

What if doing business gets expensive because of this system? Won't it ultimately trickle down and impact the consumers — i.e., us?

There are many such shortcomings which still need to be addressed.

Although imperfect, this system is forcing companies to consider their effect on the climate and has led to reduction in emissions where it has been implemented.

While this alone cannot save the world, this is definitely a step in the right direction and can help decarbonize it.

While this alone cannot save the world, this is definitely a step in the right direction and can help decarbonize it.

If you liked this read, do ReTweet🔄 the 1st tweet

and follow us @FinFloww

for more such reads every Monday, Wednesday and Friday!

and follow us @FinFloww

for more such reads every Monday, Wednesday and Friday!

Join 10,167 people who receive such stories daily on their WhatsApp:

chat.whatsapp.com

chat.whatsapp.com

Join 4486 people who are receiving some beautiful and mind-bending stories from various spheres of life every Sunday.

Subscribe to “What The Floww?” — our exclusive email newsletter: finfloww.substack.com

Subscribe to “What The Floww?” — our exclusive email newsletter: finfloww.substack.com

We're also launching our Youtube channel soon.

Subscribe to not miss our first drop: @FinFloww" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

Subscribe to not miss our first drop: @FinFloww" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

Loading suggestions...