Looking for a way to long/short arbitrum altcoins that aren't listed on CEX?

Add @SiloFinance into ur trading tools set!

📍In this thread

1️⃣ What is Silo finance

2️⃣ Why is Lambro looking at it

3️⃣ Strategies you can run with lending market

4️⃣ Speculation, action plan & Summary

Add @SiloFinance into ur trading tools set!

📍In this thread

1️⃣ What is Silo finance

2️⃣ Why is Lambro looking at it

3️⃣ Strategies you can run with lending market

4️⃣ Speculation, action plan & Summary

TLDR

Silo Finance is a lending market with isolated pool, enabling altcoins lending with isolated risk.

Lambro thoughts

❓Newly deployed on Arbitrum, opportunity?

❓Tool for strategies on volatile arbitrum altcoin?

🤔Thoughts of Silo token

Unrolled

2lambroz.substack.com

Silo Finance is a lending market with isolated pool, enabling altcoins lending with isolated risk.

Lambro thoughts

❓Newly deployed on Arbitrum, opportunity?

❓Tool for strategies on volatile arbitrum altcoin?

🤔Thoughts of Silo token

Unrolled

2lambroz.substack.com

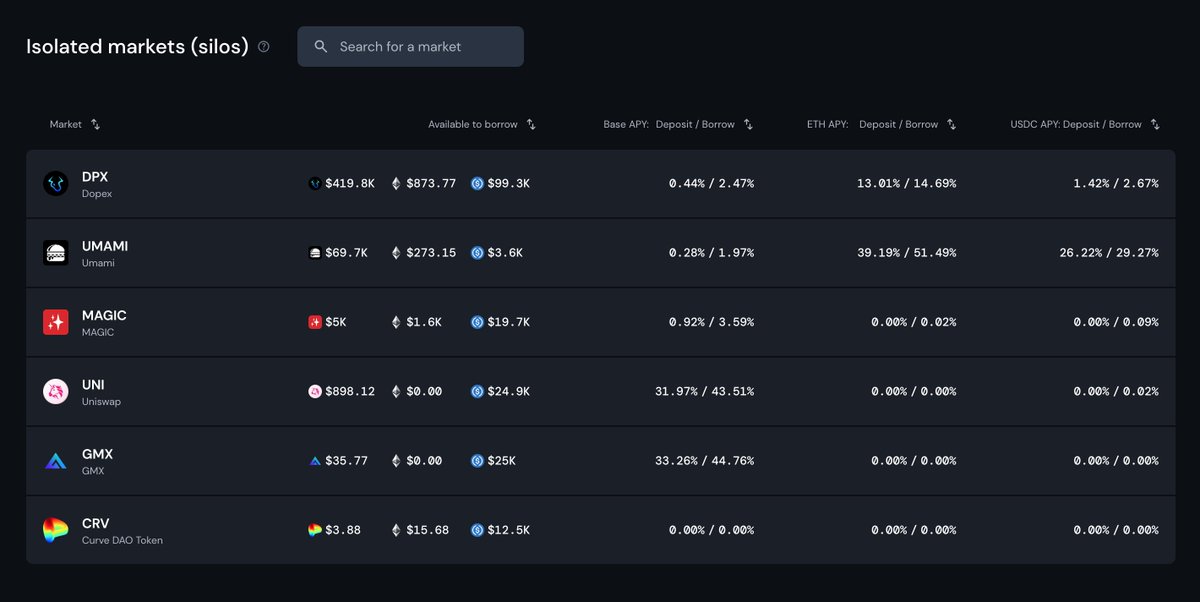

Lets go over 3 key points of the protocol

🔹Isolated Lending pools

🔹Bridge Asset ETH & Xai

🔹Interest Rate Model

🔹Isolated Lending pools

🔹Bridge Asset ETH & Xai

🔹Interest Rate Model

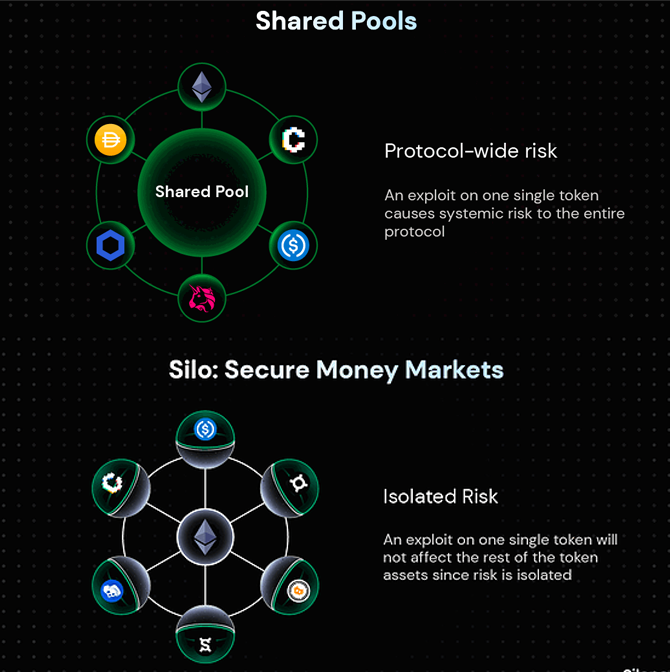

🔹Isolated Lending Pools

As mentioned before in my @eulerfinance thread, lending protocol with shared pool has better lending liquidity.

However due to the shared lending pool design, all the asset shares bad debt risk, limiting type of assets that can be listed

As mentioned before in my @eulerfinance thread, lending protocol with shared pool has better lending liquidity.

However due to the shared lending pool design, all the asset shares bad debt risk, limiting type of assets that can be listed

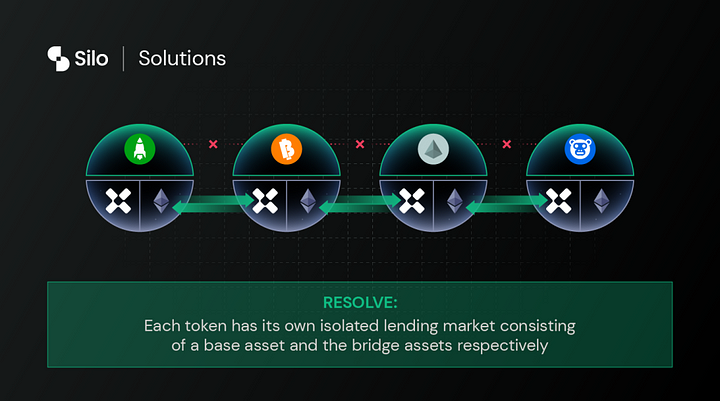

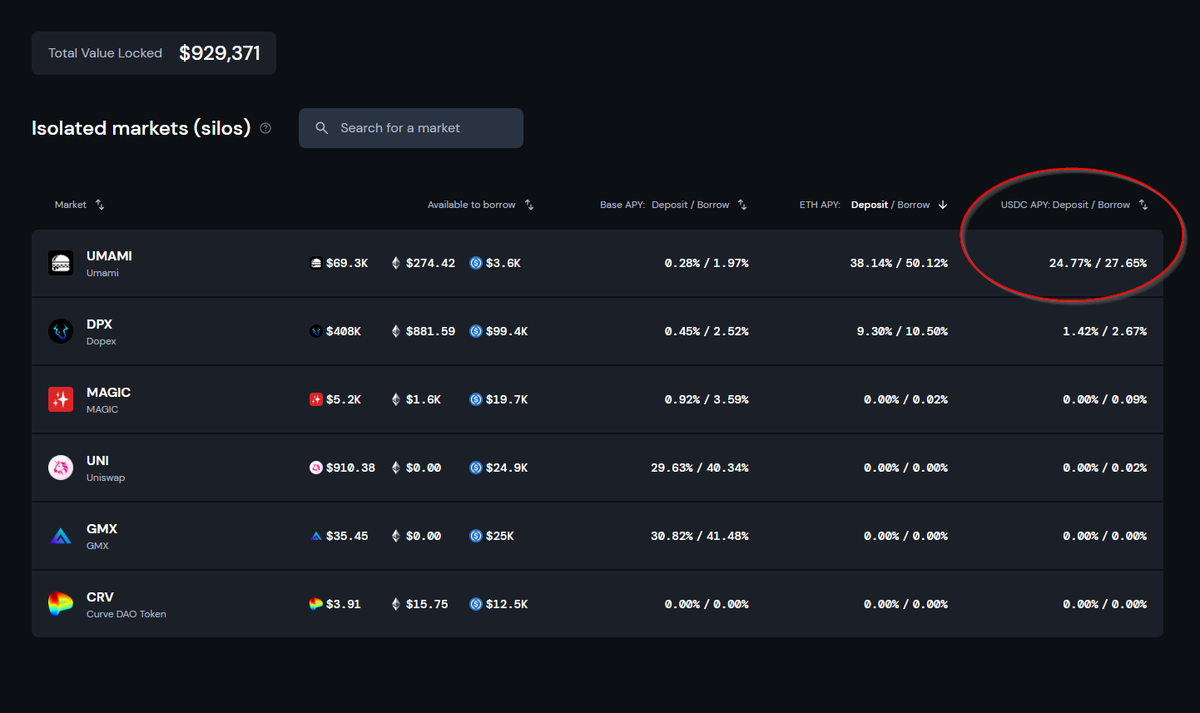

By isolating each asset into their own lending pools @SiloFinance can allow users to borrow & lend any exortic altcoins without sharing the same bad debt risk between different asset

Instead of borrowing ETH to go from asset A to B, users will be able to collateralize XAI to borrow any token asset in the protocol. However i think the adoption of XAI was not very popular and they are focusing more on USDC now.

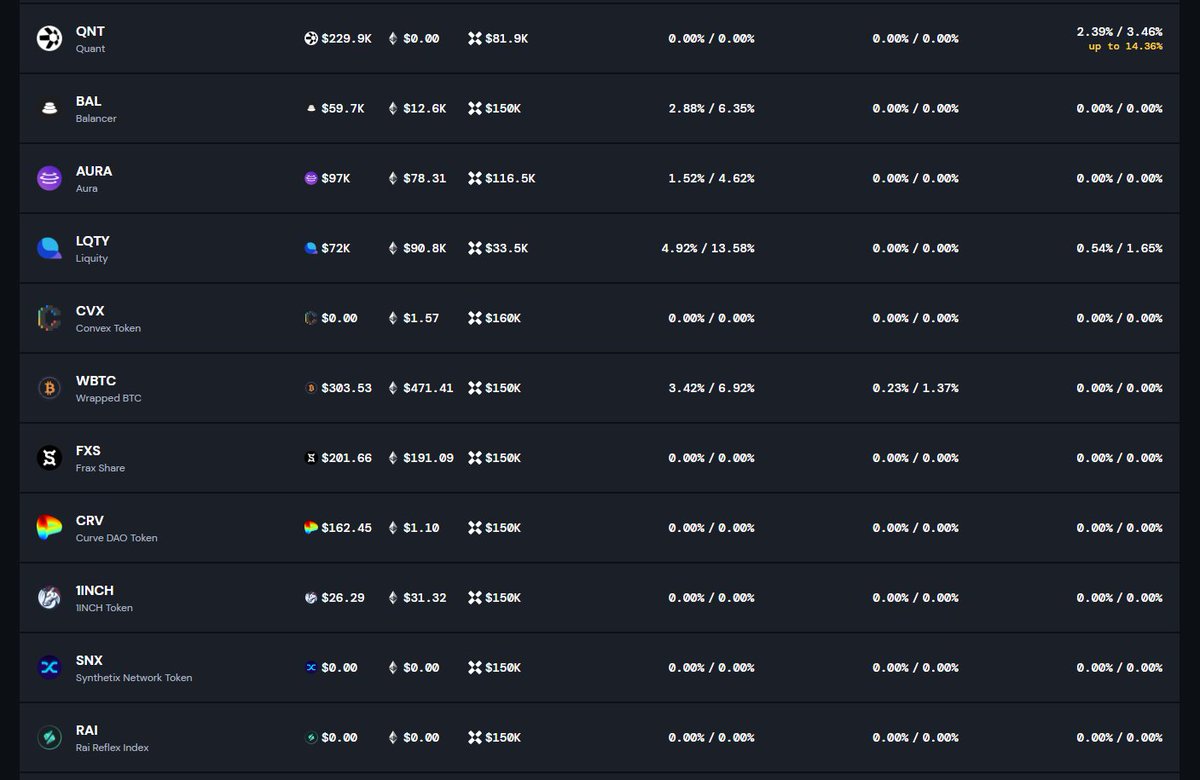

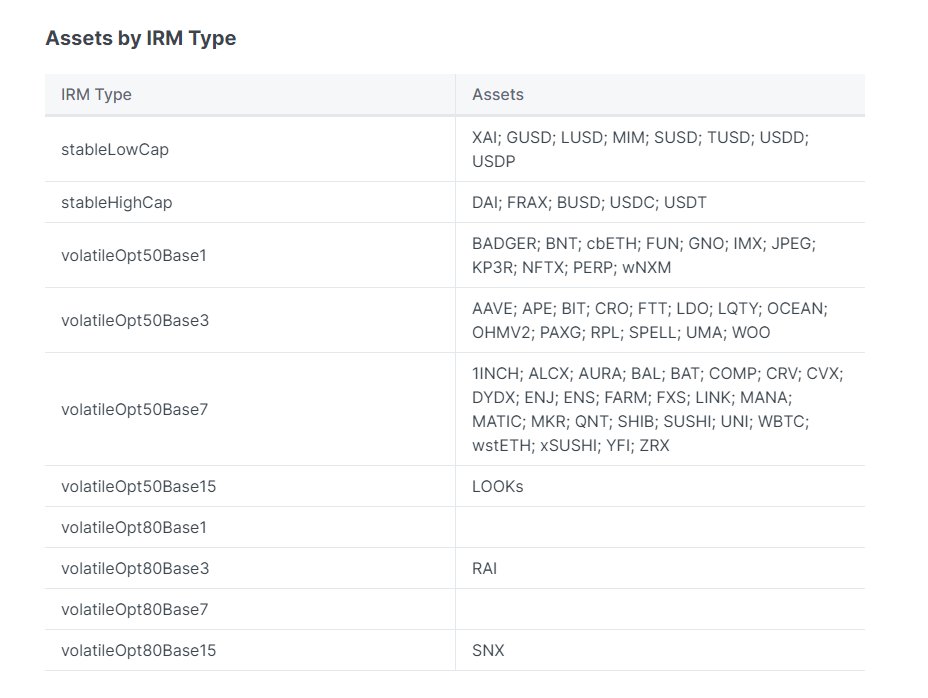

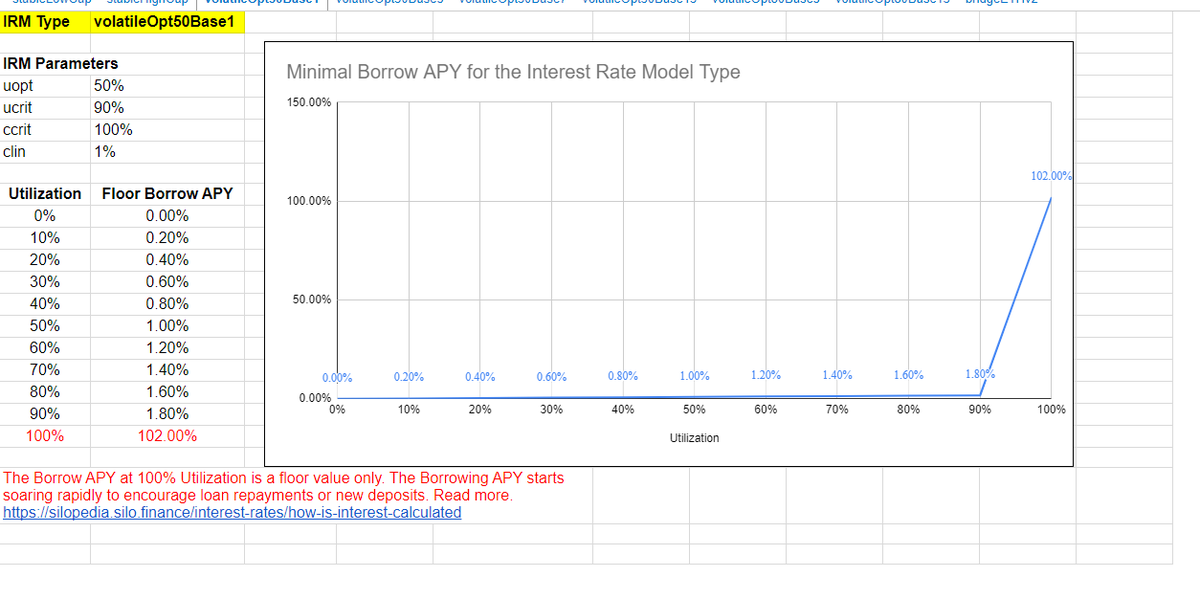

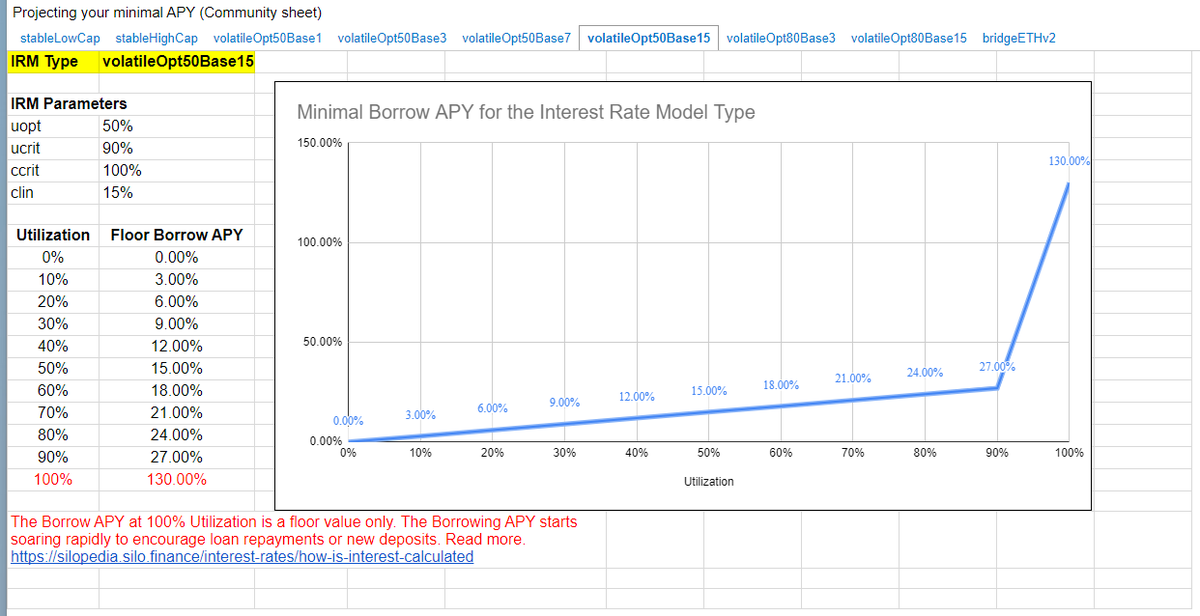

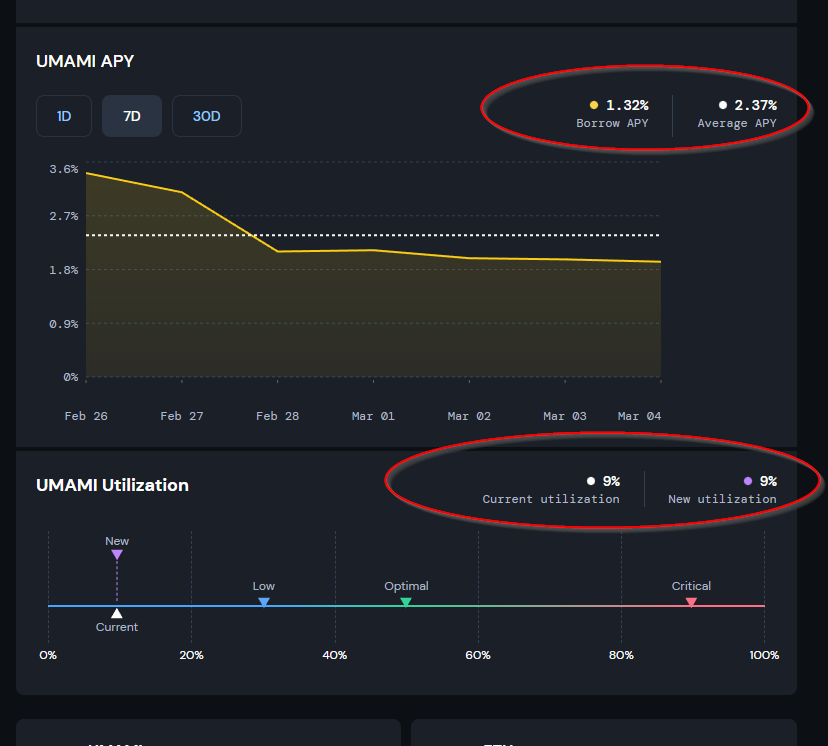

🔹Interest Rate Model

Assets set into tiers based on asset’s characteristic.

U can imagine it as the more volatile the asset is, the higher it's floor borrow rate is for different % of utilisation.

I have added base and an extreme case for ur reference.

docs.google.com

Assets set into tiers based on asset’s characteristic.

U can imagine it as the more volatile the asset is, the higher it's floor borrow rate is for different % of utilisation.

I have added base and an extreme case for ur reference.

docs.google.com

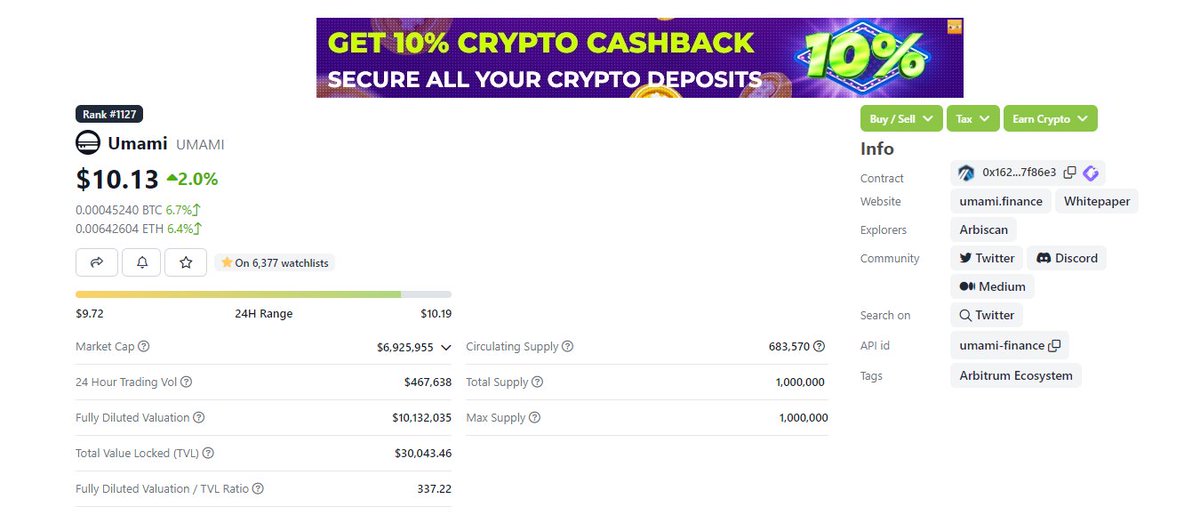

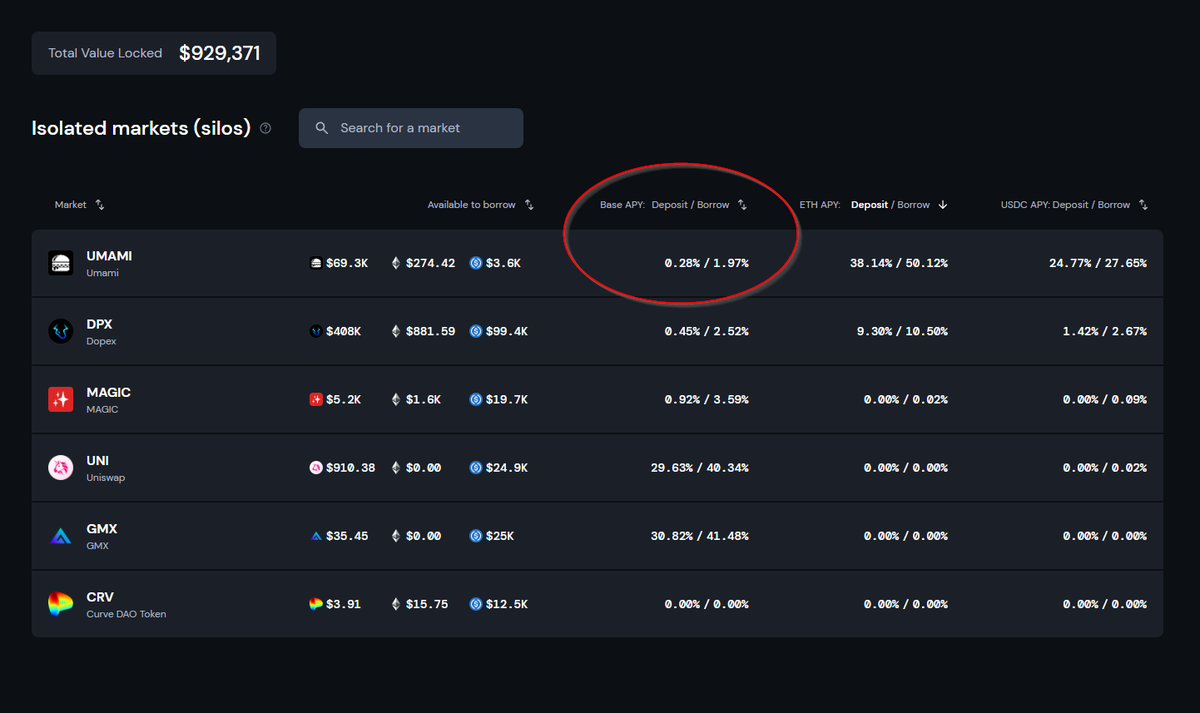

I believe in having a system, understanding and having the tools by my side when you need it is key.

E.g. when shit hit the fan in umami a few weeks ago, can u react asap in where to short it?

E.g. when shit hit the fan in umami a few weeks ago, can u react asap in where to short it?

Most of the arbitrum coins are small micro caps and not listed on CEX

Making it difficult/improssible for you to leverage long or short and this is why i have been looking at different isolated lending pools and fix yield protocols.

Making it difficult/improssible for you to leverage long or short and this is why i have been looking at different isolated lending pools and fix yield protocols.

3 ) When Umami price drop, assuming it drops to 8usd i can buy 1Umami token and return it to silo finance

4 ) My short strategy profit would be

10.13-8-(cost to short, apy*time) = approx 2 USD assuming u only held this short position for a short time

4 ) My short strategy profit would be

10.13-8-(cost to short, apy*time) = approx 2 USD assuming u only held this short position for a short time

• Take into account for Slipperage & trading fee specially for small micro caps

• Make sure u have enough collateral in shorting altcoins as tokens are likely to be more volatile

• Make sure u have enough collateral in shorting altcoins as tokens are likely to be more volatile

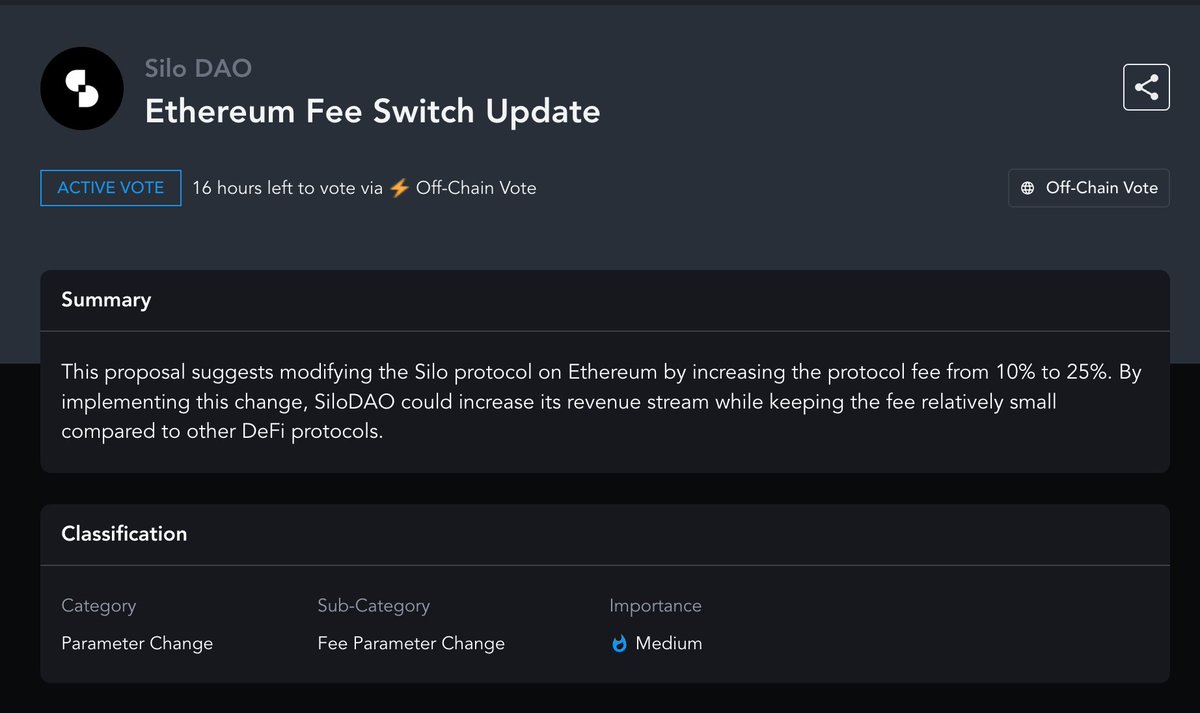

I will be keeping my eyes on their update closely mainly on

• New market silo is adding

• Incentives they are giving to different pools

For

Maybe parking some of my trading bag of arbitrum altcoins there to earn some short term lending + incentive yield before I sell.

• New market silo is adding

• Incentives they are giving to different pools

For

Maybe parking some of my trading bag of arbitrum altcoins there to earn some short term lending + incentive yield before I sell.

Depending on the new tokens they are launching i might leverage long or short on these altcoin

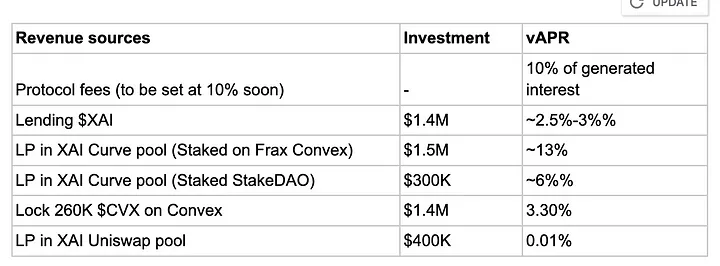

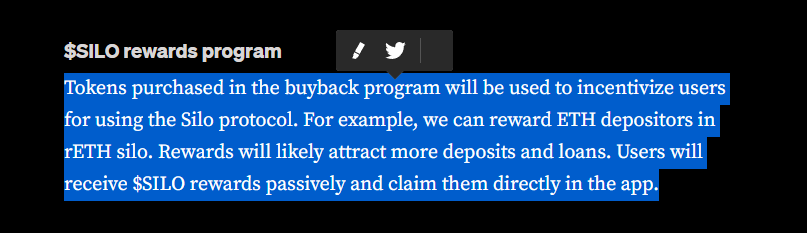

Their TVL n Fees contributing towards the buyback program vs their vesting

@SiloFinance will be great if u can share me some easy way for me check/track will be great!

Their TVL n Fees contributing towards the buyback program vs their vesting

@SiloFinance will be great if u can share me some easy way for me check/track will be great!

📍Summary

I am very interested in different lending protocols that are expanding. E.g. @eulerfinance expanding to BNB, Polygon and Silo going to arbitrum. I think its a sector we should keep an eye on, from using the protocol point of view or buying the token.

I am very interested in different lending protocols that are expanding. E.g. @eulerfinance expanding to BNB, Polygon and Silo going to arbitrum. I think its a sector we should keep an eye on, from using the protocol point of view or buying the token.

Where do u long/short arbitrum altcoins?

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@0xKillTheWolf

@mrblocktw

@0xShinChannn

@arndxt_xo

@0xJamesXXX

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@0xKillTheWolf

@mrblocktw

@0xShinChannn

@arndxt_xo

@0xJamesXXX

Loading suggestions...