1/ What do crypto VCs know that you don't?

I track the money flow to uncover their latest #DeFi trends.

It's clear that VCs are increasingly bullish on innovative protocols.

Check out these 5 new DeFi projects that just raised money: 🧵

I track the money flow to uncover their latest #DeFi trends.

It's clear that VCs are increasingly bullish on innovative protocols.

Check out these 5 new DeFi projects that just raised money: 🧵

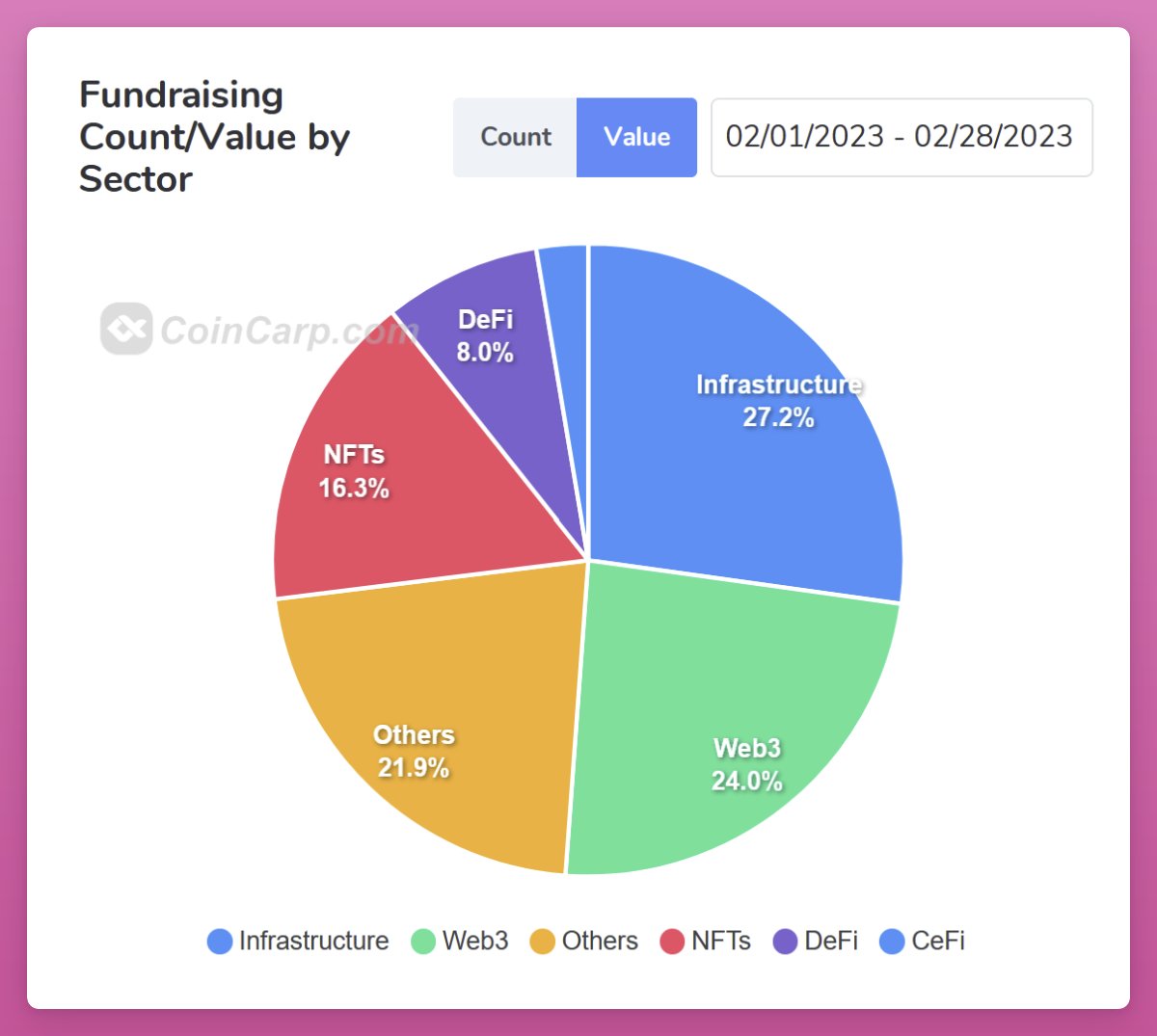

4/ I focus on Seed round investments by prominent VCs.

Most of these project don't have a token yet.

But I expect them to launch tokens soon if the market sentiment continues to improve.

There are already 45 projects on my watch list at ignasdefi.notion.site

Most of these project don't have a token yet.

But I expect them to launch tokens soon if the market sentiment continues to improve.

There are already 45 projects on my watch list at ignasdefi.notion.site

5/ I'm noticing more unique, innovative projects raising money recently.

Innovation ranges from privacy-focused DEXs to lending using income as collateral.

Check out the top 5 projects that raised money in February: 👇

Innovation ranges from privacy-focused DEXs to lending using income as collateral.

Check out the top 5 projects that raised money in February: 👇

6/

1️⃣ @alongsidefi built a crypto market index - $AMKT.

Their $11M Seed raise is surprising, as DeFi projects typically raise ~$4M, and indexes aren't trendy right now.

But VCs are usually more forward-thinking than retail investors, so I think the time for indexes is coming.

1️⃣ @alongsidefi built a crypto market index - $AMKT.

Their $11M Seed raise is surprising, as DeFi projects typically raise ~$4M, and indexes aren't trendy right now.

But VCs are usually more forward-thinking than retail investors, so I think the time for indexes is coming.

7/

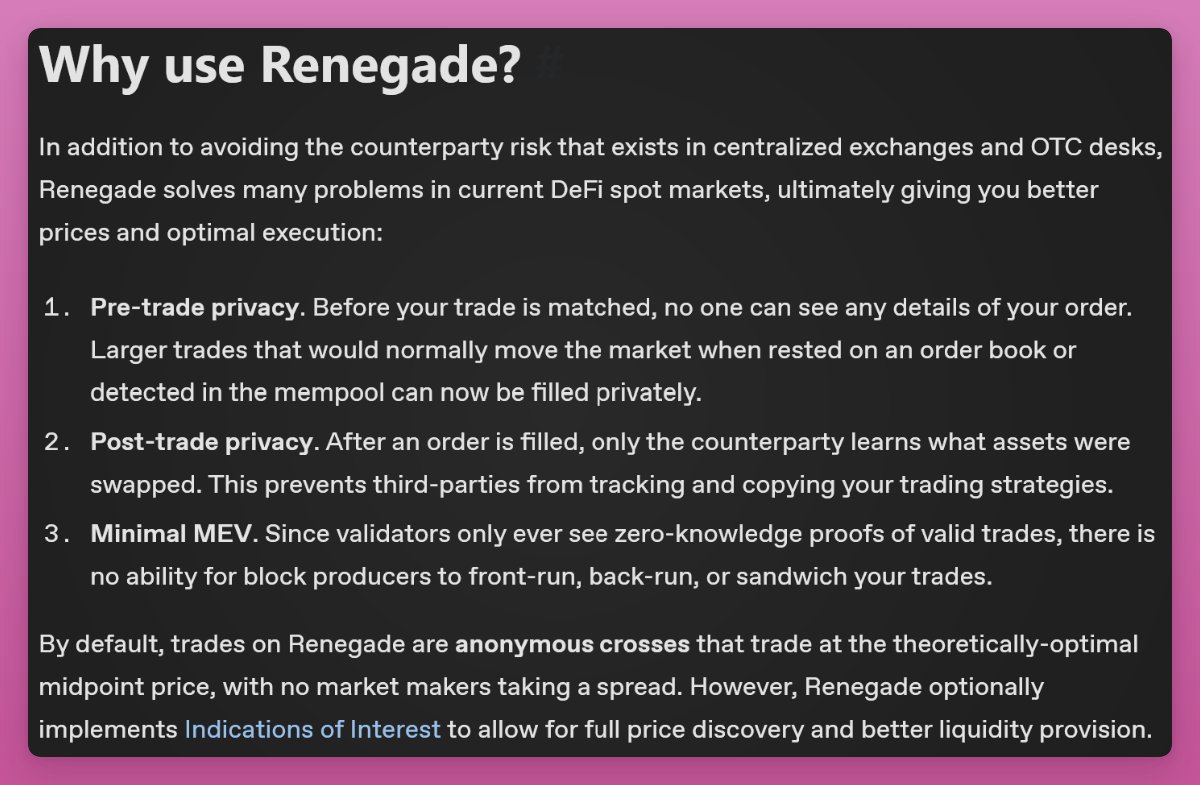

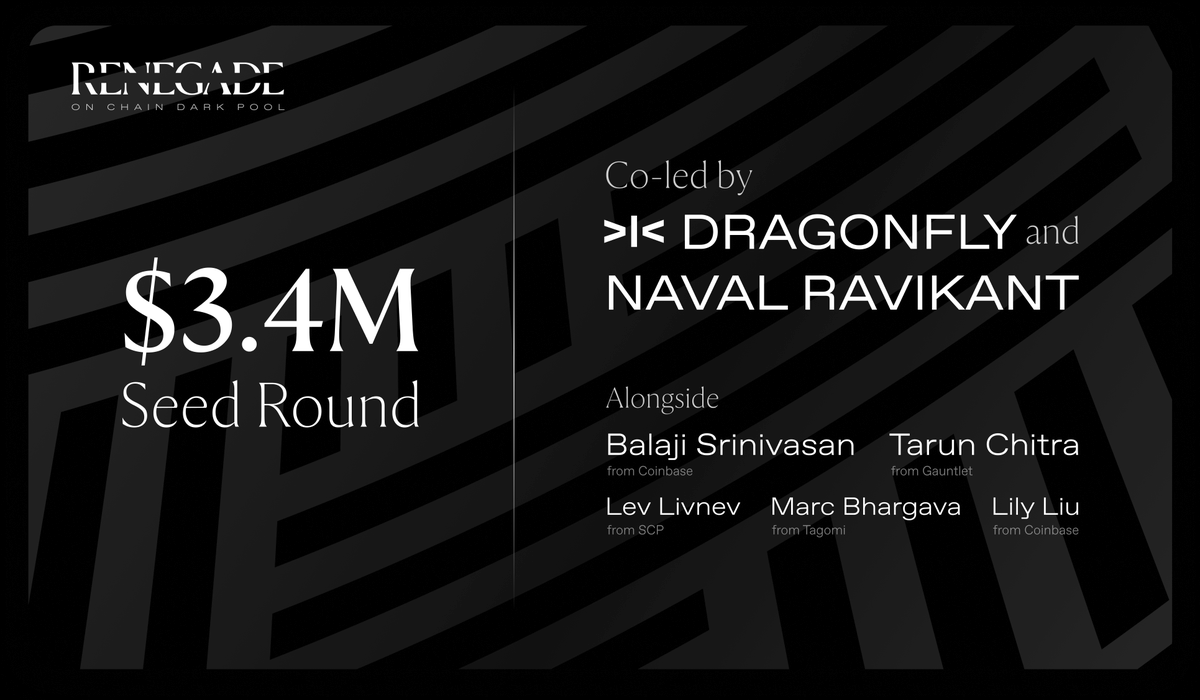

2️⃣ @Renegade is a new type of DEX: An on-chain dark pool.

DEXes are transparent, allowing anyone to see your balances and trade history.

Renegade obscures trading activity from everyone.

It means that no one, except you, can access the details of your balances or trades.

2️⃣ @Renegade is a new type of DEX: An on-chain dark pool.

DEXes are transparent, allowing anyone to see your balances and trade history.

Renegade obscures trading activity from everyone.

It means that no one, except you, can access the details of your balances or trades.

10/

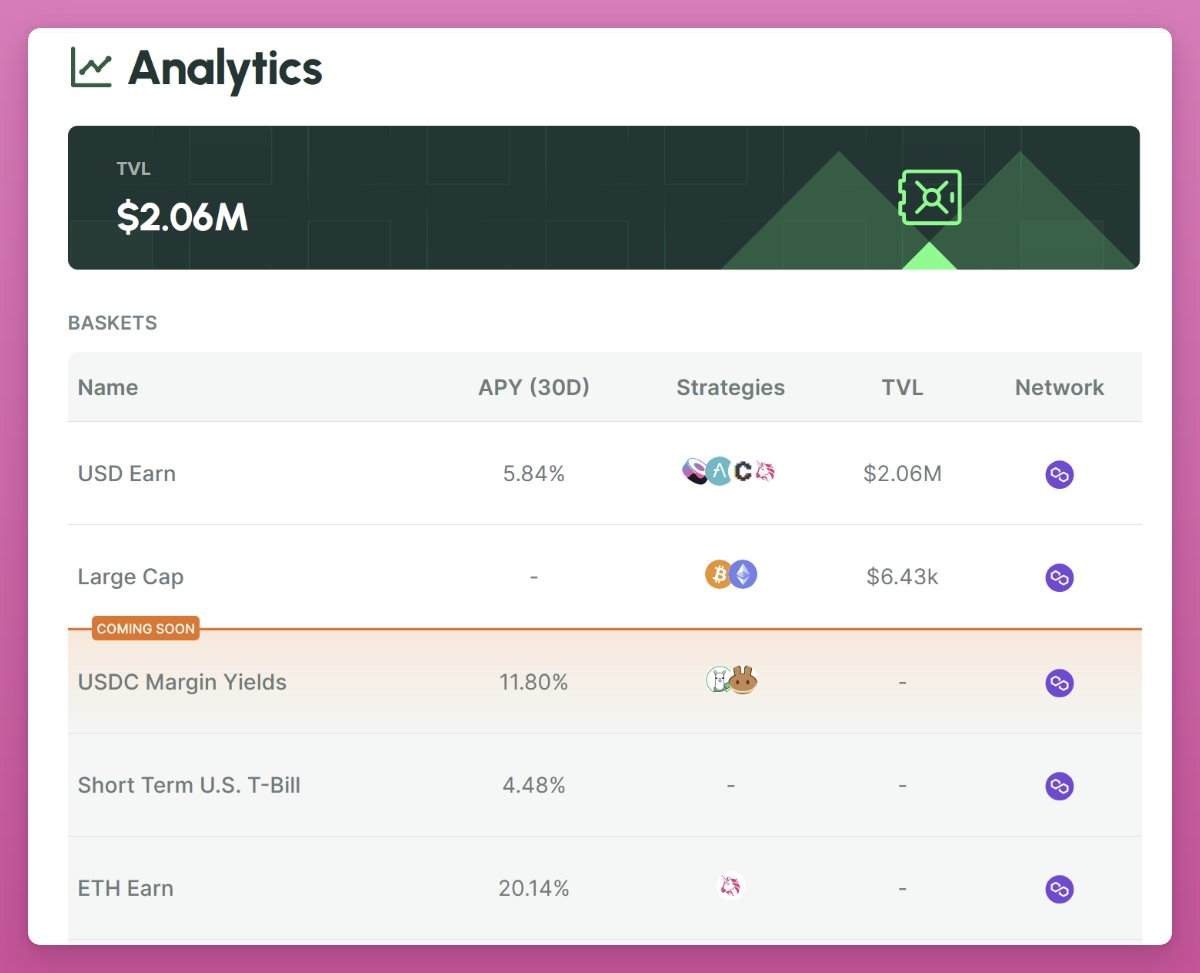

3️⃣ Thought yield aggregators are dead?

Well, @AffineDeFi is developing a cross-chain investment and savings app.

It enables investing in multiple assets, including yield-generating DeFi protocols and RWAs simultaneously.

TVL is $2M, but 5.8% APY on stablecoins is not bad.

3️⃣ Thought yield aggregators are dead?

Well, @AffineDeFi is developing a cross-chain investment and savings app.

It enables investing in multiple assets, including yield-generating DeFi protocols and RWAs simultaneously.

TVL is $2M, but 5.8% APY on stablecoins is not bad.

12/

4️⃣ @humafinance is revolutionizing lending.

It's a DeFi protocol for decentralized lending using income and receivables as collateral.

It solves the issue of over-collateralization in DeFi and enables under-collateralized lending for real-world use cases.

4️⃣ @humafinance is revolutionizing lending.

It's a DeFi protocol for decentralized lending using income and receivables as collateral.

It solves the issue of over-collateralization in DeFi and enables under-collateralized lending for real-world use cases.

14/

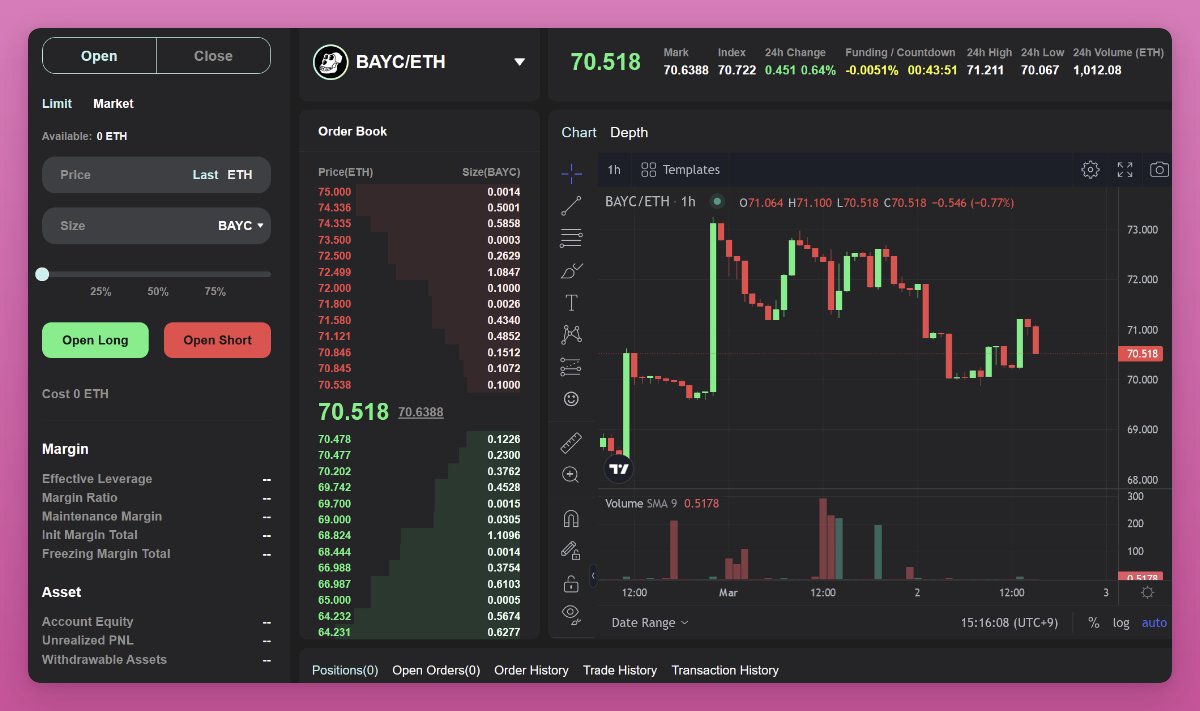

5️⃣ NFEX is a DEX for trading perpetual swaps of blue chip NFTs.

Users can take up to 10x leveraged long/short positions on NFTs without owning them.

Currently BAYC and Azuki trading is supported.

When Pudgy Penguins @nfex_official?

5️⃣ NFEX is a DEX for trading perpetual swaps of blue chip NFTs.

Users can take up to 10x leveraged long/short positions on NFTs without owning them.

Currently BAYC and Azuki trading is supported.

When Pudgy Penguins @nfex_official?

16/ DeFi innovation is happening fast and I'm excited to share more!

Introducing my 'Innovation Zone' on Substack where I'll delve deeper into unique DeFi projects like the ones in this thread.

Subscribe now: ignasdefi.substack.com

Introducing my 'Innovation Zone' on Substack where I'll delve deeper into unique DeFi projects like the ones in this thread.

Subscribe now: ignasdefi.substack.com

جاري تحميل الاقتراحات...