How to spot Delta Neutral farming on @pendle_fi

Lambro strategy inspired from pendle fi AMA chats

*pendle is a sponsor but this is an organic post dyor

My deal with pendle is to share their updates/news with my dear readers only

NO paid shill threads Fyi

Lambro strategy inspired from pendle fi AMA chats

*pendle is a sponsor but this is an organic post dyor

My deal with pendle is to share their updates/news with my dear readers only

NO paid shill threads Fyi

Unrolled here for u! sub me while u are there!

2lambroz.substack.com

2lambroz.substack.com

E.g.

if Single staking ETH gives 5% apy and it's cost to short is 3%apy

You can buy 1 ETH and short 1 ETH,

meaning you are longing 1 eth and shorting 1 eth at the same time

if Single staking ETH gives 5% apy and it's cost to short is 3%apy

You can buy 1 ETH and short 1 ETH,

meaning you are longing 1 eth and shorting 1 eth at the same time

3️⃣ Comparing the difference

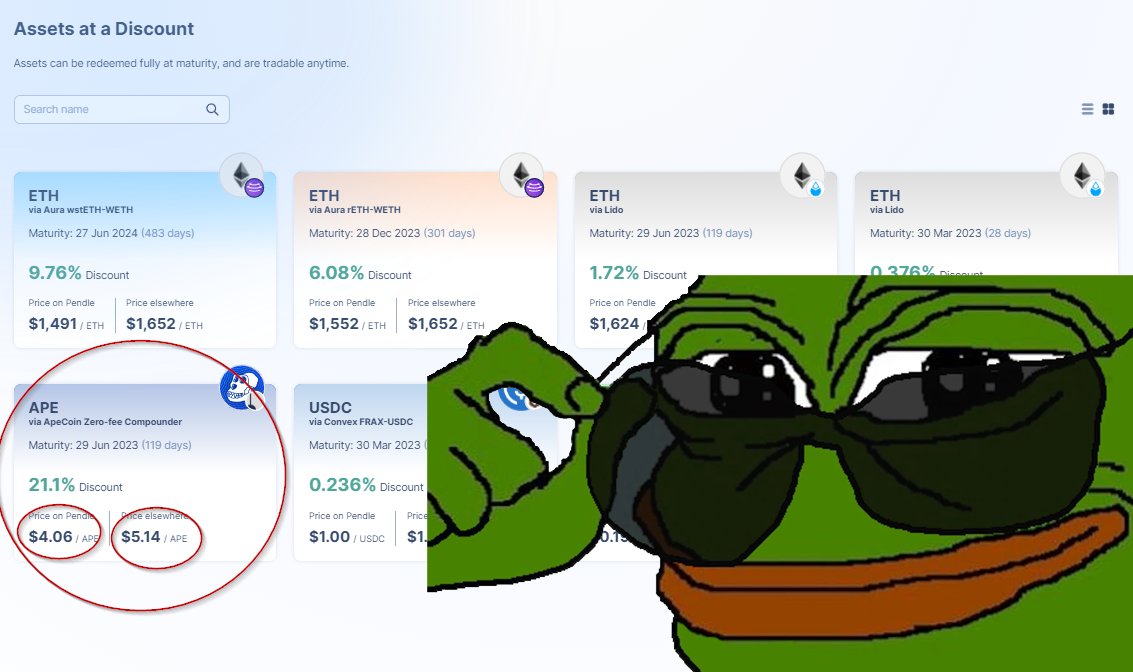

I can buy $APE (PT) token with 21.1% discount and redeem 1 APE token in 119days

I can short $APE on binance with 18.5997%

I can buy $APE (PT) token with 21.1% discount and redeem 1 APE token in 119days

I can short $APE on binance with 18.5997%

Leverage = n

Perp Cost (shorting) = (Current APE price)/n

Total Capital need = SUM(Perp Cost + Pendle Cost)

Current APE price = 5

Capital efficiency = Total Capital need / Current APE price

Perp Cost (shorting) = (Current APE price)/n

Total Capital need = SUM(Perp Cost + Pendle Cost)

Current APE price = 5

Capital efficiency = Total Capital need / Current APE price

E.g.

APE = 5$

Pendle ape Cost = 4

Leverage 2.5x on cex perp

Perp Cost = 5/2.5 = 2

Total Captital = 2 + 4

Capital efficiency = 6/5 = 1.2x

APE = 5$

Pendle ape Cost = 4

Leverage 2.5x on cex perp

Perp Cost = 5/2.5 = 2

Total Captital = 2 + 4

Capital efficiency = 6/5 = 1.2x

The number supposedly the lower the better (more efficient) however it also means you might get liquidated easier.

As u can see we will get liquidated if ape goes up by50% as our leverage is 2.

U can tune up the capital efficiency with higher leverage with more liquidation risk

As u can see we will get liquidated if ape goes up by50% as our leverage is 2.

U can tune up the capital efficiency with higher leverage with more liquidation risk

🔹Worth the Risk?

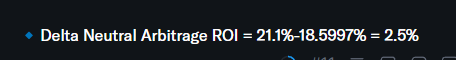

As you can see the Delta Neutral return right now at snapshot is only 2.5%

It is your view on whether this will change or stay consistent

Ideally you want to run some backtests & consider different factors based on the trade & market

As you can see the Delta Neutral return right now at snapshot is only 2.5%

It is your view on whether this will change or stay consistent

Ideally you want to run some backtests & consider different factors based on the trade & market

Most Delta Neutral strategy is not hard, just consistently monitoring & balancing is the hard part.

if you guys like i can break down some GLP delta neutral strategy with different rebalance.

DM, or comment below if u guys want me to do some backtest + examples of $GLP

if you guys like i can break down some GLP delta neutral strategy with different rebalance.

DM, or comment below if u guys want me to do some backtest + examples of $GLP

Delta Neutral strategy on @pendle_fi picking ur brains!

@milesdeutscher

@CJCJCJCJ_

@monosarin

@defi_mochi

@alpha_pls

@DeFi_Cheetah

@DeFi_Made_Here

@Slappjakke

@Only1temmy

@Chinchillah_

@0xTindorr

@cyrilXBT

@Alvin0617

@TheCryptoDog

@LouisCooper_

Delta Neutral strategy on @pendle_fi picking ur brains!

@thedailydegenhq

@DAdvisoor

@rektdiomedes

@crypto_linn

@crypthoem

@DeFi_educator

@CryptoShiro_

@DegenCamp

@crypto_condom

@CryptoDragonite

@DefiIgnas

@WinterSoldierxz

@CryptoKoryo

Delta Neutral strategy on @pendle_fi picking ur brains!

@thewolfofdefi

@eli5_defi

@TechFlowPost

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@0xKillTheWolf

@mrblocktw

@0xShinChannn

@arndxt_xo

@0xJamesXXX

Loading suggestions...