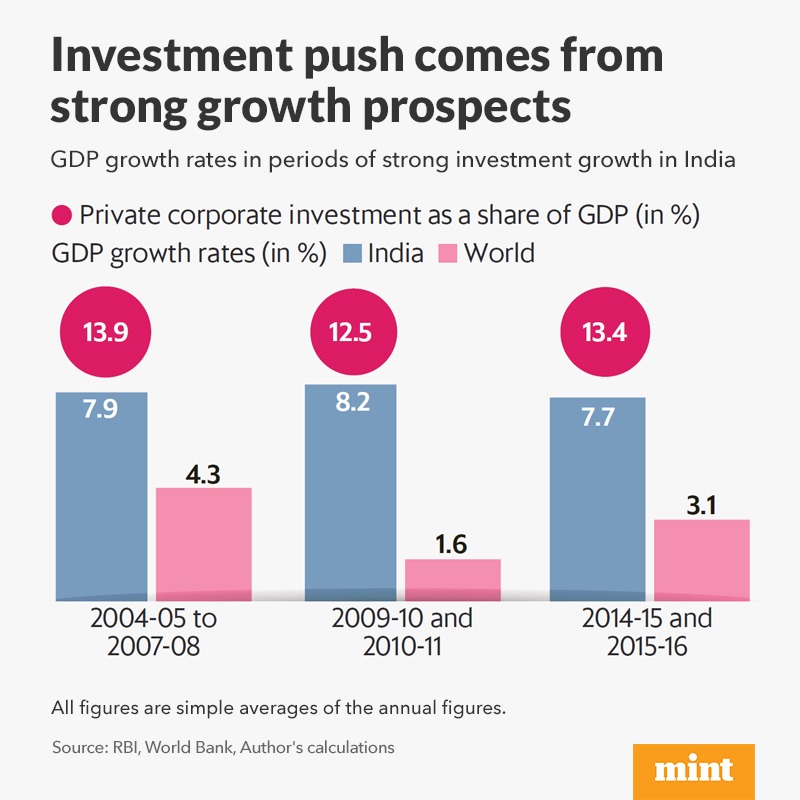

#MintPlainFacts | The 2023-24 Union Budget increased capital expenditure in the hope that public investment would crowd in private corporate investment.

Read here: livemint.com

Read here: livemint.com

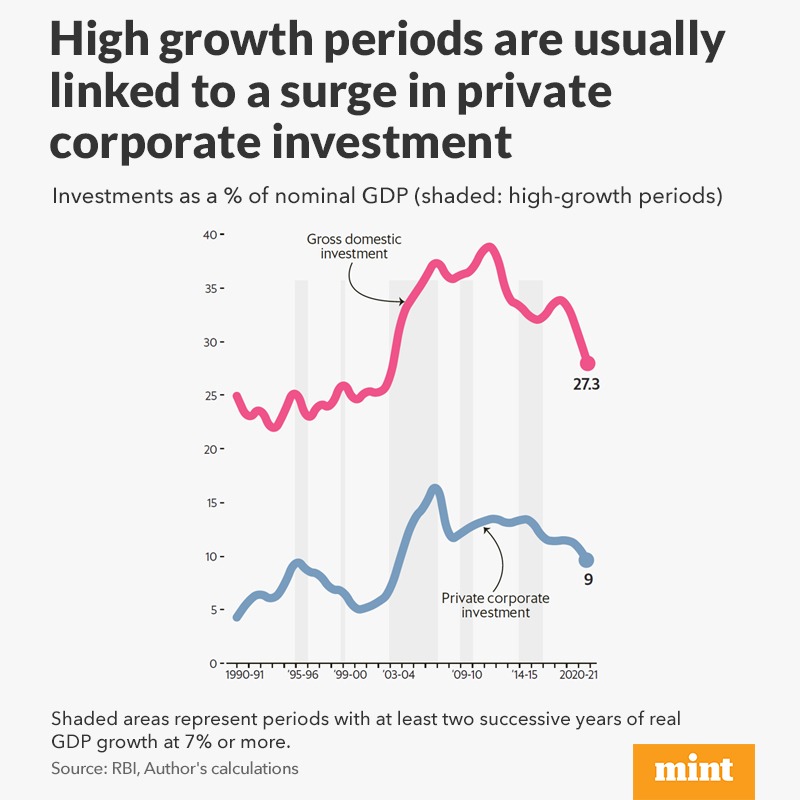

#MintPlainFacts | At its peak, private corporate investment reached 17.3% of #GDP in 2007-08; by 2019-20, it had dropped to 11%.

Read here: livemint.com

Read here: livemint.com

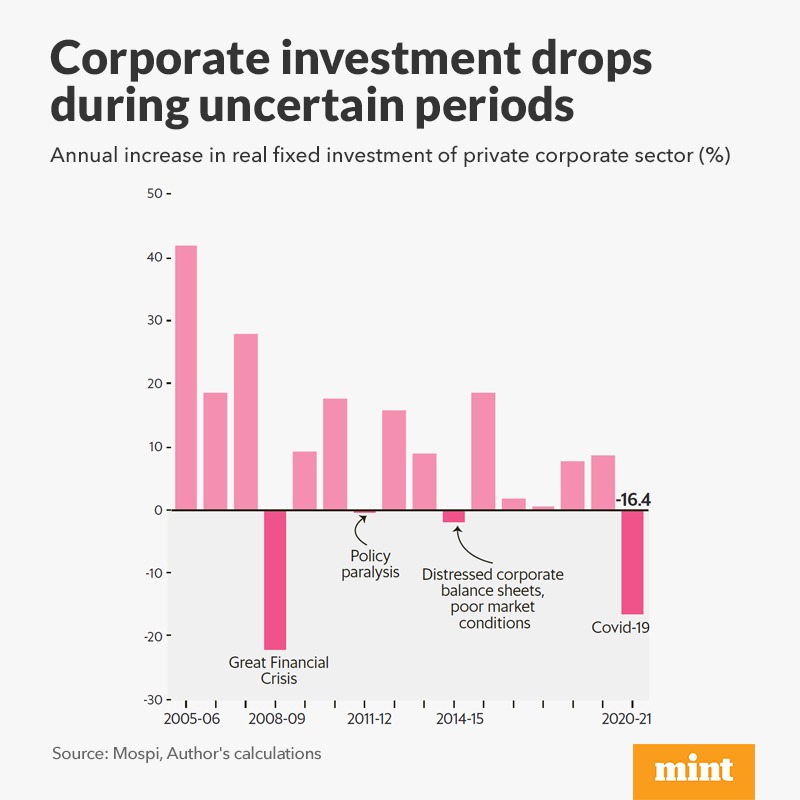

#MintPlainFacts | Corporate investment projects are typically characterized by large initial capital outlays and uncertain future returns.

Read here: livemint.com

Read here: livemint.com

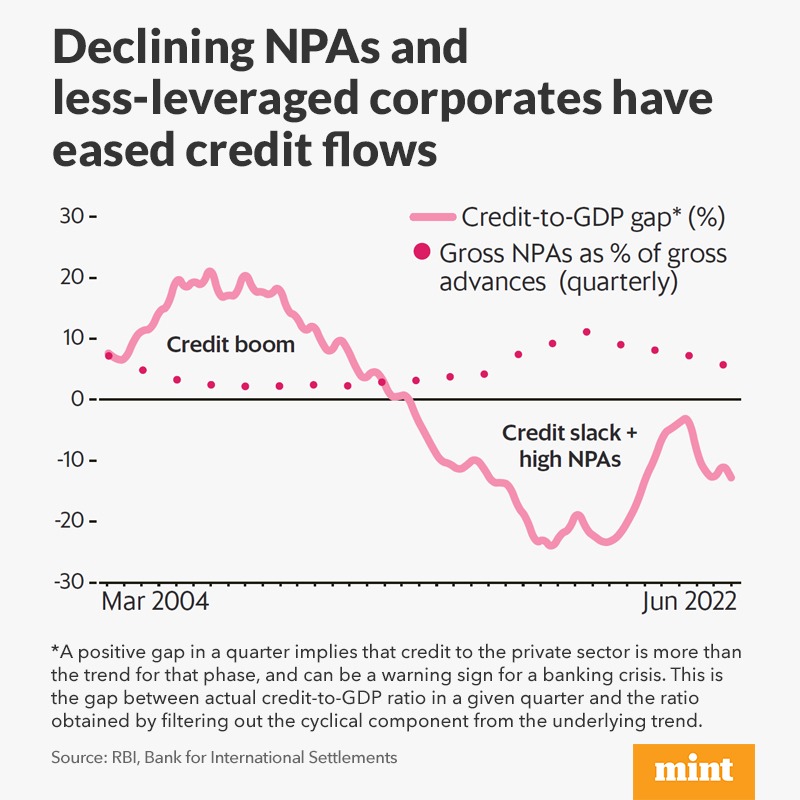

#MintPlainFacts | During 2015-19, India faced a “twin balance sheet problem", which originated from the credit-funded investment boom between 2004-07.

Read here: livemint.com

Read here: livemint.com

#MintPlainFacts | The decision to opt for higher capex over higher welfare spending sends a clear signal to the private sector to invest.

Read here: livemint.com

Read here: livemint.com

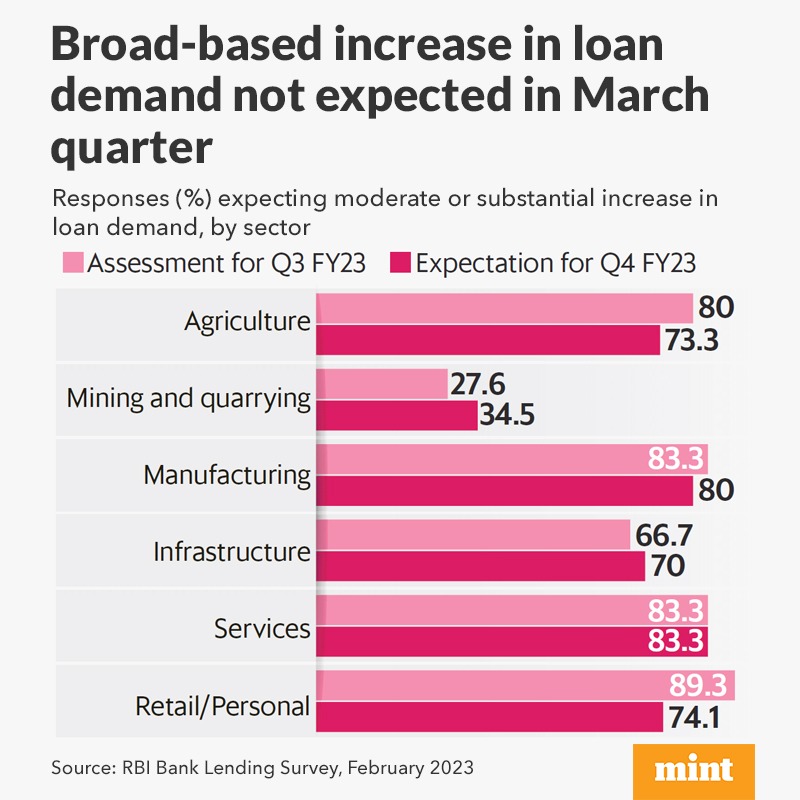

#MintPlainFacts | The multiplier impact of capex has been widely discussed after the Budget.

The theory is that a rupee increase in govt capex should result in a more than proportionate increase in GDP, mainly by crowding in private investment.

Read: livemint.com

The theory is that a rupee increase in govt capex should result in a more than proportionate increase in GDP, mainly by crowding in private investment.

Read: livemint.com

Loading suggestions...