1/ MakerDAO is facing heavy criticism following a 'counter-exploit' worth $225M.

They couldn't refuse the order of the High Court of England and Wales just yet.

But there's a strategy in place to say NO in the future: 🧵

They couldn't refuse the order of the High Court of England and Wales just yet.

But there's a strategy in place to say NO in the future: 🧵

3/ That goes against the ethos of decentralization and Bitcoin.

In fact, it goes against Maker's own mission for DAI as an Unbiased World Currency.

The goal is to make DAI as Bitcoin-like as possible.

Maker is not there yet, and I bet they hate it more than we probably do.

In fact, it goes against Maker's own mission for DAI as an Unbiased World Currency.

The goal is to make DAI as Bitcoin-like as possible.

Maker is not there yet, and I bet they hate it more than we probably do.

4/ It's worth mentioning that MakerDAO does not have control over any of the frontend providers - in this case Oasis, which is included in Maker's front page.

Nevertheless, DAI is still vulnerable to regulatory crackdown due to its exposure to RWAs.

Nevertheless, DAI is still vulnerable to regulatory crackdown due to its exposure to RWAs.

6/ Crypto industry is being attacked from all sides by regulators, most notably with the shutdown of Paxos BUSD despite its regulatory compliance.

This is a threat to every DeFi stablecoin: Prepare for a restrictive regulatory environment ASAP!

Everyone has their own strategy.

This is a threat to every DeFi stablecoin: Prepare for a restrictive regulatory environment ASAP!

Everyone has their own strategy.

7/ Maker's strategy to do so has three stages.

The 1st is Pigeon Stance. It is assumed that the regulatory threat is still minimal and global economic conditions are stable.

The goal is to 'fatten up' and generate as much revenue from RWAs as possible.

The 1st is Pigeon Stance. It is assumed that the regulatory threat is still minimal and global economic conditions are stable.

The goal is to 'fatten up' and generate as much revenue from RWAs as possible.

9/ It's where Maker is now:

They can't reject court's rulings, as they are heavily dependent on easily seizable real-world asset collateral.

The other two stages would make DAI censorship resistant enough to challenge court's decisions.

They can't reject court's rulings, as they are heavily dependent on easily seizable real-world asset collateral.

The other two stages would make DAI censorship resistant enough to challenge court's decisions.

11/ Phoenix Stance is Maker's most resilient stance for maximum resilience and survivability.

It's triggered if there are clear signs of an impending attack on the RWA collateral, or if there is general global economic and geopolitical instability.

It's triggered if there are clear signs of an impending attack on the RWA collateral, or if there is general global economic and geopolitical instability.

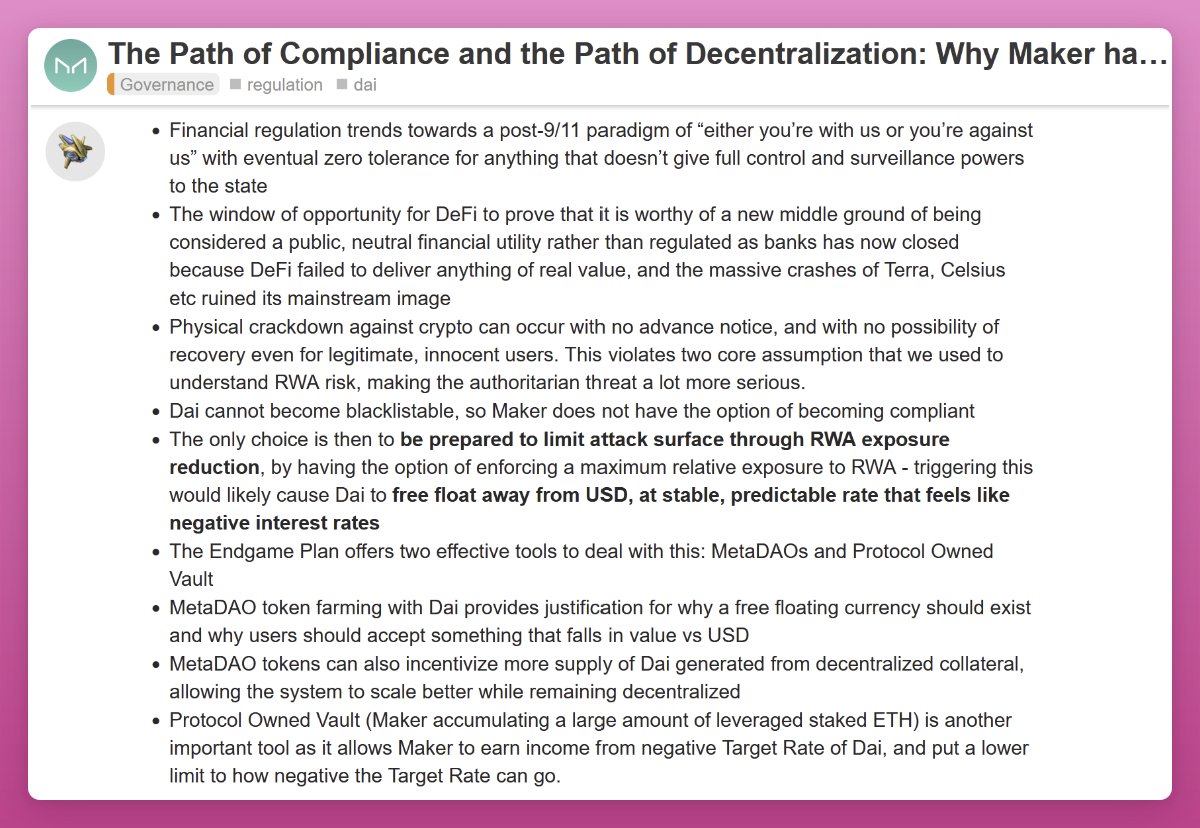

12/ Rune wrote that DeFi's opportunity to prove itself as a public, neutral financial utility instead of being regulated as banks has passed.

It's due to the lack of real value and mainstream image damage caused by Terra/FTX crashes.

It's due to the lack of real value and mainstream image damage caused by Terra/FTX crashes.

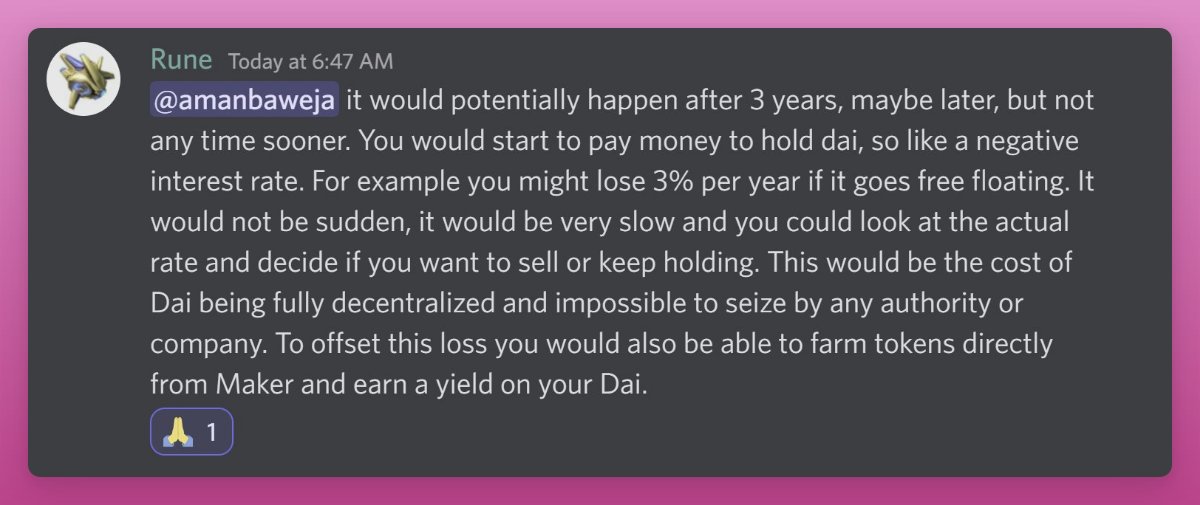

13/ Judging by this message, I'd guess he (and Maker DAO itself) is worried by what the Court's decision entails.

But it further proves the need for Maker's Endgame Plan to make DAI the most resilient stablecoin in DeFi—otherwise there's no point in it.

But it further proves the need for Maker's Endgame Plan to make DAI the most resilient stablecoin in DeFi—otherwise there's no point in it.

14/ Finally, Maker is more aggressive than ever.

The DAO is building its own DeFi ecosystem to empower DAI without dependence on others.

You can learn how in my previous thread below.

The DAO is building its own DeFi ecosystem to empower DAI without dependence on others.

You can learn how in my previous thread below.

15/ If you liked this thread, follow me @DefiIgnas for more and subscribe to my blog for:

• In-depth DeFi insights

• Actionable strategies

• Content not found elsewhere

• Coverage from lending protocols to tokenomics

ignasdefi.substack.com

• In-depth DeFi insights

• Actionable strategies

• Content not found elsewhere

• Coverage from lending protocols to tokenomics

ignasdefi.substack.com

Loading suggestions...